Caution Remains Over the Robustness of Any Economic Recovery

Stock-Markets / Financial Markets 2009 Aug 30, 2009 - 05:03 AM GMT Stock markets, in general, again logged gains last week as pundits perceived economic data to be better than expected. But the recovery path is not home and dry yet, as shown by declines in crude oil, a number of emerging stock market indices, small cap indices and high-yield corporate bonds. All said, risky assets displayed some fatigue despite positive economic reports.

Stock markets, in general, again logged gains last week as pundits perceived economic data to be better than expected. But the recovery path is not home and dry yet, as shown by declines in crude oil, a number of emerging stock market indices, small cap indices and high-yield corporate bonds. All said, risky assets displayed some fatigue despite positive economic reports.

Caution remained over the robustness of any economic upswing, as reflected by the solid performance of government bonds, with safe-haven currencies such as the US greenback and the Japanese yen also edging up.

As expected, Federal Reserve Chairman Ben Bernanke was appointed by President Barack Obama on Tuesday to serve a second term. “Mr Obama is said to credit Mr Bernanke with a leading role in helping to avert economic catastrophe. By reappointing Mr Bernanke - who worked in the Bush White House - Mr Obama can also emphasize his bipartisan credentials at a time when he is embroiled in a fiercely partisan battle over healthcare reform,” commented the Financial Times.

Source: LOLFed.com

However, critics of Obama’s decision were plentiful and Morgan Stanley’s Stephen Roach, blaming Bernanke for his pre-crisis actions, said (via the Financial Times): “It is as if a doctor guilty of malpractice is being given credit for inventing a miracle cure. Maybe the patient needs a new doctor.” Bill King (The King Report) ascribed the stock market rising subsequent to Obama’s announcement to a “thank God it’s not Larry Summers” rally.

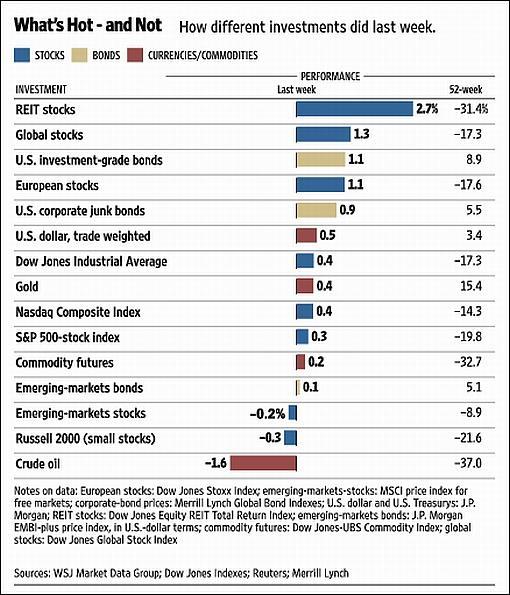

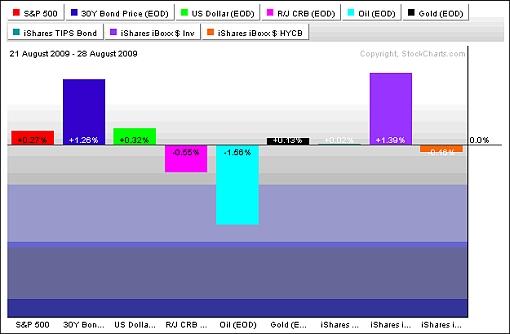

The past week’s performance of the major asset classes is summarized by the chart below - a set of numbers showing both the S&P 500 Index and government bonds rising, indicating an expectation of a subdued economic recovery and that the Fed’s monetary policy will stay easy for an extended period of time.

Source: StockCharts.com

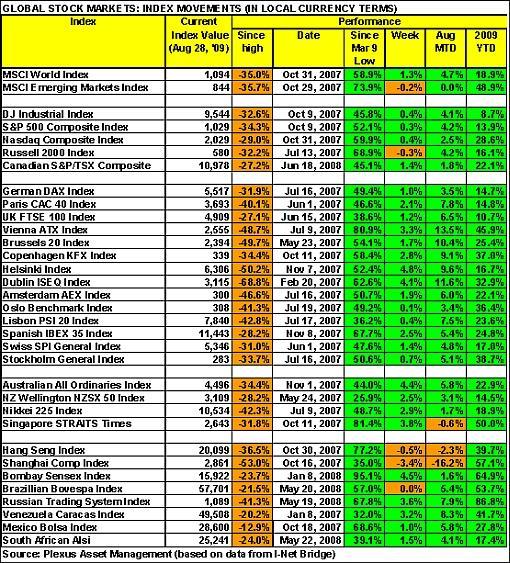

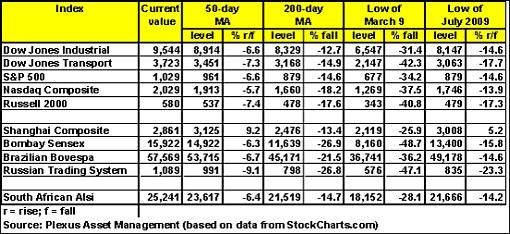

A summary of the movements of major global stock markets for the past week, as well as various other measurement periods, is given in the table below.

The MSCI World Index (+1.3%) and MSCI Emerging Markets Index (-0.2%) again followed separate paths last week as China, Hong Kong and Brazil underperformed. Mature stock markets have recorded gains for a straight seven weeks, whereas emerging markets have seen two back-to-back weeks of declines. The end result is that emerging markets have now underperformed developed markets for four weeks running. Could this be a sign of a retrenchment in risk appetite?

The major US indices extended their gains to two consecutive weeks, including eight straight up-days in the case of the Dow Jones Industrial Index, before getting snapped by a decline on Friday. The year-to-date gains are as follows: the Dow Jones Industrial Index +8.7%, the S&P 500 Index +13.9% and the Nasdaq Composite Index +28.6%. With declines on three days, the Russell 2000 Index was the odd index out last week, but still boasts a respectable +16.1% gain since the beginning of 2009.

Click here or on the table below for a larger image.

