The Power of the U.S. Fed, Deflation and U.S. Dollar Devaluation

Currencies / US Dollar Aug 29, 2009 - 02:15 PM GMTBy: Adam_Brochert

The non-federal, private federal reserve corporation has a no-bid contract to print money out of thin air and charge U.S. citizens money (interest) for this enormous privilege. Their so-called powers are legion and they are the cause of much distortion and inequality in our economy, to be sure.

The non-federal, private federal reserve corporation has a no-bid contract to print money out of thin air and charge U.S. citizens money (interest) for this enormous privilege. Their so-called powers are legion and they are the cause of much distortion and inequality in our economy, to be sure.

But the belief that the fed can inflate forever in a fiat system ignores a few important concepts. First, a debt-based system requires someone to get into debt. There has to be a willing and capable borrower for a banker to acquire a new debt slave. The American public is now finally at the point of saturation and is, in aggregate, underwater and a poor credit risk. Additionally, people in the United States in aggregate are (finally) starting to become scared to take on more debt. These are new secular trends not to be taken lightly.

Now, you must understand that, in aggregate, the banking system of the United States is insolvent. This is largely due to the amount of risk taken by the largest institutions that were just bailed out by the U.S. taxpayer to no one's advantage but those large banks, but it was aided and abetted by a bull market in real estate and confidence that spread to most medium and smaller-sized banks. You also have to understand that our "modern" banking system, after the credit boom we just had and given the skimpy reserve requirements of banks these days, is unable to tolerate the real estate market crash that has already occurred and is now in full swing.

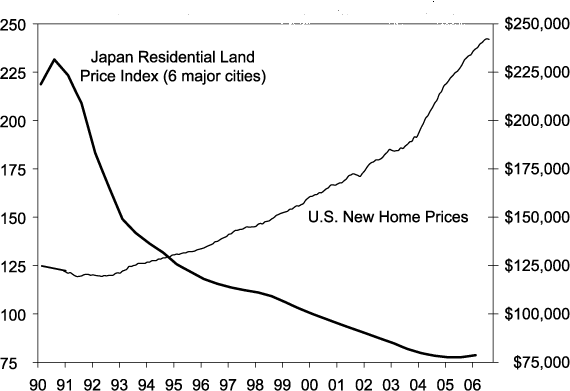

The real estate bear market is not over after 2-3 years! Anyone who says or thinks so doesn't understand the facts, market cycles or previous historical precedents (or they are just lying to you to get you to buy a house). We have a recent example from Japan in the decade after 1990. I know, I know, we're different. You know why? Because we have much more usable land and we overbuilt much more than Japan did during their boom. Otherwise, its the same, particularly the government response to help banks hide the fact that they're insolvent (which prolongs the bear market by years). Here's a chart of Japanese land price that I stole from somewhere in cyberspace (can't remember where - sorry to the creator):

Maybe we get through this mess in 6-10 years instead of 15. I don't think that's an unreasonable optimistic scenario (though it will take 20 years if the government insists on continuing to stop the free markets from functioning). So, maybe by the 2011-2012 time frame we will find a bottom in housing. If that's true, we will drag along the bottom for another 5 years as the psychology of housing as an investment or speculation turns 180 degrees in the opposite direction from a culture that actually had a popular television show about "flipping" houses. Once a bubble like this pops, it ain't coming back for a generation or two. Period.

This means that banks and debtors who hold mortgage notes are in trouble for a long, long time (in aggregate). When a bank is in trouble, it gets cautious. It doesn't want to loan money to risky borrowers. Once bitten, twice shy. Please don't forget that banks are actually in the business of trying to make money! If they don't think they can get paid back, they won't make a loan. The exception is if there is a secondary market to sell their loans to so that the banks don't have to be the ones worrying about getting paid back. This is why Freddie Mac and Fannie Mae are such nefarious organizations. They promoted (and continue to promote) unsound lending and put the risk on the taxpayers' backs with no sharing of profits when times were good!

The flip side of this is the consumer. Even if the bankers want to continue to make unsound loans and the U.S. government gave them free money to loan, the U.S. consumer, in aggregate, is exhausted. We have finally reached that point after two decades of unbelievable profligacy by the typical American. After refinancing their home, maxing out every credit card they could find and getting themselves into long term loans for vehicles, second homes, appliances and education, the final wall has been hit.

If you make $40,000/year and take out a loan for $1 billion, it doesn't matter what the interest rate is, even if it's zero. There is a mathematical limit of how much debt can be serviced by a certain income. The final stages of the credit boom required subprime debtors to take on loans with negative amortization, meaning they were paying less than interest only on housing-backed debt (i.e. Option ARM or "pick-pay" loans that are HEAVILY concentrated in bubble states like California and are now exploding on schedule) and every month their amount of debt was increasing despite making payments!

