US Gasoline Prices Expected to Fall to Under $1.50

Commodities / Gas - Petrol Jul 02, 2007 - 12:12 AM GMTBy: Nadeem_Walayat

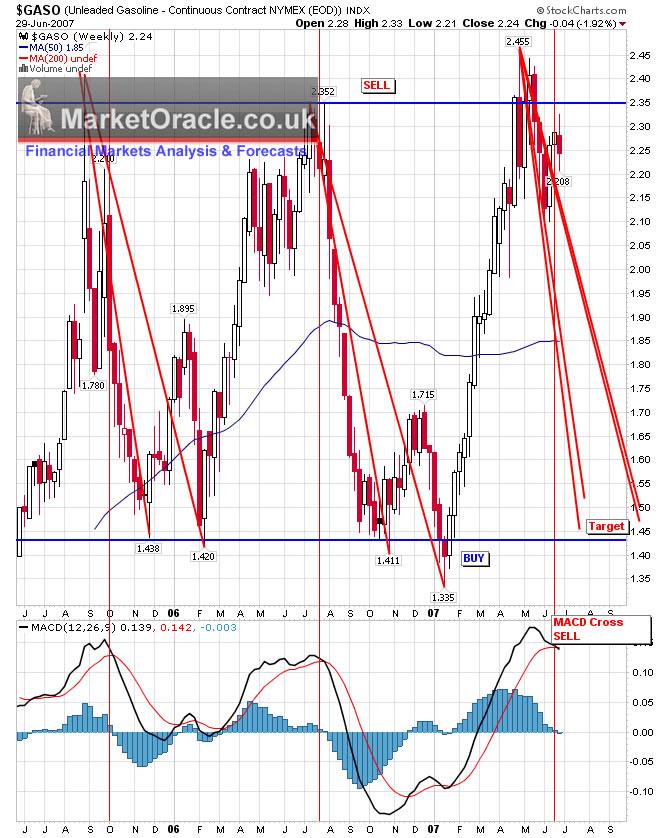

US Unleaded Gasoline futures prices peaked in April at $2.45, subsquent attempts have failed to clear that peak with the trend increasingly looking set to follow the pattern of behavior as in previous years, which implies an eventual decline to below $1.50.

US Unleaded Gasoline futures prices peaked in April at $2.45, subsquent attempts have failed to clear that peak with the trend increasingly looking set to follow the pattern of behavior as in previous years, which implies an eventual decline to below $1.50.

chart courtesy of stockcharts.com

The above chart clearly indicates resistance in US Unleaded Gasoline prices above $2.35 and support when prices drop to below $1.45. The current price at $2.24 is some 20cents off the $2.45 high and is strongly signaling a downtrend to the sub $1.45 support area, this would represent a drop of 33%.

- The decline is expected to to be fulfilled by mid October by the latest.

- The MACD indicator also confirms the sell signal with a cross off of an extreme reading.

- Immediate resistance lies is at $2.35.

Seasonally - The summer months are the strongest for Gas prices so as to coincide with the summer US holiday period, therefore this will support gas prices in the immediate future, additionally strong crude prices are also expected to support gasoline in the near term and therefore the start of the decline may be delayed for some weeks.

Gasoline Stocks - Are declining inline with summer demand expectations, last reported at 202.6mb against 212.4 a year ago, and hence expected to support gas prices in the immediate future.

As a side note Iran introduced gasoline rationing a few days ago, as a prelude to raising prices. Iran has had one of the most subsidized gas pump prices, set at nearly a tenth of the US pump prices and 1/18th of the UK's price, which is a heavy burden on the Iranian economy, as against western governments that tend to benefit from pump fuel tax revenues.

In Summary - US Gasoline is targeting a trend to under $1.45 from the current $2.25 by mid October 2007. However, in the immediate future GAS prices are supported by the holiday season, low gas stocks and a strong crude oil price.

By Nadeem Walayat

(c) Marketoracle.co.uk 2005-07. All rights reserved.

The Market Oracle is a FREE Daily Financial Markets Forecasting & Analysis online publication. We present in-depth analysis from over 100 experienced analysts on a range of views of the probable direction of the financial markets. Thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer - This Forecast / Trade Scenerio is provided for general information purposes only, and not intended as solicitation or recommendation to enter into any form of market position. You are reminded to always seek independent professional advice before entering into any investments or trading positions.

This article maybe reproduced if reprinted in its entirety with links to http://www.marketoracle.co.uk

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.