Economic and Financial System Train Wreck Dead Ahead!

Economics / Great Depression II Sep 20, 2009 - 01:45 AM GMTBy: Ty_Andros

Many ECONOMISTS AND MARKET ANALYSTS ARE PREDICTING AN END OF THE RECESSION AND GROWTH GOING FORWARD. MY RESPONSE IS THE NUMBERS HAVEN’T ADDED UP FOR YEARS, AND REGARDLESS OF WHAT THEY CLAIM, WE ARE ABOUT TO COMMENCE THE NEXT LEG DOWN INTO WHAT WILL become known as the GREATEST DEPRESSION in history. The numbers they point to are POLITICALLY-CORRECT measurements, but practically incorrect; any insights you may glean from them are HEADLINE illusions for the sheep that are being FLEECED and who have misplaced their faith in the government to PROVIDE for them.

Many ECONOMISTS AND MARKET ANALYSTS ARE PREDICTING AN END OF THE RECESSION AND GROWTH GOING FORWARD. MY RESPONSE IS THE NUMBERS HAVEN’T ADDED UP FOR YEARS, AND REGARDLESS OF WHAT THEY CLAIM, WE ARE ABOUT TO COMMENCE THE NEXT LEG DOWN INTO WHAT WILL become known as the GREATEST DEPRESSION in history. The numbers they point to are POLITICALLY-CORRECT measurements, but practically incorrect; any insights you may glean from them are HEADLINE illusions for the sheep that are being FLEECED and who have misplaced their faith in the government to PROVIDE for them.

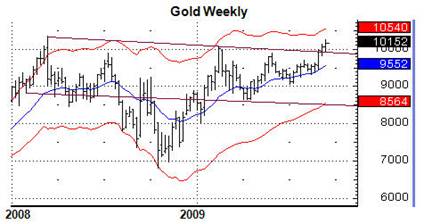

The canaries in the coal mines are singing in more markets than you can count. Just to name a few, the Baltic Dry Index of shippers is off 40% since June. The S&P 500 is trading at 5 times its highest valuation in history. Gold has broken out higher in every currency in the world (the beginnings of a CRACK UP BOOM as paper reverts to intrinsic value) and is attempting to do so in dollars - to the consternation of Barrick gold ($3 to 5 billion of losses on hedges) and all the big banks who are short the metal for POLITICAL purposes.

Gold now has an ACTIVE head and shoulders bottom pattern in place which TARGETS $1,350. A flight to REAL money has begun. The Chinese government is ACTIVELY pushing their citizens to buy gold and silver and they have the ability to STAND up to the manipulators and protect their people. THEY WILL DO SO and defend the value of their peoples’ gold and silver. Call it a BEIJING Put. The manipulators have never had to deal with someone holding over 2 TRILLION dollars on the bid and would be more than happy to TAKE DELIVERY.

Think of all the bullion banks that have leased gold from central banks at 1%, sold it into the markets to fund the carry trade and now must cover and suffer catastrophic losses. Can you say “gold and silver to the moon?” This is such delicious irony for these partners in crime, with the central banks and their gold suppression schemes. In the short end of the treasury markets, yields have been cut in half in 6 weeks and are approaching zero yield and the long end has rallied aggressively as well. The Zimbabwization of paper assets has begun, as you shall see.

Note: Before you proceed, please understand that this IS NOT doom and gloom, it is reality and must be dealt with or you will be financially harmed. In fact, it is the greatest opportunity in history for prepared investors as these REALITIES will drive expanding volatility. “Volatility is opportunity” for the prepared investor. I will be doing a series of live webinars in several weeks where I will cover the economics you must deal with, and how to potentially turn it to your favor. I will then have Q & A sessions afterwards. Details to follow in the next edition of this newsletter.

Public Serpents, er…servants have steered, and are deliberately steering, the US economy off a cliff to gather power and set the stage for the next crisis in our economy. All the while, income creation has begun its next leg down under the Jack boot of higher regulations, taxes, quantitative easing (MONEY PRINTING) and government borrowing (diverting money to government from the private sector), which they will use to solidify their almost complete evisceration of the constitution, our economy and our freedom.

Public Serpents, er…servants have steered, and are deliberately steering, the US economy off a cliff to gather power and set the stage for the next crisis in our economy. All the while, income creation has begun its next leg down under the Jack boot of higher regulations, taxes, quantitative easing (MONEY PRINTING) and government borrowing (diverting money to government from the private sector), which they will use to solidify their almost complete evisceration of the constitution, our economy and our freedom.

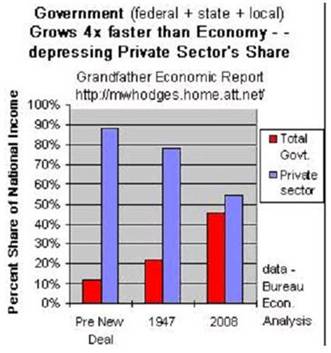

Private property has now become a myth. Between taxes, regulations and the Fiat currency and credit creation, there is nowhere to hide from our masters on all levels of G7 government. The US Government has now been growing 4 times faster than the economy and it has KILLED the host private sector as we can see from this chart going back to the end of World War II:

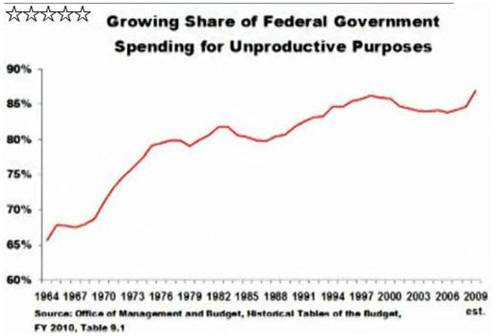

This picture is no different in the rest of the G7. I have always said a dollar into government and a dime out. Now we have a chart from the Office of Management and Budget to illustrate how little productive results we get when sending money into the federal government:

As the Ob@ma administration and the GANG of 535 (also known as the US Congress) DOUBLE the size of government, you can now understand how much MALINVESTMENTS and misapplied capital will be mushrooming and consequently destroying the private sector where ALL WEALTH AND RISING INCOMES originate.

DOZENS of unconstitutional CZ@RS are operating in direct contradiction to their oaths to defend the constitution, which MANDATES they exercise oversight of the EXECUTIVE branch of government. Our public servants, er…servants are betraying their oaths of office and constituents in favor of their special interest supporters who are feeding on the public purse. OBSCENE! The parasites of PUBLIC, government and crony capitalists feeding off the private sector are about to KILL IT. The parasites are killing the host. OUCH….

