Financial Markets Driven by Uncertainty

Stock-Markets / Credit Crisis 2009 Sep 30, 2009 - 07:32 PM GMT I can’t think of a better way to describe the last 2 years than as times of great uncertainty. Not only did we have two near catastrophic banking failures worldwide, but we also have the ever present Iran Israel nuclear contention. The USD held reasonably well during this period, although it’s weaker. In any case, gold has held up amazingly well over the period of the last two years too, in fact is at highs. What else is except US T bonds?

I can’t think of a better way to describe the last 2 years than as times of great uncertainty. Not only did we have two near catastrophic banking failures worldwide, but we also have the ever present Iran Israel nuclear contention. The USD held reasonably well during this period, although it’s weaker. In any case, gold has held up amazingly well over the period of the last two years too, in fact is at highs. What else is except US T bonds?

Pimco’s Bill Gross just said the longer term of the US T yield curve is flattening and that suggests markets expect deflation to be an ongoing concern. He moved to 44% US T exposure as a result for his total return fund. Since that is often considered gold bearish what does this mean going forward? It is hard to hedge USD risk and gold risk at the same time. But we think there is a very good hedge strategy that can accomplish both reasonably well, which hedges many of the risks out there, and still leaves a very strong gold upside if it occurs later when the USD inevitably falls in value. This strategy is a long term strategy, so it’s worth looking into.

Uncertainly at a high

Well, for one thing, the dilemma of wither gold and the USD is being driven by uncertainty. In fact, the USD held up quite well during the last 2 years deleveraging – in the sense that it was around 70 on the US Dollar index USDX at its low about 1.5 yrs ago, and started climbing during the flight to liquidity (cash). US treasury bonds are at record low yields indicating that flight to cash is still very much in place. Money market funds are sitting on something like $2 trillion in cash at the moment (they also lost the US emergency guarantee recently). It is not safe just to sit in USD if you think there is deflation building because the USD is having major credibility problems. The GBP is in a lot of trouble too, and other central banks are still flooding out liquidity and lowering interest rates to just about 0. So what is a safe strategy?

And, as we said gold is at a high again around $1000, compared to later 08 where it dropped to near $700 after the Summer 08 commodity bubble crash. The other commodities are nowhere near their highs, even though copper has rallied a good bit, but the CRB commodity basket index is still near its lows. Gold recovered but commodities did not.

So what are some of the major uncertainties out there for the next 6 months? And how can we preserve our gains so far in this rather toppy stock market? Is there an ‘uncertainty strategy’ that can account for stock risk, commodity risk, USD risk, bank risk at the same time? And of course war risk? Or are we locked into an ‘either – or’ situation where its either USD or Gold hedging as if these are mutually exclusive?

Major sources of uncertainty affecting the world

- USD risk - (affects all USD denominated investments from T bills to CDs to cash to US stocks)

- Stock risk - (worldwide) world stocks rallied a great deal with a deteriorating economy

- Deflation risk - Deleveraging worldwide causes flight to cash, stock selling and falling prices, wages and production

- Commodity risk - Tied to economic demand

- Gold stock ‘risk’ - Inverse to the USD and other currencies and affected initially in stock sell offs due to flight to liquidity

- Financial system risk - Ever threatening world bank holiday and currency collapses

- War risk - A huge wild card that can immediately affect gold, oil, and the USD and war commodities

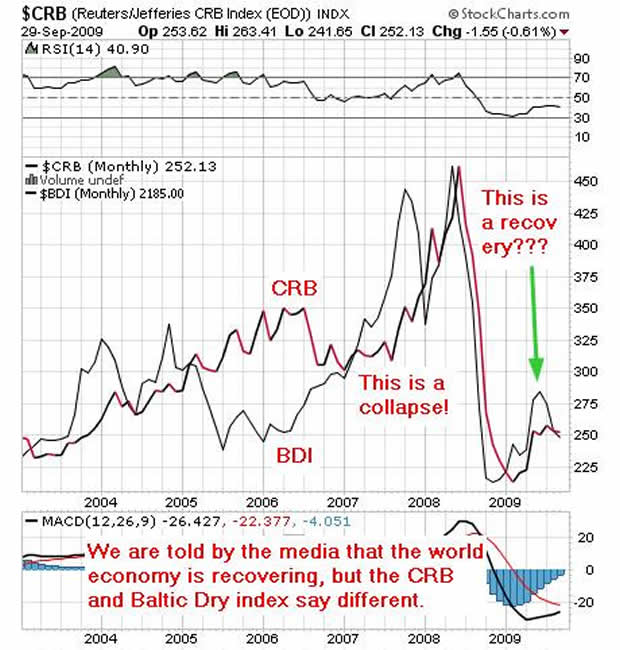

Let’s start the risk/uncertainty discussion with a chart that reveals a lot more than the media does about the economic reality out there in the world. And before we look, consider that Japan just reported an incredible 36% drop in exports year over year to date while you are looking at the chart:

The CRB commodity basket index is heavily oil weighted but it covers basic commodities and includes gold. It very much reflects economic demand and expectations of economic demand. The CRB is not even close to recovering and is falling. The BDI Baltic Dry Shipping index is falling back badly again, so demand for shipping containers is way down too. So much for economic recovery. Just consider Japan’s 36% drop in exports year to date as an example. With the US and Japan in deflation, and they are the world’s two largest economies (Aside from the EU), the fall of the BDI and CRB clearly show there is no expected economic recovery near term.

China’s GDP at very roughly $4 trillion cannot replace collapsing demand in the US and Japan with GDPs of roughly $14 trillion for the US and $4.5 trillion for Japan. So much for China carrying/replacing collapsing economic demand in the US and Japan, it is not big enough yet and still heavily dependent on exports to the West.

But the risks are not only deflation. They also include a seriously troubled USD, war, bank crises, and stock crashes. Is there an uncertainty strategy that can hedge most of these risks? We think so.

We constantly look at the risks listed to search for the best places to preserve your savings. The present times of uncertainty clearly call for the utmost caution. What are those three rules of investing? Don’t lose money, Don’t lose money, Don’t lose money!

Well, we have come up with a strategy that can hedge most of the above risks, which is very straightforward and deceptively simple. Sometimes the most powerful strategy is the simplest. Our latest several newsletters discuss this strategy and why it should work, and is based on what things have done over the last 2 years of great uncertainty. That strategy has done quite well looking back over the last two years. I expect it to be successful in these times of great uncertainty for many years. It is highly conservative, but has significant upside if there is a major USD crash later on.

We invite you to stop by our site and have a look.

By Christopher Laird

PrudentSquirrel.com

Copyright © 2009 Christopher Laird

Chris Laird has been an Oracle systems engineer, database administrator, and math teacher. He has a BS in mathematics from UCLA and is a certified Oracle database administrator. He has been an avid follower of financial news since childhood. His father is Jere Laird, former business editor of KNX news AM 1070, Los Angeles (ret). He has grown up immersed in financial news. His Grandmother was Alice Widener, publisher of USA magazine in the 60's to 80's, a newsletter that covered many of the topics you find today at the preeminent gold sites. Chris is the publisher of the Prudent Squirrel newsletter, an economic and gold commentary.

Christopher Laird Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.