Anemic Job Creation During The "Schumpeterian Economic Depression"

Economics / Recession 2008 - 2010 Sep 29, 2009 - 01:16 AM GMTBy: Mike_Shedlock

The Wall Street Journal is discussing some interesting trends in business creation and small business hiring. Please consider Sharp Drop in Start-Ups Bodes Ill for Jobs, Growth Outlook.

The Wall Street Journal is discussing some interesting trends in business creation and small business hiring. Please consider Sharp Drop in Start-Ups Bodes Ill for Jobs, Growth Outlook.

New companies will be crucial to the strength of any economic recovery. Businesses in their first 90 days of life accounted for 14% of hiring in the U.S. between 1993 and 2008, according to the Bureau of Labor Statistics.

But this recession is taking a particularly heavy toll on business creation, as sources of small-business funding dry up and would-be entrepreneurs become more risk-averse. When entrepreneurs do launch businesses, they are hiring fewer employees on average. The trends threaten to damp growth in jobs and economic output for years.

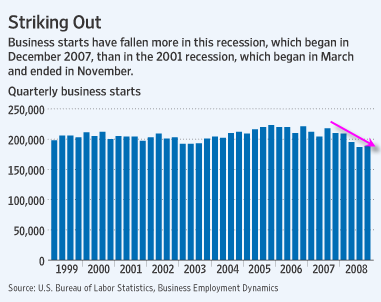

Company formation typically dips slightly in recessions, says Brian Headd, a Small Business Administration economist. Earlier this decade, business starts -- including new businesses and units of existing businesses -- fell 9% between the third quarter of 2000 and the first quarter of 2003, the BLS says.

This time, the decline has been steeper. Business starts fell 14% from the third quarter of 2007 to the third quarter of 2008; the 187,000 businesses launched in that quarter were the fewest in a quarter since 1995. The number ticked up slightly in the fourth quarter, the latest data available. But those new establishments created only 794,000 jobs, the fewest since the government began tracking the data in 1993.

To be sure, as in past recessions, some laid-off workers are starting businesses to stay afloat, or testing long-held dreams. The Kauffman Foundation, a nonprofit research group that promotes entrepreneurship, says more Americans started businesses last year than in 2007. Kauffman cites research by University of California, Santa Cruz, economist Robert Fairlie, who analyzes different BLS data.

Mr. Fairlie, says statistics suggest more businesses are being created more out of "necessity" than "opportunity." That "does not bode as well for economic growth," he says.

The number of new businesses with relatively low income potential -- such as baby-sitting and house-cleaning services -- grew last year. But compared with 2007, there were fewer new businesses with high income potential -- like law firms, medical offices and manufacturing outfits.

Trends In Business Hiring

Chart courtesy of the WSJ with data from the BLS. I added the arrow in hot pink.

Birth/Death Numbers Revisited

Inquiring minds are asking "What Birth/Death numbers for 2007 and 2008 did the BLS report?"

Jobs Flashback January 4, 2008

Unemployment Soars as Private Sector Jobs Contract

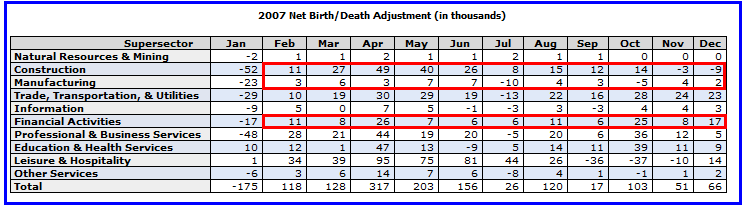

Average Birth Death Adjustment for 2007 is 94,000 jobs per month due to presumed net business job creation.