DOZENS of unconstitutional CZ@RS are operating in direct contradiction to their oaths to defend the constitution, which MANDATES they exercise oversight of the EXECUTIVE branch of government. Our public servants, er…servants are betraying their oaths of office and constituents in favor of their special interest supporters who are feeding on the public purse. OBSCENE! The parasites of PUBLIC, government and crony capitalists feeding off the private sector are about to KILL IT. The parasites are killing the host. OUCH….

Virtually ALL of the CZ@RS come from RADICAL socialist and communist party affiliations and backgrounds. They are BUSY recommending redistributive policies, costly and stifling regulations and creating opportunities for government bribery and rent- seeking public servants, like we now see at the banks and brokers. To make it worse, they are working to CENSOR opponents.

The CZ@RS are DISABLING broad sectors of the economy, such as manufacturing, health care, energy production, and minerals and mining. They are silencing TALK radio and soon the internet, so it cannot REPORT what the MAINSTREAM MEDIA fails to do. In general, we are seeing GANGSTER politics, fascism (crony capitalism) and socialism, which is MISERY SPREAD IN EVER-WIDENING CIRCLES as wealth creation is destroyed. The solution that public servant propose to a collapsing economy and incomes: More of the same.

Their INSATIABLE thirst for power over the economy, politically-extracted rents (CHICAGO POLITICS WRIT LARGE) and its citizens has now reached the point where there is no escape from the final debacle. So much of the country has FORGOTTEN how to produce more than they consume, save money (useless when purchasing power can be stolen with a government-mandated debasement) and start new businesses. Would-be entrepreneurs are FROZEN as the future is unknowable, with the government expanding at a 90% ANNUAL rate.

Government has written so many blank checks in the past and made promises for the future that the path of the future is INESCAPABLE. The US and G7 welfare states are headed to an apocryphal collapse because the debts are un-payable and inextinguishable. In July alone, the US budget deficit was $180 billion (180,000 million or 4 million per minute). CAN YOU SAY ABSURD? This is supposedly to fix the economy but it is the ruin of it. The same can be said for the broad public. The G7 publics are Debt slaves of their own purchases and the debts incurred by their corrupt leaders and their crony capitalist supporters.

One need look no further than the HEALTH CARE reform which is nothing less than the final step into socialism. It is a political solution rather than a practical one. It is not reform, it is a takeover of almost 20% of the economy and the final ownership of you and your body. Nowhere to be found is any talk of TORT reform, a primary cause of runaway costs, as defensive medicine (generally unnecessary medical tests that are performed to protect from lawsuits and the outrageous rewards in the courtroom drive costs through the roof. No mention of the tens of billions of waste fraud and abuse of Medicare and Medicaid. Listen to this short speech by Ronald Reagan explaining how socialized medicine is the path to socialism: http://www.youtube.com/watch?v=fRdLpem-AAs . It is profound.

The Cap and Tax bill is as bad as the Health Care bill; 1300 pages of filth written with RADICAL environmentalists and Crony capitalists such as Al Gore who owns the rights to the trading platforms for carbon credits in Chicago and London in partnership with who else? Government Sachs and JPMorgan chase. It is every bit as big a takeover of the energy industry as the Health care Ob@mination. Between the two bills these weasels on Capitol Hill are nationalizing 30 to 40% of the US economy so they can sell favors and regulatory forbearance to the highest bidder. If passed it will destroy the competitiveness of the US economy in relation to its competitors around the world. It actually is worse than that as they will impose it UNILATERALLY if it does not pass through the EPA who has decided the air you EXHALE is a pollutant (Plants breath carbon dioxide and exhale oxygen). Nature way of balancing things. It’s another looming disaster.

Next up is FINANCE reform, probably written by the big banks and brokers which caused the present crisis, and who use their control of the beltway to escape culpability for their reckless, casino-Ponzi finance. Conveniently left out of the bill is reform of Fannie Mae and Freddie Mac, and the primary culprits in the NSRO’s (national statistical ratings organizations) which were paid for ratings by the issuers of the toxic securities. Then, the fraudulent ratings were used to distribute these products to unsuspecting investors around the world. They are now becoming more worthless by the day and unsellable, because to do so would EXPOSE the complete and total bankruptcy of the biggest banks and brokerages (see ‘Roach Motels’ in TedBits archives, August 2007.)

We can now clearly see what is happening in the commodity markets (the canaries in the coal mine exposing serial money printers.) They are imposing position limits on the public to accomplish two things: Drive the public away from the LAST refuge from money printing (as commodities re-price to reflect the debasement of whatever currency in which they are priced) and debasement, and to drive commodity trading from the clean futures markets and into the hands of the over-the-counter ripoff factories (the bankrupt big banks and brokers, like Government, er…Goldman Sachs and JPMORGAN Chase) where counter-party solvency is UNKNOWABLE for the buyer. What else would you expect from commodity regulators headed by ex-Goldman Sachs PARTNERS and morally and fiscally corrupt public servants, er…serpents?

Unfortunately for them, Commodities are in SECULAR BULL markets after a 20-year SECULAR BEAR market. Combined with the money printing, it provides a powerful challenge for the governing and CENTRAL bank elites who believe they can challenge MOTHER NATURE and the repeal laws of supply and demand. THEY CAN’T.

Years of neglect to plan for future energy and commodities needs cannot be met or created with the stroke of a pen. Men are not gods, although our leaders believe themselves to be gods. They will never catch Mother Nature and put a bullet in her head, but their hubris will be a bullet to your head as they PRINT US INTO BANKRUPTCY. Obviously, they have not learned the lessons of King Canute.

