Deflation Threat? What Deflation Threat?

Economics / Deflation Oct 05, 2009 - 01:27 PM GMTBy: Mike_Shedlock

The deflation "recognition phase" has finally arrived. Kroger foods, Costco, and Walmart are blaming deflation for a drop in earnings. Moreover, many high profile names are discussing deflation, something most thought could never happen.

The deflation "recognition phase" has finally arrived. Kroger foods, Costco, and Walmart are blaming deflation for a drop in earnings. Moreover, many high profile names are discussing deflation, something most thought could never happen.

Please consider Stiglitz Says Deflation Threat Pushes Fed to Stay at Zero.

The U.S. faces the possibility of deflation for the first time since the Eisenhower administration, a threat that may prompt the Federal Reserve to keep interest rates near zero through next year.

Executives at Kroger Co., the largest U.S. supermarket chain, blamed deflation for a 7 percent drop in earnings in the second quarter, while falling prices for food, gasoline, and electronics left August sales unchanged at Costco Wholesale Corp. A sustained price drop might set off a chain reaction in which lower profits force employers to pare wages and payrolls. That would erode consumer demand, exacerbating wage cuts and firings.

“Deflation is definitely a threat right now,” Nobel laureate Joseph Stiglitz, 66, a professor at Columbia University in New York, said in a Sept. 22 interview. “The combination of the deflation threat and the sluggish recovery should keep the Fed on hold for quite a while.”Mish: Deflation is not a threat because deflation is here by any practical measurement. Deflation is also here by impractical measurements such as falling prices. See Humpty Dumpty On Inflation and Daniel Amerman vs. Mish: Reflections on the Great Inflation/Deflation Debate for a further discussion of a practical definition of deflation, a contraction of money supply and credit marked to market, not falling prices.

Moreover, deflation is not a threat in a second sense. Deflation is needed to purge the excesses of the last credit cycle. Attempts to defeat deflation by force will only prolong the agony while accumulating government debt, just as happened in Japan's two lost decades.

Finally, deflation is not a threat in a third sense. Falling prices are a natural state of affairs because of rising productivity over time. Inflation is a direct (and unnatural) state of affairs caused by the Fed and fractional reserve lending.

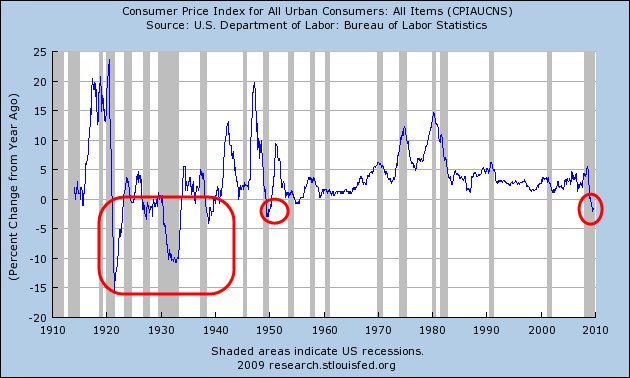

Bloomberg: Consumer prices are experiencing deflation, with the consumer price index sliding for six straight months from year-earlier levels, the longest stretch of declines since a 12-month drop from September 1954 to August 1955, according to the Labor Department.

Regional Federal Reserve Bank Presidents Janet Yellen, of San Francisco, James Bullard, of St. Louis, Richard Fisher, of Dallas, and Charles Evans, of Chicago, have expressed concern in past weeks about the possibility of declining prices.

“Disinflationary winds are blowing with gale-force effect,” Evans, 51, said in a Sept. 9 speech in New York.Mish: Prices are falling in as sustained period for only the second time since the great depression as shown in the following chart.

CPI-U Percent Change From A Year Ago

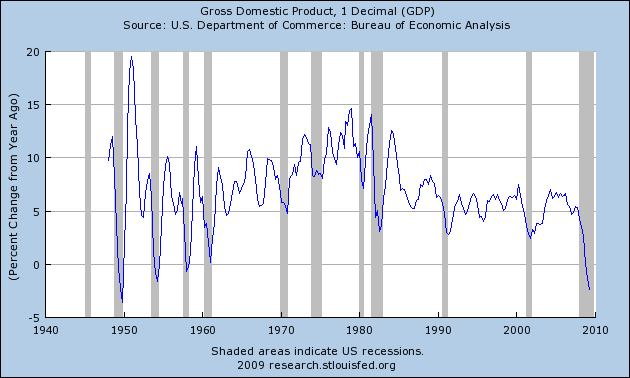

Bloomberg: While the economy contracted 2.7 percent during the 1953 recession, it shrank 3.8 percent in the current recession, the most since the 1930s. Economists at New York-based JPMorgan Chase & Co. and Goldman Sachs Group Inc., the second- and fifth- biggest U.S. banks by assets, say there’s so much deflationary excess labor and plant capacity in the economy that the Fed won’t raise interest rates until at least 2011.