The bottom line is that Americans, in aggregate, can no longer service any more debt. They have reached their mathematical limit of debt payment and much of their debt is going bad at a staggering pace as unemployment continues to rise. That feeling of being underwater on a mortgage and coming to realize that your "asset" has become a trap is not one to be underestimated. Many folks don't have the financial ability to pay their debts down any faster, by the way.

Our government and our non-federal private federal reserve corporation are trying everything to get the party going again. Since the consumer can or will no longer borrow on their own, the government takes on more debt in their name. The federal reserve pushes credit out the door at a pace that alarms anyone who is paying attention.

It seems that many think the federal reserve can create inflation and cause markets to rise at will by throwing our currency and future savings under the bus. Cash for clunkers and cash for refrigerators both show the depths the apparatchiks are willing to go to cause inflation and take on more worthless debt. Visions of helicopter Ben Bernanke throwing money from helicopters are not heart-warming to say the least.

But is there a limit? Is there a point where the party stops and nothing works anymore? The answer is yes but the question is how this party comes to an end. Some say hyperinflation and some say deflation. Hyperinflation seems to be the obvious choice. If you keep pushing and pushing cheap money, the currency just spirals down to its intrinsic value, which is zero.

Deflation requires a different view, which is that the central bank and our government are not the only ones who have an effect on the economy. The fed is not omnipotent or omniscient. They have only one play in their playbook (though it has many twists) - create money and throw it around by getting people to borrow it and multiply it. But you see, someone has to actually borrow it and do something with it to make prices rise in the real world when the system is credit-based. The deflation argument states that at times there are not enough people left who want to borrow and not enough banks who want to lend and the net decline in credit and the credit multiplier effect in the economy more than overwhelms notions of "base" money.

This is the "pushing on a string" theory that I favor is happening right in front of our eyes. You see, government debt doesn't grow the economy. Government is a parasite on the economy. Government and its private fed bank distort the primary trend, they do not create it. I think the lack of fed power is about to be exposed and I think what's left of the free markets will teach apparatchiks a powerful lesson (again) about what they can and cannot do.

Lost in many discussions is what happens to the engine of the economy at this point in the cycle. The private sector is the economy, not the government and not its non-federal central bank. If you are a citizen in debt up to your eyeballs with no realistic ability to pay that debt back and no one left to lend you money, cash becomes very valuable. And believe me, at this point in our economic cycle and country's history, there are many, many people in this boat already. Many, many more are only one paycheck away from disaster - a family illness, job loss or some other slip on a banana peel and it's game over. When thinking in "big picture" terms, this is important.

For people who are in this situation, it doesn't matter what widdle Timmy Geithner is doing to steal all he can from the taxpayer kitty. It might make these people mad and possibly (hopefully) mad enough to do something about it, but it doesn't change their economic reality. They have to cut back, start saving, and start paying down debt. Alternatively, they can or may be forced to walk away from their debts without paying. Both of these trends are highly deflationary.

When we defaulted on the Gold standard in 1971, we basically walked away from our debt to other countries. Our currency went on a pretty serious slide over the next decade, culminating in a commodity spike that Gold and silver bugs still talk about today and hope will repeat. And please remember that I am bullish on Gold. But I want to show you another historical perspective on what could happen besides stagflation or hyperinflation.

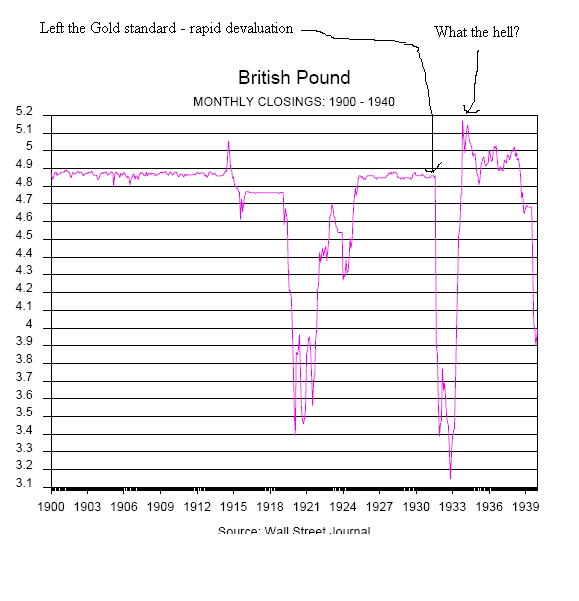

It comes from the 1930s. The major economies were on a Gold standard to start the 1930s. As things got bad to kick off the economic depression, however, governments did what they do so well - they broke their promises. Britain, the senior economy of the time in the eyes of the world, left the Gold standard completely and abandoned it in 1931, just like we did in 1971. Want to guess what happened to their currency?

