Stock Market Investor Sentiment Bullish Fodder

Stock-Markets / Stock Market Sentiment Sep 13, 2009 - 05:19 PM GMTBy: Guy_Lerner

The "It Takes Bulls To Make A Bull Market" scenario is playing out, and the best thing to do is not fight the tape. However, someone forgot to tell the Rydex market timers who continue to look for a top and short the market. For the last two months, they have become short covering fodder for the bulls.

The "It Takes Bulls To Make A Bull Market" scenario is playing out, and the best thing to do is not fight the tape. However, someone forgot to tell the Rydex market timers who continue to look for a top and short the market. For the last two months, they have become short covering fodder for the bulls.

The "Dumb Money" indicator is shown in figure 1. The "Dumb Money" indicator looks for extremes in the data from 4 different groups of investors who historically have been wrong on the market: 1) Investor Intelligence; 2) Market Vane; 3) American Association of Individual Investors; and 4) the put call ratio. The "dumb money" remains extremely bullish.

Figure 1. "Dumb Money" Indicator/ weekly

The "Smart Money" indicator is shown in figure 2. The "smart money" indicator is a composite of the following data: 1) public to specialist short ratio; 2) specialist short to total short ratio; 3) SP100 option traders. The "smart money" is neutral.

Figure 2. "Smart Money" Indicator/ weekly

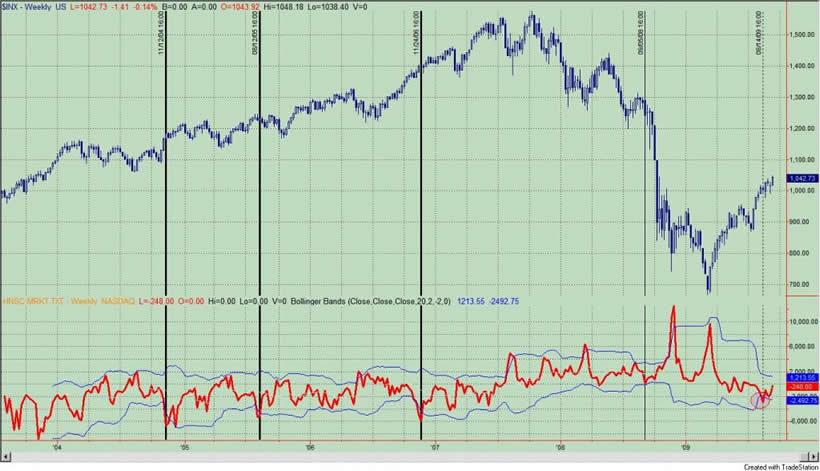

Company insiders selling their shares to a less extreme degree. See figure 3, a weekly chart of the S&P500 with the Insider Score "entire market" value in the lower panel.

Figure 3. InsiderScore Entire Market/ weekly

Figure 4 is a daily chart of the S&P500 with the amount of assets in the Rydex bullish and leveraged funds versus the amount of assets in the leveraged and bearish funds. Not only do we get to see what direction these market timers think the market will go, but we also get to see how much conviction (i.e., leverage) they have in their beliefs. Typically, we want to bet against the Rydex market timer even though they only represent a small sample of the overall market. As of Friday's close, the assets in the bearish and leveraged funds were greater than the bullish and leveraged; referring to figure 4, this would put the red line greater than green line.

Figure 4. Rydex Bullish and Leveraged v. Bearish and Leveraged/ daily

There is no question that since July 8, 2009 the equity markets have been on a moon shoot. Over those 46 trading days the S&P500 has gained 18.1%. Bulls have thrown caution to the wind, and it is paying off for now. The market in its all knowing, all seeing ways is forecasting better times ahead. It is obvious that the bears cannot see this or they just don't get it. But as a trader or an investor, you a have a choice of where, when and how you want to play. Even with the Fed punch bowl over flowing, the equity trade is getting pretty crowded. Treasury bond ETF's are looking rather appealing. I still think the best course of action is not to fight the tape, and of course, don't become fodder for the bulls.

Over the past 5 weeks, I have been stating that the equity markets will trade in a range with an upward bias; shorting the market for more than the quick flip has become a difficult proposition. This has turned out to be a good "call" as it is all bulls all the time. It is just going to take time for the extreme bullish sentiment to unwind.

By Guy Lerner

http://thetechnicaltakedotcom.blogspot.com/

Guy M. Lerner, MD is the founder of ARL Advisers, LLC and managing partner of ARL Investment Partners, L.P. Dr. Lerner utilizes a research driven approach to determine those factors which lead to sustainable moves in the markets. He has developed many proprietary tools and trading models in his quest to outperform. Over the past four years, Lerner has shared his innovative approach with the readers of RealMoney.com and TheStreet.com as a featured columnist. He has been a regular guest on the Money Man Radio Show, DEX-TV, routinely published in the some of the most widely-read financial publications and has been a marquee speaker at financial seminars around the world.

© 2009 Copyright Guy Lerner - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Guy Lerner Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.