Credit Crisis Explained- Credit and Credibility

Stock-Markets / Credit Crisis 2008 Oct 02, 2009 - 02:08 AM GMTBy: Richard_Karn

Chapter 2: “Nobody’s right, when everybody’s wrong”

Chapter 2: “Nobody’s right, when everybody’s wrong”

Chapter 1 Here : “Pay no attention to that man behind the curtain!”

Arguably more effective than the military adventurism that dominates the headlines, what amounts to American cultural imperialism has subtly seduced large swathes of the world, and it has not been limited simply to a taste for fast food, film, and fashion. The far more addictive aspect has been the successful overseas marketing of the “debt culture” via the financial innovation associated with the securitization (derivative) markets, which at $27 trillion has constituted the US’ largest export of the 21st century. This is the realm of the money center banks. 1

Enticed by various forms of off-balance sheet ‘accounting’ skullduggery, very few large banks globally managed to resist the siren song of easy profits and big bonuses offered by these financial innovations simply because it appears the only restriction on ‘profits’ was how far a bank dared to push its exposure. That these vehicles were purposefully unregulated only increased their allure: calls for regulation as far back as 1998,2 and again in the aftermath of the Enron scandal when these vehicles’ deceptive capabilities were fully exposed, were shouted down at every turn by none other than Alan Greenspan, Larry Summers and Robert Rubin and their cohorts in the SEC,3 ostensibly not to stifle innovation or to drive markets offshore. But the behavior at Enron, far from being viewed as a cautionary tale prompting stricter agency enforcement, was adopted as the exemplar by money center banks—the very same banks, incidentally, that had made the ongoing fraud at Enron possible through a host of derivatives and special investment vehicles4 the likes of JPMorgan, Citibank et al actively marketed to Enron; instead, derivatives were the mechanism use to transmit the cancer globally.4,5

This tacit government sanction suggests to us then that in effect the whole financial crisis only came to light because of what amounts to a falling out amongst thieves. No investigative reporter or oversight committee or regulatory watchdog safeguarding the interests of the public discovered and exposed any wrong-doing: major international banks’ books just became so overloaded with god-awful paper they knew may well be worthless that they grew terrified of loaning money to each other even over night for fear of not being repaid.6 Once inter-bank lending stopped, credit creation froze, and the Ponzi-scheme parallel in the fiat currency mechanism began to breakdown.6

The securitization and derivatives markets were so thoroughly corrupted by ‘innovation’ that if a bank shuffled paper, adjusted notional values and tweaked their infallible computer models furiously enough, they could arrive at the happy position of not requiring any capital reserves whatsoever to make loans. In other words, major banks worldwide indulged in what amounts to rampant uncollateralized lending—literally creating and distributing unfathomable amounts of money in the form of debt issuance from nothing, secured by nothing. And quite possibly worth nothing. It is widely assumed the still undisclosed expenditure of $2 trillion of taxpayer money referred to in the previous chapter was used to purchase boatloads of this stuff in order to stave off the recognition by the public that this behavior had rendered many of these ‘too big to fail’ money center banks literally insolvent; similar bailouts have been undertaken by governments worldwide.

Concurrent with the runaway lending, central banks throughout the world were channeling trade surpluses with the US as well as with each other into US Treasury bonds while simultaneously creating equal amounts of domestic currency to weaken it in order to maintain export competitiveness. This got so out of hand that today two-thirds of the world’s assets are denominated in US dollars.7 The most controversial of these arrangements has been the de facto vendor financing agreement China has extended to the US: China suppressed the yuan, exports exploded, and it accumulated surpluses; the US let the dollar fall, consumption exploded, and it accumulated debts.8 Both actions were irresponsible and highly inflationary. Combined with similar behavior from much of the world, it produced a flood of liquidity that was if not misinterpreted as emerging market prosperity, certainly overstated it. At the time it was noted primarily for contributing to the low interest rate environment enjoyed in the US that enabled the American consumption binge accompanying the housing bubble. Few realized housing bubbles were pandemic.