Mish: Although deeper than the 1953 recession, the GDP pullback is not as deep as the recession ending in 1949. Thus "the most since the 1930s" is factually incorrect. Nonetheless, this is a historically hard pullback as shown in the following chart.

GDP Percent Change From A Year Ago

Bloomberg: “The potential for a deflationary downdraft continues for several years” if economic growth doesn’t accelerate, Bill Gross, who runs the world’s biggest bond fund at Pacific Investment Management Co. in Newport Beach, California, said in a Sept. 29 interview with Bloomberg Radio.

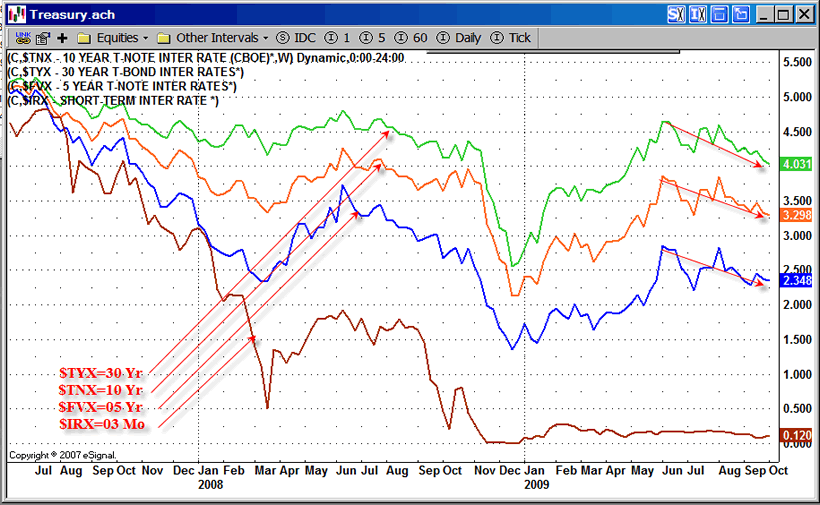

“There’s been a significant flattening on the long end of the curve,” reflecting concern about deflation, said Pacific Investment’s Gross, 65, who is buying longer-maturity Treasuries in response.Mish: Here is a weekly chart of $TYX (30-year treasury), $TNX (10-year treasury), $FVX (5 year treasury), and $IRX (3 month treasury) that shows the flattening.

Yield Curve Flattening

The above chart is one I run constantly, in real time, on my computer. The curve represents weekly closes. The flattening from the actual peak is even greater. The intraday high in the 10-Year Treasury Note is just over 4%.

By the way, that chart is a few days old. The 30-year long bond is now sitting right on 4.0% and the 10-year note is at 3.22%, 78 basis points of flattening since May.

For further discussion on Bill Gross' deflation views please see Bill Gross Bets On Deflation.

Bloomberg: The slowing in core prices is more of a concern, said Michael Feroli, an economist at JPMorgan. The core rate fell following three prior recessions in which unemployment rose above 7 percent. That “suggests that core inflation could well be below zero within two years,” Feroli said in an interview.

Mish: The "Core CPI" strips out food and energy from the CPI. As a practical matter, this makes little sense. Nonetheless, with falling rents and pressure on autos and nonessential goods, I expect to see the core CPI below zero sooner rather than later.

Bloomberg: “My personal belief is that the more significant threat to price stability over the next several years stems from the disinflationary forces unleashed by the enormous slack in the economy,” Yellen, 63, said Sept. 14 in San Francisco.