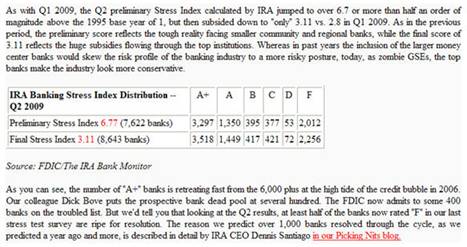

The stress tests were used to cover up the fraud and losses from the public, head off runs on the banks and keep the con game going, rather than be properly used to identify the threat to the public and deal with it through nationalization and breaking up of these systemically-threatening behemoths. The losses are MUSHROOMING like a NUCLEAR BLAST, but covered up by ROTTEN regulators, the US Treasury and Federal Reserve - partners in crime with the “TOO BIG TO FAIL” institutions. Chris Whalen and the fabulous crew at www.institutionalriskanalytics.com outline the MUSHROOMING calamity in a recent Q2 update:

The stress tests were used to cover up the fraud and losses from the public, head off runs on the banks and keep the con game going, rather than be properly used to identify the threat to the public and deal with it through nationalization and breaking up of these systemically-threatening behemoths. The losses are MUSHROOMING like a NUCLEAR BLAST, but covered up by ROTTEN regulators, the US Treasury and Federal Reserve - partners in crime with the “TOO BIG TO FAIL” institutions. Chris Whalen and the fabulous crew at www.institutionalriskanalytics.com outline the MUSHROOMING calamity in a recent Q2 update:

Thank you, Chris. The threat of bankruptcy is what makes banks behave prudently. The 19 biggest banks have now been removed from that consideration, so the recklessness we have had up to this time is exploding higher. This is called “moral hazard” (the “Bernanke Put”) and is an epidemic of recklessness condoned and SPONSORED by the Central Bank, Treasury and US government, aka public servants and crony capitalists.

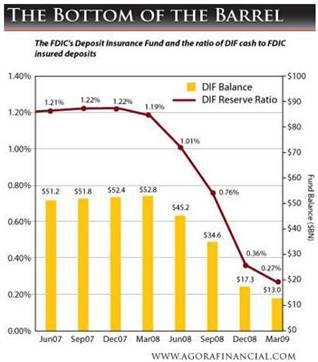

Thousands of banks stand in the waiting line at the FDIC to RESOLVE their bankruptcies, but they cannot be resolved, because neither the personnel nor the money are available to do so – as the FDIC has no clothes and no money as we can see below, courtesy of www.agorafinancial.com :

Unbelievable. trillions of dollars of NEW losses yet to be REALIZED, and NO ABILITY to cover them except through NEW BORROWING or the PRINTING PRESS. The government has ¼ of 1 percent to cover losses of trillions of dollars!

Unbelievable. trillions of dollars of NEW losses yet to be REALIZED, and NO ABILITY to cover them except through NEW BORROWING or the PRINTING PRESS. The government has ¼ of 1 percent to cover losses of trillions of dollars!

The US government is implicitly GUARANTEEING the 19 largest banks, which, if their assets were marked to their true value, are FUNCTIONALLY insolvent (this is a multi-trillion dollar liability). Take a look at an excerpt from a recent report from Bloomberg about the ACTUAL balance sheets of major national and regional banks:

Recognizing Loan Losses

The biggest change would be to the treatment of loans. The FASB’s current rules let lenders carry most of the loans on their books at historical cost, by labeling them as held-to- maturity or held-for-investment. Generally, this means loan losses get recognized only when management deems them probable, which may be long after they are foreseeable. Using fair-value accounting would speed up the recognition of loan losses, resulting in lower earnings and reduced book values.

While Regions may be an extreme example of inflated loan values, it’s not unique. Bank of America Corp. said its loans as of June 30 were worth $64.4 billion less than its balance sheet said. The difference represented 58 percent of the company’s Tier 1 common equity, a measure of capital used by regulators that excludes preferred stock and many intangible assets, such as goodwill accumulated through acquisitions of other companies.

Wells Fargo & Co. said the fair value of its loans was $34.3 billion less than their book value as of June 30. The bank’s Tier 1 common equity, by comparison, was $47.1 billion.

Widening Gaps

The disparities in those banks’ loan values grew as the year progressed. Bank of America said the fair-value gap in its loans was $44.6 billion as of Dec. 31. Wells Fargo’s was just $14.2 billion at the end of 2008, less than half what it was six months later. At Regions, it had been $13.2 billion.

Other lenders with large divergences in their loan values included SunTrust Banks Inc. It showed a $13.6 billion gap as of June 30, which exceeded its $11.1 billion of Tier 1 common equity. KeyCorp said its loans were worth $8.6 billion less than their book value; its Tier 1 common was just $7.1 billion.

These banks and the government agencies which REGULATE them are morally and FISCALLY BANKRUPT. For the complete article, click here: http://www.bloomberg.com/apps/news?pid=20601039&sid=a04oVutXQybk , but when you do, please be prepared with a fresh pair of underwear. Remember, in March, your elected representatives pressured the Financial Accounting Standards Board to SUSPEND the mark-to-market rules shortly after receiving MILLIONS in campaign contributions. Furthermore, the losses continue to climb, unaccounted for and unfunded, but earmarked for the PUBLIC. They obviously DON’T work for you…

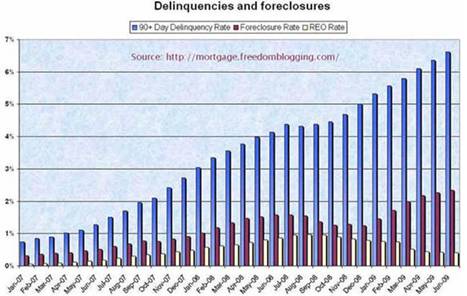

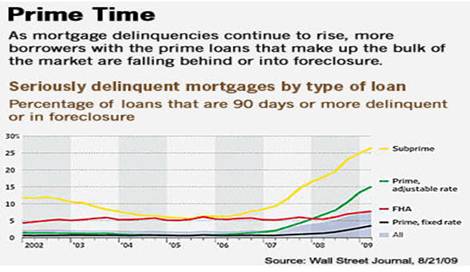

Not only that, but their assets are PLUMMETING. It was announced on CNBS that mortgage delinquencies in all home categories are now over 13% of all homes:

Not only that, but their assets are PLUMMETING. It was announced on CNBS that mortgage delinquencies in all home categories are now over 13% of all homes:

There have been approximately 1.5 million defaults to date; another 4 million are at the doorstep, and over 600,000 homes have been held out of the market by the banks waiting for markets to recover. Soon they will be FORCED TO CAPITULATE and then it will be WATCH OUT BELOW.