Top performers in the stock markets this week were Lithuania (+28.2%), Estonia (+17.3%), Latvia (+12.6%), Egypt (+9.6%) and Iceland (+9.1%). The top three positions were all occupied by eastern European countries where worries over the risk of some economies collapsing have receded. At the bottom end of the performance rankings, countries included Nepal (-4.0%), China (-3.4%), Kenya (-2.7%), Uganda (-2.6%) and Bangladesh (-1.8%).

The Chinese Shanghai Composite Index recorded its fourth consecutive down-week as investors remained concerned about how long China’s exceptionally loose monetary policy will continue. The banking regulator has already instructed lenders to raise reserves to 150% of their non-performing loans by the end of this year - up from 134.8% at the end of June, and the central bank has increased money-market rates to drain liquidity.

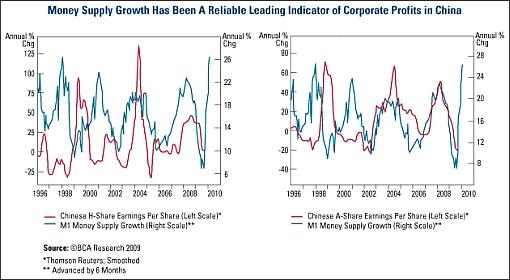

However, US Global Investors opines that historically sustainable market rallies out of a cyclical trough usually start with an expansion in valuation multiples followed by a recovery in earnings. “China may be poised to enter this second stage against a favorable macro backdrop. With surging money supply and significantly lower commodity prices from a year earlier, corporate earnings in China could produce upside surprises going forward,” said the report.

Source: US Global Investors - Weekly Investor Alert, August 28, 2009.

Of the 96 stock markets I keep on my radar screen, 77% (last week 47%) recorded gains, 18% (47%) showed losses and 5% (4%) remained unchanged. (Click here to access a complete list of global stock market movements, as supplied by Emerginvest.)

John Nyaradi (Wall Street Sector Selector) reports that as far as exchange-traded funds (ETFs) are concerned, the winners for the week included CurrencyShares Russian Ruble (XRU) (+5.0%), First Trust Amex Biotechnology (FBT) (+4.8%), iShares MSCI Australia (EWA) (+4.5%) and iShares Silver Trust (SLV) (+4.2%).

On the losing side of the slate, ETFs included Claymore/AlphaShares China Real Estate (TAO) (-4.2%), Market Vectors Coal (KOL) (-3.1%), SPDR KBW Regional Banking (KRE) (-3.1%) and iShares MSCI Brazil (EWZ) (-3.0%).

As far as credit markets are concerned, Bloomberg reported that banks were increasing lending to buyers of high-yield company loans and mortgage bonds at what might be the fastest pace since the credit-market debacle began in 2007. “Federal Reserve data show the 18 primary dealers required to bid at Treasury auctions held $27.6 billion of securities as collateral for financings lasting more than one day as of August 12, up 75% from May 6. The increase over that 14-week stretch is the biggest since the period that ended April 2007, three months before two Bear Stearns Cos. hedge funds failed because of leveraged investments.” This is a sign of credit markets moving towards normalization.

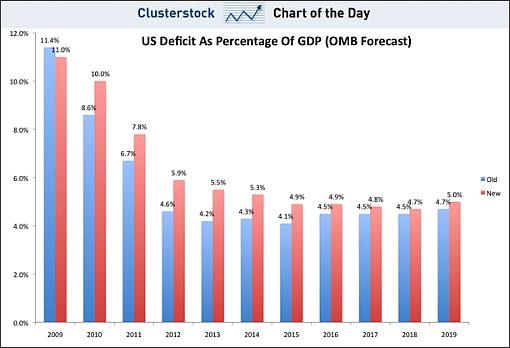

Referring to the mind-boggling US budget deficit, the quote du jour this week comes from 85-year old Richard Russell, author of the Dow Theory Letters. He said: “Comes the dawn - and the penalty. There’s a price to be paid for Bernanke’s all-out battle to thwart the bear market. And now it’s being told. Yesterday the White House itself admitted that the budget deficit over the next 10 years would be $2 trillion above their original outrageous estimate of $7 trillion dollars.

“As I said all along, it would have been better to have allowed the bear market to run its course to conclusion. That would have been extremely painful, but the US would have recovered. However, deficits in the trillions could ultimately ‘break’ this nation. I can’t imagine how Bernanke-Obama plan to handle the coming mind-blowing deficits, plus the interest on those deficits.

“The pressure will be on the reserve status of the dollar, the level of the dollar compared to other international currencies, interest rates, and the standard of living of all of us living in the new ‘banana republic’, the United States of ‘bankrupt’ America.

“When you take all this in, you can begin to see how this bear market could end with stocks selling below known values and people despising the stock market and capitalism.”

Other news is that the Fed must for the first time identify the companies in its emergency lending programs - created to address the financial crisis - after losing a Freedom of Information Act lawsuit against Bloomberg. The Fed is likely to appeal against the order on the grounds that such disclosure would threaten the companies and the economy.

Also, the Federal Deposit Insurance Corporation (FDIC) on Thursday said (via the Financial Times) the number of “problem banks” had grown from 305 to 416 during the second quarter, representing total assets of $299.8 billion. In the meantime, the FDIC’s deposit insurance fund, which insures up to $250,000 per depositor in each bank, had fallen to just $10.4 billion - the lowest level since March 1993 - as a result of all the bank failures, tallying 84 so far in 2009.

Next, a tag cloud of all the articles I read during the past week. This is a way of visualizing word frequencies at a glance. Key words such as “market”, “Fed”, “bank”, “prices”, “rates” and “economy” featured prominently. Interestingly, “recovery” is still moving up the ranks as the global economy seems to have turned the corner.

The key moving-average levels for the major US indices, the BRIC countries and South Africa (from where I am writing this post) are given in the table below. With the exception of the Chinese Shanghai Composite Index, which fell below its 50-day moving average about two weeks ago, all the indices are trading above their respective 50- and 200-day moving averages. The 50-day lines are also in all instances above the 200-day lines and therefore not threatening the bullish “golden crosses” established when the 50-day averages broke upwards through the 200-day averages.