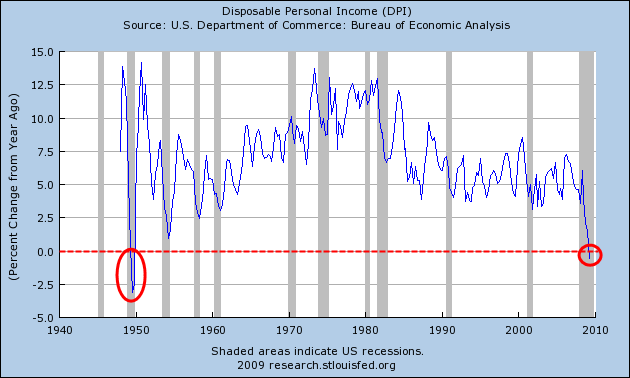

Wages for U.S. workers fell for eight months in a row, dropping 5.6 percent from October 2008 to June 2009, according to Commerce Department figures. In contrast, wages continued to grow in the 1954-1955 deflation period.

“A weak labor market in a competitive environment puts downward pressure on wages,” said Stiglitz, who won the Nobel prize for economics in 2001. “So, the possibility of another actual decline in wages cannot be ruled out.”Mish: Disposable Personal Income is negative for the first time since the late 1940's.

Disposable Personal Income Percent Change From A Year Ago

Bloomberg: The deflation danger is compounded by household debt, said Paul Ashworth, senior U.S. economist at the consulting firm Capital Economics in Toronto. U.S. homeowners owed $13.9 trillion in the third quarter of 2008, compared with an average of $8.5 trillion in the 57 years the Fed has kept records.

“As incomes start to fall, that debt gets bigger in real terms: You have a smaller income to pay off that debt,” Ashworth said. “Deflation combined with high indebtedness can be very problematic.”Mish: Indeed “Deflation combined with high indebtedness is problematic.” The solution is to not blow debt bubbles rather than attempting to keep them inflated as Geithner and Bernanke are doing. The way to not blow debt bubbles is to get rid of the Fed and fractional reserve lending.

Bloomberg: Rodney McMullen, president of Cincinnati-based Kroger, blamed price reductions for second-quarter earnings that fell 10.5 percent short of analysts’ estimates.

“We certainly sold more units. But lower retail prices and profit per unit pressured” results, McMullen told analysts in a Sept. 15 conference call. “We began to see deflation.”

At Wal-Mart Stores Inc., the world’s largest retailer, “headwinds” from deflation were in part responsible for a 1.4 percent drop in second-quarter revenue to $100.9 billion, chief financial officer Thomas Schoewe told analysts Aug. 13.Mish: Kroger, Costco, and Walmart are all blaming deflation for decreased earnings. Gee, who could have possibly predicted that? Certainly not your average inflationista.

Furthermore, Treasury yields (although up from December) are still at previously unprecedented lows.

Rosenberg and Tavakoli on Deflation

Inquiring minds are interested in what economist Dave Rosenberg has to say. Please consider Rosenberg: “We are certainly in a deflationary state”.

If you have not yet done so listen to an excellent On The Edge interview with Max Keiser regarding derivatives and debt levels, Janet Tavakoli: Risk of deflationary collapse greater now than in 2007

Twilight Zone Owners' Equivalent Rent

Finally, those who think inflation is best measured by the CPI should consider BLS Owner's Equivalent Rent Numbers From Twilight Zone.

The CPI is massively overstated here, not by my preferred measure (Case-Shiller CPI), but rather by the BLS's preferred measurement.

Deflation Denial Phase Is Over

In light of all of the above, the deflation "denial phase" should now be over for all but the most stubborn inflationistas. The "recognition phase" has finally arrived. The Bernanke "panic phase" is waiting on deck.

Please note that Bernanke's Deflation Preventing Scorecard is a perfect zero. Lord knows what Bernanke will try next.

The Real Threat

We are already in uncharted territory, and the risk is what the Fed, Congress, the Treasury department, the Administration, and central bankers globally do to prevent something that needs to happen: the liquidation of malinvestments and debt.

Thus the "real threat" (and risk) is not deflation, but rather the foolish attempts by Keynesian clowns to circumvent what needs happen.

Japan is proof that such efforts are futile. Note that Japan is once again back in deflation, and all the government has to show for its efforts is debt equaling 150% of GDP. Falling prices, lower wages, lower asset prices, and especially debt liquidation are not to be feared, they are a necessary part of the healing process, lest the country stagnate for years.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.