Our analysis concludes it was never a case of a “global savings glut” as proclaimed by Mr. Bernanke and the Fed in 200510 and reiterated by ex-Treasury Secretary Paulson11 earlier this year to deflect blame for the global financial crisis but a global fiat currency glut—a case of rampant global monetary inflation. Too much money could be leveraged too many times and transferred between too many international markets too quickly. In addition to masking the extent of fiat currency creation, it produced, by historic standards, rapid-fire sequential bubbles in a range of real assets and commodities supported by credible explanations like ‘the emerging market infrastructure build-out,’ or ‘they’re not making any more real estate’ or ‘emerging middle classes will want to improve their diets’ or ‘Peak Oil,’ and was reinforced by price action. These bubbles, as they must be, were largely based on the sound reasoning, analysis and extrapolations of economic data, as was the price action that supported it on charts; however, positive technical chart patterns cannot readily distinguish between breakouts driven by a glut of fiat currency looking for a speculative return and the supply and demand imbalances in this instance attributed to emerging market growth. Momentum produced the self-reinforcing hype of being right—something the ETR fell victim to itself—and as markets have discovered, it works in both directions. 10,11

Because there was so much fiat currency made available by these artificial means, the global spending binge was presumed to be prosperity and to reflect the wonders of globalism. Certainly lives were improved initially and stand to be improved further in the future, but too much cheap money invariably leads to a misallocation of resources, and in retrospect over-capacity was certain to result. The World Bank’s chief economist places global capacity utilization today at a record low of between 50 and 60%, which means despite the ‘green shoots’ there will be more lay-offs coming.12 Many of the frothier aspects of globalism have deflated, some would argue have overcorrected, and a clearer picture of supply and demand will emerge, but the discovery process as well as the ravages attendant to such imbalances are unlikely to be either pleasant or subject to a quick fix because too much damage has been inflicted. Now the trap door of the monetary inflation mechanism has been sprung open: as asset values decline, debt levels remain fixed, resulting in previously ‘manageable’ amounts of leverage becoming nightmarish. An increasing percentage of income is required to service obligations taken on during the ‘good times’ and will likely be exacerbated further as income and spending declines during the ongoing economic contraction. In an attempt to combat this, central banks are monetizing debt and suppressing interest rates in an attempt to get more money into circulation, for in this case what applies to an individual applies as well to entire nations.

This glut of fiat currency produced a surfeit of debt, the most volatile of which is concentrated in emerging markets, and represents a potential calamity for global financial markets because the majority of this debt is not denominated in native currencies which may be inflated away or rolled over indefinitely but primarily in euros, Swiss francs, and yen. The Swiss have devalued their currency and the Japanese are apparently considering it (see below),13 but the EU is exercising what they consider to be fiscal restraint. Germany has been particularly vocal in denouncing quantitative easing and the unfettered expansion of the monetary base for they well-remember the Weimar hyperinflation. Whether the ‘green shoots’ of an economic recovery or simply an inventory rebuild following record draw-downs,14 dollar weakness has coincided with a bounce in global equity and commodity markets and has provided emerging market currencies with a respite of sorts. But the euro is particularly strong in part because of their comparative fiscal restraint, which is undermining export-dependent euro zone economies, like Germany, and putting increasing stress on emerging market debtors.

The rally out of the March low has seen considerable strength in emerging market currencies, but these conflicting central bank actions have seen few actually recover their pre-crisis values, which makes their euro-denominated debts in particular increasingly expensive and difficult to service. Latvia (see below) and Vietnam, which has been unsuccessfully attempting to sell debt since February,15 are but two of the latest cases of countries being unable to access the capital markets: despite forecasts for a record $11.69 trillion of government debt issuance this year, and a pick up in emerging market issuance since the March low in global markets, a reluctance to lend to weaker economies remains.16 Having to compete in the capital markets with AAA-rated American and European central banks already committed to raising $3.5 trillion in 200917 at the same time surplus-generating countries, notably China, Japan, and the Gulf states, are contracting and likely to continue focusing their resources on domestic programs is resulting in a liquidity squeeze that is driving numerous emerging markets deeper into recession, capital controls and default.18

Many developing countries have maintained or raised interest rates to avoid capital flight, which has sparked a rebound of the carry-trade in which low-interest dollars, euros and yen are sold to buy a basket of commodity currencies such as the Australian and New Zealand dollars mixed with high yielding currencies like the Brazilian real, Hungarian florint, Turkish lira, Indonesian rupiah, and South African rand.19 A hiccup in the global recovery could inflame currency volatility as these carry-trades are closed, especially if the amount of leverage approaches anything like that employed in the past. As was seen in the latter half of 2008, violent currency swings can render emerging market fiat currencies virtually worthless outside their borders while driving price inflation within, especially for imported goods such as energy and food.