The August 17 lows that represent short-term support levels for the major US markets and are as follows: Dow Jones Industrial Index (9,135), S&P 500 Index (980) and Nasdaq Composite Index (1,931).

Click here or on the table below for a larger image.

For more on key levels and some ideas regarding the short-term direction of the S&P 500 Index, Adam Hewison’s (INO.com) short technical analysis provides valuable insight. Click here to access the presentation.

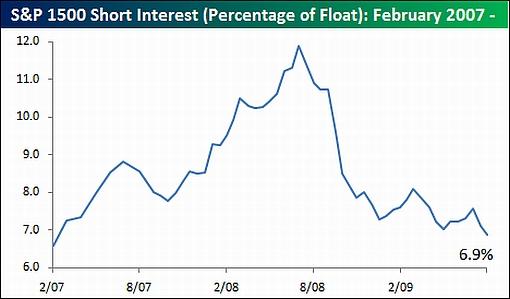

The chart below, courtesy of Bespoke, shows that the average short interest as a percentage of float for stocks in the S&P 1500 is currently at 6.9% - the lowest level since February 2007 when the average was 6.6%. “In 2008, it was the bulls who argued that high levels of short interest were a reason the market should rally. With the recent data, however, it is now the bears who will argue that low levels of short interest suggest that investors are now too bullish,” remarked Bespoke.

Source: Bespoke, August 26, 2009.

Doug Kass (The Street.com) said: “The authorities have created a sugar high for speculation, with a Federal Reserve that has maintained interest rates so low that there is no return on savings and with an Administration that promises to provide stimulus until it manufactures economic growth. My view is that investors will shortly see through the current sugar high and the better-than-expected earnings cycle and will begin to look over the valley at the chronic and secular issues that have emerged from the past cycle and from policy decisions aimed at returning the domestic economy toward self-sustaining growth.”

The last words on equities go to Jeff Saut, investment strategist of Raymond James, who said “‘Breakout or fake out?’ is the question du jour. Yet as market maven Arthur Zeikel wrote decades ago, ‘Despite what theoreticians tell us, investing - particularly at the margin - is not the product of rational and objective analysis, but an emotional relative analysis - anxiety about the future.” My colleague Bob Ferrell put it this way: ‘Emotions are simply stronger than reason; people do not change and people make markets!’ Indeed, fear, hope and greed are only loosely connected to the business cycle. And, at session 30 in the ‘buying stampede’, we are clearly in the ‘greed phase’. We continue to invest, and trade accordingly.”

For more discussion on the direction of financial markets, see my recent posts “Stages of a secular bear market“, “The lie of the investment land, according to Hugh Hendry“, “Picture du Jour: Stock market rally long in the tooth” and “RGE: Impact of China on financial markets“.

Economy

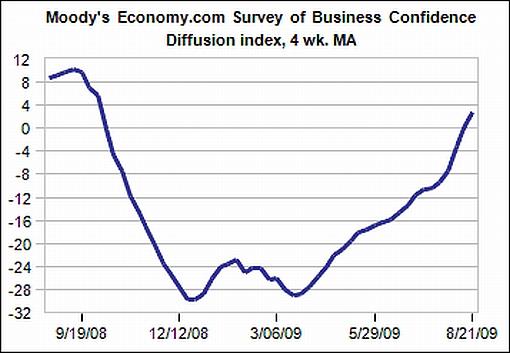

“Global business confidence remained positive last week for the third straight week. The last time confidence was consistently positive was nearly a year ago,” said the latest Survey of Business Confidence of the World by Moody’s Economy.com. “Businesses are responding most positively to broad assessments of the current economic environment and the outlook into early 2010; they are as strong as they have been since the financial crisis first hit in the summer of 2007.” The Survey results suggest that the global recession is coming to an end, but isn’t quite over yet.

Source: Moody’s Economy.com

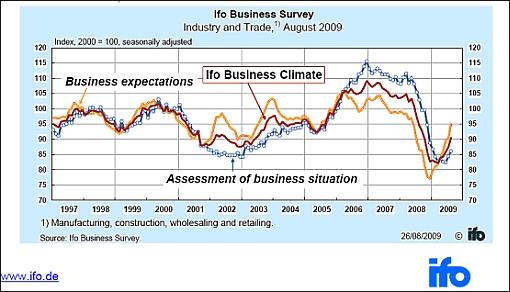

The German economy expanded in the second quarter of 2009 with real GDP rising by 0.3% on a seasonally adjusted basis from the previous quarter. Also, the Ifo Business Survey reported that German business confidence improved to an 11-month high in August, indicating a further improvement in GDP in the second half of 2009.

Source: Ifo, August 27, 2009.

Heading home from Jackson Hole a week ago, the world’s central bankers seemed in no hurry to start increasing interest rates - intent on not repeating the monetary policy tightening mistakes of the Great Depression. As reported by the Financial Times, Martin Feldstein, a Harvard professor, thought it would be possible to have “two years or more of very low interest rates” without risk of excess inflation, given the labor and factory capacity in the economy.

Meanwhile, after keeping the interest rate at a record low of 0.5% from April to July 2009, the Bank of Israel (BoI) became the first central bank to raise interest rates in this cycle, increasing the benchmark rate to 0.75%. Analysts believe Australia and Norway will tighten first among the G-10 central banks in 2010, as reported by RGE Monitor.

A snapshot of the week’s US economic reports is provided below. (Click on the dates to see Northern Trust’s assessment of the various data releases.)

