U.S. Dollar Bottoming and Gold Bullion Topping Forecasts

Commodities / Financial Markets 2009 Oct 09, 2009 - 03:23 AM GMTBy: Ronald_Rosen

The U. S. Dollar Index is bottoming or has bottomed today and will rise for approximately one year in Wave [C] up.

The U. S. Dollar Index is bottoming or has bottomed today and will rise for approximately one year in Wave [C] up.

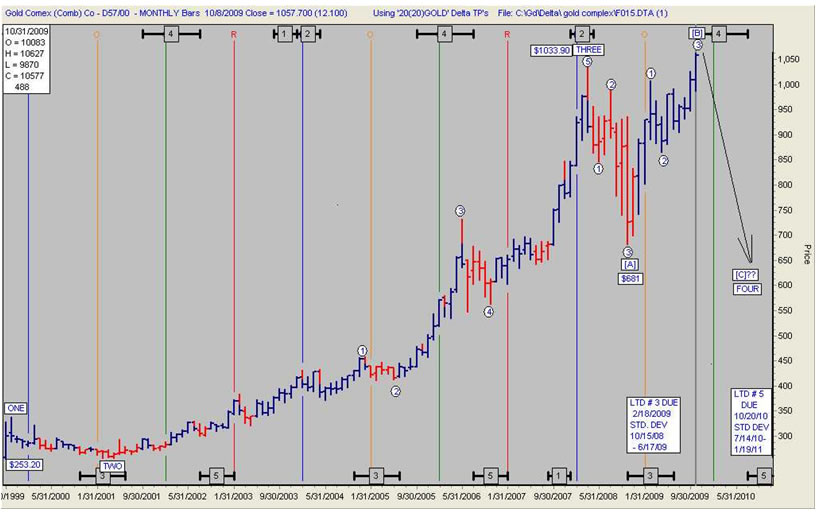

Gold bullion is peaking or has peaked and will decline for approximately one year in Wave [C]down.

THERE IS A RIGHT WAY AND A WRONG WAY

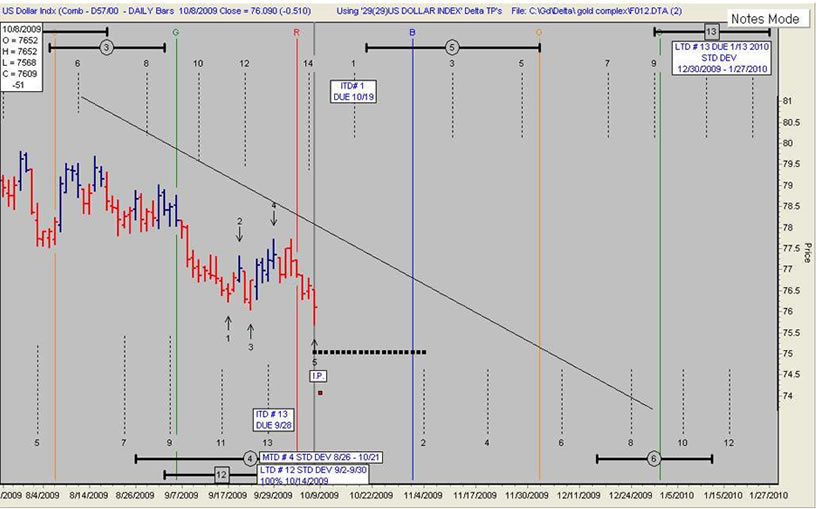

ITD # 1 for the U. S. Dollar Index has or will soon invert to a high.

The U. S. Dollar Index has either bottomed at MTD # 4 low and LTD # 12 low or it will in a matter of days. The next high will be LTD # 13 due to arrive in January 2010. That will not be the final top for the dollar.