The list of countries that are vulnerable in this regard, whether due to the implementation of capital controls or to being otherwise burdened by what may prove to be unserviceable debts or dubious policies, represents a broad cross-section of what have been perceived as emerging market success stories over the last decade:

Table 1: Emerging Market Vulnerability

Export-driven economies the world over are being hit hard by consumer cutbacks in the US and the OECD. This can only worsen as the World Bank expects another 25 million people to lose their jobs in the OECD alone by 2010.26 Germany, the EU’s strongest economy, suffered a 23% year-over-year decline in exports in the first quarter of 2009.27 The spring rebound in Asian exports may be faltering: Chinese exports dropped 26.4% year-over-year in May, accelerating from a 22.6 per cent fall in April, marking the seventh consecutive month of decline28; similarly, South Korea's exports were down 28.3%, Malaysia’s down 26%, and India’s down 33%.29 Japanese exports fell a record 26% in May, and its gross domestic product fell at an annual pace of 14.2 % in the January-March period, also the steepest decline on record, and marking the fourth straight quarter of decline.30 There is growing speculation Japan may follow the lead of Switzerland and Taiwan and devalue the yen as they did in 2003-4. South Korea, Singapore and Sweden seem to be on the same track, and apparently members of China’s politburo have a similar inclination, motivated in part by the need to offshore its productive over-capacity.

Ironically, for all of the early condemnation of American recklessness, according to the Bank for International Settlements it turned out Western European Banks had far more exposure and a greater degree of leverage to emerging market debt than either the US or Japan. In fact, they held almost all of it. As with most of the world, the EU gained an illusion of wealth from unsustainable spending in countries on the periphery that longed for membership; the asset bubbles, credit growth and investment booms that powered the spending collapsed concurrently with the even more significant bubble in the US. 32 By late in 2008 Austria’s emerging market debt exposure to Central and Eastern Europe amounted to 85% of GDP; Switzerland’s to 50%; Sweden’s to 25%, the UK’s to 24%, albeit primarily in Asia; and Spain’s to 23%, primarily in Latin America; by way of comparison, US exposure amounted to 4% of GDP.33 The collapse devastated activity in the export-dependent countries, especially Germany, and poor risk mitigation has severely damaged many European banks. Today, although the situation has improved in step with global equity markets, Western European bank exposure to Central and Eastern Europe alone exceeds $1.6 trillion.34

The failed auction of sovereign debt in Latvia on June 3, 2009 may foreshadow what is to come throughout Central and Eastern Europe, occurring as it did despite the backstop provided by the International Monetary Fund (IMF) in the form of anti-crisis funding programs for Latvia, Hungary, Ukraine, Belarus, Georgia and Armenia.35 Attempting to raise a paltry-sounding $110.7 million, the government was unable to sell any of its debt, not least because the Latvian economy is now expected to contract by 18% this year, as opposed to the 5% assumed under the original IMF agreement, and it is widely assumed that a devaluation of its currency, the lat, is now inevitable. A devaluation, which the IMF favors, would put Latvia in violation of the Exchange Rate Mechanism currency peg they must maintain for membership in the EU, but the attempt to maintain the peg has been ripping the Baltic economies asunder because the bulk of their borrowing was not in their own currency but mainly euros and Swiss francs. Latvian house prices have collapsed by 50%, earning it the dubious distinction of experiencing the most dramatic collapse in the world.36 The failed auction had an immediate ripple effect on the currencies of Hungary, Poland and the Czech Republic, but the most damage may have been inflicted on the Swedish Banking Index, the SEB, because its banks have lent heavily to the Baltic republics: it lost 11% on the day.37 A growing fear is that other countries in the region besides Latvia’s Baltic brethren with similar macroeconomic vulnerabilities and refinancing needs (please refer to the chart below), with Bulgaria and Romania being mentioned frequently, may find themselves in Latvia’s position in short order.38 It should also be noted that the political instability in the region has already seen governments in Latvia, Hungary, the Czech Republic and Estonia fall during the economic crisis.39