Friday, August 28 • “Cash for clunkers” lifts consumer spending in July

Thursday, August 27 • Jobless claims decline, but continuing claims including special programs advance • Q2 real GDP unchanged at -1.0%

Wednesday, August 26 • Sales of new homes advanced, inventories are shrinking • Defense and aircraft orders lift durable goods in July

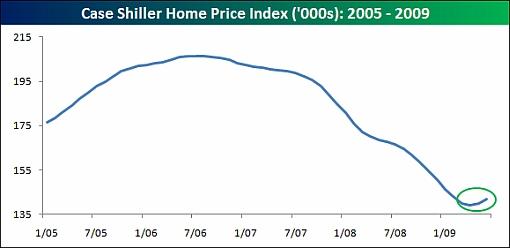

Tuesday, August 25 • Case-Shiller Home Price Index and FHFA House Price Index - noteworthy recovery • Gain in consumer confidence during August nearly erases losses of prior two months

Monday, August 24 • Chicago Fed National Activity Index - confirms positive signals of other reports

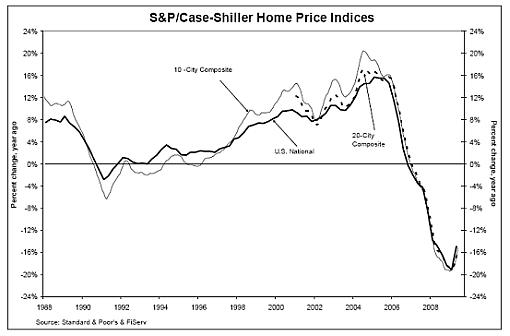

The S&P/Case-Shiller Home Price Index for June showed its second straight monthly increase. According to Bespoke, the last time home prices increased two months in a row was back in the summer of 2006 at the end of the last housing boom. “June’s 1.4% monthly gain was also the largest monthly increase since June 2005. There’s no denying that these numbers are showing considerable improvement.”

Source: Bespoke, August 25, 2009.

The White House confirmed on Tuesday that the US deficit would be wider than they had previously estimated. The graph below, courtesy of Clusterstock - Business Insider, shows that although the budget deficit as a percentage of GDP has been revised down for 2009 - due to less bailout spending - it has been increased for every year through 2019.

Source: Clusterstock - Business Insider, August 25, 2009.

“The longest and deepest recession of the postwar era has ended,” said IHS Global Insight chief economist Nariman Behravesh (via MarketWatch). However, he expressed concern that the recovery could lose steam in a few quarters, warning: “A sustained, robust global recovery depends on renewed growth in consumer spending and capital investment. The coming expansion will be restrained by cautious consumers in the United States and Europe, who are saving to rebuild depleted assets and reduce debt burdens.”

Week’s economic reports

Click here for the week’s economy in pictures, courtesy of Jake of EconomPic Data.

Source: Yahoo Finance, August 28, 2009.

Click here for a summary of Wells Fargo Securities’ weekly economic and financial commentary.

The European Central Bank (ECB) will make an interest rate announcement on Thursday (September 3). US economic data reports for the week include the following:

Monday, August 31 • Chicago PMI

Tuesday, September 1 • Construction spending • ISM Index • Auto sales

Wednesday, September 2 • ADP employment • Productivity • Factory orders • FOMC minutes

Thursday, September 3 • Initial jobless claims • ISM services

Friday, September 4 • Nonfarm payrolls • Unemployment rate

Markets

The performance chart obtained from the Wall Street Journal Online shows how different global financial markets performed during the past week.

Source: Wall Street Journal Online, August 28, 2009.

“Great minds talk about ideas. Average minds talk about events. Small minds talk about people,” said Eleanor Roosevelt. Let’s hope the news items and quotes from market commentators included in the “Words from the Wise” review will assist Investment Postcards readers to generate money-making ideas that look past the noise investors so often wave to wade through.

For short comments - maximum 140 characters - on topical economic and market issues, web links and graphs, you can also follow me on Twitter by clicking here.

That’s the way it looks from Cape Town (from where I am leaving on a business trip to Slovenia in five days’ time - let me know if you are in Ljubljana at the time and would like to meet).

Source: Nate Beeler, August 28, 2009.

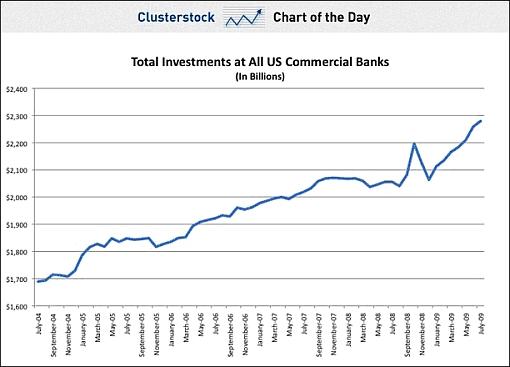

Clusterstock: The great banking recovery or next bubble? “Should we be happy that the value of investments owned by commercial banks has begun to rapidly climb? Or should we be worried that the value is climbing at such a rapid clip that it looks a bit like an unsustainable bubble? Or is it just evidence of banks hoarding money and refusing to lend it out, holding Treasuries and securities instead?”

Source: John Carney and Rory Maher, Clusterstock - Business Insider, August 26, 2009.

Bloomberg: World economy emerging from worst recession since World War II “The global economy may be coming out of the worst recession since World War II as record-low interest rates and trillions of dollars in fiscal stimulus spur demand.

“Sales of existing US homes jumped in July to the highest level since August 2007, and German service industries expanded this month for the first time in almost a year, reports yesterday showed. The Japanese economy grew for the first time in five quarters, according to a report earlier this week.

“‘There is no question the global economy is healing and emerging from recession,’ Kenneth Rogoff, a Harvard University professor and former chief economist for the International Monetary Fund, said in a Bloomberg Television interview yesterday.

“Federal Reserve Chairman Ben Bernanke and other global policy makers cautioned that the recovery is likely to be muted, indicating they would not soon remove all the stimulus injected into the financial system.

“‘Strains persist in many financial markets across the globe,’ Bernanke said in a speech yesterday at the Kansas City Fed’s annual symposium in Jackson Hole, Wyoming. ‘The economic recovery is likely to be relatively slow at first, with unemployment declining only gradually from high levels.’

“The US housing market, which led the way into the recession, is showing signs of righting itself after almost four years of declines. The 7.2% rise in sales of existing homes last month was the biggest since the National Association of Realtors began keeping records in 1999.

