A Tale of Two Inflations

Economics / Inflation Sep 10, 2009 - 02:59 AM GMTBy: Tim_Iacono

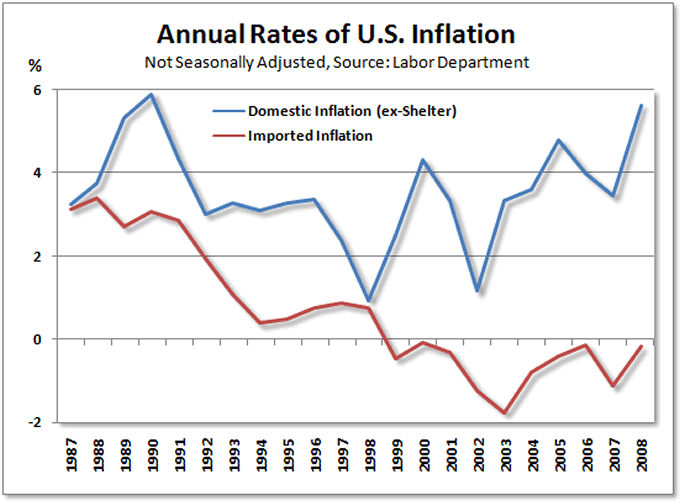

For some time now, the disparity between price increases for imported goods and price increases for domestic goods and services has been of great interest to me and, after working through all of the applicable Labor Department data on this subject, it quickly becomes clear that there is an interesting story to tell here about two very different types of U.S. inflation in recent years - domestic inflation and imported inflation.

For some time now, the disparity between price increases for imported goods and price increases for domestic goods and services has been of great interest to me and, after working through all of the applicable Labor Department data on this subject, it quickly becomes clear that there is an interesting story to tell here about two very different types of U.S. inflation in recent years - domestic inflation and imported inflation.

The data in the graphic above will be detailed in the paragraphs ahead because it is deserving of close inspection. To be sure, it is a quite fascinating subject for those not familiar with how dramatically inflation in the U.S. has changed over the years.

But, the more important point to be made here first is that this disparity between domestic and imported inflation was one of the primary reasons why central bank policy in the U.S. had been steering us on a wayward course for so many years. Clearly, two of the major factors that enabled the nation's "easy money" policies for the past two decades have been:

- The fixation on consumer prices (while ignoring asset prices)

- The irrational fear of falling prices (today and in 2002-2003)

To a large extent, the Holy Grail of benign inflation and the threat of deflation were not what they appeared to be. In short, the deceptive combination of sharply rising domestic prices combined with falling prices for imported goods has been a major contributor to policy mistakes by the central bank, one of many policy mistakes made over the years that have now come home to roost.

Breaking the Consumer Price Index Apart

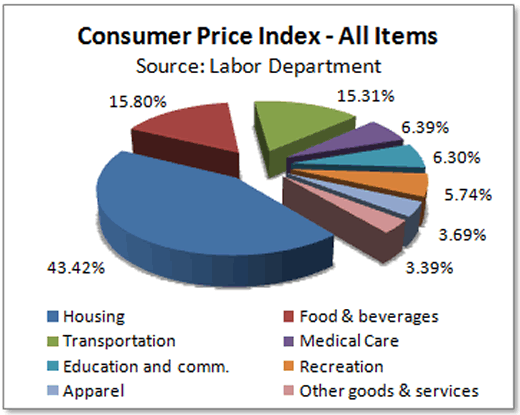

The Labor Department breaks consumer prices down into eight major categories, weighted as shown below. This composition is intended to represent a "basket of goods" that consumers purchase and the overall, weighted increases in prices are intended to represent the "rate of inflation" in the U.S.

For the purposes of this discussion and as the source for all the charts that appear here, only original Labor Department data is used and all issues related to such things as hedonic adjustments, geometric weighting, and other factors that contribute to the "reported" rate of inflation almost always coming in lower than the rate of inflation experienced in the "real" world will be ignored.

Importantly, lower "reported" inflation goes a long way in limiting government liabilities for such things as cost of living adjustments and makes central bankers, the stewards of American fiat money, look better than they otherwise might, so, this is not a subject that should be dismissed as inconsequential because, clearly, it is not.