U. S. DOLLAR INDEX DAILY

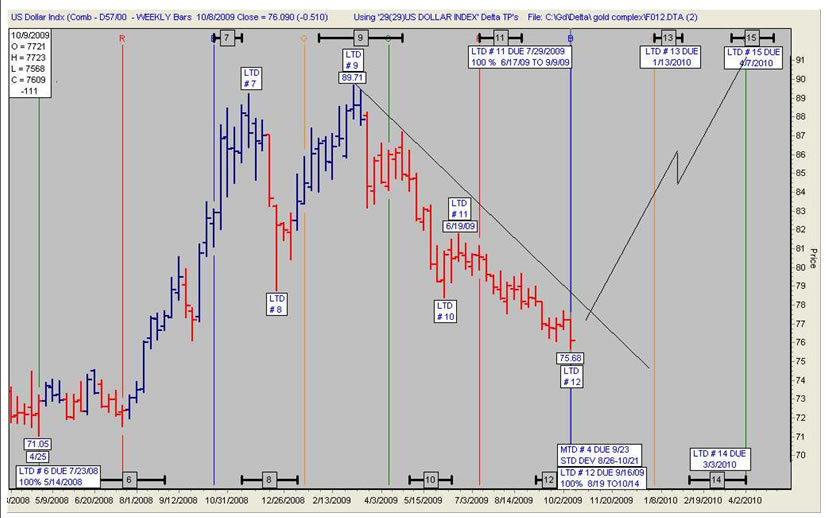

LTD # 15 high will not be the top for the U. S. Dollar Index.

U. S. DOLLAR INDEX WEEKLY

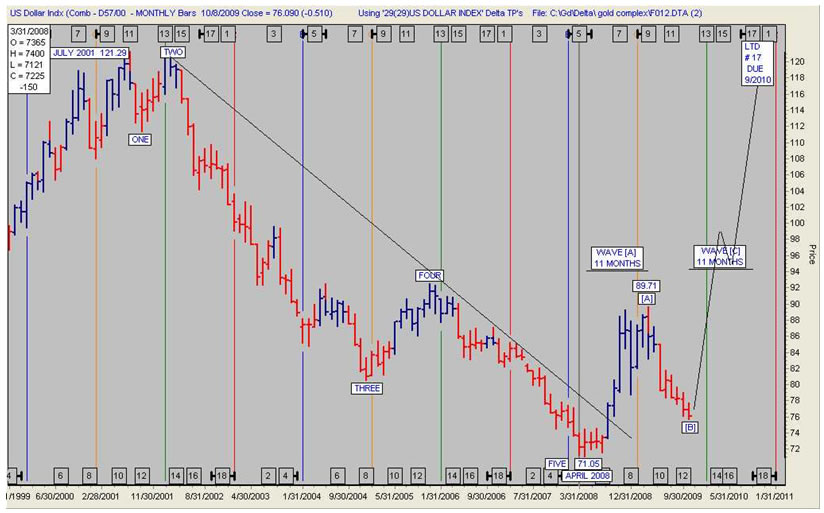

To the highest probability LTD # 17 high due to arrive in September 2010 will be the final [C] wave corrective high for the U. S. Dollar Index. That is approximately eleven months from now. The total amount of time consumed by wave [A] up is about eleven months. Wave [C] up should consume approximately the same amount of time that wave [A] consumed.

U. S. DOLLAR INDEX MONTHLY

As Mother Nature would have it, the final [C] leg down in the expanded flat correction that gold is undergoing should bottom at LTD # 5 low. The LTD # 5 low is scheduled to bottom in October 2010.

GOLD MONTHLY CHART

The U. S. Dollar Index will be rising until approximately September 2010.

Gold bullion will be declining until approximately October 2010.

It is the Delta Long Term turning points that have pointed the way and allowed us to have a peek into the future progress of the gold and dollar index markets.

With the knowledge of Delta in one hand and an understanding of the wave theory in the other, we have a reasonably accurate road map to profits with two major provisos.

Deep down where it really counts we best take special care of our dearest friends, those most elegant ladies, Patience and Prudence.

Subscriptions to the Rosen Market Timing Letter with the Delta Turning Points for gold, silver, stock indices, dollar index, crude oil and many other items are available at: www.wilder-concepts.com/rosenletter.aspx

By Ron Rosen

M I G H T Y I N S P I R I T

Ronald L. Rosen served in the U.S.Navy, with two combat tours Korean War. He later graduated from New York University and became a Registered Representative, stock and commodity broker with Carl M. Loeb, Rhodes & Co. and then Carter, Berlind and Weill. He retired to become private investor and is a director of the Delta Society International

Disclaimer: The contents of this letter represent the opinions of Ronald L. Rosen and Alistair Gilbert Nothing contained herein is intended as investment advice or recommendations for specific investment decisions, and you should not rely on it as such. Ronald L. Rosen and Alistair Gilbert are not registered investment advisors. Information and analysis above are derived from sources and using methods believed to be reliable, but Ronald L. Rosen and Alistair Gilbert cannot accept responsibility for any trading losses you may incur as a result of your reliance on this analysis and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities. Do your own due diligence regarding personal investment decisions.

Ronald Rosen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

kk

10 Oct 09, 00:19 |

bull

??? |

|

Truth

16 Oct 09, 06:45 |

Not even close.

Not even close. Do you even take into consideration macro economic factors? |