“In Germany, Europe’s largest economy, ‘business sentiment among service providers strengthened in August and was the most positive since January 2006,’ Markit Economics said yesterday, pointing to its purchasing managers’ survey.

“‘The recession is over,’ said Klaus Baader, chief European economist at Societe Generale SA in London, who called the Markit data an ‘incredible reading’.

“Japan’s economy is also being boosted by government measures ahead of an election. Prime Minister Taro Aso, whose party is trailing in opinion polls before the August 30 parliamentary elections, has put forward a 25 trillion yen ($265 billion) stimulus plan.

“The 3.7% rise in Japanese gross domestic product in the second quarter followed an 11.7% contraction in the first three months of the year. Exports led the revival of the world’s second-largest economy last quarter, jumping by 6.3%.”

Source: Rich Miller and Alison Sider, Bloomberg, August 22, 2009.

Nouriel Roubini (RGE Monitor): The exit strategy from the monetary and fiscal easing - damned if you do, damned if you don’t “In the last few months the world economy has been saved from a near depression. That feat has been achieved by a range of extraordinary government stimulus measures: In the US and in China, and to a lesser extent in Europe, Japan and other countries, governments have pumped liquidity, slashed policy rates, cut taxes, primed demand and ring-fenced and back-stopped the financial system. All of this has worked, but it has worked at a cost. Governments have been spending and borrowing like never before. The question now is: how do they stop?

“This is not a simple problem. Restore normality too soon and the risk is that a weak recovery will double dip into a second and deeper recession. Restore it too late and inflation will already be ingrained.

“The second quarter GDP estimates for the US show just how significant this aggressive front-loaded policy stimulus has been. While total GDP growth was sharply negative in the first quarter - around -5.6% - the rate of decline in the second quarter had moderated to around -1.5%. Credit this relative improvement to governmental monetary, fiscal and financial stimulus. The private components of GDP, private demand and capex, were actually still very weak. But government spending rose by 5.6%, breaking what otherwise would have been another quarter of headlong GDP contraction.

“Necessary as the stimulus has been, it cannot go on indefinitely. Governments cannot run deficits of 10% or more of GDP, and they cannot go on doubling the monetary base, without eventually stoking inflation expectations, pushing up long term interest rates and eventually eroding their very viability as sovereign borrowers. Not even the US can do that.”

Click here for the full article.

Source: Nouriel Roubini, RGE Monitor, August 24, 2009.

Financial Times: Central bankers content to keep rates low “The world’s central bankers were in no hurry to start raising interest rates as they headed home on Sunday from the US Federal Reserve’s annual retreat in Jackson Hole, Wyoming.

“In private and in public, most officials indicated they believed that rates could be maintained at ultra-low levels for a considerable time without generating excess inflation, in spite of better economic data and a return of ‘animal spirits’ in financial markets.

“Some used the platform of the conference to push back against calls for early implementation of ‘exit strategies’ that would reverse the current extraordinary degree of monetary stimulus.

“‘There is no reason to re-assess our monetary policy stance,’ Erkki Liikanen, Finland’s central bank governor, told Bloomberg news agency. Ewald Nowotny, Austria’s central bank chief, said he did not favour adding a surcharge to the European Central Bank’s next offer of one-year loans to banks - a view shared by some other European officials in Jackson Hole.

“If the ECB simply offers the money at its current policy rate, the market is likely to interpret this as a signal that it does not expect to raise interest rates for 12 months.

“Federal Reserve officials have edged up their assessment of economic conditions but have not significantly revised 2010 forecasts. They are encouraged by the shares rally, and see scope for this to support economic activity by restoring lost wealth and improving confidence, but are not betting too much on this.

“Don Kohn, vice-chairman of the Fed, said he saw no contradiction between its commitment to keep rates low for an ‘extended period’ and the desire to keep inflation at moderate levels - though he emphasised that this was a conditional commitment that could change if the economic outlook changed.

“Martin Feldstein, a Harvard professor, thought it would be possible to have ‘two years or more of very low interest rates’ without risk of excess inflation, given the spare capacity in the economy.

“Rick Mishkin, a former Fed governor, told the Financial Times the Fed would be easing policy further if it were not for the costs associated with monetising government debt.

“‘Optimal policy suggests more Treasury purchases would make sense. But that ignores the fiscal situation,’ he said. ‘The Fed is absolutely right to get off that programme - it cannot be seen to be accommodating the government deficit.’

“Jean-Claude Trichet, president of the European Central Bank, meanwhile spoke against a return to complacency and a failure to follow through on financial reforms, even though ‘we are a little bit out of the current episode’.”

Source: Krishna Guha, Financial Times, August 23, 2009.

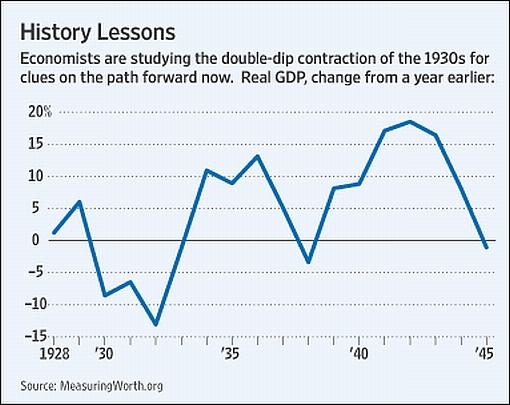

The Wall Street Journal: Policy makers seek to learn from 1937’s stalled comeback “A few months ago, Obama administration officials were sounding the alarm about another 1929. These days, it’s 1937 that has them in a sweat.

“The Great Depression was W-shaped. The stock-market collapse led to a steep economic decline. But by 1933, the economy had rebounded. Then a series of monetary and fiscal blunders drove the country back into a deep recession at the end of 1937.

“That episode is at the heart of the debate over how quickly the government and the US Federal Reserve should unwind the emergency measures they have taken to fend off a Depression-like contraction.

“For the administration, the answer is clear: Err on the side of continued expansionary policies. ‘What you learned from that episode in 1937 is that it’s not enough to be recovering,’ says Christina Romer, chairman of the president’s Council of Economic Advisers and an expert on the Great Depression. ‘You don’t want to do anything when you start recovering that nips it off too soon.’

