The Economy and Debt, A Pragmatic View

Economics / Economic Recovery Oct 03, 2009 - 10:53 AM GMTBy: Brian_Bloom

In Australia (as in many other countries of the world), our Federal Government’s reaction to the financial crisis was to distribute money in the form of “gifts”. Their intentions were supposedly honorable. They wanted to stimulate the economy. In the first instance, they wanted to stimulate the construction industry because housing is a very important element of the economy. So they offered the gift of a significant cash rebate (funded by taxpayer money) to first home buyers. What was the impact of this?

In Australia (as in many other countries of the world), our Federal Government’s reaction to the financial crisis was to distribute money in the form of “gifts”. Their intentions were supposedly honorable. They wanted to stimulate the economy. In the first instance, they wanted to stimulate the construction industry because housing is a very important element of the economy. So they offered the gift of a significant cash rebate (funded by taxpayer money) to first home buyers. What was the impact of this?

- Many first home buyers who couldn’t really afford to, bought homes that they should/would not otherwise have bought and are now up to their ears in debt.

- The price of low end housing rose – typically by an amount which exceeded the amount of the cash rebate, because banks will lend you nine dollars for every one of your dollars to buy a house and the government’s cash rebate was considered “your dollars”.

- The Australian Federal Government’s budget blew out.

Then the various governments (State and Federal) offered cash gifts to people who would install energy saving “devices” such as solar hot water systems and/or ceiling insulation. Again, the intentions were supposedly honorable. Al Gore and the IPCC had convinced everyone that carbon dioxide was “bad” so they wanted to reduce Australia’s dependence on coal fired electricity whilst at the same time stimulating the economy. What was the impact of this?

- Sales of solar hot water systems boomed. Waiting lists grew. Whilst prices of competitor systems were roughly comparable, installation charges rose. This analyst called for several quotes. For half a day’s work to install similar systems, the installation quotes ranged from A$900 to A$1800. Two people working for five hours at A$50 an hour should have charged A$500 for their labor. The difference? Maybe it was the cost of travel time and plastic piping. Maybe the installers decided they could get away with A$100 to A$150 an hour for their labor. Who cares? The government’s paying.

- Sales of ceiling insulation bats boomed. Local manufacturers couldn’t cope. Imports from China rose. Unscrupulous vendors raised prices. Sometimes by as much as 100% on what they were previously charging for products that may well have been landing them at a lower cost than the Australian manufacturers had been charging. Very probably, the lower cost was associated with a lower quality.

- The State and Federal Governments’ budgets blew out.

There were other examples, but you get the picture.

Question: Given the above, will unemployment continue to grow?

Answer: In all likelihood, yes, particularly within the US economy. And, given that the US economy is the largest in the world, this seems likely to cascade into other countries.

Why?

The answer is multi dimensional. In the first instance it has to do with a phenomenon called “monetary inflation”. The United States Federal Reserve (an institution whose very existence flies in the face of Article 1, Section 8 of US Constitution) has the ability to create money out of thin air – without any Congressional supervision whatsoever. When you “inflate” the money supply of a nation, you are creating what economists describe as an inflationary environment.

There are three possible outcomes of monetary inflation:

- If it serves to stimulate economic activity without placing a strain on the currently underutilized capacity of commerce and industry to supply, then prices remain constant but debt levels rise.

- If it serves to stimulate the economic activity and, at the same time, this places a strain on the capacity of commerce and industry to supply, (as has happened in Australia in the above examples) then prices rise. But debt levels also rise.

- If it serves to stimulate the economic activity and overseas suppliers move in to fill demand because local suppliers are unable to do so, then the likely result will be a fall in the value of the currency of the country which is increasing the money supply. This, in turn, will give rise to higher import prices and prices in general will likely rise. Debt levels also rise.

The bottom line is that debt levels always rise following monetary inflation. If it’s not government debt levels then it’s personal and/or corporate debt levels. Usually it’s all three.

