SPX Stocks Index Topping or Breaking Out?

Stock-Markets / Stock Index Trading Sep 22, 2009 - 02:01 PM GMTBy: The_BullBear

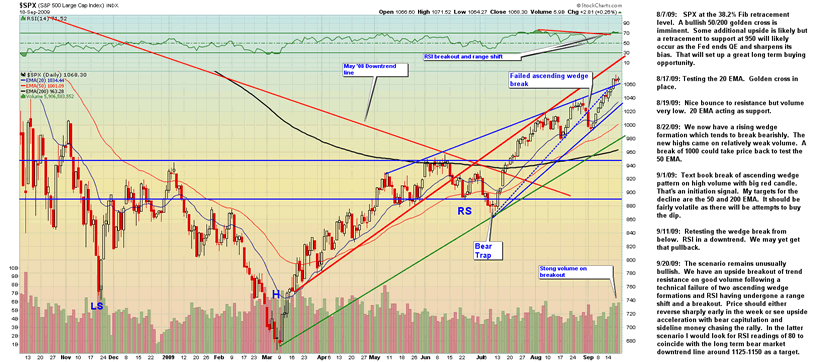

While there certainly could be a top here I think that to call one at this point would be pure speculation and guesswork. Picking a top is not advisable. There is some evidence that we are seeing the acceleration of the bull trend rather than its fading.

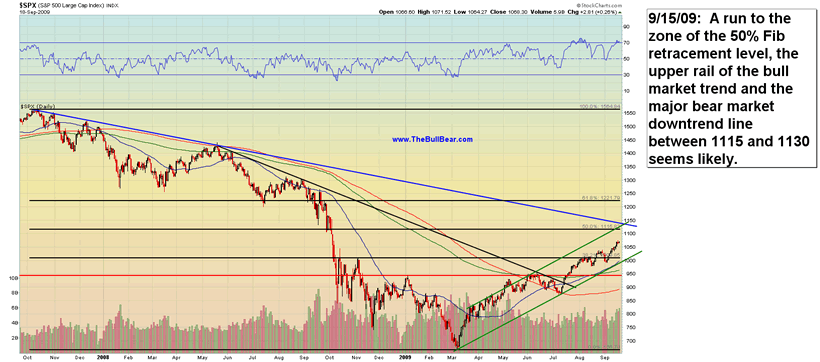

The scenario remains unusually bullish. We have an upside breakout of trend resistance on strong volume following a technical failure of two alternate rising wedge formations and RSI having undergone a range shift and breaking a downtrend. Price should either reverse sharply early in the week or see upside acceleration with bear capitulation and sideline money chasing the rally. Note that an upside breakout of a normally bearish ascending wedge pattern is a highly bullish occurrence.

In the latter scenarion I would look for RSI readings of 80 to coincide with the long term bear market downtrend line around 1115-1130 as a target. The breakout could certainly be a bull trap however and a reversal and breakdown of the rising wedge could happen but it would need to happen fairly soon.

By Steve Vincent

The BullBear is the social network for market traders and investors. Here you will find a wide range of tools to discuss, debate, blog, post, chat and otherwise communicate with others who share your interest in the markets.

© 2009 Copyright Steven Vincent - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.