United States Following Japans Deflation Footsteps

Economics / Deflation Sep 24, 2009 - 02:56 AM GMTBy: Mike_Shedlock

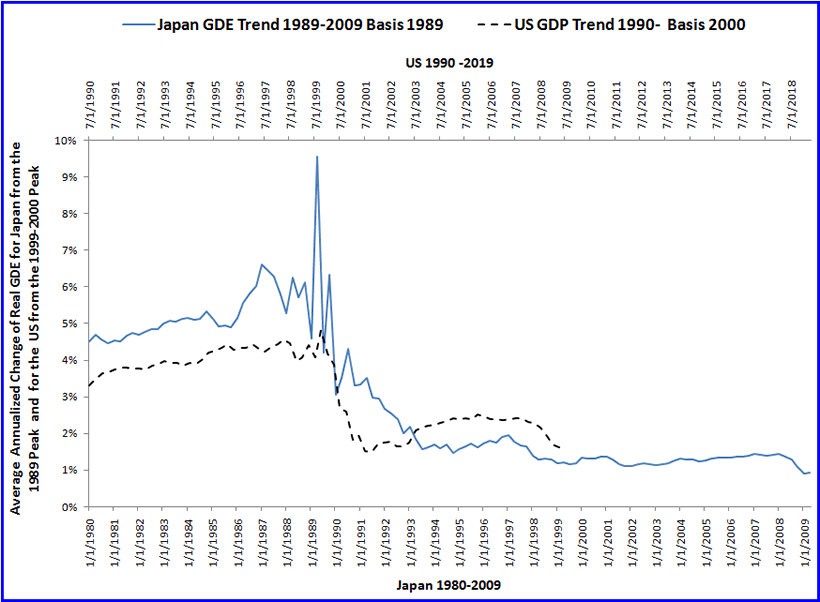

The US is following the footsteps of Japan. It is now undeniable. Please consider the following chart.

The US is following the footsteps of Japan. It is now undeniable. Please consider the following chart.

Japanese GDE from the 1989 peak to Present

US GDP 1999 peak to Present

Offset is 10 Years

The above chart is from my friend "BC" who writes:

The rate shown is the trend rate of growth of GDP at any point from the secular peak rate.

For example, for the US, the real GDP trend rate in the '90s was 3-4%, whereas since the '99-'00 peak the trend rate has fallen to the 1.5-2.5% range for the '00s (1.6% today).

For Japan, the real GDE trend rate in the '80s was 4-6%, with the trend rate since the '89-'90 secular peak falling to 1-1.5% to 2% (0.91% today).

A chart of the trend rate since '97 or '00 in Japan would show an even slower trend rate of real GDP at 0.4-0.5%. Similarly for the US, the trend real GDP rate since '04 and '05 is barely 1% to 0.6% respectively.

I suspect we will see a further deceleration of the trend real GDP rate hereafter from ~1.5% to 1% or less through the late '10s, including 2-3 more recessions, i.e., "multiple dips", along the way.

It is repeatedly said that we're not Japan; however, in some respects we might be worse this time around, i.e., the depth of our recession today vs. that of Japan in '97-'98 (Asian Crisis).

To get back to a trend of 3.3% real growth from '00, the US would have to grow at an average real rate of 5.5% through '14-'15.

For a 2.5% trend rate from '00 (the current average trend rate since '80), average real growth would have to be 3.5-4% for the next 5-6 years.

Japan's real GDE grew at just 0.4-0.6% from '97 to '01-'03, with ~1% price deflation, QE, and ongoing bailouts and government spending.

So, in the context of the likely secular trend, double dips and "recovery" will tend to be moot issues. We are more likely to have multiple dips, little or no growth, and the only recovery will have been from 10% real GDP contractions along the way.

We will have recovered from nearly having falling off the ledge into the abyss; but our climb from the ledge will be steep, long, and yield little progress.Psychology of Deflation Revisited

In January 2007, someone on the Motley Fool told me "Too even compare the citizens of Japan to the US is stupid, stupid, stupid Forest Gump!"

I was also told "Fannie Mae can revive the housing bubble" and that I "ignore an enormous amount of 1990s monetary theory by Bernanke and co about how they would have dealt with Japans deflation."

Inquiring minds can read Q&A on the Psychology of Deflation to see my replies.

It now seems that Things That "Can't" Happen, did happen.

Deflation Japanese Style

Some still argue that Japan never went through deflation. One basis for that argument is that "money supply" never contracted over a sustained period. The other argument is that prices as measured by the CPI never fell much. Those are flawed arguments.

Although Japan was rapidly printing money, a destruction of credit was happening at a far greater pace. There was an overall contraction of credit in Japan for close to 5 consecutive years. Property values plunged for 18 consecutive years. The stock market plunged from 40,000 to 7,000. Cash was hoarded and the velocity of money collapsed. Those are classic symptoms of deflation that a proper definition incorporating both money supply and credit would readily catch. Those looking at consumer prices or monetary injections by the bank of Japan were far off the mark.

Is Bernanke a Wizard?

If Bernanke was such as wizard, why is the US in such miserable shape, and why is Bernanke's Deflation Preventing Scorecard a big fat zero?

Bernanke is not a wizard and neither is Greenspan. The difference is Greenspan had the wind of consumption blowing briskly at his back. Bernanke is on the backside of Peak Credit with a breeze of frugality blowing briskly in his face.

Attitudes make all the difference in the world.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.