The chart below shows “total debt outstanding in the United States, both secured and unsecured, as a percentage of GDP” .Source: http://www.newamerica.net/publications/policy/overcoming_americas_debt_overhang_case_inflation

The debt levels are a direct consequence of the activities of the US Federal Reserve, which was formed in December 1913, nine months before the outbreak of World War I.

The above begs the following question: When does a country reach the point when its debt levels are too high to be sustained?

The pragmatic answer to that question is: When the level of delinquencies becomes chronic and continues to rise despite economic stimulus.

At the end of the day, rising delinquencies are typically driven by rising unemployment. When you have chronic and rising unemployment, it doesn’t matter what the prevailing levels of interest rates may be and it doesn’t matter whether or not you “refinance” your debts. If you are unemployed, you will not have sufficient income to make either interest or capital repayments.

Additional to the above, there are a couple of “nuances” (some nuances!):

- One question revolves around whether the banks are accurately reporting the levels of delinquencies. The issue here ultimately devolves to whether or not the banks are showing assets on their books (loans to consumers and corporations) which they really should be writing off as bad debts. If not, the question arises as to whether the US banking industry as a whole (as an example) is solvent. That’s where we appear to be right now.

Quote: “…. 4.89% of mortgages were 30 days past due in August 2008, while in August 2007, the rate was 3.44%, as Equifax data showed. The rate of subprime mortgage delinquencies currently tops 41%, growing from about 39% in each of the prior five months.

Thus, in compliance with the data got by Reuters, 7.58% of US homeowners were at least 30 days late on payments in August, up from 7.32% in July”

Quote: “The proportion of credit card accounts at least 60 days past due was down in August for the third straight month, while subprime card delinquencies also fell. That improvement in delinquency rates partly reflects risk-aversion among issuers, [analyst emphasis] which have reduced the number of cards by 82 million, or 19%, over the past year, while cutting credit limits by $721 billion, to about $3.6 trillion.”

(Source: http://mostlyeconomics.wordpress.com/.. )

Quote: “Bank of America said its charge off-rate -- loans the company does not expect to be repaid -- rose to 14.54 percent in August from 13.81 percent in July.

Citigroup, the largest issuer of MasterCard-branded credit cards, said its charge-off rate rose to 12.14 percent in August from 10.03 percent in July.” Source: http://www.reuters.com/.. )

Author comment: When you write off a non performing loan it ceases to be classified as non performing. Credit card delinquencies may have fallen in the three months to August because charge-off rose. So, the question is: “Have the banks been charging off mortgages? If not, why not?”

- Another question revolves around whether the US Federal Government is itself able to service its debts. If it cannot match its committed expenditure stream with its income stream from taxes then it will be forced to collaborate with the Federal Reserve to continue printing money to “plug the gap”. In turn, if the US Federal budget is in chronic deficit then this will result in an ever upwards spiraling of US public debt levels. At some point, questions begin to be asked about whether the dollars being created out of thin air by the Federal Reserve have any value at all. That’s where we appear to be right now.

Is it possible that the US Federal Government’s income stream from taxes could rise to cover its expenditures? The answer to this question, once again, boils down to the anticipated level of unemployment.

So let’s look at unemployment from a different perspective.

The following is a quote from a recently published article by Frank Shostak. (See: http://mises.org/story/3697 )

“A weakening in the growth momentum of lending has taken place despite central banks' massive monetary pumping. Commercial banks in major economies are finding it more attractive to sit on the newly injected money rather than lend it out.”

The article is entitled “Does a Liquidity Trap Pose a Threat” and I would strongly recommend that readers take the time to read this article very carefully

What Frank is talking about in this article is the meaning of “real” savings. Here is another quote:

“once the economy falls into a recession on account of a falling pool of real savings, any government or central bank attempts to revive the economy must fail. Not only will these attempts fail to revive the economy, but they will deplete the pool of real savings, thereby prolonging the economic slump.”

Let me try to explain this in layman’s terms (given that I am a layman as opposed to an economist)

Assume that Joe Sixpack earns $60,000 a year and assume that he is one of the lucky employed in an environment where the government statistics admit to 9.8% unemployment but the real figure is probably higher.