“For fiscal conservatives, the answer is equally clear: Start cutting the federal deficit and slowing the growth in the money supply now, before the binge generates a burst of inflation.

“Ms. Romer is ’sending the absolutely wrong message - that we can’t do anything to worry about inflation until the recovery is locked in because of concern for unemployment,’ says Allan Meltzer, a political economist at Carnegie Mellon University. ‘The reason economists and central bankers have two eyes is so they can do two things at once.’

“The economy was recovering briskly during Franklin D. Roosevelt’s first term in the White House. The jobless rate, which had peaked at 25% in 1933, fell to 14% in 1937 - not exactly cause for celebration but a relief nonetheless.

“The comeback stalled in 1937. Banks, nervous about the fragile recovery, were holding huge amounts of cash in reserve at the Fed. Fearing an inflationary surge should the banks decide to lend that money out to businesses and individuals, the Fed - which had made the mistake of tightening monetary policy soon after the 1929 stock-market crash - miscalculated again. The Fed ratcheted up banks’ reserve requirements three times, starting in 1936. The banks reacted by cutting lending even further.

“‘There’s no doubt that [Fed Chairman Ben] Bernanke is heavily influenced by these two mistakes of the Fed during the Depression and is absolutely intent on not repeating them,’ says Alex J. Pollock of the American Enterprise Institute, a free-market think tank in Washington.”

Source: Michael Phillips, The Wall Street Journal, August 24, 2009.

Financial Times: Obama to offer Bernanke second term “Ben Bernanke is to be reappointed by President Barack Obama for a second four-year term as chairman of the Federal Reserve, according to a White House official.

“Mr Obama will make the announcement on Tuesday in Martha’s Vineyard, where he is on holiday with his family. The decision is the ultimate seal of approval for the Fed chairman, who was originally appointed by George W Bush, the Republican former president, and whose reappointment was seen as far from guaranteed.

“It follows Mr Bernanke’s extraordinarily aggressive efforts to fight the economic crisis, including radical interest rate cuts, loans to non-bank financial institutions, Fed-led bailouts of Bear Stearns and AIG and gigantic asset purchases - exploiting the Fed’s powers to their legal limits in a bid to prevent a second Great Depression.

Economists, investors and fellow central bankers overwhelmingly favour Mr Bernanke’s reappointment. However, disquiet in Congress over the exercise of extraordinary Fed powers has raised a cloud over his future.

“The Fed chairman’s reappointment still has to be approved by the Senate, but his prospects look good. Chris Dodd, chairman of the Senate banking committee, on Monday said that ‘reappointing Chairman Bernanke is probably the right choice’, though he promised a ‘thorough and comprehensive confirmation hearing’.

“Mr Obama is said to credit Mr Bernanke with a leading role in helping to avert economic catastrophe. By reappointing Mr Bernanke - who worked in the Bush White House - Mr Obama can also emphasise his bipartisan credentials at a time when he is embroiled in a fiercely partisan battle over healthcare reform.”

Source: Krishna Guha, Financial Times, August 25, 2009.

The Wall Street Journal: Bernanke reappointment politically shrewd “As President Obama trumpets the turnaround in the economy, WSJ’s Executive Washington Editor Gerald Seib says the reappointment of Federal Reserve chairman Ben Bernanke, therefore, is a politically shrewd move.”

Source: The Wall Street Journal, August 25, 2009.

Stephen Roach (Financial Times): The case against Bernanke “Barack Obama has rendered one of his most important post-crisis verdicts: Ben Bernanke will be nominated for a second term as chairman of the Federal Reserve. This is a very shortsighted decision. While America’s head central banker deserves credit for being creative and courageous in orchestrating an unusually aggressive monetary easing programme, it is important to remember that his pre-crisis actions played an equally critical role in setting the stage for the most wrenching recession since the 1930s. It is as if a doctor guilty of malpractice is being given credit for inventing a miracle cure. Maybe the patient needs a new doctor.

“Mr Bernanke made three critical mistakes in his pre-Lehman incarnation:

“First, and foremost, he was deeply wedded to the philosophical conviction that central banks should be agnostic when it comes to asset bubbles.

“Second, Mr Bernanke was the intellectual champion of the ‘global saving glut’ defence that exonerated the US from its bubble-prone tendencies and pinned the blame on surplus savers in Asia.

“Third, Mr Bernanke is cut from the same market libertarian cloth that got the Fed into this mess.

“Notwithstanding these mistakes, Mr Obama may be premature in giving Mr Bernanke credit for the great cure. No one knows for certain as to whether the Fed’s strategy will ultimately be successful. The worst of the US recession appears to have been arrested for now - a fairly typical, but temporary, outgrowth of the time-honoured inventory cycle. But the sustainability of any post-bubble recovery is always dubious. Just ask Japan 20 years after the bursting of its bubbles.

“While financial markets are giddy with hopes of economic revival - in part inspired by Mr Bernanke’s cheerleading at the Fed’s annual Jackson Hole gathering - there is still good reason to believe that the US recovery will be anaemic and fragile. US consumers are in the early stages of a multi-year retrenchment as they cut debt and rebuild retirement saving. The unusual breadth and synchronicity of the global recession will restrain US export demand from becoming a new growth engine.

“It would be the height of folly to reward Mr Bernanke for the recovery that never stuck. Yet Mr Bernanke’s apparent reward is, unfortunately, typical of the snap judgments that guide Washington decision-making. In this same vein, it is hard to forget Mr Greenspan’s mission-accomplished speech in 2004 that claimed ‘our strategy of addressing the bubble’s consequences rather than the bubble itself has been successful’. Eager to declare the crisis over, the Obama verdict may be equally premature.”

Source: Stephen Roach, Financial Times, August 25, 2009.

The Wall Street Journal: Into the abyss - budget deficit deepens “The White House has released its budget deficit estimates and the news is grim, WSJ’s Deborah Solomon reports. With economic output tipped to fall by almost 3% this year, the US economy is facing more tough times.”