And delinquencies are soaring in all loan categories:

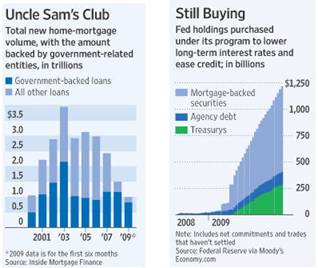

The Mortgage Debt market has closed for business except for Uncle Sam and the Federal Reserve purchases:

This QE will NEVER end. The federal government, public servants and the Federal Reserve are virtually the ONLY groups providing finance to this sector of the economy. They are the ONLY FOOLS who will stand in front of the growing wave of foreclosures which will threaten millions of existing homebuyers, as well as every new home buyer because values are obviously going to begin a next leg DOWN as supply multiplies in the near future.

TALK ABOUT FOOLISH BEHAVIOR! They are not preventing the meltdown; they are POSTPONING and ENLARGING it. Who are the guarantors of these poor decisions of the fed, treasury and public servants? YOU, the public and future generations.

The housing credit for first-time home buyers expires in November, at which time we will see sales PLUMMET as these buyers comprised future demand that was brought forward by the FREE MONEY, just as we are witnessing with the Cash for Clunkers BOONDOGGLE. No doubt, the weasels in Washington will try to extend it as a kiss to constituents for the 2010 elections.

The housing credit for first-time home buyers expires in November, at which time we will see sales PLUMMET as these buyers comprised future demand that was brought forward by the FREE MONEY, just as we are witnessing with the Cash for Clunkers BOONDOGGLE. No doubt, the weasels in Washington will try to extend it as a kiss to constituents for the 2010 elections.

The monetizing of the mortgage markets will extend forever until the private sector finances them. Additionally, it is clear that the stealth monetizing “QE” of treasury debt is indirectly being practiced

with foreign central banks which are trading in their agency and mortgage-backed securities to the Fed, then turning around and buying the record US treasury issuance.

A housing bottom as the touts are claiming? DON’T BET ON IT! You have to wonder how they get away with these outright lies. The answer: The regulators encourage it to keep the panic from MAIN STREET. Who are they protecting, the banks and elites, or you?

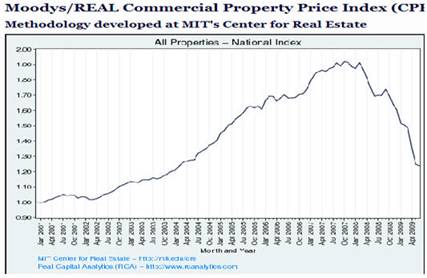

Now let’s look at the commercial REAL ESTATE values since January 2000, of which over $1 trillion of refinancing MUST take place by the end of 2010:

Stunning, an approximate 68% loss since the highs in 2007, these are just beginning to hit the books in all the CDO’s, CMB’S, bank loan books, etc. This quarter will BE THE LAST where the cover-ups can continue as their CORE revenues PLUMMET, losses skyrocket, and now they MUST rely on trading revenues. This is problematic and we know why: no new Glass-Steagall Acts will be reinstituted, because ZOMBIE banks have now completed the transformation to HEDGE FUNDS in disguise. They don’t know HOW to make money from core banking activities

Anti-trust and the FDIC laws are meant to deal with this and break them up like AT&T in the early 1980’s. Now these BANKSTERS ARE ABOVE THE LAW, and you are on the hook for their GAMBLING activities today.

The banks - also known as credit card issuers - are charging 25 to 40% with the full knowledge of our elected officials (bought and paid for). On the approximate $2.5 trillion of debt, this is almost $750 billion per year in loan shark type revenues, before overdraft fees and gotcha clauses, all this, combined with weasel-word agreements which generate tens of billions of dollars per year of extra income through various fees. This is making consumers DEBT SLAVES of the banks and government creditors who hold interest rates low so savers are CHEATED out of their income and it is transferred to the banks!!!

The banks - also known as credit card issuers - are charging 25 to 40% with the full knowledge of our elected officials (bought and paid for). On the approximate $2.5 trillion of debt, this is almost $750 billion per year in loan shark type revenues, before overdraft fees and gotcha clauses, all this, combined with weasel-word agreements which generate tens of billions of dollars per year of extra income through various fees. This is making consumers DEBT SLAVES of the banks and government creditors who hold interest rates low so savers are CHEATED out of their income and it is transferred to the banks!!!

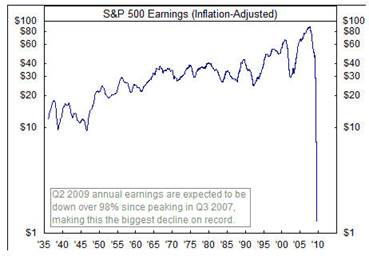

In the last newsletter, I detailed the insane valuation of stocks today, and the LIES being distributed by CNBS, WALL STREET BROKERS and the TOO-BIG-TO-FAIL banks which say that stocks are great values. Look at this chart of ACTUAL earnings going back to 1935, brought to us by Jim Willie of the www.goldenjackass.com and www.chartoftheday.com :

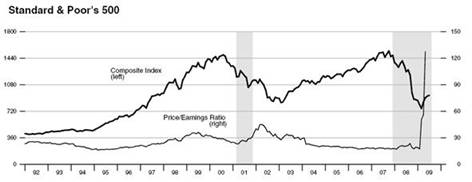

Earnings are the lowest in history. How will they pay their lenders in the corporate bond markets? How will the government fund its gargantuan deficits and spending? Look at the S&P 500 price with a P/E ratio going back to 1992, from the St. Louis Fed in their Money Trends Report outlining a gentler version of the insanity we see above:

Earnings are the lowest in history. How will they pay their lenders in the corporate bond markets? How will the government fund its gargantuan deficits and spending? Look at the S&P 500 price with a P/E ratio going back to 1992, from the St. Louis Fed in their Money Trends Report outlining a gentler version of the insanity we see above:

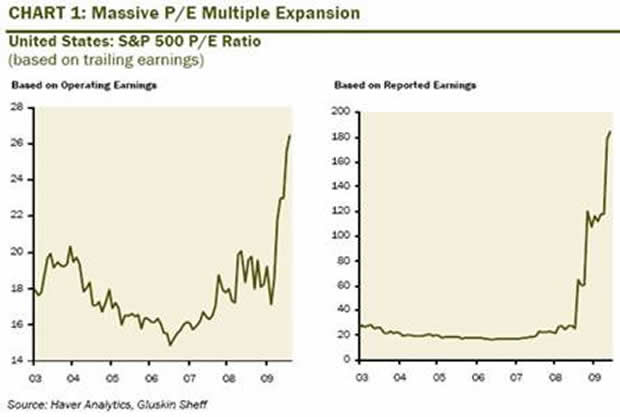

David Rosenberg at http://www.gluskinsheff.com/ notes:

