Robert Prechter and What's Behind Moves In Gold?

Commodities / Gold & Silver 2009 Sep 02, 2009 - 05:27 AM GMTBy: Mike_Shedlock

In response to How Will China Handle The Yuan? I received many emails regarding a single statement I made: "Prechter, who does not view gold as money, thinks gold will collapse. Thus, not all deflationists think alike."

In response to How Will China Handle The Yuan? I received many emails regarding a single statement I made: "Prechter, who does not view gold as money, thinks gold will collapse. Thus, not all deflationists think alike."

The first half of that statement "Prechter, who does not view gold as money" is an inaccurate representation of Prechter's views.

Inquiring minds pointed out that the title of Chapter 1 in Prechter's Gold and Silver eBook (a publication you can download for free) is "Gold Is Still Money".

Apologies go to Robert Prechter.

That out of the way, there are many things worthy of discussion from the same eBook. Please consider the following image snip.

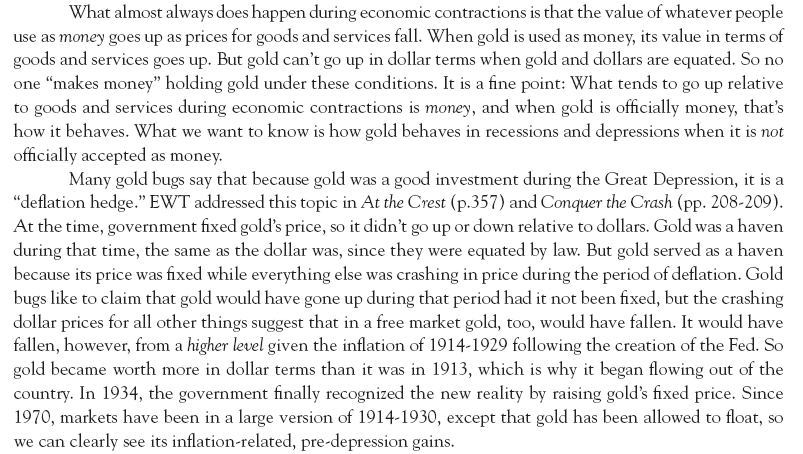

From the chapter: Does Gold Always Go Up In Recessions and Depressions?

When Does Gold Act Like Money?

While Prechter states "gold is still money", the above paragraph shows that he thinks gold acts differently when "gold is officially money".

On the other hand, I think gold is money and gold acts like it as well, regardless of whether or not governments make it "official". Please see Misconceptions about Gold for a detailed explanation.

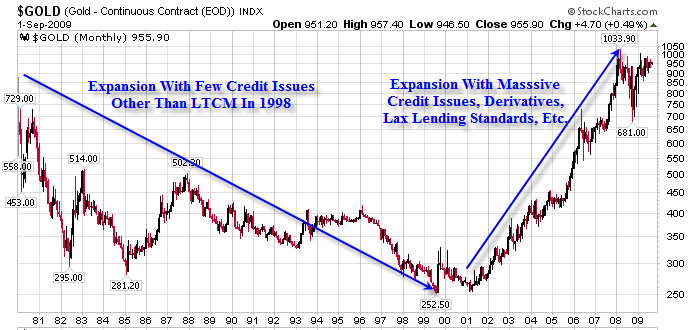

In the eBook, Prechter notes "All the huge gains in gold have come when the economy was expanding".

That is a true statement. However, this is a true statement as well: "All the huge losses in gold have come when the economy was expanding."

Please consider the following charts.

Gold 1980 To 1988

Gold 1988 - 2000

Instead of asking "Does Gold Always Go Up In Recessions and Depressions?" one could easily ask "Does Gold Always Go Up In Expansions?"

Gold does not always do anything. However, given that recessions make up minimal periods from 1980 through 2000, this is an accurate representation of the period.

