Housing Market Mortgage Meltdown and the Hedge Fund Collapse

Stock-Markets / Financial Crash Jun 25, 2007 - 09:35 AM GMTMartin Weiss writes: For many months, Mike Larson has been warning you about a meltdown in America's vast new market for home mortgages.

Now that meltdown is here.

He told you home sales and prices would fall, and they did.

He told you that American homeowners would default on their mortgage payments in record numbers, and they have.

He warned this would shake Wall Street to its core. Now it is.

The evidence is ubiquitous and indisputable:

- From their peaks in 2005, existing home sales are down 16.9%; new home sales, down 29.4%.

- For the first time since data was collected in 1968, home prices have declined nationally for nearly a year.

- Worst of all, American homeowners are falling behind on their mortgage payments in record numbers: The delinquency rate on low-quality mortgages has surged to 13.8%. On medium-quality mortgages, it has more than doubled. And on all mortgages, it has now surpassed the worst level of the last recession.

This mortgage meltdown has struck down the stocks of home builders, low-quality lenders, and now, as Mike demonstrated on Friday , also the widely owned Real Estate Investment Trusts (REITs).

The mortgage meltdown has mortally wounded or killed 82 higher-risk lenders, delivering huge loan losses, early payment defaults and funding cutoffs. Some have severely curtailed lending operations. Others have filed for bankruptcy.

And last week came the clincher:

The Mortgage Meltdown Has Just Precipitated One of the Largest Hedge Fund Collapses of All Time

The fund's manager, Bear Stearns, promptly come to its rescue with an astounding sum of $3.2 billion. But the collapse — and even the rescue itself — have raised a series of urgent questions for investors that few on Wall Street seem ready to answer:

Urgent Question #1. The fund's marketing and even its name — High-Grade Structured Credit Strategies Fund — stressed safety. Were they lying?

Urgent Question #2. Until recently, the fund's investments were supposedly holding their value pretty nicely, with relatively modest losses despite the mortgage meltdown. So how did that value evaporate so quickly?

Urgent Question #3. The last time a major hedge fund — Long Term Capital Management — collapsed in the U.S., the Federal Reserve and nearly all of Wall Street came to its rescue. This time, Bear Stearns acted alone. And it did so much more quickly. Why?

Urgent Question #4. Is this an isolated event? Or is it just the tip of the iceberg?

Urgent Question #5. What does it mean for other mortgage and real estate investments — Fannie Mae and Freddie Mac mortgage bonds … homes, shopping malls, and office buildings … real estate stocks and REITs?

Urgent Question #6. What should you do about it, regardless of what you invest in?

Here are our answers …

Why These Supposedly "Safe" Investments Were Really Investment Time Bombs in Disguise

The hedge fund that collapsed last week invested more than 90% of its assets in securities that were touted as being as safe as, or almost as safe as, a U.S. Treasury bond, according to documents reviewed by The Wall Street Journal.

But the truth is another matter entirely: These investments are "collaterized debt obligations," or CDOs, and they're a far cry from Treasuries:

- U.S. Treasury debt was originally created to finance the American Revolution in the days of George Washington and Ben Franklin. In contrast, these CDOs were created by the now-defunct Drexel Burnham Lambert in 1987, where former junk-bond king Michael Milken made his home.

- Unlike Treasury securities, CDOs are not backed by the full faith and credit of the U.S. Government. Quite to the contrary, they are based on home mortgages now defaulting in record numbers.

- Unlike a simple cash investment in bonds, these CDOs were usually leveraged to the hilt with huge borrowings from major Wall Street firms like Merrill Lynch, J.P. Morgan, Goldman Sachs and Barclays.

- Most important, unlike Treasury securities, they are not traded in a huge, active market where investors can buy and sell them at fair prices. Instead they are traded only sparsely, with few buyers or sellers in the open market.

And therein lies the crux of the problem …

If These CDO Investments Aren't Actively Traded, How Do You Know What The Heck They're Really Worth?

The answer provided by companies like Bear Stearns: We guess! More specifically, their procedure has been to …

Estimate what these CDO investments should be worth based on assumptions about delinquency rates … hope that, if their assumptions turn out to be wrong, no one will find out … and pray that, if someone does find out, they'll be able to cover it up.

That's precisely what we believe has happened here!

First, their assumptions about their CDOs were dead wrong.

They figured it would be impossible for delinquency rates to be this high, especially without a recession. But now the "impossible" has happened.

Second, their hopes about no one finding out were hopelessly naive.

Indeed, in recent days, as soon as big Wall Street firms got wind of the real nature of the troubles, they tried to sell some of their CDOs to test the market.

But the values that were being assumed for these CDOs were a fiction. In the real world, the bids that sellers got weren't 90 cents on the dollar — not even 80 or 70 cents on the dollar. No. For most of the material, they got bids of 50 cents on the dollar or, worse, no bids at all.

Result: If they try to sell any notable quantity of these CDOs, they could wind up with as little as 20 cents or even 10 cents on the dollar!

Third, it appears that …

The Main Reason Bear Stearns Is Bailing Out Its Failed Fund Is To COVER UP the Sinking Value of These Esoteric Securities

If major Wall Street firms go ahead and sell these in the open market, everyone will find out how little they're really worth. And if everyone knows that they're really worth only a fraction of their stated value, the game is up.