David Rosenberg at http://www.gluskinsheff.com/ notes:

“All we know is we have a trailing P/E multiple operating earnings on the S&P 500 of 25.5x – a record eight multiple point expansion from the low over a six-month span. Take note that this is the highest P/E multiple since March 2002, which is right around the time that the bear market at that time (also premised on post-crisis V-shaped recovery hopes) began to roll over. It took a good year for the fundamental bottom in the market to be put in, and that was heresy back then too. The P/E multiple on non-scrubbed reported earnings has scored 60 points since March to 184x – not only a record but five times more expensive than what we saw during the peak of the dotcom bubble a decade ago (Oh! But we forgot – write-downs don’t matter.)”

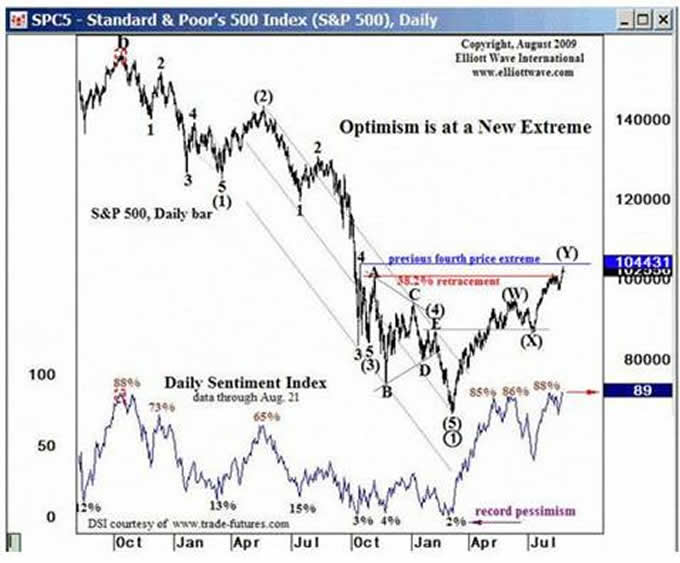

Thank you, David, and Gluskin Sheff. In any event, we would CAUTION you to avoid the hype from CNBS and the mainstream financial media. Meanwhile, BULLISH sentiment is at RECORD HIGHS as detailed by www.elliotwave.com and Investors Intelligence. Let’s look at the charts:

Notice how sentiment has now EXCEEDED the all-time high in October 2007.

Notice how sentiment has now EXCEEDED the all-time high in October 2007.

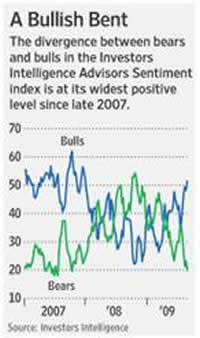

Now on to newsletter writers at Investors Intelligence:

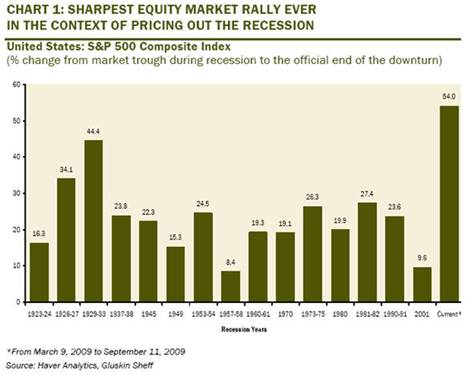

NEAR-record divergences between bulls and bears. Previous highs have been poor places to invest, that much is certain. Look closely at both of the previous illustrations. Now look at another chart from David Rosenberg and Gluskin Sheff, outlining the NEVER-BEFORE-SEEN rally from the March lows, in terms of both TIME and price, as we supposedly EMERGE from recession:

As I said, this is a move never before seen in HISTORY and it smells fishy to me. Take a look at insider selling, courtesy of www.thegartmanletter.com and www.trimtabs.com :

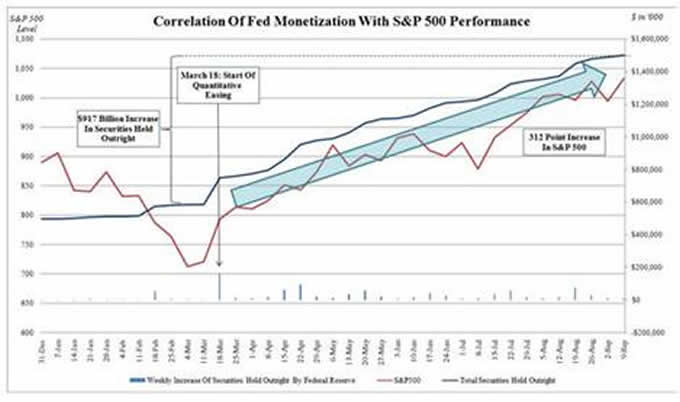

What is driving the rises in the stock and bond markets? It is our friends at the central banks who are PRINTING toilet paper, er…money out of thin air. Take a look at this chart outlining QE (quantitative easing) and the S&P 500, courtesy of www.zerohedge.com :

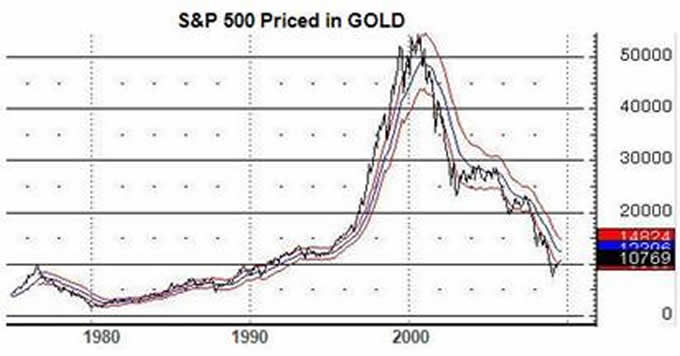

Can you say a “correlation of ONE to ONE on money printing versus WALL STREET asset prices?” You can see it everywhere; stocks, short, intermediate and long-term treasuries, corporate and junk bonds. ZIMBABWE has arrived in the G20. Let’s take a look at our old friends, the charts of the S&P 500 and Ten-Year Notes priced in real money, also known as gold:

