Stock Market SELL Signals and Inflation Missing from 2010

Stock-Markets / Financial Markets 2009 Sep 26, 2009 - 10:13 AM GMTBy: Nadeem_Walayat

Early in the week I went hunting for signs for high UK inflation in the analysis -UK Inflation Forecast, Will RPI Deflation Return to Inflation? However despite zero interest rates and all the money printing to date, I was surprised not to find it, not for 2009 and not for the whole of 2010! and given the double dip depression (more on this tomorrow), probably beyond. What does this mean ? It means the Bank of England NEEDS to act to CREATE inflation AHEAD of the double dip Depression (again more on this tomorrow).

Early in the week I went hunting for signs for high UK inflation in the analysis -UK Inflation Forecast, Will RPI Deflation Return to Inflation? However despite zero interest rates and all the money printing to date, I was surprised not to find it, not for 2009 and not for the whole of 2010! and given the double dip depression (more on this tomorrow), probably beyond. What does this mean ? It means the Bank of England NEEDS to act to CREATE inflation AHEAD of the double dip Depression (again more on this tomorrow).

What implications does this have for the stock indices ?

Answer - NONE! You see this is where many widely followed and quite rigorous analysts such as John Mauldin are going wrong by trying to fit this that and the other onto the stock market indices and then scratching their heads and wonder why is it doing the complete opposite. I was there following the 1987 Crash (which I caught), but I missed that bull run back to Dow 2,700 because I LISTENED to what 'SHOULD' happen, rather than WHAT IS happening, Luckily I learn from my mistakes.

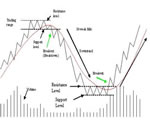

Stock Market Initial SELL Signals

If you follow my analysis then you will know that I have been strongly bullish on stocks since early March with analysis of the past 2 months converging towards a significant correction to begin late Sept / Early October from stock market targets for 2009 of Dow 9,750 to 10,000 and FTSE 5,000.

- 15 Mar 2009 - Stealth Bull Market Follows Stocks Bear Market Bottom at Dow 6,470

- 23 Jul 2009 - Vicious Stocks Stealth Bull Market Eats the Bears Alive!, What's Next?

- 29 Aug 2009 - Stocks Bull Market 50% Advance Signals September Opportunity for Deluded Bears

- 07 Sep 2009 - The Crumbliest Flakiest Stocks Bull Market Never Tasted Before

Both indices fulfilled these targets and this week BOTH indices gave sell signals, triggering SHORT positions (trading will eventually be covered at walayatstreet.com). The indices this close to the swing peaks means that the initial stops NEED Room to BREATH, hence Dow 10,050 and FTSE 5200.

The initial short triggers need secondary and tertiary confirming triggers to be hit before a target can be better determined. However earlier analysis had penciled in Dow 8900 from Dow 9750 and FTSE 4,500. The only negative will be highly perma bears who failed to capitalise on the 55% or so bull market to date will now crow loudly "I told you so!" with the 10% or so of crumbs that are likely to be offered.

LESSON for Today - The further you deviate from the present the more likely you are to be wrong! Forget trying to compare today to the charts of the 1930's, or even last year. Therefore train yourself to react to price movements in real time. (I am sure I have said this before a few times already).

Your stock index futures trading analyst taking each swing at a time.

By Nadeem Walayat http://www.marketoracle.co.uk

Copyright © 2005-09 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Featured Analysis of the Week

|

|

|

|

|

|

|

|

INO TV - Watch From Your Computer for FREE Here are the newest authors: Jack Schwager, John Murphy, Jake Bernstein, and Ron Ianieri. All experts, all well recognized, and highly trafficked by our current members. http://tv.ino.com/ |

|

|

|

|

|

|

Most Popular Financial Markets Analysis of the Week :

| 1. Economic and Financial System Train Wreck Dead Ahead! |

By: Ty_Andros

Many ECONOMISTS AND MARKET ANALYSTS ARE PREDICTING AN END OF THE RECESSION AND GROWTH GOING FORWARD. MY RESPONSE IS THE NUMBERS HAVEN’T ADDED UP FOR YEARS, AND REGARDLESS OF WHAT THEY CLAIM, WE ARE ABOUT TO COMMENCE THE NEXT LEG DOWN INTO WHAT WILL become known as the GREATEST DEPRESSION in history. The numbers they point to are POLITICALLY-CORRECT measurements, but practically incorrect; any insights you may glean from them are HEADLINE illusions for the sheep that are being FLEECED and who have misplaced their faith in the government to PROVIDE for them.

| 2. Gold, The Big Score |

By: Howard_Katz

Well, here we are with the price of gold above $1,000. Since this is the day so many thought would never come, it is time for reflection. I have lived my life in a society in which most of the “experts” have been wrong over and over.

| 3. Gold $1,500 This Year |

By: The_Gold_Report

Post summer doldrums, we're now beginning to see a nice fall run up in the price of gold—one that marks the beginning of a parabolic move, according to Greg McCoach. The seasoned bullion dealer, investor and newsletter writer sees a number of factors culminating in ever-increasing prices going forward. In this exclusive interview with The Gold Report, Greg reveals current and forthcoming events that will continue driving the yellow metal's price northward. . .not the least of which involves the commercial real estate market and its "associated derivative sewage."

| 4. Doomsday for the Natural Gas Market? |

By: Joseph_Dancy

The bearish story for natural gas is becoming very well known. Lots of bearish natural gas analysts are around - rightfully so. With record levels of natural gas storage and weak industrial and generation demand spot prices have dropped to seven year lows (see chart, courtesy Bloomberg).

INO TV - Watch From Your Computer for FREE Here are the newest authors: Jack Schwager, John Murphy, Jake Bernstein, and Ron Ianieri. All experts, all well recognized, and highly trafficked by our current members. http://tv.ino.com/ |

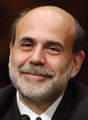

| 5. The Recession has Technically Ended, Is Bernanke Joking? |

By: Bob_Chapman

To borrow from an old joke about politicians, we ask our subscribers if they know how to tell when Helicopter Ben Bernanke, the current Fed Head, is lying. Answer: Whenever his lips are moving. Now we hear from the Dollar-Destroyer that our recession has technically ended (heaven forbid that we should call our current Fed-caused calamity a depression, which is what it has been since Obama took office). So we guess that we should take his word for it, seeing that every call he has made during his short tenure as Chairman of the Federal Reserve Board has been 100% wrong.

| 6. Outrageous Artificial Deflation and the FDIC Black Hole |

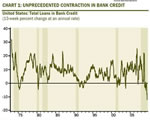

By: John_Mauldin

This week we continue to look at what powers the forces of deflation. As I continue to stress, getting the fundamental question answered correctly is the most important issue we face going forward. And the problem is that we cannot use the usual historical comparisons. This week we look at one more factor: bank lending. I give you a sneak preview of what will be an explosive report from Institutional Risk Analytics about the problems in the banking sector. Are you ready for the FDIC to be down as much as $400 billion? This should be an interesting, if sobering, letter.

| 7. Gold in a Beautiful Long-term Secular Bull Market |

By: John_Mauldin

The short and intermediate-term future for Gold and any investment for that matter are tricky to navigate. I have guessed right and wrong many times on shorter-term moves. It seems that the best most investors can hope to do is identify the long-term secular bull market (i.e. the major bull market of the current 10-20 year period) that is in progress, buy into it, and hold on.

| Subscription |

How to Subscribe

Click here to register and get our FREE Newsletter

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.