It just won't be part of this discussion.

As for separating the consumer price index (CPI) into "domestic" and "imported" components, in looking at the top-level categories above, one can clearly spot a few that are predominantly domestic - education/communication, food/beverages, and medical care - and, while there are surely some imported goods in each of these groups (e.g., the 0.214 percent weighting for personal computers within the first group), it can safely be said that the "domestic" label fits all three.

Similarly, since the U.S. essentially stopped making their own clothes years ago, it can safely be said that the apparel category consists of primarily imported goods.

But, after that, things get a little trickier.

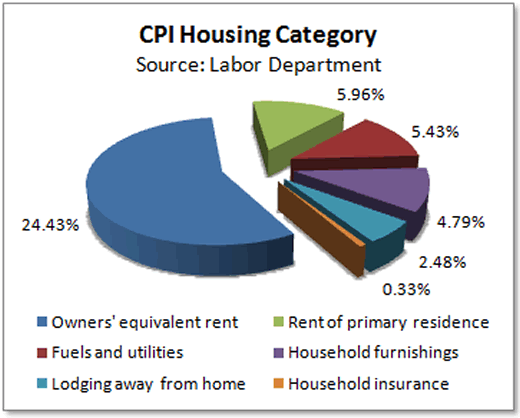

Making Sense of the Housing and Other Categories

The housing category breaks down as shown below and, as noted here many times before, probably the single biggest blunder of all regarding the consumer price index was the substitution of "owners' equivalent rent" for the cost of homeownership back in 1983.

As far as monetary policy is concerned, this was one of the major "enablers" for the late great housing bubble and its subsequent bursting since there would have been little chance of short-term lending rates resting at one percent back in 2003 and 2004 if home prices that were rising at an annual the rate of eight to ten percent nationally had been included in the calculation of consumer prices rather than the dubious measure of what homeowners think their place might rent for.

In fact, owners' equivalent rent has so distorted consumer prices in the U.S. that they, along with rental costs within the "Shelter" subcategory of the CPI, are completely excluded from the domestic/imported inflation discussion here.

[Note: For a complete breakdown of the CPI categories see this item at the BLS.]

With rents excluded from this list you are left with one sub-category of goods that is mostly imported - household furnishings - and the rest can be safely categorized as domestic.

Moving on to the transportation category we find cars, trucks, and the fuel that is required to run them and, while these are clearly both domestic and imported goods, the task of separating the two is nearly impossible. Since they are primarily made in the U.S., for the purposes of this discussion they are considered domestic.

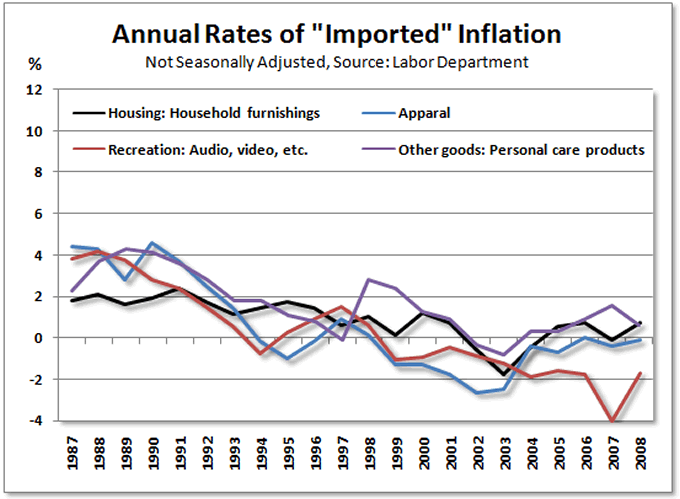

Similarly, the recreation and other goods and services categories contain a mix of products, however, here they can be easily segregated. For example, nearly all cameras and audio equipment are imported while movie tickets and film processing are domestic services. And in the final "other"category, tobacco products are clearly home grown while personal care products are largely imported.

Prices for Imported Goods are Falling Faster Than you Think

Lo and behold, when only looking at products that are imported (mostly from Asia), one sees that we've had "deflation" for quite a few years now and not just the "one-off" variety where readings come in at minus one percent and persist for only a month at a time.