Jobs Flashback January 9, 2009

Jobs Contract 12th Straight Month; Unemployment Rate Soars to 7.2%

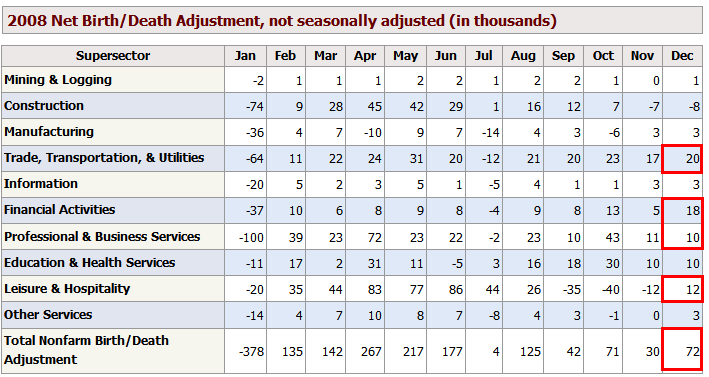

Average Birth Death Adjustment for 2008 is 57,000 jobs per month due to presumed net business job creation.

That does reflect a dip, but remember that birth/death adjustments are net figures. The article did not provide a chart of businesses that went out of business in during the recession.

In the third quarter of 2008 the the 187,000 businesses launched were the fewest in a quarter since 1995 and the number of jobs per startup had collapsed, yet the BLS still had positive net numbers for the year.

Presumably the net number of business startup jobs rose during the entire recession even though the number of startups and the number of jobs created per startup were both declining,

I do not buy it. Can we see the data on business deaths please?

Jobs Flashback September 4, 2009

Jobs Contract 20th Straight Month; Unemployment Rate Hits 9.7%

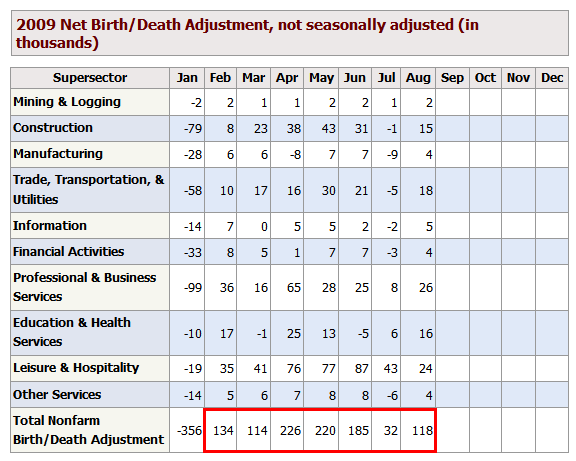

Anyone believe that preposterous set of numbers?

So far in 2009, The Birth Death adjustment is adding 84,000 jobs per month due to presumed net business job creation.

Thoughts on the Schumpeterian Depression

My friend "BC" writes:

During Schumpeterian Depressions, large, cash-rich firms dominate and push increasing scale and standardization, whereas small firms suffer from a lack of capital and a reluctance by banks to lend.

This trend should persist well into the next decade, as deflationary depressions and the associated demographic cycle reduces business start-up activities, and this time around Venture Capital activity.

Also, younger workers of a peak demographic cohort lack the capital and longevity in the occupational structure to have made sufficient contacts and gotten access to capital and equipment in order to reach the necessary critical mass of experience, reputation, and problem solving one demonstrates sometime in their mid- to late 20s to early to mid-30s.

Thus, we are not likely to see a new wave of incremental innovation and new capital formation and business start ups until no earlier than the mid-to-late '10s to early '20s. In the meantime, mass cross-industry consolidation, R&D moving inside large firms, spin-offs, firings, wealth consumption, and shifting composition of household spending led by Boomers in late life will combine to slow growth for years to come.

Moreover it is questionable as to whether China and India can buck the larger demographic and Schumpeterian-curve trends, as they have come to rely so heavily upon US supranational firms' Foreign Direct Investment in plants, equipment, trade credits, and intellectual property. The growth of US and Japanese firms' FDI will likely continue to decelerate with "trade" for years to come.For more on Schumpeterian Depressions, please see Creative Destruction.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.