Chart 1: Central European Refinancing Needs in 2009 as a percentage of Foreign Exchange Reserves

Source: Wood/IMF40, 41

Because the European central bank has not embraced quantitative easing and Western European banks have written down so little debt, especially compared with their US counterparts,41 a number of commentators contend the banking crisis has yet to fully hit Europe. Essentially, because European banks employed more leverage, they have less freedom to mark down debt, which makes them vulnerable in these conditions. In addition to the situation in Central and Eastern Europe, Western European banks face substantial US property losses they have yet to recognize, and are exposed to euro zone corporate debt to the tune of $11 trillion, equaling 95% of the combined economy, compared with US exposure of roughly 50%.42 If this were not enough, a significant portion of the Russian banking industry is under considerable stress, with $280 billion of a total $400 billion in debt to European banks being due in the next four years, and the issues regarding repayment and threats of non-payment that rattled markets regularly earlier in the year have yet to be resolved.43

As a result of the financial crisis, a potential rift in European Union solidarity has been exposed regarding issues of fiscal policy, labor competitiveness, unemployment, and budget surpluses versus deficits—all issues that fall along the cultural north-south divide that has existed since the euro’s inception. In January, Standard and Poor’s downgraded Spain’s AAA-rated sovereign debt to AA, the first such downgrade since Japan in 2001, and Deutsche Bank determined the entirety of the euro zone could find itself in violation of its own Growth and Stability Pact this year if the financial crisis did not abate.44 The Economist’s main risk scenario for the global economy, to which they assign but a 30% probability, sees “a material risk of euro zone sovereign defaults and one or more euro zone countries exiting the single currency under duress.”45

The rapid economic deterioration sparked widespread political unrest in Iceland, Greece, Ireland, Italy, Spain, and France. The riots that were widely expected this spring and summer as the implications of the financial crisis were absorbed by the masses46 have been forestalled by the revival of global markets but serve to highlight a percolating dissatisfaction. Moscow and Beijing put direct authoritarian measures in place in February in preparation for the anticipated disaffection,47 and The Economist’s Political Instability Index identified 95 countries in the ‘very high’ and ‘high’ risk categories in 2009, up from 35 combined in 2007.48

The irony that attempting to maintain some semblance of fiscal sanity in a world of fiat madness could potentially undermine the European Union is testament to how far things have gotten out of hand. Something on the order of three-quarters of net capital movements globally are transacted in US dollars, 49 with no likely substitute on the horizon, so as the only credible alternative to the dollar, should a banking crisis erupt in Europe in the current unstable environment, a collapse of the euro, which was unthinkable a year ago, can no longer be dismissed out of hand. To much of the world’s chagrin, even the hint of such instability could cement the US dollar’s position as the world’s reserve currency for years if not decades to come for there are simply no alternatives.50

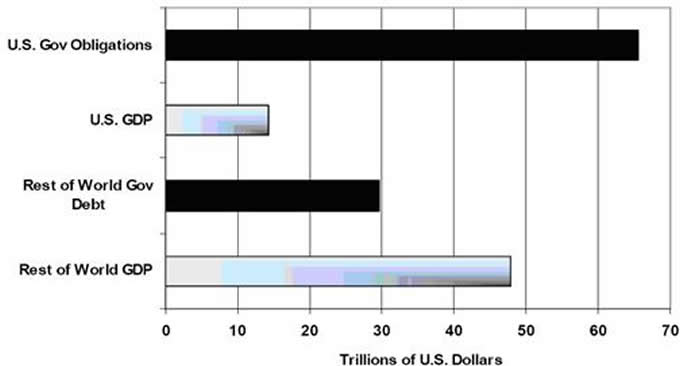

However, neither common sense nor logic has anything to do with the matter, for if it did, in light of the following chart, which unfortunately does not include the Obama administration’s current and projected expenditures of an additional $22.4 to $29.1 trillion,51 pushing the total well beyond $85 trillion, who in their right mind would invest in the US dollar or US Treasury debt?