For example, the apparel category has posted year-over-year price declines in 13 of the last 14 years and clothes cost a cumulative 15 percent less than they did in the 1990s.

Now that's what I call "deflation", though, it has more to do with cheap labor and fixed exchanged rates in Asia than it does with anything else.

Prices for most imported goods have been declining consistently over the last decade, however, you don't hear too much about this as most news reports and analysts cite the headline inflation numbers or, worse, "core" inflation, excluding food and energy.

Falling prices for imported goods have been a key factor in being able to report overall "moderate" rates of inflation in recent years.

Prices for Domestic Goods and Services are Quite High

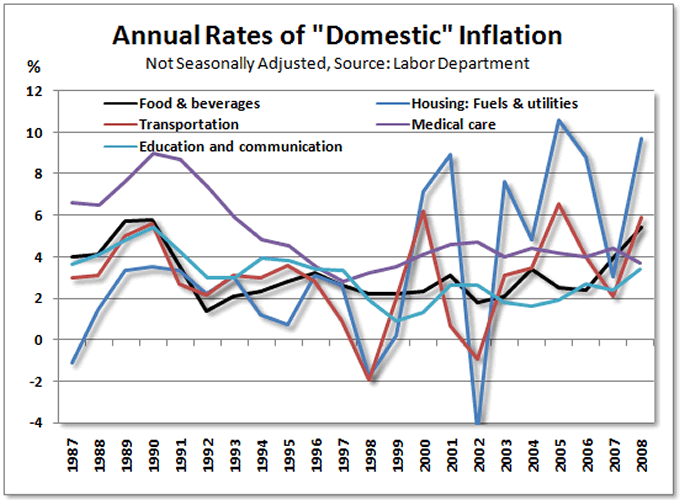

On the domestic side, when looking past the volatility that somewhat obscures the underlying pattern in the chart below, prices are clearly rising much faster than headline inflation has been indicating, particularly since the turn of the century.

[Note: The scales are the same for the chart below and the one in the previous section in order that the magnitudes can be more easily compared.]

While food price have been rising only modestly up until last year, it probably won't come as a surprise to anyone to learn that medical services costs have more than doubled over the same period of time that apparel prices have plunged, as noted in the previous section.

It is not until you look closely at the individual components of the consumer price index that you realize we really have been living in a world of "two inflations" - tumbling prices for imported goods and rapidly rising prices for domestic goods and services.

Combine these two inflations and throw in the huge "shelter" component that neither rises nor falls much as home prices soar and then plunge and the result is "benign" inflation.

What Does this all Mean?

For years, persistently low and falling prices for imported goods such as electronics and apparel have been masking much higher levels of domestic inflation in areas such as medical services and household energy.

Any economist with a spreadsheet and a web browser could have confirmed that.

But, what is significant about this is that this phenomenon should have been factored into monetary policy over the last decade or so but it wasn't.

Low inflation, regardless of its source, was used as a justification for keeping interest rates too low for too long and the unfounded fear of "de-flation" was the reason cited for keeping rates at "freakishly" low levels for several years in this decade.

Yes, pegged currencies in Asia play a role here, but surely the folks at the Federal Reserve, even with their misguided focus on consumer prices to the exclusion of nearly all other considerations, could have seen that inflation in the U.S. was only as low as it was because of cheap imports.

Had this been understood and had interest rates been kept higher over the last ten years, we probably wouldn't have near the number of problems that we've seen in the last year or two.

By Tim Iacono

Email : mailto:tim@iaconoresearch.com

http://www.iaconoresearch.com

http://themessthatgreenspanmade.blogspot.com/

Tim Iacano is an engineer by profession, with a keen understanding of human nature, his study of economics and financial markets began in earnest in the late 1990s - this is where it has led. he is self taught and self sufficient - analyst, writer, webmaster, marketer, bill-collector, and bill-payer. This is intended to be a long-term operation where the only items that will ever be offered for sale to the public are subscriptions to his service and books that he plans to write in the years ahead.

Copyright © 2009 Iacono Research, LLC - All Rights Reserved

Tim Iacono Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.