Global Economic Growth Trends, The Falling Value of the U.S. Dollar

Economics / Economic Recovery Oct 14, 2009 - 07:37 PM GMTBy: Hans_Wagner

Global growth trends are important factors that significantly influence the opportunities for investors. In the first article, we discussed the long-term employment problem within the United States that will cause the economic recover to be weaker than previous recoveries. In this article, we are addressing the three of the important fundamental factors encouraging U.S. dollar’s down trend.

Global growth trends are important factors that significantly influence the opportunities for investors. In the first article, we discussed the long-term employment problem within the United States that will cause the economic recover to be weaker than previous recoveries. In this article, we are addressing the three of the important fundamental factors encouraging U.S. dollar’s down trend.

The performance of the U.S. dollar vs. other currencies depends on a number of factors, primarily relative interest rates and inflation of each country, the level of deficit spending by governments, and the demand and prices for imports and exports.

Interest Rates and Inflation

Economists have assumed that higher interest rates will lead to an appreciation in the currency. On the demand side, they assume that higher interest rates will attract foreign capital that increases the demand for the local currency. On the supply side, higher interest rates tend to reduce domestic consumption, reducing the demand for imports that lowers the supply of currency leading to a higher value. Unfortunately, this simple view does not always work out as expected.

The August 5-11, 2007 issue of the The Economist showed that countries whose currencies have gained the most against the dollar are high interest rate economies. High interest rates tend to help a currency rise relative to other currencies. Inflation offsets these high interest rates, so it is important to understand real interest rate. Countries that experience rising inflation may see a short-term rise in their currency due to higher interest rates. For inflation prone countries, this will be short lived, once investors understand the inflation prospects. Higher inflation leads to a reduction of capital flow as investors do not want to lose the value of their money. Therefore, investors look to the real interest rate (the nominal interest rate minus the inflation rate). Higher real interest rates tend to attract capital, which helps to drive up the price of the currency.

Presently in the U.S., inflation is very low and some fear that deflation could be near by. The Federal Reserve is keeping interest rates low by maintaining the fed funds rate in the 0.00 to 0.25% range. They are also buying mortgage securities, which helps to force longer-term rates down. The intent of these low rates is to encourage the economy to recover.

When investors look at the inflation rate for a country, they must consider the current rate as well as the future rate. After all, they want to be sure to account for any changes in the rate of inflation, as it will affect their investment. If inflation is more likely to rise in the next several years, then investors will look for higher interest rates to protect their investment. If longer-term rates do not adequately cover their inflation expectations plus a return on their money, capital is likely to flow out of the country, forcing currency rates to fall. Since the Federal Reserve is working hard to keep interest rates low, it is by default encouraging those investors who fear inflation in the future to move their capital out of the U.S. When capital flows out of a country, the value of the currency tends to fall. As long as inflation expectations give investors a very low real return on their investment along the yield curve, we should expect the U.S. dollar to fall. This is especially true if capital can find a more attractive place to go.

Spending Deficits

According to the Office of Management and Budget (OMB) the U.S. is running a deficits of $459 billion in 2008, $1,841 billion in 2009 and $1,258 billion in 2010. The deficit is 46% of government outlays in 2009, 35% in 2010, and 25.5% in 2011. This assumes a GDP growth of -1.2% in 2009, 3.2% in 2010, and 4.0% in 2011. That is strong economic growth and well above the blue chip consensus of economists.

| Budget Items | 2008 | 2009 | 2010 | 2011 |

| Receipts | 2,524 | 2,157 | 2,333 | 2,685 |

| Outlays | 2,983 | 3,998 | 3,591 | 3,615 |

| Deficit | (459) | (1,841) | (1,258) | (930) |

| Deficit % of outlays | 15.4% | 46.0% | 35.0% | 25.7% |

| GDP | 14,222 | 14,240 | 14,729 | 15,500 |

| Deficit % GDP | 3.2% | 12.9% | 8.5% | 6.0% |

| Debt | 9,986 | 12,867 | 14,456 | 15,674 |

| Debt % of GDP | 70.2% | 90.4% | 98.1% | 101.1% |

| Real GDP growth year over year (%) |

|

|

|

|

| 2010 Budget | 1.3 | (1.2) | 3.2 | 4.0 |

| Congressional Budget Office (March 2009) | 1.1 | (3.0) | 2.9 | 4.0 |

| April Blue Chip Consensus | 1.1 | (2.6) | 1.8 | 3.4 |

To fund this deficit the government sells bonds to whoever will buy them. Many of the buyers are foreign banks and governments. When these bonds are sold, it acts as a capital inflow to the U.S. that should encourage the dollar to rise. Currency traders realize that this money is not a capital investment; rather it is a loan to cover expenses. It is not being invested into any form that will generate money that can be used to pay back the loan. This raises the prospect that the money may never be paid back. If it does not, then the money is a loss. In these cases, it puts more downward pressure on the dollar. As the deficits grow, currency traders become increasingly concerned that their money is more at risk. This forces the dollar to fall further.

