Failure of Economics, the Super Trend and Elements of Deflation

Economics / Economic Theory Sep 05, 2009 - 09:47 AM GMTBy: John_Mauldin

The Elements of Deflation

The Elements of Deflation

The Failure of Economics

The Super Trend Puzzle

Final Demand and Income

Unemployment Was NOT a Green Shoot

As every school child knows, water is formed by the two elements of hydrogen and oxygen in a very simple formula we all know as H2O. Today we start a series that starts with the question, What are the elements that comprise deflation? Far from being simple, the "equation" for deflation is as complex as that of DNA. And sadly, while the genome project has helped us with great insights into how DNA works, economic analysis is still back in the 1950s when it comes to decoding deflation. Notwithstanding the paucity of understanding we can glean from the dismal science, in this week's letter we will start thinking about the most fundamentally important question of the day: is inflation, or deflation, in our future?

But quickly, I want to thank the many people who wrote very kind words about last week's letter. Many thought it was one of the better letters I have done in a long time. If you did not read it, you can read it here. And of course, you can go there and sign up to get this letter sent to you each week for free. Why not become of my 1 million (plus and growing) closest friends?

The Failure of Economics

Among the economists and writers I regularly read, there are some who, if they agree with me, I go back and check my assumptions - I must have been wrong. Paul Krugman is one of those thinkers. I admit to his brilliance, but his left-leaning philosophy does not particularly square with mine, and I find that most of the time I disagree.

That being said, I strongly encourage you to read his essay in the New York Times Magazine, which comes out this weekend. It is worth the high price of the Times to read it, if you can't get it online. It is a very hard critique and analysis of the failure of current macro and financial economic thought, which didn't even come close to predicting the current financial malaise. Indeed, as he points out, most schools of thought said the state we are in could not happen. You can read at the essay if you are a member, or register for free if you are not. http://www.nytimes.com/2009/09/06/magazine/06Economic-t.html?_r=1.

Krugman writes, as I have in repeated columns, that we have taught two generations of economists and financial practitioners faulty theories. Even now, believers in the Efficient Market Hypothesis and CAPM hold to their beliefs in the face of clearly contrary evidence. It is a very thought-provoking piece and worthy of a long weekend read. He names specific names and pulls no punches. This is as close to starting a barroom brawl as you get in economic circles.

He calls for a return to and fresh analysis of Keynesianism. Sigh. I would go further. A plague on all their houses. Whether Keynes or Friedman (monetarism) or von Mises (the Austrian school of economics) or the rather new school of behavioral economics, they all have deficiencies and (sometimes gaping) holes in their logic. At the same time, they all contribute to our general understanding of the world, and there are benefits to studying them.

Let me risk an analogy. It is like reading about some religious scheme for interpreting the world and then becoming a true believer, arguing for that point of view as received wisdom - it's your belief system. Five Nobel laureates say this and seven say that. My guru is smarter than your guru. Look at how the math proves this point. And so on...

Krugman concludes: "So here's what I think economists have to do. First, they have to face up to the inconvenient reality that financial markets fall far short of perfection, that they are subject to extraordinary delusions and the madness of crowds. Second, they have to admit - and this will be very hard for the people who giggled and whispered over Keynes - that Keynesian economics remains the best framework we have for making sense of recessions and depressions. Third, they'll have to do their best to incorporate the realities of finance into macroeconomics.

"Many economists will find these changes deeply disturbing. It will be a long time, if ever, before the new, more realistic approaches to finance and macroeconomics offer the same kind of clarity, completeness and sheer beauty that characterizes the full neoclassical approach. To some economists that will be a reason to cling to neoclassicism, despite its utter failure to make sense of the greatest economic crisis in three generations. This seems, however, like a good time to recall the words of H. L. Mencken: 'There is always an easy solution to every human problem - neat, plausible and wrong.'"

I agree we need to examine our assumptions. I am not sure that makes me want to unreservedly embrace Keynes. Keynesians missed as badly as anyone else in this crisis. Yes, the Austrians generally called some of the problem, but their solutions call for 25% unemployment and an unworkable global economy and a serious depression. Not sure that I want to sign up for that, either. And, they totally discount the concept of the velocity of money, which we will look at next week.

