Housing Rents Deflationary Impact on CPI Inflation Data

Economics / Deflation Oct 05, 2009 - 08:41 AM GMTBy: Mike_Shedlock

In Bill Gross Bets On Deflation I posted some links on falling rent prices courtesy of Lansler on Real Estate. Here is a recap.

In Bill Gross Bets On Deflation I posted some links on falling rent prices courtesy of Lansler on Real Estate. Here is a recap.

Rents Falling Everywhere

Given that the official measure of CPI is based on rents not housing prices, please consider the following collection of links courtesy of Lanser on Real Estate: Really? Rents fall almost everywhere.

- Manhattan:Apartment Rents Drop as Employers Cut Jobs

- Houston: Renters are snagging deals in a slowing local market

- Tuscon: On your mark, get set, go! Apartment firm makes game of it.

- Nashville: Apartment rates squeezed by lower demand

- Nationwide: Renters look for thirfty comfort, not style

- Tokyo: Apartment rents under pressure

- Middle East: 17% fall in rents seen in Qatar this year

- Orange County: O.C. renters get twice the freebies

Falling Rents In Puget Sound

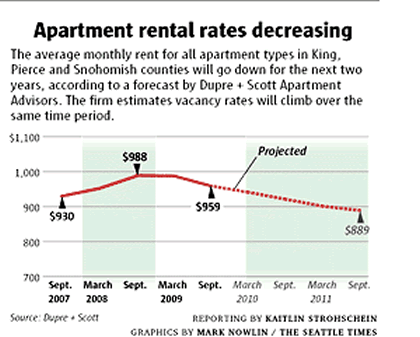

Over the weekend several people sent me a link about rents in the Seattle area. Please consider Apartment rents falling in Puget Sound area.

A shrinking number of jobs and a growing supply of apartments will continue to push the Puget Sound region's rents down next year as vacancy rates climb, industry experts predict.

Job losses killed our market, and development buried it," Mike Scott, of Dupre + Scott Apartment Advisors, told landlords at an industry conference Tuesday.

The average monthly rent across all apartment types in King, Pierce and Snohomish counties fell from $988 to $959 during the 12 months ending in September, and a continuing decline through 2011 will further cut that figure to $889, Dupre + Scott projects.

While demand for apartments is falling, the supply is rising.

So far, 4,100 new units have opened this year, and more than 2,000 others are expected to become available by year-end, according to Dupre + Scott.

The firm estimates that about 20 percent of the 6,000 condos completed in the past three years are also on the rental market now.

The combination of job losses and new units has upped the region's vacancy rates from 6.6 percent last spring to 7.2 percent now, and heading toward 9 percent next year, the firm said.

To attract renters, landlords have lowered rents, and six out of 10 are offering concessions worth an average $757, according to the firm's research.

New York City Landlord Chimes In

On August 27, I received an email from a landlord in New York City about falling rents and concessions. Please consider a snip from Landlord From NYC Chimes In On Falling Rents.

Hi Mish,

I'm a landlord here in NYC (as well as an avid reader of your blog) and I actually feel the 7-10% drop mentioned in the article understates the case somewhat. Based on what I'm experiencing, I'd say that rents are down 10 to perhaps as high as 20% from their peaks.

With home prices crashing year-over-year and both housing rents and apartment rents droping as well one might think that falling rents would be reflected in the CPI.

Inquiring minds are investigating 2009 BLS CPI Data to see if theory matches reality.

In what should be no surprise to anyone, the BLS is not in the ballpark. Here are some numbers and a chart.

CPI Data for September 2009: The rent index was unchanged and the index for owners’

equivalent rent increased 0.1 percent.

CPI Data for August 2009: The rent index was unchanged and the index for owners’ equivalent rent increased 0.1 percent.

CPI Data for July 2009: The indexes for rent and owners’ equivalent rent were unchanged.

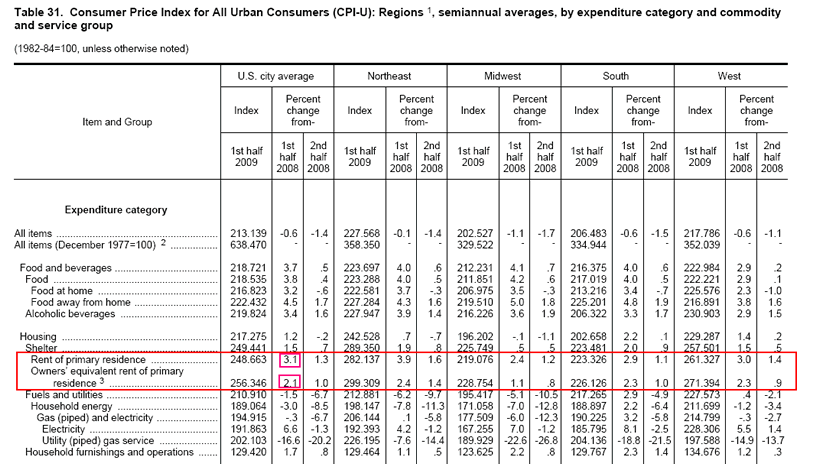

CPI Data for First Half 2009:

Unbelievable Statistics

- The BLS is reporting that rent from the first half of 2009 is up 3.1 % from the first half of 2008.

- The BLS is reporting that OER from the first half of 2009 is up 2.1 % from the first half of 2008.

Effect On The CPI

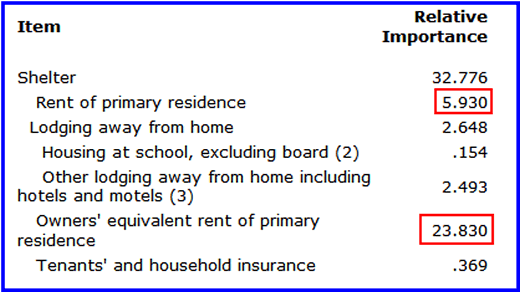

Inquiring minds are reading Consumer Price Indexes for Rent and Rental Equivalence

Rent of primary residence (rent) and Owners' equivalent rent of primary residence (rental equivalence) are the two main shelter components of the Consumer Price Index (CPI).

Rental equivalence. This approach measures the change in the price of the shelter services provided by owner-occupied housing. Rental equivalence measures the change in the implicit rent, which is the amount a homeowner would pay to rent, or would earn from renting, his or her home in a competitive market.

Relative Importance Of Shelter Components In The CPI

Note that OER is the single largest component of the CPI at 23.83%. OER plus rent of primary residence is a whopping 29.96% of the CPI.

With home prices crashing, a massive inventory of unsold homes, and a massive shadow inventory of unsold homes on top of that, does anyone think that rental prices of homes is rising?

Bear in mind that everyone but the BLS seems to know that rent prices are dropping like a rock.

Not The First BLS Error

This is not the first major error by the BLS. I have been harping for two straight years that a massive revision in jobs was coming because of a fatally flawed Birth/Death Model.

Last Friday, the BLS announced they would revise the number of jobs lost during the recession by a whopping 824,000. Please see Huge Downward Jobs Revisions Coming for details.

Most were shocked by this announcement. The only shock to me is how low the number is. Look for an upward revision (or for the BLS to smooth the number over time).

Effect On The CPI

Rents of primary residence are clearly falling and OER should be falling as well. Given that OER and rent make up 29.96% of the CPI, the Year-Over-Year CPI is massively overstated at -1.5%.

The BLS is once again in the twilight zone.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.