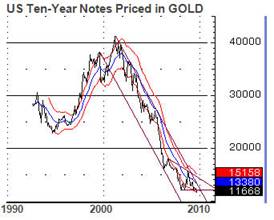

Wow, back to 1990 values. Most investors have no clue about the amount of losses they have sustained through monetary debasement. Notice how the rally from 2003 DISAPPEARS when measured in real money. That rally in nominal terms was a GREAT ILLUSION!! Now let’s look at supposedly the safest investment in the world: a US Ten-Year Note, but priced in GOLD to unmask the fallacy of this BELIEF:

It shows a decline in VALUE of 50% BELOW its value in 1995 in REAL terms; hardly risk free. In fact, few investments have fallen as far over this period. With the recent breakouts in gold and silver indicating an approximate 40% RISE in dollar terms, it would signal a 40% FALL in real values from here. Notice how it is BREAKING down from the triangle and the top of the TREND channel going back to 1990? BOMBS, er…BONDS away, as the next drop in REAL terms has now begun.

It shows a decline in VALUE of 50% BELOW its value in 1995 in REAL terms; hardly risk free. In fact, few investments have fallen as far over this period. With the recent breakouts in gold and silver indicating an approximate 40% RISE in dollar terms, it would signal a 40% FALL in real values from here. Notice how it is BREAKING down from the triangle and the top of the TREND channel going back to 1990? BOMBS, er…BONDS away, as the next drop in REAL terms has now begun.

So let’s take a shorter-term look at the S&P 500 chart in gold, courtesy of www.chartoftheday.com :

Whoopsee, we are now at a logical stopping point of the rally in PAPER and a resumption of the trend in TANGIBLE assets and commodities. Notice how the market rallied the bottom of the previous trend channel from the real top in the DOW in 2000, and it stopped in its tracks both at the longer-term trend line and the top of the trend line since October 2007. This is called a FAILURE.

Whoopsee, we are now at a logical stopping point of the rally in PAPER and a resumption of the trend in TANGIBLE assets and commodities. Notice how the market rallied the bottom of the previous trend channel from the real top in the DOW in 2000, and it stopped in its tracks both at the longer-term trend line and the top of the trend line since October 2007. This is called a FAILURE.

These pictures can be seen in all paper assets, stocks and corporate, public and junk bonds, etc. The money they are creating is not going to Main Street, it is going to WALL STREET. INSANE OVERVALUATIONS in all asset classes and the public is getting in AT THE TOP!! Anybody who buys FINANCIAL assets at these levels is insane. The BIG BANKS and BROKERS are unloading their trash on them with GOVERNMENT forbearance, and thus, TACIT APPROVAL. Make no mistake; stock prices WILL REVERT to reflect these realities.

This is a recipe for a collapsing private sector (the REAL ECONOMY) and stock market. I predict a 60 to 80% decline in stock market values from wherever this INSANE bear market rally ends over the next several years…

This is a recipe for a collapsing private sector (the REAL ECONOMY) and stock market. I predict a 60 to 80% decline in stock market values from wherever this INSANE bear market rally ends over the next several years…

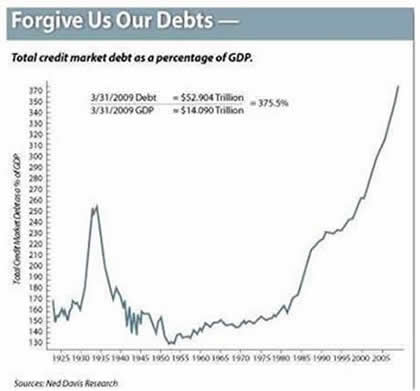

Debt-to-GDP ratios are fully 50% HIGHER and headed to 100% greater than the peaks of the Great Depression:

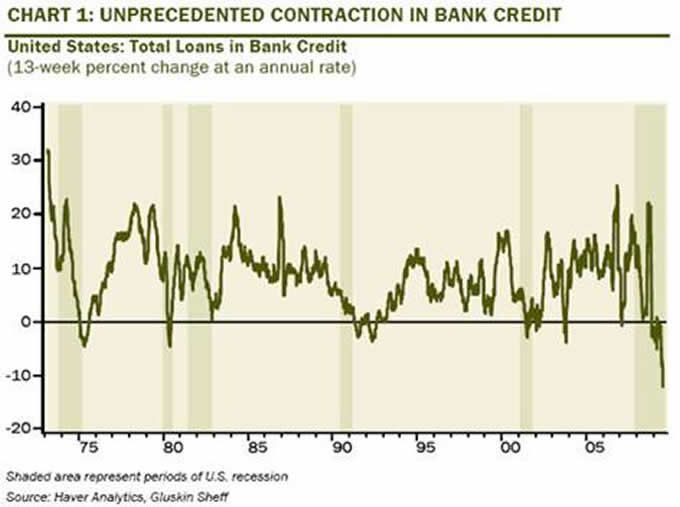

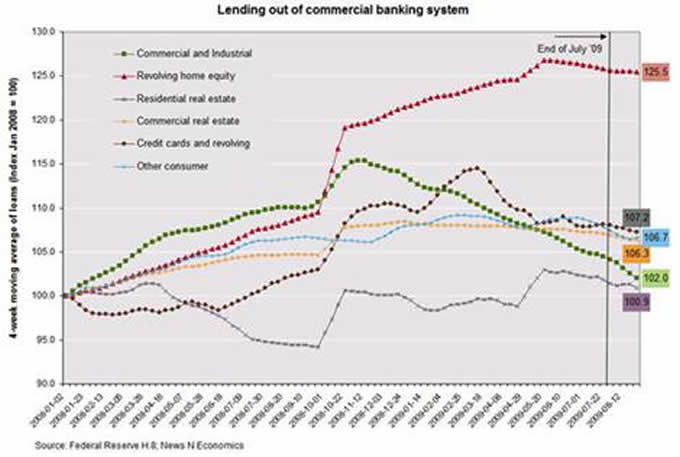

Notice how the debt-to-GDP ratio climbed into 1935-36. I project that this will happen again, and project it to skyrocket higher to 500% of GDP, as INSANE public servants try to borrow and spend their way to prosperity and BIGGER GOVERNMENT. It took 15 years to resolve that deleveraging; why would you expect it to end now in a year or two? Additionally, credit is contracting in all sectors, except government, at UNPRECEDENTED rates in the REAL economy as outlined in these next two charts:

This is the most important chart in this missive, as growth CANNOT resume until this chart turns positive. It tells you that TARP and all Federal Reserve programs have FAILED, and that the stimulus program is bogus. The $2-3 trillion that has been spent was sent to Wall Street, the banks, and the politically connected; none of it is getting to MAIN STREET.