We need a new and better economic understanding, not some semireligious adherence to dogma laid down by men who were in no way familiar with current world conditions. Keynes, von Mises, Fisher, Schumpeter, Minsky, Hayek, Smith, et al. were giants. They absolutely must be read and understood. But a real science builds on the work of the former generations and does not hold onto theories as if they were scripture.

As much as many economists would like to think so, economics is not a precise science. A global economy cannot yield to hard math in the way that one can model a protein, at least not with any model that has yet been offered. At best, the models let us see through a glass darkly, suggesting the potential for connections between a few variables, while assuming that all others are held constant. It is precisely the illusion that we can model the economy that got us into the current mess.

(By the way, good friend Paul McCulley has written a very interesting essay on why the Fed has to change their models on inflation targeting - the Taylor Rule is not up to the task - and whether or not to deal with bubbles before the fact, rather than mopping up after they burst. What was assumed has clearly not worked. You can read it at www.pimco.com.)

I am often asked what school of economic thought I adhere to, and the answer is, none. I would rather try to get it right. And rather than argue for one policy or another (which admittedly I sometimes do), it is more important to figure out what those who actually will effect policy will do, and then make sure we are not in the way of the train they are sending down the tracks. Agree with Krugman or not, he is one of the principal conductors on the train.

And that brings us back to the elements of deflation.

The Super-Trend Puzzle

I am a big fan of puzzles of all kinds, especially picture puzzles. I love to figure out how the pieces fit together and watch the picture emerge, and have spent many an enjoyable hour at the table struggling to find the missing piece that helps connect the patterns.

Perhaps that explains my fascination with economics and investing, as there are no greater puzzles (except possibly the great theological conundrums or the mind of a woman, about which I have only a few clues).

The great problem with the economic puzzles is that the shapes of the pieces can and will change as they rub against one another. One often finds that fitting two pieces together changes the way they meld with the other pieces you thought were already nailed down, which may of course change the pieces with which they are adjoined, and suddenly your neat economic picture no longer looks anything like the real world.

(Which is why all of the mathematical models make assumptions about variables that allow the models to work, except that what they end up showing is not related to the real world, which is not composed of static variables.)

There are two types of major economic puzzle pieces. The first are those pieces that represent trends that are inexorable: they will not themselves change, or if they do it will be slowly; but they will force every puzzle piece that touches them to shift, due to the force of their power. Demographic shifts or technology improvements over the long run would be examples of this type of puzzle piece.

The second type is what I think of as "balancing trends," or trends that are not inevitable but which, if they come about, will have significant implications. If you place that piece into the puzzle, it too changes the shape of all the pieces of the puzzle around it. And in the economic super-trend puzzle, it can change the shape of other pieces in ways that are not clear.

Deflation is in the latter category. I have often quipped that when you become a Federal Reserve Bank governor, you are taken into a back room and are given a DNA change that makes you viscerally and at all times opposed to deflation. Deflation is a major economic game changer. You can argue, as Gary Shilling does, that there is a good kind of deflation, where rising productivity and other such good things produces a general fall in prices, such as we had in the late 19th century.

But that is not the kind of deflation we face today. We face the deflation of the Depression era, and central bankers of the world are united in opposition. As McCulley quipped to me this spring, when I asked him if he was concerned about inflation, with all the stimulus and printing of money we were facing, "John," he said, "you better hope they can cause some inflation." And he is right. If we don't have a problem with inflation in the future, we are going to have far worse problems to deal with.

Saint Milton Friedman taught us that inflation is always and everywhere a monetary phenomenon. That is, if the central bank prints too much money, inflation will ensue. And that is true, up to a point. A central bank, by printing too much money, can bring about inflation and destroy a currency, all things being equal. But that is the tricky part of that equation, because not all things are equal. The pieces of the puzzle can change shape. When the elements of deflation combine in the right order, the central bank can print a boatload of money without bringing about inflation. And we may now be watching that combination come about.

Final Demand and Income

For instance, inflation always seems to be accompanied by higher wages. That makes sense, as workers want more to justify their labor if prices are rising. But today we have wages dropping over time. Yes, even though wages went up this month by 0.3%, it was all due to a one-time increase in the minimum wage. Without that government mandate wages would have been flat or falling. Look for wages to fall over the rest of the year.