Chart 2: Government Obligations vs GDP—2008

Source: FRB, BEA, IMF, BIS, Williams/SGS52

Part of the answer is simply that there is no credible alternative to the dollar, but habit and momentum play a role as well. As mentioned earlier, two-thirds of the world’s assets are denominated in dollars. The vast majority of the world’s reserves are held in US Treasuries, and the majority of international trade is conducted in dollars. There is less chance of the United States of America and the dollar collapsing than there is of the European Union and euro, the dollar’s most credible challenger; and has been demonstrated once again during the global financial crisis, in a time of abject financial panic, the role of the reserve currency is to safeguard capital—not in the sense of making a return on the money deposited in the custodial safe haven but to ensure the return of the money after the crisis passes so it can be put back to work. To provide a bit of perspective on the scale of the capital flight to US Treasury instruments, the 4-month period from August to November 2008 saw foreigners buy $352 billion worth of US Treasury bills—more than during the cumulative 30-year period ending in June 2008.53 This spring, once the crisis was perceived to have passed, the money was repatriated, inducing dollar weakness as that money sought a speculative return elsewhere.

But there is also something far larger at play that is best appreciated by approaching the matter from an oblique angle, somewhat akin to applying Occam’s Razor. Leading up to the global financial crisis, when the dollar was in what appeared to be terminal decline, the crowing over the fiat dollar’s impending demise came from all quarters and was deafening. Then, as the financial crisis plumbed one new depth after another, when outspoken critics of the dollar, whether China’s Wen, Russia’s Putin, Venezuela’s Chavez, Iran’s Armadinejad, or even France’s Sarkozy and Germany’s Merkle found themselves either standing numb in the rubble of collectivist fantasies or staring into the abyss of economic collapse, all fell silent: the world, which clearly and rightly blamed the US for the crisis, was in fact relying on the US to lead the way back.

The world in fact shut-up and let the dollar, not the euro, yen, yuan, franc, or ruble, do its job, which is to guarantee the resiliency and continuity of the global economy. To an as yet undetermined degree the Fed and Treasury have done exactly that by taking the most extraordinary steps imaginable. US officials did something while their European and Chinese counterparts stood around wringing their hands. We question the legitimacy as well as the efficacy of those efforts, but the world looked to the US for leadership and the US delivered.

Now that global markets have bounced and visions of ‘green shoots’ and the dawning of the ‘Asian Century’ are dancing through Wall Street’s head, the vitriolic rhetoric is back in full force, accompanied now with condemnations of capitalism and warnings of runaway inflation. A stream of American commentators, with Wall Street analysts leading the parade, are adamant the end of the dollar is neigh—and we have long maintained that this will indeed be the fate of the dollar, just not yet, for with the exception of the EU the rest of the world has been practicing various forms of quantitative easing, i.e. printing money, as fast or faster than the US; in fact, Wall Street darling China, which we discuss in the next chapter regarding decoupling, is expanding its monetary base, as measured by its M2 to GDP ratio, at a pace nearly three times faster than the US.54Imagine that.

Another glaring anomaly is that ‘normally’ gold and the dollar have a negative correlation; that is, their prices generally tend to move inversely. Little commented on by the US media, but as can be seen on the following chart, the period between early December 2008 and the March 2009 bottom saw the price of gold and the dollar synchronize as both were sought in the global flight to safety:

Chart 3: Gold vs. the US Dollar

During the worst of the panic, gold led the dollar up, making new highs against the fiat euro, Swiss franc, ruble, rupee, Australian dollar, South African rand, South Korean won, and Mexican peso to name but a few. 55 This signaled a profound change in the monetary landscape. In fact, virtually the only two currencies that gold did not make new highs against were the US dollar (and currencies pegged to it) by virtue of its reserve currency status and the yen, arguably due to the unwinding of leveraged carry-trade positions and the Japanese penchant for repatriating yen during crises. Simultaneously, the US dollar strengthened against all of the aforementioned currencies except the yen and demand for Treasury instruments as safe haven investments approached bubble proportions. Gold and the dollar appreciating together as safe haven investments reflected fears the global fiat currency regime was unraveling, collapsing from the outside in, from the emerging market economic periphery toward the New York center, and those able to seek safety were doing so.

