Why this is a Bear Market Bounce and Not a New Stocks Bull Market

Stock-Markets / Stocks Bear Market Oct 07, 2009 - 05:25 PM GMTBy: Brian_Bloom

My view that we are in a market bounce is now in the minority but I am still strongly convinced that this is the case for the following reasons:

My view that we are in a market bounce is now in the minority but I am still strongly convinced that this is the case for the following reasons:

Quote: “This is a very realistic view of what’s happening in retail,” says Scott Krugman, vice president for public affairs for NRF [National Retail Federation] in Washington. “The rate of decline is not so bad, but the reality is this is not a consumer-led recovery and the consumer is not back yet.”

http://features.csmonitor.com/economyrebuild/2009/10/06/retail-report-holiday-sales-to-drop-this-year/

BB Comment: So, if the US consumer accounts for 65% - 70% of US GDP and “this is not a consumer led recovery” then what has been driving the recovery? Legacy corporations that are retrenching are not, at the same time, investing. Has it been Central Government spending? When that has filtered through, then what?

Quote from this same article: “Although the first nine months of the year have been negative, the fourth quarter has potential for improvement, Krugman says. “There is lots of pent-up demand,” he says. “The consumer is paying down debt and putting money in the bank. If things improve, many consumers have the wherewithal to spend.”

BB Comment: So, nothing has changed. Business (and political?) leaders are still looking for the punch drunk consumer to come out fighting.

Yes, Google is hiring, the Australian Reserve Bank lifted interest rates and the politicians are trumpeting that the recession is over.

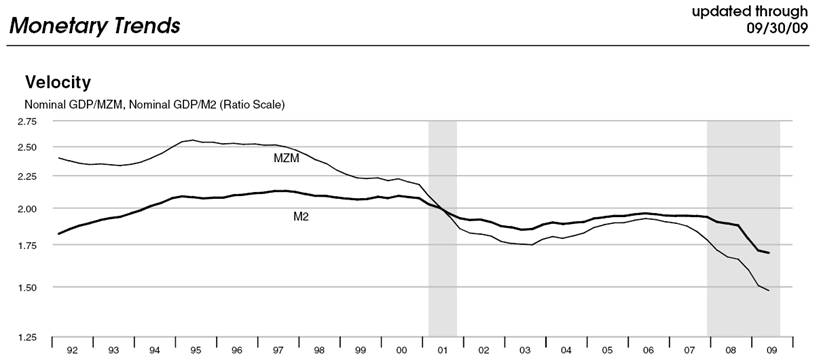

To me, these are straws in the wind. The recession will be over when the velocity of money stops falling and then starts to rise again. As at September 30th (8 days ago) it was still falling. http://research.stlouisfed.org/publications/mt/page12.pdf - largely because the commercial banks are not yet lending. (Or maybe it’s because consumers are choosing to pay down debt?)

The reality is that consumers are paying down debt because they are afraid of losing their jobs. The reality is that banks are cancelling credit cards in large numbers. Possibly as many as one in six able bodied Americans are now unemployed if you add back all the exclusions.

To me, an “investment led” recovery will be required to build lasting economic momentum.

The following is a link to a report that disagrees with this observation: http://ideas.repec.org/a/bla/rdevec/v7y2003i1p44-57.html#download

Quote: “These findings suggest that strong positive associations between economic growth and FDI [Foreign Direct Investment] inflows or GDI [Gross Direct Investment] rates do not necessarily mean that high FDI inflows or GDI rates lead to rapid economic growth.”

BB Comment: It is important to ask the right question. If you ask the wrong question, you get an answer which is meaningless. I am personally convinced that the “nature” of investment is the key. What is needed is investment which specifically targets strategically relevant, emerging primary and secondary industries’ technologies which, in turn, can “drive” employment creation across a broad front. Investment in services and/or real estate which leverage off the existing momentum of legacy industries or which add to the existing momentum of legacy industries does not influence the primary trend of economic activity. Investment in infrastructure might help, but it needs to be strategically relevant infrastructure. We do not need the existing economic drive train to travel faster. We need a new and more powerful economic drive train. The issue is not related to the position of the monetary accelerator. It is related to the capacity of the motor.

There is as yet too little investment of the type that will drive new economic momentum, and – given peak oil – the momentum of legacy industries will continue to deteriorate. That, in essence, is why I am of the view that we are currently experiencing a bounce in the markets.

The personal and business implications of this conclusion – if the conclusion is correct – are strategically important. For the foreseeable future we should be in capital preservation mode. We should be paying down debt and we should be protecting income streams where possible. If the conclusion is correct then there will be asset price deflation and consumer price inflation as currencies of debt ridden, net importing nations deteriorate relative to currencies of cash rich, net exporting nations.

Of course, if/when the facts change then the outlook will change. In the meantime I have been dickering around too much. I need to take some serious time out to follow through on my next novel – which will be investigating one of the possible drivers of new economic momentum. Unfortunately, this will force me to take my eye off day to day developments.

Brian Bloom

Beyond Neanderthal is a novel with a light hearted and entertaining fictional storyline; and with carefully researched, fact based themes. In Chapter 1 (written over a year ago) the current financial turmoil is anticipated. The rest of the 430 page novel focuses on the probable causes of this turmoil and what we might do to dig ourselves out of the quagmire we now find ourselves in. The core issue is “energy”, and the story leads the reader step-by-step on one possible path which might point a way forward. Gold plays a pivotal role in our future – not as a currency, but as a commodity with unique physical characteristics that can be harnessed to humanity's benefit. Until the current market collapse, there would have been many who questioned the validity of the arguments in Beyond Neanderthal. Now the evidence is too stark to ignore. This is a book that needs to be read by large numbers of people to make a difference. It can be ordered over the internet via www.beyondneanderthal.com

Copyright © 2009 Brian Bloom - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.