Gold 1980 - 2000

Gold collapsed from over $850 to just above $250 during one of the biggest expansionary periods in history. That is the reality and the charts show it perfectly well. Thus the statement "all of gold's gains were in expansions" is very misleading, at best.

What's Behind Moves In Gold?

1) What was behind gold's move in the Great Depression?

2) What was behind gold soaring to $850 in the 80's?

3) What is behind gold collapsing to $250?

4) What is behind gold soaring again now?

Clearly it is not expansion or contraction driving the price of gold, but rather something else. That "something else" is credit issues.

The great depression sported a massive contraction in credit. Gold rose by force when Roosevelt confiscated, and re-pegged it. Nixon taking the US off the gold standard was also a massive credit event. The difference is that gold, allowed to float, soared.

From the $850 high, gold then plunged to $250 even though there was inflation every step of the way. What happened? Credit fears collapsed. Psychology changed (more on psychology and attitudes below). Moreover, gold's reaction to Long Term Capital Management (LTCM) was a big yawn suggesting that the crisis would be contained.

In general, Gold, like Fiat money does poorly when economic conditions are generally rosy, credit worries are non-existent, and interest rates are falling. In simple terms, cash (and gold) are trash, and assets are where you want to be. Free to float, gold is apt to do worse as Prechter notes.

In 2002 when Greenspan stepped on the gas to fight deflation. Gold started reacting in advance to the pending credit event, an event that blew sky high in 2008. Gold's reaction now suggests the crisis is still not over.

In the early 30's even before Roosevelt stole the citizens' gold, it value in relative terms soared, just as one would expect.

This go around, gold sunk in the initial credit collapse as leverage everywhere was forcibly repudiated. Unlike other commodities however, gold quickly regained its composure, as I surmised.

Email Exchange With Robert Prechter

I had an email exchange with Prechter on August 12 regarding my post Social Safety Nets Mask The Deflationary Depression and his video "Dollar's Hit A Major Bottom" in which he notes that a deflationary depression is coming.

Mish to RP: You are looking for a "major economic depression". I think it is clear we are already in one.

The only reason it is not more readily visible is people are living in foreclosed houses unable or unwilling to pay their mortgage, one in nine living in the US is on food stamps, and unemployment insurance has been extended twice. Congress is now debating extending it a third time.

RP to Mish: Hi Mike,

By all means we are in a depression. It began in July 1999 and is a long way from the bottom.

RP

If the depression began in 1999 then the "gold does well in deflation" camp is clearly winning the debate!

Regardless, this depression has been one massive credit event of epic proportions. It should be no surprise that gold has been rising.

Not all recessions are made alike, nor are all deflations. Certainly Japan was in deflation and the price of gold dropped, but Japan, in comparison to the rest of the world was a small piece of the pie, not enough to influence the price of gold in and of itself in a healthy global economy. Thus it is also important to understand the context of deflation in the global economy.

One final point: Gold does well in "real" terms during deflations. It can do better in nominal terms at other times. "Real" means purchasing power of what it buys.

Praise For Prechter

Tossing aside a difference of opinion on gold, I praise Robert Prechter as a pioneer and a visionary. His views on deflation, although famously early, paved the way for others.

Moreover, I am extremely fond of his theory that shifts in social mood lead the markets, not the other way around.

Housing is a good example. Most still believe consumer attitudes have fallen because the stock market is down and/or because housing is down. The reality is attitudes changed first.

In summer of 2005, people were camping out overnight in Florida hoping to be one of "the lucky ones" to secure a deal on a condo. A few weeks later the lines were gone. Prices did not drop significantly for a year.

What happened?

Attitudes changed first, then prices eventually followed. Once attitudes changed, the party was over.

A common applicable statement is "The Pool Of Greater Fools Ran Out".

Prechter's Elliott Wave theory is also based on patterns of attitudes, that things play out in waves, finally ending in trend exhaustion.

It's easy to be critical of economic pioneers because they are frequently early. That should not get in the way of giving credit where credit is due.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.