Predicting The Future

Stock-Markets / Liquidity Bubble Jun 22, 2007 - 05:15 PM GMTAs investors our most valuable tool is definitely the crystal ball, but unfortunately we have yet to find a wizard that is willing to part with his. So if we do not have a crystal ball can we predict the future?

In our opinion the answer is in part, yes. An absolute prediction would be to call specific events at specific times with impeccable accuracy. We can not do this, but we do believe we can reasonably hypothesize what we think will happen in the markets. But what will give us the insight we require to invest accordingly?

As contrarian investors we have a few guidelines that help lead us through our investment decisions. For example, we think the mass public is usually wrong about investment decisions and therefore we do not want to subscribe to their commonly accepted thoughts and theories. If we invest like the average person, how can we do any better than the average person?

We believe the interpretation of commonly accepted theories such as Keynesian Economics, puts restrictions, boundaries and rules in the minds of investors; ideas that are portrayed as being absolutely perfect and therefore the only way to examine economies. Keynesian Economics appears to be interpreted by the mass public and media as more of a science than a theory. Many television stations promote analysts justifying this market movement and that market movement because of “this” or “that” major news worthy event. The public is told that gold will not rise in value and when it does the media seems to explain the exact fundamental reasons as to why it did rise and why it will soon fall. The public is told why interest rates will not rise and then when they do, they are then told exactly why it happened and why it will not last.

The media and mass public incorporating common theories often appear to inaccurately predict what will happen in the Economy and if proven wrong they quickly explain what they think is the exact cause. Instead of learning from their mistakes, re-evaluating their assumptions and strategies, they seem to justify why they were not wrong by pointing the finger at some unpredictable event that nobody could have known. As a result we believe they continually duplicate the same wrong assumptions and mistakes again and again.

For example, did the unpredictable popping of the NASDAQ bubble cause other US markets to collapse, or were all US stock markets over extended with excess speculative capital and due for a correction? Was the NASDAQ the cause of the other US stock market collapse or was the NASDAQ simply the worst of a bad situation? Were there signs that the NADAQ and other major US stock markets were overheated? Could it have been anticipated and profited from?

It is our belief that those who challenge these commonly accepted explanations and ask important questions such as the ones above are the individuals who will likely outperform the markets. We think that those who justify their wrong predictions with unknowable events that could not have been anticipated are doomed to fail again and again.

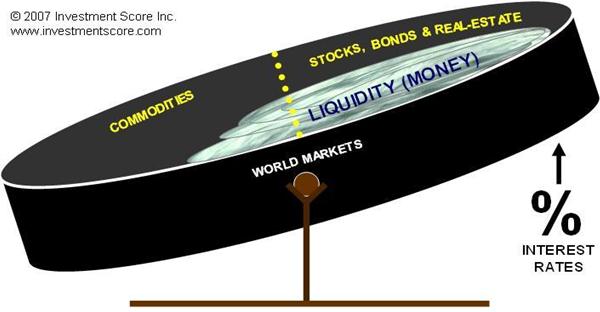

So in terms of investing now, what is likely to happen going forward? In our opinion this answer could easily be an entire article on its own. We think there are many fundamental reasons why inflation will cause commodities to rise and real estate, stocks and bonds to drop. In fact, we will likely write another article in the future explaining many of these factors; but for now let us simplify our reasoning. We believe all markets are simply investment opportunities competing for world funds. When one asset class becomes too popular, widely accepted and inflated beyond reason, another asset class is neglected and undervalued. The massive, popular markets of the past few decades will have huge amounts of excess capital sloshing around and looking for capital growth from lower ground. In our opinion that lower ground is currently the unpopular commodities market, and when investors realize that economic conditions have changed and their “popular assets pool” is simply too full of excess capital they will panic and pour that excess capital into this new favorite asset class, commodities. We think that in the coming years, interest rates will trend higher, causing capital to flow out of stocks, bonds and real-estate into commodities.

So let us make a prediction that should be documented for future reference. In the next twelve to twenty four months, we believe interest rates will continue to trend higher. We think this will continue to cause capital to flow out of stocks, bonds and real-estate and into commodities such as gold and silver. We also think the increasing wave of inflation and rise in commodity prices will result in the media, analysts and public pointing their fingers to some unknowable fundamental cause. This event could be a war, foreign policy, terrorist attack, climate change laws, natural disaster, foreign market crash etc.

The point is we think that the mass public, media and analysts will not be able to anticipate the new investment opportunity and see it coming but will claim they know exactly why it happened after the fact. Their justification will likely be incorrect and those who understand market psychology will continue to profit from this apparently flawed set of principles. We do not know what this fundamental event will be, but looking into the future we predict something will happen. Some unforeseen event will likely be used as blame for the sudden rise in inflation and commodity prices. We will let time and our investment portfolio tell us if we are correct. Of course we could be wrong and we must be ready to react if our assumptions are incorrect, but currently we are confident in our prediction and we are investing accordingly.

Our favorite commodity and current investment of choice is first silver and second gold. We think these markets are in the very early stages of a major bull market. At www.investmentscore.com we do not have a crystal ball but instead we use common sense analysis and custom built timing charts to help us determine where investment funds are flowing. This helps us determine where we think we should place our capital to benefit from what we believe is the misinformed, slow moving investing public. Visit our website www.investmentscore.com to subscribe to our free newsletter and learn more about our custom technical market timing charts and investment strategy.

Investmentscore.com is the home of the Investment Scoring & Timing Newsletter. Through our custom built, Scoring and Timing Charts , we offer a one of a kind perspective on the markets.

Our newsletter service was founded on revolutionary insight yet simple principles. Our contrarian views help us remain focused on locating undervalued assets based on major macro market moves. Instead of comparing a single market to a continuously moving currency, we directly compare multiple major markets to one another. We expect this direct market to market comparison will help us locate the beginning and end of major bull markets and thereby capitalize on the largest, most profitable trades. We pride ourselves on cutting through the "noise" of popular opinion, media hype, investing myths, standard over used analysis tools and other distractions and try to offer a unique, clear perspective for investing.

Disclaimer: No content provided as part of the Investment Score Inc. information constitutes a recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. None of the information providers, including the staff of Investment Score Inc. or their affiliates will advise you personally concerning the nature, potential, value or suitability or any particular security, portfolio of securities, transaction, investment strategy or other matter. Investment Score Inc. its officers, directors, employees, affiliates, suppliers, advertisers and agents may or may not own precious metals investments at any given time. To the extent any of the content published as part of the Investment Score Inc. information may be deemed to be investment advice, such information is impersonal and not tailored to the investment needs of any specific person. Investment Score Inc. does not claim any of the information provided is complete, absolute and/or exact. Investment Score Inc. its officers, directors, employees, affiliates, suppliers, advertisers and agents are not qualified investment advisers. It is recommended investors conduct their own due diligence on any investment including seeking professional advice from a certified investment adviser before entering into any transaction. The performance data is supplied by sources believed to be reliable, that the calculations herein are made using such data, and that such calculations are not guaranteed by these sources, the information providers, or any other person or entity, and may not be complete. From time to time, reference may be made in our information materials to prior articles and opinions we have provided. These references may be selective, may reference only a portion of an article or recommendation, and are likely not to be current. As markets change continuously, previously provided information and data may not be current and should not be relied upon.

Investmentscore.com Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.