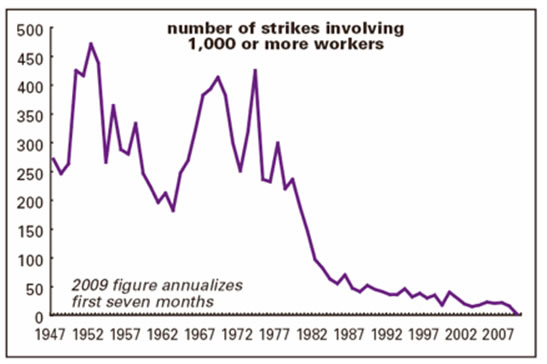

There are no pricing pressures on wages. Look at this very eye-opening graph from my friends at one of my must-read letters, The Liscio Report. (www.theliscioreport.com).

Throughout the last decade, the number of strikes involving a thousand or more workers averaged about 22 (but averaged over 300 annually from the time they started tracking this item). We are on target this year for 2, an amazing 62-year low. Indeed, we have the opposite happening. Workers are seeing jobs lost, wages being slashed, hours being cut back, and a loss of benefits, as businesses react with cost cuts to the lack of demand.

While it is technically possible to have inflation with rising unemployment and falling wages, it would take a great deal of monetization to achieve, and that will bring us to a new idea in a few paragraphs.

Unemployment Was NOT a Green Shoot

But quickly, let's look at today's unemployment numbers. This was not the way one would want to celebrate Labor Day. Unemployment rose to 9.7%. Some take comfort in that unemployment in the Establishment Survey (where they call existing business and poll them) was only down by 216,000, which admittedly is better than 600,000 but is still a very bad number. Rising unemployment is not the stuff that inflation is typically made of. And there are reasons to think the picture may be worse than that. Here are a few thoughts from David Rosenberg:

"What was really key were the details of the Household Survey, which provide a rather alarming picture of what is happening in the labor market.

"First, employment in this survey showed a plunge of 392,000, but that number was flattered by a surge in self-employment (whether these newly minted consultants were making any money is another story) as wage & salary workers (the ones that work at companies, big and small) plunged 637,000 -- the largest decline since March (when the stock market was testing its lows for the cycle). As an aside, the Bureau of Labor Statistics also publishes a number from the Household survey that is comparable to the nonfarm survey (dubbed the population and payroll-adjusted Household number), and on this basis, employment sank -- brace yourself -- by over 1 million, which is unprecedented. We shall see if the nattering nabobs of positivity discuss that particularly statistic in their post-payroll assessments; we are not exactly holding our breath."

The ISM numbers came out this week and, while manufacturing is up, the service industry (which is far larger) is still contracting, and the employment elements in the surveys show employers are still planning to cut jobs. Think about almost 11% unemployment next summer in the middle of the political season. Watch the competition among politicians to demonstrate they care and "get it." And watch as they spend your money to show how much they care.

And from the above mentioned Liscio Report: "As we outlined back in May, financial crises hammer employment, resulting in average losses of 6.3% followed by a long flat line. We hate to point it out, but we're currently down 4.8% from the December 2007 onset, and if US job losses in this recession stay in line with the major financial recessions in "advanced" countries studied by the IMF, we stand to lose another 1.8 million jobs. Some of those will likely be taken out in upcoming benchmarks, stimulus money has some clout, and no one has a reliable crystal ball, but we need to remember where we are in a painful cycle if we see some hopeful flickers."

That would take us to well over 11% unemployment.

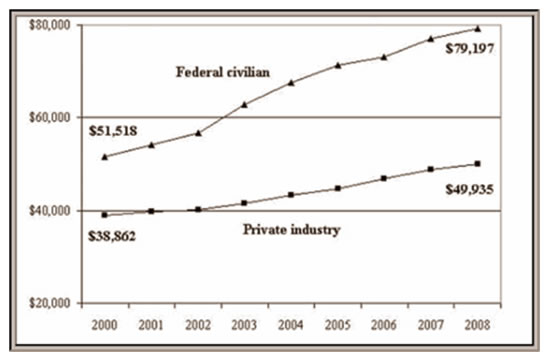

Interesting statistic. Want to know where wages are rising? Think federal government workers. The gap between civilian and government workers was less than $13,000 nine years ago, but now is almost $30,000. Inflation has been 24%, but government wages are up 55%. According to a recent release from Rasmussen Reports, a government job remains "the top employment choice in today's economic environment." (chart from Clusterstock)

States, counties, and cities are having to make deep cuts, in both jobs and programs. Today's Wall Street Journal talks about the cuts in state after state. States cannot print money like the US can, so at some point they have to either raise taxes or cut spending to balance their budgets. Raising taxes just makes it less profitable for businesses to remain in your state. There is a very high correlation with high state taxes and unemployment.