His $60,000 a year is spent on things like mortgage and other debt repayments, clothing, food, schooling for his kids, medical expenses, entertainment.

Now, in an environment where there is a growing delinquency in debt servicing and/or repayments, the US Government tries to stimulate the economy by printing US Dollars. But there are inadequate “real savings” to back these new dollars. As a consequence, the pool of real savings is depleted further and the dollar loses value.

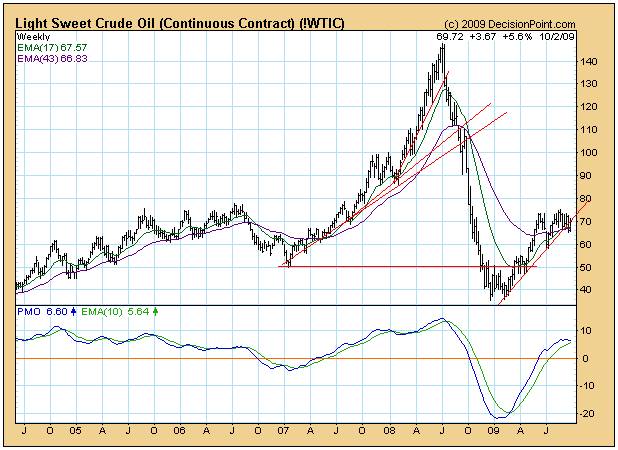

Even if the US Dollar doesn’t “appear” to fall in value (in terms of the US$ index), raw materials which are crucial to the maintenance of a buoyant economy start to rise in price in US$ denominated terms. From the US’s perspective, the most important of these is oil given that 90% of all transport within the US is powered by oil. Below is a chart of the price of oil (courtesy Decisionpoint.com)

Note how the price of oil started to rise in early 2009 after the US Fed began to man the printing presses like there would be no tomorrow.

Unfortunately, when the oil price rises, this adds to the cost of transport for Joe and it also adds to the cost of other things that Joe buys that also have transport costs as part of their cost structure (like fruit and vegetables and meat).

Eventually, Joe can’t come out on his $60,000 a year anymore. But he’s in a bind. He can’t go to his boss to ask for a raise in salary because his boss is firing people in order to cut wage costs. Maybe Joe will be seen as a trouble maker and he will also be fired.

So Joe does the only thing he can. He cuts back on purchases of non essentials. In turn, this translates, eventually, to a downward pressure on economic activity across the entire country and on GDP.

Last week the author hereof published an article entitled “A Peter Pan Market” (See:Stock Market, A Peter Pan Market ). In that article it was explained what happens to corporate profits when a recession hits. But there was insufficient space to look closely enough at this issue. So, below the reader can find four tables which show more accurately what typically happens in the real world when a recession hits. (The reader is cautioned that these Tables are conceptual)

Table 1: A notional corporation’s profit model before the recession hits

Table 2: After the recession hits and assuming no competitor reaction (7.5% fall in revenue arbitrarily assumed. Everything else remains constant)

Table 3: After the recession hits and assuming there is competitor reaction in the form of discounting. (5% discounting wins some sales and only 5% fall in revenue. Everything else remains constant)

Table 4: Optimistic. After the recession hits and assuming competitor reaction in the form of discounting. (5% discounting wins all sales back. No fall in revenue. Everything else remains constant)

The reader’s attention is drawn to the line marked “Fixed Costs”. They start off at 30% of revenue but they have been kept constant at $300. In reality, employers fight at two levels when a recession hits. At one level they try to protect their sales line by giving discounts. At another level they try to cut their fixed costs by retrenching staff amongst other things.

In the current economic environment, with historically high debt levels (and low real savings) the more the US Federal Government tries to stimulate via a US Fed assisted policy of monetary inflation, the more there will be an upward pressure on prices and the more there will be a downward pressure on revenue and an increasing propensity on the part of employers to retrench. Eventually, some employers will go into insolvency and the unemployment rate will rise further.