Source: The Wall Street Journal, August 25, 2009.

Bill King (The King Report): Withholding taxes down “For all the hope and hype of recovery, withholding taxes keep making new lows (via Matt Trivisonno’s blog).”

Source: Bill King, The King Report, August 28, 2009.

Asha Bangalore (Northern Trust): Q2 real GDP decline unchanged “The real gross domestic product (GDP) of the economy declined at an annual of 1.0% according to the preliminary estimate, unchanged from the advance report. The revisions offset each other to leave the headline unchanged.

“The upward revisions of consumer spending (-1.0% vs. -1.2% in advance estimate), residential investment expenditures (-22.8% vs. -29.3% in the advance report), equipment and software spending (-8.4% vs. -9.0% in advance estimate) led to an upward revision of real final sales (+0.4% vs. -0.2% in advance report), which is the first gain after two quarterly declines.

“Exports were also revised up which led to a smaller trade gap than previously estimated. The decline in inventories (-$159.2 billion vs. -$141.1 billion) is larger than the earlier estimate, implying a big addition to inventories in the second-half of the year. The US economy is projected to show a mild recovery in the second-half of the year.

“The overall GDP price index was revised down to a flat reading but the core personal consumption expenditure price index was left unchanged at a 2.0% increase.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary, August 27, 2009.

MoneyNews: Fed official - real unemployment at 16% “The real US unemployment rate is 16% if persons who have dropped out of the labor pool and those working less than they would like are counted, a Federal Reserve official said Wednesday.

“‘If one considers the people who would like a job but have stopped looking - so-called discouraged workers - and those who are working fewer hours than they want, the unemployment rate would move from the official 9.4% to 16%, said Atlanta Fed chief Dennis Lockhart.

“He underscored that he was expressing his own views, which ‘do not necessarily reflect those of my colleagues on the Federal Open Market Committee,’ the policy-setting body of the central bank.”

Source: MoneyNews, August 27, 2009.

ViktorCapitalist: US - 34% of workers have one week or less of savings “An online survey reveals the thin savings cushion of American:

“(Mish’s Global Economic Trend Analysis) … Over a one week period beginning July 6 and running through July 13, more than 16,000 visitors to Monster.com participated in the Monster Meter Poll question ‘If you were laid off without severance, how long would your savings cover your living expenses?’

* One Week or Less: 34% * 2-4 Weeks: 16% * 1-2 Months: 16% * 3-5 Months: 14% * 6 Months or Longer: 20%

“Creating three broad groups, 50% have less than a month of savings, while only 20% have 6 months or more.”

Source: ViktorCapitalist, August 26, 2009.

Asha Bangalore (Northern Trust): “Cash for clunkers” lifts consumer spending in July “Nominal consumer spending increased 0.2% in July, after a 0.6% gain in June. In July, the ‘cash for clunkers’ program accounted for the 1.3% increase in purchases of durables (mostly cars). After adjusting for inflation, consumer spending moved up 0.2% in July vs. a 0.1% increase in June. Outlays on non-durables dropped 0.3% in July and purchases of services rose 0.1%. Real consumer spending has now registered three consecutive monthly increases. The “cash for clunkers” program should raise consumer spending in August, albeit a large increase compared with July. The main implication is that consumer spending in the third quarter is most likely to grow around a 2.0% annualized rate after a 1.0% drop in the second quarter. This supports forecasts of an increase in real GDP in the third quarter.

“Personal income held steady in July, following a 1.1% drop in June and a 1.4% increase in May. Personal income data reflect the impact of the American Recovery and Reinvestment Act of 2009 in the past few months, with large transfer payments leading to the wide swings in personal income. Focusing on wages and salaries gives a better picture of earnings. Wages and salaries rose 0.1% in July, this is noteworthy because it is the first monthly increase recorded since October 2008.

“Personal saving as a percent of disposable income was 4.2% in July, down from 4.5% in June. It appears that the saving trajectory is close to 4.0% after excluding the distortions from transfer payments related to the American Recovery and Reinvestment Act. The personal saving rate was 1.7% and 2.6% in 2007 and 2008, respectively.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary, August 28, 2009.

Standard & Poor’s: S&P/Case-Shiller Home Price Indices - home prices on an upswing in the second quarter “Data through June 2009, released today by Standard & Poor’s for its S&P/Case-Shiller Home Price Indices, the leading measure of US home prices, show that the US National Home Price Index improved in the second quarter of 2009.

“The chart above depicts the annual returns of the US National, the 10-City Composite and the 20-City Composite Home Price Indices. The S&P/Case-Shiller US National Home Price Index - which covers all nine US census divisions - recorded a 14.9% decline in the 2nd quarter of 2009 versus the 2nd quarter of 2008. While still a substantial negative annual rate of return, this is an improvement over the record decline of 19.1% reported in the 1st quarter of the year. The 10-City and 20-City Composites recorded annual declines of 15.1% and 15.4%, respectively. These are also improvements from their recent respective record losses of -19.4% and -19.1%.

“‘For the second month in a row, we’re seeing some positive signs,’ says David Blitzer, Chairman of the Index Committee at Standard & Poor’s. ‘The US National Composite rose in the 2nd quarter compared to the 1st quarter of 2009. This is the first time we have seen a positive quarter-over-quarter print in three years. Both the 10-City and 20-City Composites posted monthly increases, as did most of the cities. As seen in both seasonally adjusted and unadjusted data, as well as the charts, there are hints of an upward turn from a bottom. However, some of the hardest hit cities, especially in the Sun Belt, show continued weakness.’”

Source: Standard & Poor’s, August 25, 2009.