Out of the March bottom, both declined together as well as trepidation regarding the validity of the ‘green shoots’ and ‘Asian Century’ themes lingered. By mid-April, the crisis was perceived to have passed, and gold and the dollar decoupled again as speculative fervor took hold of the global markets once more. We view this relationship not as a leading but as a confirming indicator of periods of advance and remission in the global credit crisis and believe it should be monitored closely going forward. If gold and the US dollar were to become synchronized again, the longer the two moved in tandem, the more risk we would see for the global economy.

Another anomaly brings a simple truth that has been lost in all of the noise into sharp focus. For all of the aforementioned self-righteous posturing and indignation, politicians and central bankers the world over have long understood perfectly well that if they were to collectively refute the dollar and dump US Treasuries it would affect a bloodless coup d'état, the financial losses incurred being the price of economic freedom as it were, and American dollar hegemony would end virtually overnight. Instead, in the aftermath of the collapse of the biggest credit bubble in history, the Federal Reserve’s holdings of Treasuries on behalf of other central banks and institutions, including China, rose by $68.8 billion, or 3.3 percent, in May of 2009, the third most on record.56 This opportunity to overthrow the dollar has been on offer for years, and would be far cheaper than taking on the US militarily, but as the world has become increasingly enamored with the machinations of fiat currency creation, the political class has lacked the wherewithal to act for two reasons.

The first is that when push comes to shove, none of the outspoken politicians or central bankers really wants to see the end of fiat currency use, just more power for their respective currencies and a louder say in policy. In October 2008, French President Sarkozy damned the Fed’s policy of serial bubble-blowing in calling for a new global financial order because “the same problems will trigger the same disasters,” which in our view is an accurate assessment. Calls for global regulatory reform and a Bretton Woods II to create a ‘multi-polar economic world’ that entails a heightened role for the euro as a counterpoint to the dollar, however, amounts to mere political posturing and empty rhetoric—halfway measures that can accomplish nothing for they would rest on the same foundation of sand as any fiat currency and be subject to the same corruption as the dollar. In any case, Sarkozy’s comments were made before the extent of European bank shenanigans and exposure to the emerging market debt bubble became apparent, which has since necessitated wholesale bank nationalizations and cooled the rhetoric somewhat. 57

Similarly, today China and Russia are leading a public relations campaign to adopt the IMF’s Special Drawing Rights (SDRs) as the world’s new reserve currency, with the goal of the BRIC nations’ currencies eventually becoming part of the mix. That the yuan is not freely traded and the ruble is not even trusted within Russia is conveniently overlooked, as is authoritarians’ historic affection for fiat currency abuse. Be that as it may, the IMF calculates the value of SDRs daily, with the dollar having a 44% weighting, the euro 34%, and the remainder split between the yen and the pound. Currently, China has a 3.66% vote in the IMF policy-making, Russia 2.69%, India 1.89% and Brazil 1.38%; the U.S. has a 16.77 percent.58 The BRIC nations recently announced plans to sell $70 billion of US Treasuries and to use the money to buy IMF debt and a bigger say in SDR policy. Affecting the adoption of the SDR as the world’s reserve currency would not cure any of the problems that stem from the use of a fiat currency, for SDR itself is a fiat currency: it would merely collectivize its management.

Essentially what they are all calling for is a bigger piece of the action, not legitimate reform. None want to see the return of a rules-based monetary system that could be easily monitored to insure adherence to its principles, such as the gold standard, because it would severely restrict their room to maneuver—if not making their jobs redundant. Without a synchronized global push into such a mechanism to supplant the fiat dollar and to normalize global trade relations, nothing of substance can eventuate.

