Gold Long-term Rating Remains Bullish

Commodities / Gold & Silver 2009 Oct 04, 2009 - 11:46 AM GMTBy: Merv_Burak

So, the 2016 SUMMER Olympics will be held in WINTER. Do I have that right? On the other hand I guess it’s summer all year round in Rio. Nothing helped the precious metals market this week. Maybe we’ll see more movement this coming week.

So, the 2016 SUMMER Olympics will be held in WINTER. Do I have that right? On the other hand I guess it’s summer all year round in Rio. Nothing helped the precious metals market this week. Maybe we’ll see more movement this coming week.

GOLD : LONG TERM

I wouldn’t bother dwelling too much on the long term as the week’s activities did nothing to change the existing indicators or rating. Gold remains above its positive sloping long term moving average line and the momentum indicator remains in its positive zone. The momentum indicator is, however, still below its negative sloping trigger line and needs a couple more upside days to get above its trigger. The volume indicator has shown some weakness lately but is still above its long term positive sloping trigger line. Putting it all together the long term rating remains BULLISH.

INTERMEDIATE TERM

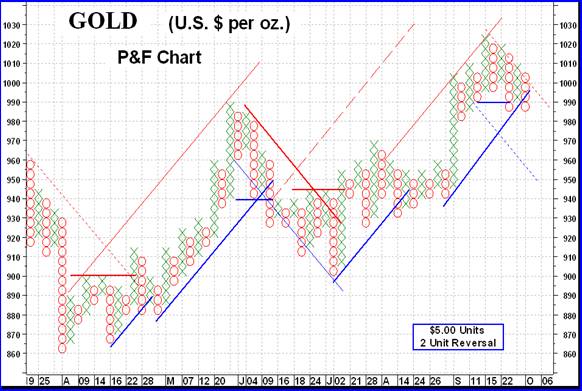

The P&F chart show here could be sort of in-between an intermediate and short term chart. With P&F charts, with the wide range of units and reversal possibilities it’s sometimes hard to tell if a particular chart represents short, intermediate or long term trends. As long term readers to these commentaries may remember, the heavy solid lines represent primary trends and support or resistance levels. The lighter lines as well as the dashed ones represent secondary support or resistance lines. The dotted lines today suggest possible future trends or in the case of the initial red down line, where the potential resistance might have been, lacking earlier data on the chart. The red is bearish while the blue is bullish. Regardless of the chart units or reversals, for a trend reversal I require the breaking of BOTH, the up (or down) trend line AND a move below two previous lows (or highs). Since last going bullish in mid-July at $950 we have not reversed but are now getting close. A move to the $985 level would breach both requirements for a reversal and we would then be in a bearish trend, P&F wise. It should be noted that the long term P&F chart shown here many times in the past is still some distance from going bearish. At the present time that would not be until the $900 level is reached.

As for my usual indicators, gold remains above its positive sloping intermediate term moving average line. The momentum indicator remains in its positive zone although, like the long term indicator, it too is below its negative sloping trigger line. The volume indicator is now below its still positive sloping trigger line for a mixed reading. However, putting this all together the intermediate term rating remains BULLISH. The short term moving average line remains above the intermediate term line for a confirmation of this rating.

SHORT TERM

As the short term chart shows, gold price basically moved sideways this past week with a small upside bias. The price moved up and down, above and below its short term moving average line ending the week just very slightly above the line. The line itself is still in a minor downward slope. The momentum indicator stayed in its positive zone throughout the week but still ended the week slightly above a still negative trigger line. Nothing much can be deciphered from the daily volume action. The short term rating has improved with this oscillating price moves and is now a + NEUTRAL rating. The very short term moving average line is still below the short term line and is not yet confirming a direction change to the up side.

As for the immediate direction of least resistance, that looks to be to the up side. The Stochastic Oscillator is moving higher rapidly (although this could change on a moment’s notice). The price does seem to have made a short term support at the $985 level and is expected to hold above that level or else we have some further downside coming.

SILVER

We seem to have a very nice trend going on in silver. Going back 11 months the price has been in an up trending channel. The volume indicator has also been in an up trending channel confirming the price trend. The momentum indicator has been confirming each new price peak with a slightly higher peak of its own. The only problem now is that it looks like we may be in for some more downside action ahead, say back to the $14 to $15 level, before the price starts its next advance. Of course trends do not last forever and this one will end sometime.

For now the short term has already reversed and is losing strength. The short term momentum is just about to go negative following the price trend which has broken below its moving average line. The short term moving average has also turned downward. The short term rating is BEARISH.

The other periods are still okay. The silver price remains above the intermediate and long term moving average lines and the lines slopes are still positive. Momentum for both periods are still positive but the indicators are moving lower and have dropped below their negative trigger lines. Despite the weakening momentum the ratings for both periods remains BULLISH.

PRECIOUS METAL STOCKS

When the major Indices are being sold off look to the Pennies for encouragement. How can one worry about a possible bear market in the precious metal stocks when the pennies are still going strong? The Merv’s Penny Arcade Index of 30 penny stocks had an average gain of 2.6% while every other major North American Index declined. There is a warning here, however. Looking at the momentum indicator, it is not keeping pace with the Index. If this keeps up and the Index goes into a reversal prior to the momentum going into new highs we will then have a negative divergence that is a real killer most of the time. So, although the pennies are still in a great mood, that may not last. A trend reversal in the pennies is something that I would expect BEFORE the higher quality stocks top out so I still see more upside in the better quality stocks ahead. But if the pennies should reverse course then it’s a disaster warning for the quality stocks, maybe not immediately but sometime in the not to distance future after a penny reversal. The last time the pennies topped out was in April 2007, almost a year before the quality stocks topped out. In the mean time go with the trend but keep your stop loss points handy.

MERV’S PRECIOUS METAL INDICES TABLE

Well, that’s it for another week.

By Merv Burak, CMT

Hudson Aero/Systems Inc.

Technical Information Group

for Merv's Precious Metals Central

For DAILY Uranium stock commentary and WEEKLY Uranium market update check out my new Technically Uranium with Merv blog at http://techuranium.blogspot.com .

During the day Merv practices his engineering profession as a Consulting Aerospace Engineer. Once the sun goes down and night descends upon the earth Merv dons his other hat as a Chartered Market Technician ( CMT ) and tries to decipher what's going on in the securities markets. As an underground surveyor in the gold mines of Canada 's Northwest Territories in his youth, Merv has a soft spot for the gold industry and has developed several Gold Indices reflecting different aspects of the industry. As a basically lazy individual Merv's driving focus is to KEEP IT SIMPLE .

To find out more about Merv's various Gold Indices and component stocks, please visit http://preciousmetalscentral.com . There you will find samples of the Indices and their component stocks plus other publications of interest to gold investors.

Before you invest, Always check your market timing with a Qualified Professional Market Technician

Merv Burak Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.