Gold Acting as a Currency

Commodities / Gold & Silver 2009 Sep 16, 2009 - 11:33 AM GMT And it’s being jumped on by a speculator bash. But, gold has good reasons to rally. Caution is warranted because speculators are involved.

And it’s being jumped on by a speculator bash. But, gold has good reasons to rally. Caution is warranted because speculators are involved.

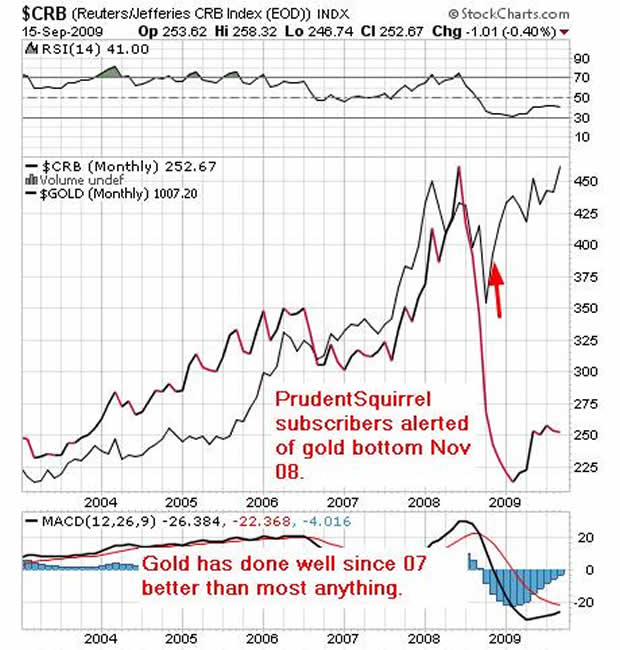

Longer term: The economic statistics reflect a bounce back from the cliff fall of last Winter for the Western and emerging economies. But that is not likely to last into later 09. If things again turn downward, there will be new stimulus packages by the US for sure, and likely by others. Gold is reflecting that expectation- the $trillions in stimulus. In fact, the only market that has convincingly held steady since 07 is gold, all the other basic commodities even oil nowhere near their highs. I might also point out that we called a gold bottom back in late Nov 08…

A move from safety into stocks generally is causing the USD to fall and it’s below 77 on the USDX as we speak. But gold is not following that script, ie people leaving flight to safety is usually gold bearish, but gold is operating more like a currency at this point and reacting to the world stimulus packages.

Even if markets turn around and start to crash again like last year and 07, gold has held steady after its initial reactions to those sell offs, and recovered soon after.

Gold is one of the safest bets out there if you are mostly concerned about saving your wealth. (And gold stocks; silver too but it’s more volatile).

The stock markets are rather flat at their recent highs. But the prospect for ultra low US interest rates (we are now below some key Japanese rates) is gold bullish and USD bearish into next year. We are still watching for signs of a stock sell off and USD rally end of year 09 due to flight to safety, but that has yet to prove out. Caution in this gold rally is warranted therefore. If gold can break $1030 and hold for a few days, we can see new highs in this rally. However, remember this gold rally is young still and has some proving to do.

There are other important factors, one is Barrick de hedging and buying several million ounces since July, with more to come. Also the gold/metal shorts might be in a squeeze. China suggesting buying gold below $1000 is also quite interesting, as is their suggestion to the public to buy gold.

By Christopher Laird

PrudentSquirrel.com

Copyright © 2009 Christopher Laird

Chris Laird has been an Oracle systems engineer, database administrator, and math teacher. He has a BS in mathematics from UCLA and is a certified Oracle database administrator. He has been an avid follower of financial news since childhood. His father is Jere Laird, former business editor of KNX news AM 1070, Los Angeles (ret). He has grown up immersed in financial news. His Grandmother was Alice Widener, publisher of USA magazine in the 60's to 80's, a newsletter that covered many of the topics you find today at the preeminent gold sites. Chris is the publisher of the Prudent Squirrel newsletter, an economic and gold commentary.

Christopher Laird Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.