This is what Frank was talking about in real world terms when he said that “. Not only will these attempts fail to revive the economy, but they will [further] deplete the pool of real savings, thereby prolonging the economic slump.”

Now, in the above context, let’s look back into history. The market peaked on October 10th 2007 when the Standard & Poor Industrial Index hit a high of 1565.36.

At that time, as can be subjectively judged from the chart below, the P/E ratio of the $SPX (black line) was around 18X (courtesy DecisionPoint.com)

In rough terms, 1565/18 = eps of around $87 a share.

But the tables above show that earnings might be expected to fall by between 30% and 66% if the revenue volumes fall by around 7.5% in real terms as a result of the recession. In broad brush terms, it seems likely that earnings are far more likely to be around the $45 – $50 level than the $87 level and, if this happens, Price/Earnings ratios will inevitably fall back to more “normal” levels of 10X – 15X . Oops!

The reader is once again cautioned that the tables above reflect a conceptual argument. The purpose of these tables is to demonstrate a point of principle. Regardless of whether profits fall by 30% or 50% or 66% the question is: “Can corporate profitability be expected to get back to previous peaks in the foreseeable future given that further stimulus by the US Federal Government is likely to give rise to increasing unemployment?

The short answer to that question is: No. Therefore, P/E ratios will very likely contract.

Conclusion

If you are of sound mind, and if you have any empathy with the above, you will probably not want to be invested in anything but “special situations” in the equity markets and you will probably want to avoid most debt instruments that are denominated in US Dollars. Additionally, you will probably also want to avoid leaving your hard earned savings in the US banking system that is “insured” by the Federal Deposit Insurance Corporation which, in turn, is funded by dollars printed by the US Federal Reserve.

What do we do about all of this?

On a personal level we should erase the word “want” out of our lexicons and we should focus exclusively on the word “need”. Ask yourself: What do I absolutely need in order to survive what is coming down the turnpike?

If possible, you need to be debt free and you need to have an income that exceeds your expenditure.

If this is not possible, then you need to be prepared to dip into capital to augment your income for a few years. If you can’t achieve this, then you need to cut back on your lifestyle by moving to a less expensive neighborhood and/or by living more frugally.

On a more macro level, you might want to investigate owning some gold as an insurance policy. Gold tends to hold its value in times of economic crisis.

On an even more macro level, you can buy a copy of my factional novel, entitled Beyond Neanderthal. This book may be a few years ahead of its time but it points a possible way forward. You can purchase a copy via Amazon or via the weblink below.

The reader should understand that it is “energy” that drives the world economy and that fossil fuels passed their use-by date in the mid 1970s. In essence, the Fed has been printing money as a response to the fact that wealth creation activities which rely on fossil fuel energy input have become increasingly impotent. As a consequence, debt levels have exploded to unmanageable levels. That, in essence is why the world economy is now teetering. One alternative energy “driver” of the world economy may be nuclear fission. But it may not be. That is why I am now researching a second factional novel which will focus on nuclear fission. In the meantime, perhaps we might find ways of accelerating implementation of the vision articulated in Beyond Neanderthal

Brian Bloom

Beyond Neanderthal is a novel with a light hearted and entertaining fictional storyline; and with carefully researched, fact based themes. In Chapter 1 (written over a year ago) the current financial turmoil is anticipated. The rest of the 430 page novel focuses on the probable causes of this turmoil and what we might do to dig ourselves out of the quagmire we now find ourselves in. The core issue is “energy”, and the story leads the reader step-by-step on one possible path which might point a way forward. Gold plays a pivotal role in our future – not as a currency, but as a commodity with unique physical characteristics that can be harnessed to humanity's benefit. Until the current market collapse, there would have been many who questioned the validity of the arguments in Beyond Neanderthal. Now the evidence is too stark to ignore. This is a book that needs to be read by large numbers of people to make a difference. It can be ordered over the internet via www.beyondneanderthal.com

Copyright © 2009 Brian Bloom - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.