This is the worst contraction in 40 years, and if you review the period between 1936 and 1953 on the debt-to-GDP chart you see that this can go on for up to 15 years, it is in all categories and it is just getting started:

Broad measures of credit growth have rolled over and are PLUMMETING and the narrowest measures are rising as money seeks safety.

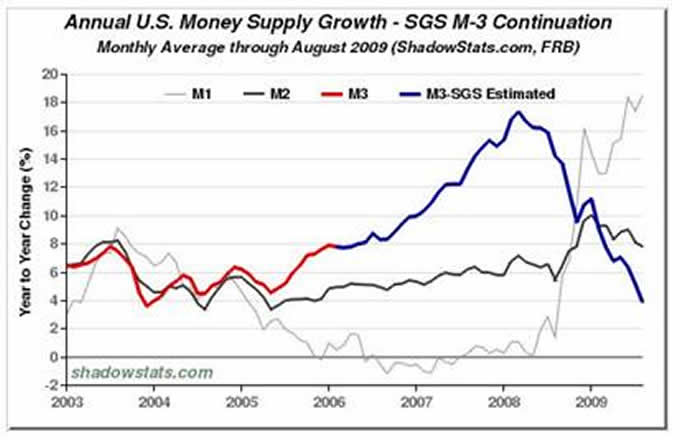

Check out this chart from www.shadowstats.com:

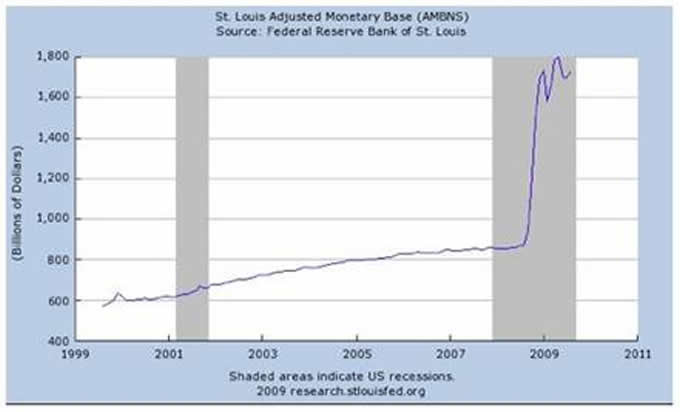

At the same time, Federal Reserve presidents Bullard, Dudley and Fisher are saying publicly that the Federal Reserve’s balance sheet is about to expand to over $3 trillion by early 2010, so we can expect MZM (money of zero maturity):

So, you can expect this to expand by 50% in the next six months, as the Federal Reserve takes toxic assets and exchanges them for freshly-printed CASH to slow down the unfolding and deepening insolvency of the banks.

The hoi polloi at the central banks claim they can print with impunity, as the output gap and CPI and PPI remain low. But the REAL numbers say LIAR! Take a look at the basket of commodities since the beginning of 2009 through the middle of August:

Talk about a squeeze on consumers and the private sectors as they pay more for EVERYTHING, contrary to every government report. Prices paid in the PPI are up almost 20% just since JULY.

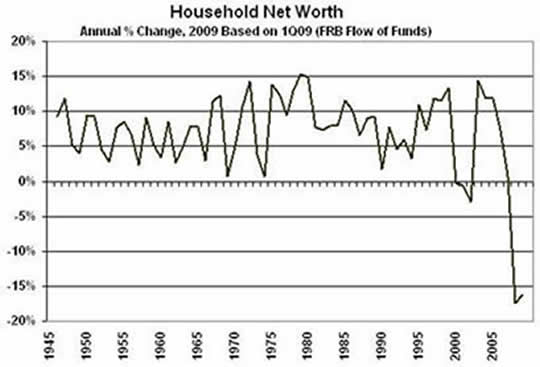

But the bankruptcies emerging in the private and corporate sectors just keep on RISING. Household net worth has tumbled the greatest amount since WWII, as outlined by the chart above from www.shadowstats.com (I urge you to subscribe.)

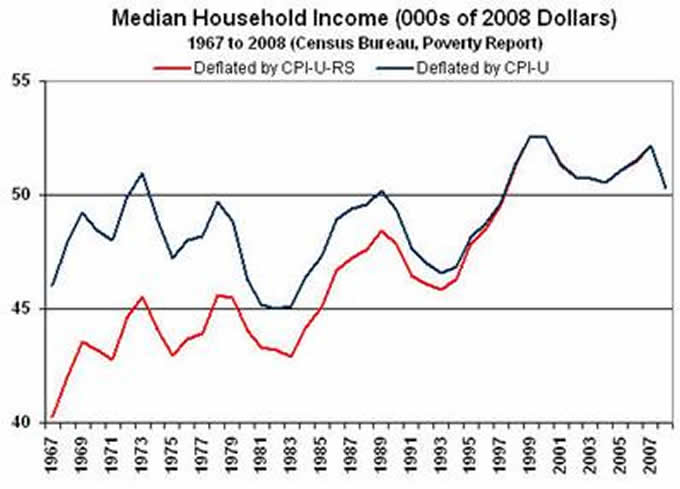

And household income has now declined to pre-1997 levels, as the above chart shows:

Furthermore, debt has doubled since then, as we saw in the DEBT-to-GDP chart with INCOMES below levels of 12 years ago. Double the amount of debt to service and income at 12 year lows! Think about it. Are employment and income set to advance at this point? Don’t bet on it, as these two charts from David Rosenberg and www.gluskinsheff.com illustrate:

As you can see, the private sector is flat on its back, and if you look at charts of declining inventories, you will quickly see they are still almost DOUBLE the lows we saw at the bottom of the 2002-03 recession valleys, so a lot of reductions REMAIN to be made.

As you can see, the private sector is flat on its back, and if you look at charts of declining inventories, you will quickly see they are still almost DOUBLE the lows we saw at the bottom of the 2002-03 recession valleys, so a lot of reductions REMAIN to be made.

