Government Economic Stimulus, How Many Rabbits Are Left In The Hat?

Economics / Economic Stimulus Sep 06, 2009 - 01:48 AM GMTBy: Mike_Shedlock

As amazing as it seems, inquiring minds are interested in hats and rabbit, more specifically, "How Many Rabbits Are Left In The Hat?"

As amazing as it seems, inquiring minds are interested in hats and rabbit, more specifically, "How Many Rabbits Are Left In The Hat?"

Dave Rosenberg was rabbits and hats in Friday's Lunch With Dave, NOT LABOUR’S DAY.

There is much more in the report including a look at Canadian unemployment, retail sales, and consumer confidence numbers.While the Obama economics team is pulling rabbits out of the hat to revive autos and housing, there is nothing they can really do about employment; barring legislation that would prevent companies from continuing to adjust their staffing requirements to the new world order of credit contraction. While nonfarm payrolls were basically in line with the consensus, declining 216,000 in August, there were downward revisions of 49,000 and the details were simply awful. The fact that 65% of companies are still in the process of cutting their staff loads is quite disturbing — even manufacturing employment fell 63,000 in August, to its lowest level since April 1941 (!), despite the inventory replenishment in the automotive sector and all the excitement over the recent 50+ print in the ballyhooed ISM index. The fact that temp agency employment is still declining, albeit at a slower pace, alongside the flat workweek and jobless claims stuck at 570,000, are all foreshadowing continued weakness in the labour market ahead. Until we see signs of a sustained turnaround in the jobs market all bets are off over the sustainability of any economic recovery.

What was really key were the details of the Household Survey, which provide a rather alarming picture of what is happening in the labour market.

First, employment in this survey showed a plunge of 392,000, but that number was flattered by a surge in self-employment (whether these newly minted consultants were making any money is another story) as wage & salary workers (the ones that work at companies, big and small) plunged 637,000 — the largest decline since March (when the stock market was testing its lows for the cycle). As an aside, the Bureau of Labor Statistics also publishes a number from the Household survey that is comparable to the nonfarm survey (dubbed the population and payroll-adjusted Household number), and on this basis, employment sank — brace yourself — by over 1 million, which is unprecedented. We shall see if the nattering nabobs of positivity discuss that particularly statistic in their post-payroll assessments; we are not exactly holding our breath.

Second, the unemployment rate jumped to 9.7% from 9.4% in July, the highest since June 1983 and at the pace it is rising, it will pierce the post-WWII high of 10.8% in time for next year’s midterm election. And, this has nothing to do with a swelling labour force, which normally accompanies a turnaround in the jobs market — the ranks of the unemployed surged 466,000 last month.

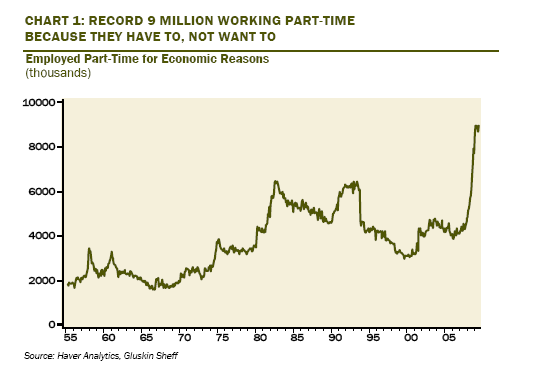

Record Part-Time Employment

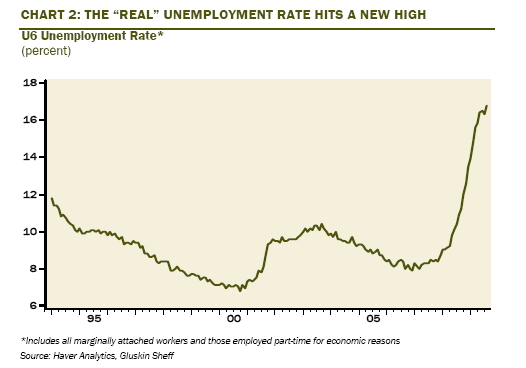

As with the headline data, the details beneath the surface of the unemployment rate figure are very troubling. The adult male unemployment rate has already climbed above the 10% level. When all the labour market slack is included, for example, the fact that full-time employment cratered 336,000 and those working part-time for economic reasons surged 298,000, the all-inclusive U6 jobless rate rose to an all-time high of 16.8% from 16.3% in July. Unless the laws of supply and demand have been permanently repealed, this record and growing amount of slack in the labour market is only going to exert more downward pressure on wages at a time when organic personal income is deflating at nearly a 5% annual rate. Unless Uncle Sam extends his generosity, the outlook for the consumer is fraught with fragility, and all one has to do is have a read of those tortured FOMC minutes that were released earlier this week from the August meeting to see how nervous the Fed really is over prospects for a sustainable recovery.