The following chart shows how rapidly income taxes are falling. Sales tax receipts are down. At some point voters are going to demand that their federal government show some of the same restraint that households, cities, and counties are being forced into. My bet is that next year raises for government workers, even those in unions, will come under attack. They won't be cut, but watch as political backlash builds.

Without federal stimulus, the GDP of the US would have been over minus 6% in the second quarter, not the minus 1% it was. The third quarter would be flat to down and not the plus 3% it is likely to be. Housing and autos will turn down as the stimulus on those markets goes away.

I think it is very possible we will see a negative GDP by the first quarter of next year. Unemployment will still be rising. Deflation will be more of a problem, because the housing component (the largest portion of the consumer-inflation index), based roughly on rentals, is clearly under pressure. While we don't have enough space this week to go into detail, savings are up and consumer spending is down. Without the stimulus, things would be much worse.

Here's the kicker. Expect to see a big push for another large stimulus package next spring (and maybe sooner), as the effects of the current one wear off. The government wants to bring back demand by getting consumers to spend again. And you can count on unemployment benefits being extended. A tax holiday on Social Security taxes below a certain income? In the short run they can do it, but at a long-run cost.

It is going to be hard for a Democratic administration to not push for another large stimulus. That is what Krugman and his fellow travelers will be pushing. Classic Keynesian thinking wants both for the government to run large deficits and for the central bank to print more money. Remember, last year I said that the Fed would print a lot more money than they are talking about in the current plans. They are going to have the cover to do so, because deflation is going to be seen as the problem.

Next week, we will look at money supply and the velocity of money, savings, consumer demand, and more as we further explore the complex molecule that is deflation.

But one last thought, as I have had a lot of questions on gold recently. "Isn't gold telling us that inflation is coming back?" The answer is no. Since the early '80s the correlation between gold and inflation has dropped to zero. Gold has had very little to say in the last 30 years about inflation.

But what it may be saying is that paper currencies are a problem. Gold is going up not only in dollar terms, but in euros, pounds, yen, and more. My view is that gold should be seen as a neutral currency. The dollar is the worst currency in the world, except for all the others. Is it possible the Fed will not respond and print more money next year? Sure. And the dollar could rise as deflation kicks in. The only time we saw the purchasing power of the dollar rise in a sustained manner was during deflation, in the last century.

The race is not always to the swiftest or the fight to the strongest, but that's the way to bet. And right now, my bet is the Fed will print money to fight a double-dip recession and deflation. And gold would be one way to play that bet.

Washington, DC, San Diego, and Johannesburg

Quick inside industry note: Many RIA and brokers have left some of the large brokerage firms to go with smaller broker dealers or start up as independent investment advisors. Some of the larger firms had platforms that accessed the world's top hedge-fund managers. Now that the advisors are independent, they are looking for a similar platform.

Altegris Investments has a world-class lineup of top-tier hedge-fund managers that advisors can access for their clients at much lower minimums. Altegris employs 65 people and has over $2 billion under management. They focus solely on alternative investments. They have 10 staff members dedicated to research and due diligence on the hedge-fund universe. I know Jon Sundt (CEO of Altegris) personally and I know that he is driven to find the best investment talent in the world. If you are an advisor for high-net worth-clients, you should go to www.accreditedinvestor.ws and sign up and they will call you.

And if your clientele consists mostly of smaller clients, you should look at the platform of trading advisors at CMG. http://cmgfunds.net/public/mauldin_questionnaire.asp

Next week I have to go to Washington, DC for a quick trip and then the next night fly to San Diego for the Schwab conference. Coincidentally, both Altegris and CMG will be at the conference. I will be around those booths on Tuesday the 15th. Look me up.

And next Tuesday I will speak via satellite to a CFA conference in Johannesburg. I've done a lot of TV over satellite, but not a full, hour-long speech and Q and A. This should prove interesting.

It is getting late and time to hit the send button, so I will cut my remarks short and just wish you a happy Labor Day and a great week.

Your ready for a holiday analyst,

By John Mauldin

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2008 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.