Bear Stearns' credit and Bear Stearns' shares will sink like a rock. Major banks will lose fortunes. And ultimately, most of America's mortgage markets could collapse.

In our view, that's the key reason Bear Stearns acted so swiftly last week. And that's why Bear Stearns didn't wait around for other major banks to join in the bail-out.

But it's also why …

It Could Already Be Too Late!

Look: The truth is out. It's all over the front page of Saturday's New York Times and Saturday's Wall Street Journal .

Plus, earlier in the week, Bloomberg scooped them both with this report about the first major firm that tried to sell a substantial amount of these securities …

"Merrill Lynch & Co.'s threat to sell $800 million of mortgage securities seized from Bear Stearns Cos. hedge funds is sending shudders across Wall Street.

"A sale would give banks, brokerages and investors the one thing they want to avoid: a real price on the bonds in the fund that could serve as a benchmark….

"Because there is little trading in the securities, prices may not reflect the highest rate of mortgage delinquencies in 13 years. An auction that confirms concerns that CDOs are overvalued may spark a chain reaction of writedowns that causes billions of dollars in losses."

This Is Serious!

It reminds me of the 1970s, the first time I warned of an equally massive cover-up — thousands of S&Ls that were grossly overstating the value of their assets.

It reminds me of a similar episode in the early 1990s, when we broke the news that major life and health insurance companies were covering up the true value of their junk bonds.

And we saw it happen again when most Wall Street firms put out hundreds of "buy" ratings on companies they knew were going bankrupt. (See my 2003 submission to Congress and regulatory agencies on this subject .)

Moreover, if anyone tells you this is an "isolated event," show them to the door. Indeed …

This is Not the Only Bear Stearns Hedge Fund in Danger!

Bear Is Not the Only Big Wall Street Firm Involved!

And Wall Street Is Not the Only Place This Is Happening!

First, Bear Stearns manages another, similar, fund that's bigger and riskier — the High Grade Structured Strategies Enhanced Leverage Fund.

Together, The Wall Street Journal reports that the two funds have commanded investments of more than $20 billion . So we figure that, if they're down 50% or more, even if Bear Stearns triples its rescue effort and puts up as much as $10 billion, it may still not be enough.

Second, Bear Stearns is just one of several big players in the CDO market — a market which has mushroomed in size from virtually nothing a few years ago to over $1 trillion today.

Just in 2006, industry-wide sales reached $503 billion, a fivefold increase in three years. And more than HALF of those were based on mortgages issued to people with poor credit, little loan history, or high debt, according to Moody's Investors Service.

Third, as I noted at the outset, this is not just a Wall Street phenomenon. Rather, it's caused by a broader mortgage meltdown, which, in turn, is part and parcel of an even broader real estate bust.

So even if Bear Stearns can put out this particular fire, it's going to be very hard pressed to contain the crisis for long. That's why we believe …

Nearly ALL Real Estate Investments Are, Or Will Soon Be, in Grave Jeopardy

This crisis is expanding in concentric circles.

First, it affected just the niche players in the non-prime mortgage business.

Then, it spread to mid-grade mortgages.

And now it's hitting Wall Street in the gut.

Next, don't be surprised to see investors snub higher quality mortgage-backed securities like those backed by Fannie Mae and Ginnie Mae, where underlying default rates are also rising, and where well-publicized accounting shenanigans have not yet been fully overcome.

Plus, given Mike Larson's frequent warnings, it should come as no surprise that REITs stocks have also begun to tumble — an advance warning that commercial properties themselves, including shopping malls and office buildings, are destined for a similar fate.

What You Should Do About It, Regardless of What You Invest In …

First, for your cash assets, continue to favor the highest quality investments in the U.S. That's still short-term Treasuries or a Treasury-only money market fund .

Second, hedge with investments that are designed to go up in precisely this kind of environment.

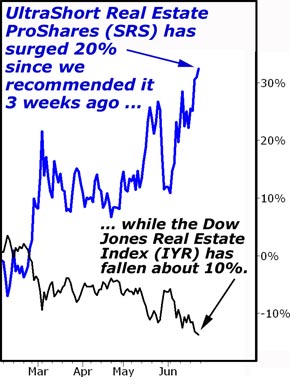

Example: One exchange-traded fund we like, UltraShort Real Estate ProShares (SRS), is designed to rise 2% for every 1% decline in the Dow Jones Real Estate Index.

And sure enough, just since the beginning of this month when we recommended it in our Safe Money Report, it's up close to 20%.

Third, if you haven't done so already, switch a significant portion of your portfolio to investments that are divorced from the real estate woes in the U.S. … and tied to the success of rapidly growing foreign economies, where mortgage debt is relatively scarce and real estate remains strong.

For example, you can go for a $245,000 windfall with the three global resource stocks Sean is going to recommend tomorrow, provided you're on board by midnight tonight. For all the parameters, see his latest report , just posted on the Money and Markets website this weekend.

Above all, stay safe!

Good luck and God Bless!

By Martin Weiss

This investment news is brought to you by Money and Markets . Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.moneyandmarkets.com .

Money and Markets Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.