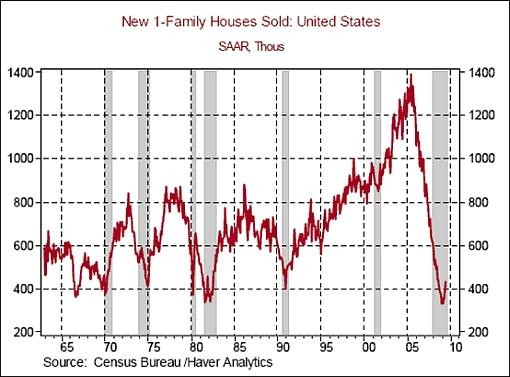

Asha Bangalore (Northern Trust): Sales of new homes advanced, inventories are shrinking “Sales of new single-family homes rose 9.6% in July, after upward revisions for May and June. Purchases of new homes have risen in five of the first seven months of the year. Sales of new single-family homes are now up roughly 32% from a record low reading of 329,000 units registered in January 2009. On a regional basis, sales of new homes rose in the Northeast (+32.4%) and South (+16.2%), fell in Midwest (-7.6%) and was nearly steady in the West (+1.0%). The $8,000 credit for home buyers appears to have raised sales of new and existing single-family homes. Breakdowns of new home sales based on price ranges show a small increase in purchases of homes prices upwards of $400,000 and below $750,000.

“From a year ago, sales of new single-family homes are down only 9.3%; it is a significant improvement compared with double digit declines seen in recent months. The largest drop in the median price of a new single-family home for the cycle was in January 2009 (-45.5%).

“The inventories-sales ratio is encouraging because it declined to a 7.5-month mark, down from a cycle high of 12.4-months in January 2009. The median of this ratio during 1963-2000 is 6-month supply.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary, August 26, 2009.

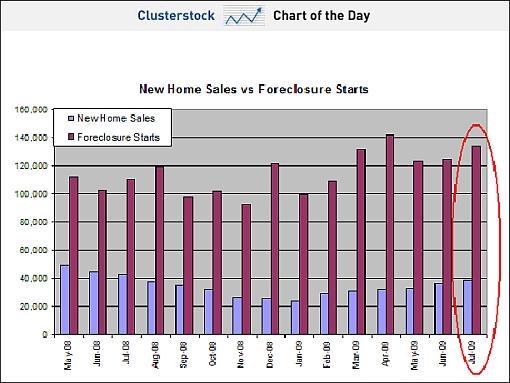

Clusterstock: New foreclosures dwarf new home sales “New home sales are ticking up again, bringing some much-needed relief to the beleagured homebuilders. But watch out. Mark Hanson produced this chart, showing foreclosure starts against new home sales. As you can see, the new foreclosure starts jumped even more in July than new home sales, meaning trouble down the road for homebuilders - especially once that $8,000 first-time homebuilder tax credit runs out.”

Source: Joe Weisenthal and Rory Maher, Clusterstock - Business Insider, August 27, 2009.

Asha Bangalore (Northern Trust): Defense and aircraft orders lift durable goods “Orders of civilian aircraft (+107%) and defense items (+14.8%) led to the 4.9% jump of bookings of durable goods during July. Excluding aircraft and defense, orders of durable capital goods fell 0.3% in July after a 3.6% increase in June and a 4.3% gain in May.

“The main message from the ISM manufacturing survey, industrial production report, and orders of durable goods is that the factory sector is moving toward a complete recovery.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary, August 26, 2009.

Financial Times: US “problem” bank list hits 15-year high “The number of US banks at risk of failure is at a 15-year-high while the fund protecting depositors is at its lowest level since 1993, according to figures that highlight the spread of the crisis to the lower reaches of the financial system.

“The Federal Deposit Insurance Corporation, a banking regulator, on Thursday said the number of ‘problem banks’ had risen from 305 to 416 during the second quarter. The FDIC does not name the lenders on the ‘problem list’ but said that total assets of that group had increased from $220 billion to $299.8 billion in the three months through June.

“That relatively low figure suggests that after hitting large institutions which traded complex securities, the financial crisis and the recession are taking a toll on smaller banks that lend to businesses and consumers.

“Sheila Bair, the FDIC chairman, said on Thursday that while earlier losses in the industry were related to troubled residential loans and complex mortgage-related assets, there were now problems with more conventional types of retail and commercial loans that have been hit hard by the recession. ‘These credit problems will outlast the recession by at least a couple of quarters,’ she said.

“Thursday’s news of a sharp fall in the FDIC’s deposit insurance fund, which insures up to $250,000 per depositor in each bank, underscored the problems faced by regulators when contemplating the rescue or wind-down of institutions with trillions of dollars on their balance sheets.

“The agency said its fund had fallen to just $10.4 billion from $13 billion in the quarter, the lowest level since March 1993 when the US was in the middle of the savings and loans crisis. The fund has been depleted by bank failures: regulators have shut 81 banks this year.

“‘In many important respects, financial markets are returning to normal,’ said Ms Bair. ‘Combined with the positive economic news in recent weeks, we’re hopeful that this will lead to a moderation in credit problems in coming quarters. But, as our report shows, cleaning up balance sheets is a painful process that takes time.’”

Source: Joanna Chung and Francesco Guerrera, Financial Times, August 27, 2009.

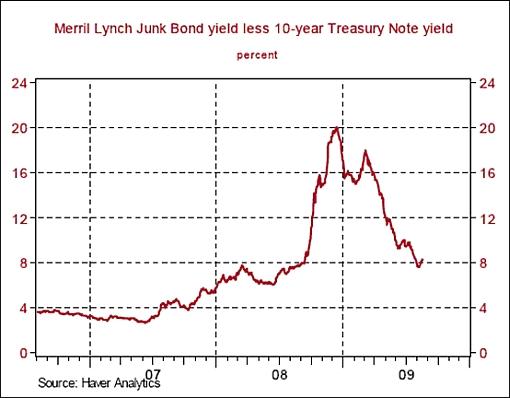

Asha Bangalore (Northern Trust): Some market spreads are widening again “At the short end, financial market spreads continue to narrow. However at the long end, the situation is different. Two representative long end market spreads - Moody’s Baa less 10-year Treasury note yield and junk bond yield less 10-year Treasury note yield - have both widened during August 11-20. The reasons are not clear as economic reports strongly suggest that underlying fundamentals are improving. Concern about the nature of economic recovery and projected status of balance sheets of banks could be factors influencing these spreads.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary, August 24, 2009.

Over the Robustness of Any Economic Recovery

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2009 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.