In conclusion: These are the pictures of BLACK SWAN events. Dominoes of the next leg down in the global economy. Statistically, the economy may grow in the next several quarters, but in real terms, it will be an illusion, courtesy of PRINTING MONEY and politically-correct economic statistics which are outright FALSEHOODS and illusions for PUBLIC consumption. This period is right out of George

Orwell’s Animal Farm and the Ministry of TRUTH.

Buy and hold is DEAD as these realities must now be priced into every market you know. This volatility is an OPPORTUNITY for you! Learn how to CAPTURE it (click here). It will be a trading market for 15 years, just as it was between 1929 and 1950. The dollar is becoming the funding currency for the carry trade.

Public and private debt are at record highs, and income is at record lows for the same. Real median household income is below 1973 in the private sector, and at all-time lows in the corporate sector. Widespread destruction of bomb, er…BOND markets looms, as the incomes to service them DOES NOT exist, and the ASSETS which underpin them no longer have the NOMINAL values they once did. Refinancing will become increasingly IMPOSSIBLE. The greatest transfer of wealth from those that hold it in paper to those that don’t has commenced.

Public and private debt are at record highs, and income is at record lows for the same. Real median household income is below 1973 in the private sector, and at all-time lows in the corporate sector. Widespread destruction of bomb, er…BOND markets looms, as the incomes to service them DOES NOT exist, and the ASSETS which underpin them no longer have the NOMINAL values they once did. Refinancing will become increasingly IMPOSSIBLE. The greatest transfer of wealth from those that hold it in paper to those that don’t has commenced.

NO entrepreneur or corporate manager would dare step onto the field as long as the blind, fascist, socialist IDEALOGUES on capital hill are driving the economy. Why start a business or take a risk hiring someone, when the federal and state governments are poised to take your money through spiraling taxes, regulations, energy costs (Cap and tax will triple the cost of energy minimum), new health mandates or who knows what. It would be capital suicide….

Oh, the irony. The people behind Ob@manomics and the Gang of 535 are a reflection of their representatives. Ob@manomics may have just started a trade war with China.Amerika is doomed because they have forgotten honesty, loyalty, the work ethic and producing more than you consume, also known as producing REAL wealth, not nominal wealth. What used to be the economic powerhouse of the world knows nothing but how to print a bunch of money to paper over systemic fraud, falling crony capitalists and scams, and what do you expect? Money is being pumped into a society that, at the business/political leadership levels, knows how to do nothing besides fraud to make money.

What is frightening is that the plans of the Gang of 535, aka the US Congress and the Ob@ma administration, have been finalized but not implemented. As the implementation unfolds, so will the deepening depression and collapse in income generation. Ob@manomics has just started a trade war with China over low-cost tires that the US NO LONGER MANUFACTURES, at the behest of UNION masters. It is only the first shot of blind ideologues and socialists which are creating the crisis for personal and political goals. This is a deliberate destruction of the economy in order to seize power and the private sectors they don’t already have. Saul Alinsky and Carl Marx must be smiling.

The crony capitalists are having a field day preying on people and businesses outside the government-guaranteed sectors., People and business that are CUT off from credit while the predators still have access to the FRESHLY-PRINTED cash. As Thomas Jefferson once said:

"If the American people ever allow private banks to control the issue of their money, first by inflation and then by deflation, the banks and corporations that will grow up around them (around the banks), will deprive the people of their property until their children will wake up homeless on the continent their fathers conquered."

This time has now arrived, but it has a twist as fiat currencies and irresponsible public serpents will usher in a hyperinflationary end game. Jefferson did not consider fiat currencies since they were prohibited by the constitution…

Capital flight from the US is intensifying, but running into the G7 currencies is like jumping from the frying pan into the fire. Why would any sane investor invest in America with these recipes coming from our fascist, socialist masters in Washington who are totally oblivious to history and who are presiding over a country which cannot generate its own energy needs (we are completely able to supply our own needs, but it is POLITICALLY incorrect, and so practical solutions are OUTLAWED?)

The Fed and G7 have succeeded in PROPPING UP PAPER ASSET VALUES through unbelievable money printing. But valuations are absurd and this excess liquidity is driving up the price of everyday goods and the raw materials businesses use.

The FED and G7 are dedicated to keeping the liquidity spigots open and point to the “output gap” and POLITICALLY-CORRECT, cosmetic CPI and PPI data. They will be the instigators of the coming hyperinflation as the central banks and G7 treasuries are pulling out every stop to SAVE their banking masters.

Runaway budget deficits will do the rest as we head into an inflationary depression. In the past 50 years, federal government outlays have averaged 20 to 22%. The Fiscal 2010 budget raises this figure to 27.2%, and when health care reforms are fully implemented, the federal outlays as a percentage of GDP will rise to almost 43.2%. When the last bull market began, interest rates were beginning a 28-secular bull market (declining interest rates), regulations were cut in half over an 8 year Reagan presidency, and taxes were being slashed as well.

Now we face a nascent-secular BEAR market (rising rates to compensate for debasement, runaway deficits and government risk) in bonds, a DOUBLING in regulations, and massive tax hikes of all kinds to pay for NEW and EXISTING programs, which are the FAIRY GODMOTHER COME TO LIFE, but serve no productive purpose.

The plunge protection team is OUT of CONTROL. Worthless stocks such as AIG, Fannie Mae and Freddie Mac, CIT, Citigroup, and Bank of Amerika have been almost 25 to 40% of the total volume traded for almost 6 weeks. These stocks all have NEGATIVE book values if properly accounted for.

Thank you for reading Tedbits if you enjoyed it send it to a friend and subscribe its free at www.TraderView.com don't miss the next edition of Tedbits.

If you enjoyed this edition of Tedbits then subscribe – it's free , and we ask you to send it to a friend and visit our archives for additional insights from previous editions, lively thoughts, and our guest commentaries. Tedbits is a weekly publication.

By Ty Andros

TraderView

Copyright © 2009 Ty Andros

Hi, my name is Ty Andros and I would like the chance to show you how to capture the opportunities discussed in this commentary. Click here and I will prepare a complimentary, no-obligation, custom-tailored set of portfolio recommendations designed to specifically meet your investment needs . Thank you. Ty can be reached at: tyandros@TraderView.com or at +1.312.338.7800

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

Ty Andros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.