Trade Balance

Another important factor in the value of a currency is the status of the trade balance. Countries that have a positive trade balance where exports exceed imports, see capital flow into their economy. This capital inflow encourages the value of the currency to rise, raising the cost of exports, and lowering the cost of imports. In theory if all other things are equal, this will tend to stabilize the trade balance.

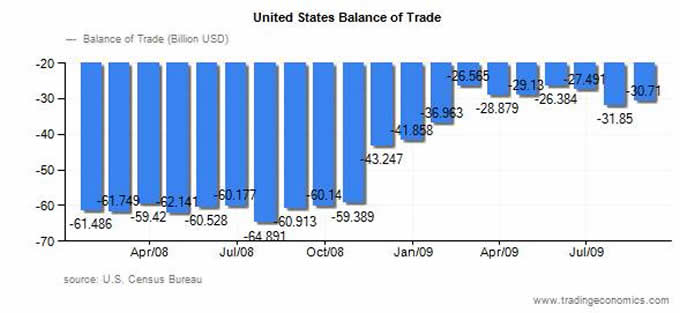

For countries that experience a trade deficit, like the U.S., capital flows out of the country. This outflow puts downward pressure on the currency as a balancing mechanism. In the chart below, we see that the balance of trade has fallen as the value of exports has risen relative to the value of imports.

When the prices of oil, copper, gold and other commodities rise, they tend to take with them the currency of the country exporting the material. As demand for commodities, increases it tends to raise the value of currencies of commodity-producing countries. Rising prices of commodities help the commodity-rich nations to experience falling trade deficits and might even lead to positive trade accounts, as long as they manage their imports. Currencies of commodity exporters fall when commodity prices fall. The reverse holds for commodity importers.

The drop in the U.S. dollar is having a positive affect on the overall trade balance. While there is a tendency to believe the U.S. dollar must fall further to continue the change in the overall trade balance that is not necessarily true. It takes time for markets and companies to adjust to the changes in the value of a currency. Businesses have inventories purchased at the older prices and items the have been manufactured reflect the former value of the currencies. Over time, companies adjust their plans to adjust to the new value of the dollar. As these adjustments flow through markets they will show up as changes in the trade balance of all the countries affected.

Of course, the value of the U.S. dollar could still fall further, until it finds a fundamental level that reflects its economic value. Along the way, there will be disruptions and some countries will try to prop up their currency to protect their economies from the negative affects of an appreciation in the value of their currency. In the end, the U.S. dollar is falling in value relative to many other currencies.

The Bottom Line

These and other factors contribute to the value of a currency relative to others. When evaluating the value of a currency and its trend there are many factors to consider. However, it helps to understand the underlying fundamentals that influence the trend. The U.S. dollar is reflecting the negative consequences of low interest rates relative to the potential for inflation, serious government spending deficits and a large trade deficit. Any one would put downward pressure on the dollar. All three together will encourage the dollar to fall over time. The fundamentals of the dollar will force it to fall further despite what the politicians say.

As investors, we should align our portfolios to take advantage of the industries and companies that will benefit from this trend. This includes sectors and companies that export a substantial mount of their products and services from the U.S., multinational companies that receive a substantial amount of their revenue from international operations, commodity based companies. The materials, technology, and industrial sectors come to mind. Financial firms that facilitate this trade also will perform well.

Companies that receive most of their revenues by importing into the U.S. and from operations within the U.S. will tend to struggle.

By Hans Wagner

tradingonlinemarkets.com

My Name is Hans Wagner and as a long time investor, I was fortunate to retire at 55. I believe you can employ simple investment principles to find and evaluate companies before committing one's hard earned money. Recently, after my children and their friends graduated from college, I found my self helping them to learn about the stock market and investing in stocks. As a result I created a website that provides a growing set of information on many investing topics along with sample portfolios that consistently beat the market at http://www.tradingonlinemarkets.com/

Copyright © 2009 Hans Wagner

Hans Wagner Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.