Real Unemployment - U6

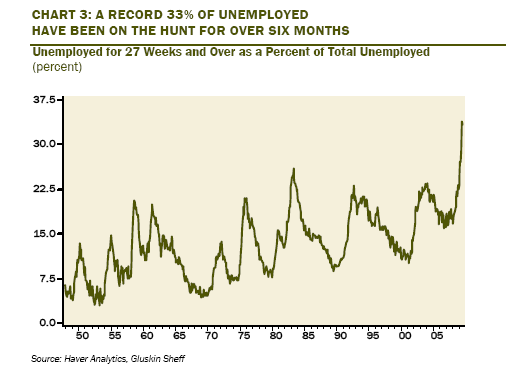

The number of people not on temporary layoff surged 220,000 in August and the level continues to reach new highs, now at 8.1 million. This accounts for 53.9% of the unemployed — again a record high — and this is a proxy for permanent job loss, in other words, these jobs are not coming back. Against that backdrop, the number of people who have been looking for a job for at least six months with no success rose a further half-percent in August, to stand at 5 million — the long-term unemployed now represent a record 33% of the total pool of joblessness.

Record Unemployment For 6 Months Or Longer

Our advice to the Obama team would be to create and nurture a fiscal backdrop that tackles this jobs crisis with some permanent solutions rather than recurring populist short-term fiscal goodies that are only inducing households to add to their burdensome debt loads with no long-term multiplier impacts. The problem is not that we have an insufficient number of vehicles on the road or homes on the market; the problem is that we have insufficient labour demand.

Two final items: First, some will point to the fact that average hourly earnings were up 0.3% MoM in August as a sign of a renewed wage growth. Sorry, but what this represented was the spillover from the minimum wage hike, which was so evident in the 1% surge in retail sector earnings and the 0.5% boost in leisure/hospitality — the two sectors most affected. Outside of these sectors, wages barely rose at all last month.

Second, aggregate hours worked fell 0.3% MoM in August and so far in the third quarter, aggregate hours declining at a 2.5% annual rate. Think about that statistic for a moment, in order to achieve the 3.5% consensus estimate for current quarter real GDP growth, productivity would have had mushroomed at a 6% annual rate, mirroring the 2Q performance. We’re not saying this is impossible, but we are saying that you pretty well have to go back 40 years to see the last time the economy achieved such a feat.

Geithner Continues To Heap Praise On Himself

Meanwhile, although it's clear there were no job-related rabbits in the hat, Geithner continues giving himself undeserved praise for his handling of the situation.

Please consider Statements by Secretary Geithner at the G-20 Meeting of Finance Ministers and Central Bank Governors.

Good afternoon. My thanks and compliments to Chancellor Darling and his team for hosting this meeting. The United States looks forward to welcoming the Prime Minister and the Chancellor to Pittsburgh, along with the Leaders and Finance Ministers of the G-20, in just a few weeks.

On April 2, facing the greatest challenge to the world economy in generations, the G-20 gathered here in London and committed to an unprecedented program of policies to restore growth and reform the international financial system. Those actions have pulled the global economy back from the edge of the abyss. The financial system is showing signs of repair. Growth is now underway.

However, we still face significant challenges ahead. Unemployment is unacceptably high. Conditions for a sustained recovery led by private demand are not yet established. The classic errors of economic policy during crises are that governments tend to act too late with insufficient force and then put the brakes on too early. We are not going to repeat those mistakes.

We need to provide sustained support for growth and financial repair until we have in place a strong foundation for recovery. But that strategy will not be effective unless we can make fully credible our commitment to reverse those actions as soon as conditions permit. This means our strategies will need to evolve as we move from crisis response to recovery, from rescuing the economy to repairing and rebuilding the foundation for future growth.

We must lay a foundation for a more balanced and sustainable pattern of future growth, both within and across countries. In the United States, we are going through a necessary and fundamentally healthy transition, raising savings rates and borrowing less from the rest of the world. As this happens, we need to see a complementary shift in countries outside the United States toward stronger domestic demand-led growth.Geithner Dead Wrong

Geithner is dead wrong. Growth may be underway, using the term loosely. However, sustainable growth is certainly not. Cash-For-Clunkers was a huge boondoggle that created no jobs. Instead it robbed some taxpayers for the sole benefit of others. Furthermore, and as discussed many times, it shifted demand forward.

Now what?

Government cannot create sustainable growth by spending. Sustainable growth comes from businesses voluntarily investing in productive capacity.

It's clear we are going to get a rebound in GDP. Nearly 100% of that rebound will be government spending.

Then what?

Then a double dip recession will come immediately as soon as government stops spending, or later even if it does not. Indeed, the US faces Structurally High Unemployment For A Decade

There are no sustainable job rabbits in the Government's hat, nor will there ever be.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.