As for gold standard proponents, which include the ETR, an ugly truth is that no country today would be allowed to have a currency backed by gold. Gresham’s Law has proven time and again that bad money drives out good, which simply means other countries would trade fiat for the gold-backed currency until the reserves, and thus the currency, were exhausted. This means that until all fiat currencies collapse, there is little hope of a return to fiscal sanity, and the Fed is nothing if not resourceful. Ironically, unless GATA accusations regarding the state of US gold reserves prove to be true,59 even the adoption of a gold standard would still produce a currency dominated by the US, whose official gold holdings nearly double those of the next three largest holders of gold, Germany, France and Italy, combined.60

The second reason there has been no coordinated effort to put an end to dollar hegemony, and the more important reason in our opinion, is that the dollar’s collapse would not be in politicians’ best interests. The fallout of a dollar collapse would inflict significant collateral damage on the world economy, if not precipitating a collapse of all fiat currencies; however, the political fallout could well result in these same politicians being swept from power, or worse, by angry citizens. There are numerous historical precedents for this which serves as a strong motivation for politicians, so we expect what amounts to at minimum tacit support for the dollar to continue.

We submit the majority of politicians and central bankers globally, regardless of ideological stripe, tacitly support dollar hegemony because they have in effect been either subverted or suborned by the power and wealth afforded them by operating fiat currency franchises themselves. In the very least these policy-makers are complicit by taking advantage of those less well-versed in the fiat currency mechanism—namely, their own citizens. As far as a politician is concerned, the benefits of operating a fiat currency franchise were detailed in the first chapter but the appeal can be summarized as the subtle theft of their citizens’ wealth, the accrual of power, regular deliveries of fresh ‘financial innovation’ to profit from, an enemy to vilify as well as to offer up as a diversion while affecting designs to plunder their own economy, and regular financial crises providing the opportunity to further pet agendas under the guise of ‘helping’ their people by inflating their currencies with abandon while they hide out in dollars for the duration.

The de facto cost of a franchise has to be the purchase of US Treasury debt. Otherwise, how can you explain the world continuing to buy debt from a country that is as patently incapable of ever repaying its debts as the US?

This is what we mean by all fiat currencies have become but derivatives of the dollar. Whether a grand conspiracy or a sad commentary on human nature will be a matter for historians to debate, but we would have you remember that soon after President Nixon ended dollar convertibility to gold, his Treasury Secretary, John Connally, famously informed a European delegation, “It may be our currency, but it is your problem.” US authorities have relied since on their assessment that politicians and central bankers’ allegiance is to power and money first, the welfare of their citizens a distant third to maintain dollar hegemony. Until those priorities are broadly reversed and acted upon, it is not in America’s self-interest as determined by and applied to its interventionist policymakers and their financier cronies, to make significant changes in US monetary policy aside from token compromises to maintain the appearance of engagement, such as the scraps tossed to the media to reassure equity markets at the G-20 meeting in April of this year.

There are significant implications, investment and otherwise, stemming from this assessment. Obviously, first and foremost, it means the dollar is neither going to collapse nor lose its place as the world’s reserve currency any time soon; more importantly from our perspective is the notion of using this understanding as a filter to tune out the endless hype in order to observe what is actually being done. Second, with most of the world printing just as fast if not faster than the US, we believe there will be increased exchange rate volatility, which will be exacerbated by speculators attracted to the massive leverage extant in the currency markets, and which will further add a new velocity to events that will broadly obscure a range of central bank machinations. Third, long term this will be supportive of commodity prices, but as the markets have amply demonstrated in the course of the last year over the short term literally anything is possible. Fourth, the world will buy more, not less, US Treasury debt. And fifth, the increasingly desperate measures implemented in response to the myriad deceptions, back-room deals and outright frauds operational today virtually guarantees that the global financial crisis is not over—just awaiting fresh revelations of wrongdoing. More than ever physical gold constitutes real savings in the traditional sense of the word: an intrinsic store of value you can rely on over time.

The world is now relying President Obama and his team to reassert American economic leadership—or at least to guarantee continuity so the world can go about the business of making money. And in order to do that, the Fed and Treasury simply have to find a way to get American consumers consuming again—the more profligately, the better. China is anxiously biding its time, keeping civil unrest at bay by pointing fingers at the US and embarking on the greatest infrastructure build-out in its history, ostensibly in anticipation of a rebound in global demand. As discussed in the first chapter, the problem is that the American consumer appears to have exhausted both his credit and his inclination to borrow at the same time his access to credit has been cut off by the very money center banks his taxes are financially supporting. Admittedly skewed by the recession, in the first quarter of 2009 consumption accounted for 72.4% of US GDP, a new record; pre-bubble, the norm was in the range of 67%,61 and the longer the economic downturn persists, the more likely consumption will overshoot to the downside.