Well, here's what actually happened (chart copied from Martin Armstrong's book "The Greatest Bull Market in History" but credited to the Wall Street Journal by him):

Not what you'd expect, eh? And, no Britain did not return to the Gold standard to cause the spike in their currency back higher after the plunge in the early 1930s. So, why did their currency spike higher even after they left the Gold standard? Simple: a deflationary depression caused a bull market in cash and, additionally, every other government in the world played the same game and devalued their currency! Major European countries left the Gold standard in the early 1930s and only the U.S. stayed on the Gold standard. Even the U.S. finally changed the rules and did a one-time devaluation of its currency and switched to a weaker, watered-down quasi-Gold standard in 1934 after stealing its citizens Gold and criminalizing private Gold possession.

So, I hold Gold instead of U.S. Dollars to protect from what now seems an inevitable U.S. (and global?!) currency devaluation. But there's a good chance the U.S. Dollar won't spiral into hyperinflation, but rather a one-time rapid devaluation will help spark a weak cyclical bull market in anti-dollar plays (i.e. stocks and commodities) and then the value of cash may well rise once again (just like in Britain in the 1930s).

We won't be making new highs in stocks or commodities for several years in my opinion, as the underlying economy is too weak to support such a rise. I think the international currency Gold will outperform the U.S. Dollar and thus it is my preferred form of cash. Forget interest payments, I want my purchasing power retained and enhanced and I want protection against a one-time intentional currency devaluation or temporary capital flight from the U.S caused by economic weakness and an unrealistic fiscal policy (we are not the only country at risk, by the way!).

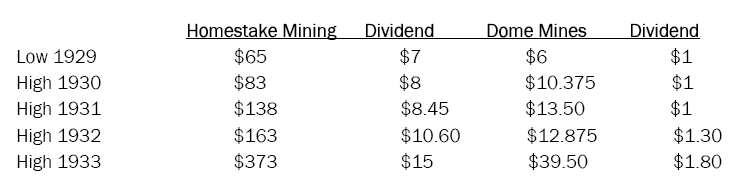

If you are a Gold stock bull, like I am, deflation is a wildly bullish scenario. Most Gold bugs don't understand that Gold miners can more consistently grow profits during deflation than during inflation. This is paradoxical only when you look at Gold as a commodity instead of as a form of cash. Gold is money. If Gold (i.e. cash) is becoming more valuable and the costs of mining are going down (i.e., the Gold:Commodity ratio as a proxy), miner profitability for unhedged miners goes up exponentially. This is why Gold miners did so well during the last economic depression of the 1930s.

So, not only can you make money buying Gold stocks, but your profits will be more valuable in U.S. Dollar terms relative to real estate, general equities and commodities. Though I am not interested in buying senior Gold stocks at current prices, especially since the equity bear market is about to resume, another great buying opportunity is coming and it should be welcomed and seized by interested investors.

I realize that many people think Gold will get killed during deflation but none of the deflationists who predicted this thought Gold would be within spitting distance of its all-time highs a few months after the most intense deflationary liquidation this country has seen in 30 years (i.e. the fall Panic of '08). All Gold stock investors should personally welcome a deflationary decade after seeing the table below, stolen from Ian Gordon. This table is shown because these were two of the main senior Gold stocks and this is their price action during the worst stock bear market America has seen in 100 years (i.e. the 1929-1932 bear, during which the Dow Jones lost 89% of its value).:

And believe me, Gold stocks absolutely exploded over the three years following this table's data!

Why am I harping about all this? Because I like Gold as a cash equivalent and insurance and Gold stocks as an investment, but I don't like commodities at this point in the business cycle. Most Gold bugs are just inflationists or hyperinflationists and don't understand the role of Gold as money and a hedge and they don't understand that deflation is consistently bullish for Gold miners' profits. Another good Gold and Gold stock buying opportunity is coming soon I believe, and I for one am happy to wait patiently for it.

I don't believe the fed or any other single private corporation can control everyone in the economy. The primary trends in the real economy are all deflationary and the fed cannot stop them. If you believe the fed is all-powerful and can control the value of the currency at will, then let me play along for a minute. A willful creation of hyperinflation, and it would have to be willful, would put the federal reserve franchise at risk. If you owned the for-profit federal reserve, which is not part of the U.S. government and has no allegiance to it, why would you want to end the most lucrative no-bid government contract in history?

Visit Adam Brochert’s blog: http://goldversuspaper.blogspot.com/

Adam Brochert

abrochert@yahoo.com

http://goldversuspaper.blogspot.com

BIO: Markets and cycles are my new hobby. I've seen the writing on the wall for the U.S. and the global economy and I am seeking financial salvation for myself (and anyone else who cares to listen) while Rome burns around us.

© 2009 Copyright Adam Brochert - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.