If Credit is Not Created Out of Excess Reserves, What Does That Mean?

Economics / Credit Crisis 2009 Sep 21, 2009 - 05:15 PM GMTBy: Washingtons_Blog

We've all been taught that banks first build up deposits, and then extend credit and loan out their excess reserves.

We've all been taught that banks first build up deposits, and then extend credit and loan out their excess reserves.

But critics of the current banking system claim that this is not true, and that the order is actually reversed.

Sounds crazy, right?

Certainly.

But as PhD economist Steve Keen pointed out last week, 2 Nobel-prize winning economists have shown that the assumption that reserves are created from excess deposits is not true:

The model of money creation that Obama’s economic advisers have sold him was shown to be empirically false over three decades ago.

The first economist to establish this was the American Post Keynesian economist Basil Moore, but similar results were found by two of the staunchest neoclassical economists, Nobel Prize winners Kydland and Prescott in a 1990 paper Real Facts and a Monetary Myth.

Looking at the timing of economic variables, they found that credit money was created about 4 periods before government money. However, the “money multiplier” model argues that government money is created first to bolster bank reserves, and then credit money is created afterwards by the process of banks lending out their increased reserves.

Kydland and Prescott observed at the end of their paper that:

Introducing money and credit into growth theory in a way that accounts for the cyclical behavior of monetary as well as real aggregates is an important open problem in economics.

In other words, if the conventional view that excess reserves (stemming either from customer deposits or government infusions of money) lead to increased lending were correct, then Kydland and Prescott would have found that credit is extended by the banks (i.e. loaned out to customers) after the banks received infusions of money from the government. Instead, they found that the extension of credit preceded the receipt of government monies.

Keen explained in an interview Friday that 25 years of research shows that creation of debt by banks precedes creation of government money, and that debt money is created first and precedes creation of credit money.

As Mish has previously noted:

Conventional wisdom regarding the money multiplier is wrong. Australian economist Steve Keen notes that in a debt based society, expansion of credit comes first and reserves come later.

And as Edward Harrison writes:

Central to [Keen's] ideas is the concept that demand for credit creates loans which create reserves, which is the opposite causality of what one sees in neoclassical economics.

This angle of the banking system has actually been discussed for many years by leading experts:

“[Banks] do not really pay out loans from the money they receive as deposits. If they did this, no additional money would be created. What they do when they make loans is to accept promissory notes in exchange for credits to the borrowers' transaction accounts."

- 1960s Chicago Federal Reserve Bank booklet entitled “Modern Money Mechanics”

"The modern banking system manufactures money out of nothing. The process is perhaps the most astounding piece of sleight of hand that was ever invented.

- Sir Josiah Stamp, president of the Bank of England and the second richest man in Britain in the 1920s.

Banks create money. That is what they are for. . . . The manufacturing process to make money consists of making an entry in a book. That is all. . . . Each and every time a Bank makes a loan . . . new Bank credit is created -- brand new money.

- Graham Towers, Governor of the Bank of Canada from 1935 to 1955

[W]hen a bank makes a loan, it simply adds to the borrower's deposit account in the bank by the amount of the loan. The money is not taken from anyone else's deposit; it was not previously paid in to the bank by anyone. It's new money, created by the bank for the use of the borrower.

- Robert B. Anderson, Secretary of the Treasury under Eisenhower, in an interview reported in the August 31, 1959 issue of U.S. News and World ReportRecently, the vice president of one of the 3 biggest banks in America stated that the bank's loan officers do not really check the bank's deposits, reserves or capital base before making a loan.

Indeed, some critics of the current banking system - like Ellen Brown - claim that the entire credit-creation system is an accounting sleight-of-hand, and that banks simply enter into loan agreements, and then obtain the reserves later from the Fed or in the open market. In other words, they claim that banks extend money first, and then increase their reserves on their books later to cover the loans.

So What Does It Mean?

So what does it mean that loans and debt are created first, and then reserves and credit come later?

There are several results.

First, it makes it less likely than most people think that the giant banks will increase the amount of money they're loaning out to individuals and small businesses. Specifically, since loans are made before new infusions of government cash (Kydland and Prescott), there is not a simple cause-and-effect relationship. So the bailouts to the banks will not necessarily encourage them to make more loans. Indeed, the heads of the big banks have themselves said that they won't really increase such loans until the economy fundamentally stabilizes (no matter how much money the government gives them).

As Mish writes today:

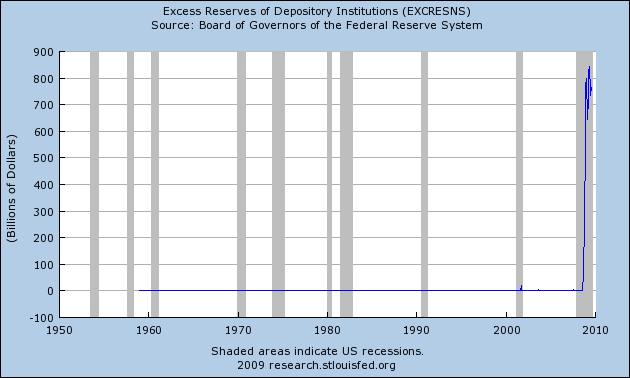

A funny thing happened to the inflation theory: Banks aren't lending and proof can be found in excess reserves at member banks.

Excess Reserves

...

In practice, banks lend money and reserves come later. When defaults pile up, the Fed prints reserves to cover bank losses. Thus, those "excess reserves" aren't going anywhere. They are needed to cover losses. It's best to think of those reserves as a mirage. They don't really exist.Second, if banks won't increase their lending in response to government funds, then that argues against inflation and for continuing stagnation in the economy.

Third - going beyond what most economists believe or will publicly discuss (and going beyond what I have any background or inside information to confirm) - monetary reformers like Ellen Brown argue that the entire banking system is based upon a fraud. Specifically, she and other monetary reformers argue that the banks have intentionally spread the false reserves-and-credit first, loans-and-debt later story to confuse people into thinking that the banks are better capitalized than they really are and that the Federal Reserve is keeping better oversight than it really is.

Moreover, many monetary reformers argue that the truth of loans-before-reserves is hidden in order to obscure the alleged fact that the entire financial system is built on nothing but air. Specifically, Brown argues that unless more and more debt is continually created, since money creation follows debt creation, what we think of as the money supply will shrink, and the economy will crash. In other words, they say that we a massive, ever-expanding debt bubble has been blown for many decades, and that the myth that banks make loans out of their excess reserves helps to fuel the bubble.

Monetary reformers argue that the government should take the power of money creation back from the private banks and the Federal Reserve system.

As Josiah Stamp (former president of the Bank of England) said:

Banking was conceived in inequity and born in sin . . . . Bankers own the earth. Take it away from them but leave them the power to create money, and, with a flick of a pen, they will create enough money to buy it back again. . . . Take this great power away from them and all great fortunes like mine will disappear, for then this would be a better and happier world to live in. . . . But, if you want to continue to be the slaves of bankers and pay the cost of your own slavery, then let bankers continue to create money and control credit."

Do the monetary reformers go too far? If so, what should the reality of the way credit is created mean for us and the stability of the economy?

Global Research Articles by Washington's Blog

© Copyright Washingtons Blog, Global Research, 2009

Disclaimer: The views expressed in this article are the sole responsibility of the author and do not necessarily reflect those of the Centre for Research on Globalization. The contents of this article are of sole responsibility of the author(s). The Centre for Research on Globalization will not be responsible or liable for any inaccurate or incorrect statements contained in this article.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.