A number of President Obama’s economic team served in the Clinton administration and were involved in a range of policy decisions that have enabled some of the most egregious financial misbehavior in American history, including what proved to be significant impetus for increased sub-prime lending and blocking derivative regulation. As the Obama administration has already demonstrated beyond a shadow of doubt, whatever rescue plans the new administration institutes next rely not only on the continuance but also the expansion of the established interventionist monetary policies that has landed us in this predicament. In other words, more of the same—only harder…much harder.

The critical task is either to get more money into the hands of working Americans or to find a way to lighten their debt loads to the point they can start spending again. The Depression Era make-work projects in the first stimulus plan are a start, but clearly will not be enough as there was more pork than legitimate stimulus. The Fed has demonstrated its willingness to sacrifice the dollar if necessary to keep interest rates low in order to ‘save’ the American consumer, and much of the world is doing their part to help by practicing quantitative easing as well, but the ebb and flow of global liquidity complicates their efforts: during the global financial crisis the world fled to dollar instruments aiding the Fed’s efforts to keep rates low, but now the threat is increasingly perceived to have passed, repatriating money drives up rates again, undermining their efforts. Paradoxically, that was as good as it could possibly get for the Fed: unless there is a significant durable conflict somewhere in the world that threatens many economies without touching the US, which will attract and hold foreign investment, this ebb and flow of a perpetually increasing volume of funds will accelerate with each new financial calamity, undermining Fed efforts anew. We suspect the Fed is desperate to find a way to buy the time they need to convince American consumers to translate their existing debts via government-sponsored refinancing schemes into new instruments of longer duration, perhaps something along the lines of 50- or 75-year mortgages, thereby reducing monthly payments for borrowers without reducing the principal for creditors, and both enabling Americans to start spending and banks to start lending more.

Since no one on the planet consumes as profligately as Americans, emerging markets, especially China, will make a lot of noise but continue to buy US Treasuries to help get Americans back on their feet financially, for there are no other ‘consumers of last resort’ and China can only stockpile so many commodities in anticipation of a rebound that can only go so far without the participation of the world’s largest economies. And that puts the notion of decoupling in a co-dependent light and lays the groundwork for a whole new dynamic.

* * * * *

Credit and Credibility presents the Emerging Trends Report’s comprehensive assessment of today’s financial turmoil and what we consider to be five of the most pressing issues that stand to impact the global economy in the years ahead. These issues are explored in the first five chapters:

- fiat currency, the financial abuse it engenders, interventionist policy response to perpetuate it, and the role of the US dollar going forward;

- our contention that all fiat currencies today have become derivatives of the US dollar has stunning implications globally;

- the extent to which emerging markets can decouple from ‘consumer’ economies, and the role of China as the litmus test for both the regional and the emerging market thesis;

- our contention that the world has had its fill of ‘financial innovation,’ and the only way the US economy can recover will be through its traditional strengths in agriculture, manufacturing, invention, and hard work; and,

- our assessment of the issues attendant to the anthropogenic global warming debate and pending legislation.

Credit and Credibility then delineates the investment approach demanded in this ‘brave new world,’ identifying potential pitfalls to recovery, asset classes likely to become candidates for bubble-dom, a set of leading indicators likely to mark the true bottom, and how these five issues will affect each of our investment themes.

In order to facilitate the comparison and update of our nine themes within this context, we are including complete copies of our original coal, gold, water & food, nuclear energy, silver, electric grid, transportation fuels, material science, and natural gas reports and have appended substantial commentary regarding the performance of each going forward, including a ranking by viability in the current environment. The heavily annotated eBook runs to more than 430 pages of text, not including 200+ pages of source material and suggestions for further reading.

To purchase Credit and Credibility as an individual report, or on an annual subscription basis, we invite you to visit our website at: http://www.emergingtrendsreport.com

By Richard Karn/ETR

310 Arctic Boulevard #102

Anchorage, AK 99503

Phone: 510-962-5021

www.emergingtrendsreport.com

© 2009 Copyright Richard Karn / ETR - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.