British Pound in Precarious Situation, Government Debt Downgrade Coming Soon ?

Currencies / British Pound Aug 27, 2009 - 04:49 AM GMTBy: Frederic_Simons

A lot has been written lately about a possible US Dollar crash. Currently, however, it looks as if a crash in the world's reserve currency has been averted for the time being. Only EUR/USD trading above 1.44 would put the US Dollar crash alert on yellow again.

A lot has been written lately about a possible US Dollar crash. Currently, however, it looks as if a crash in the world's reserve currency has been averted for the time being. Only EUR/USD trading above 1.44 would put the US Dollar crash alert on yellow again.

The fundamental rationale underlying a possible US Dollar crash has been the fact that the US is facing a very big financial deficit, and the lurking possibility of a credit rating downgrade. But the United States have an ally with regard to this dilemma. It is its predecessor in terms of the nation that claims global power, the United Kingdom.

Silently, the currency of the United Kingdom, the British Pound, has started to lose value again compared to all of the important fiat currencies in the world, including the US Dollar, the Japanese Yen, and the Euro. In what seems to be a global race between the nations to devaluate their currencies, the Pound is leading again.

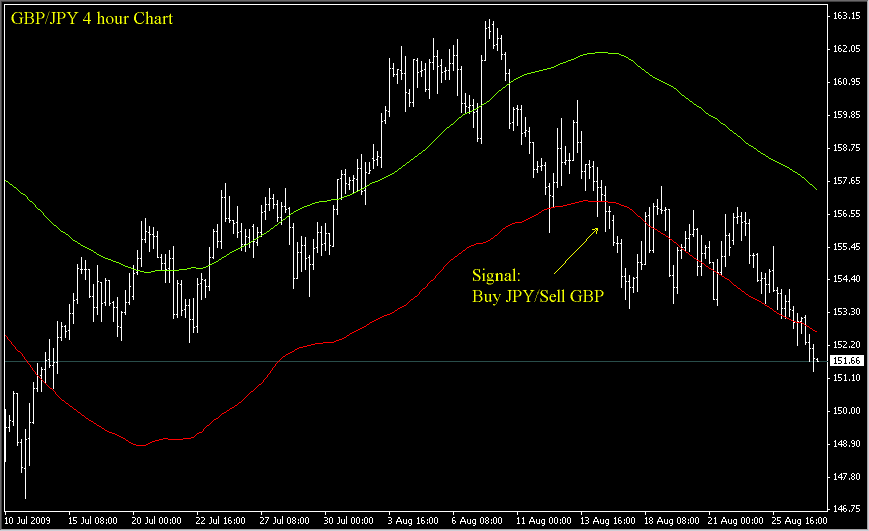

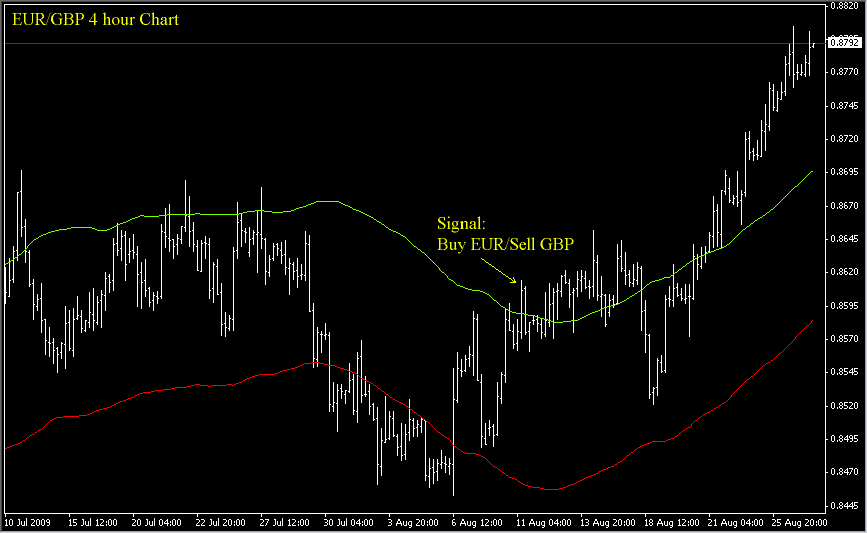

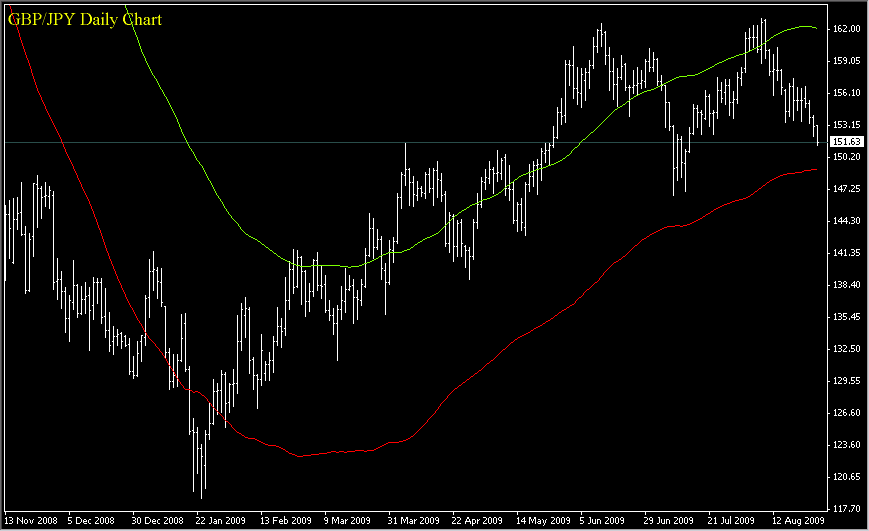

The following 4 hour charts illustrate the current technical situation, where you can see that the British pound is intermediate term bearish against the Japanese Yen, the US Dollar, and the Euro.

GBP/USD 4 hour chart:

[Please click here for additional information about the trading system and how to read the charts]

GBP/JPY 4 hour chart:

EUR/GBP 4 hour chart:

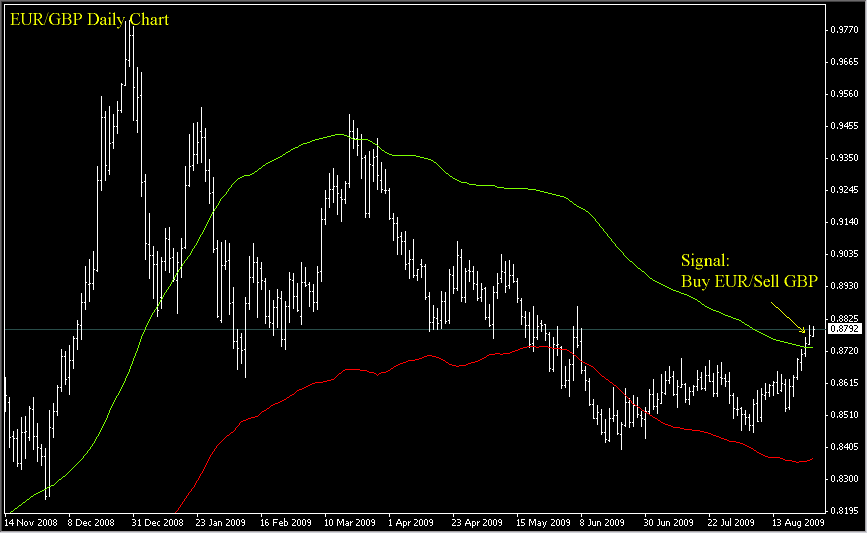

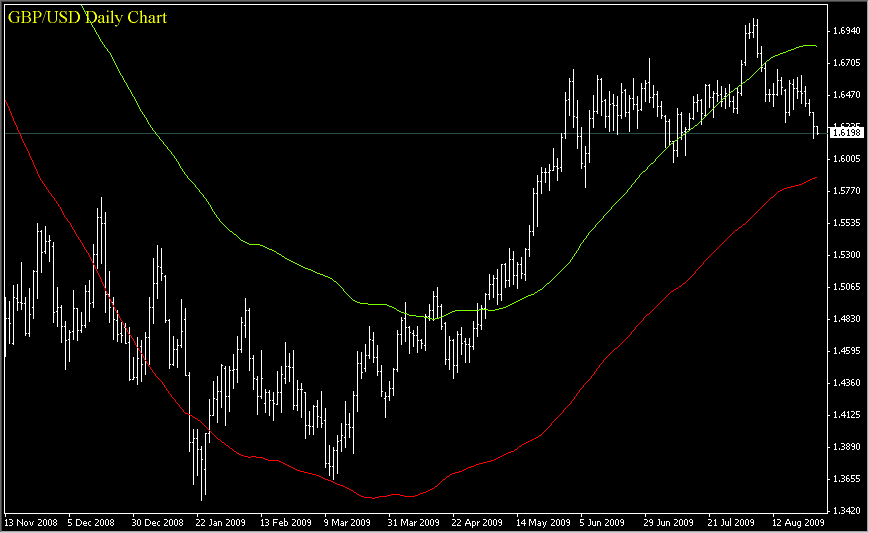

If you look at the longterm daily charts, the Pound is already bearish against the Euro, and it would not take too much in order to turn the British Pound longterm charts bearish against the US Dollar and the Japanese Yen as well.

EUR/GBP daily chart:

GBP/USD daily chart:

GBP/JPY daily chart:

As a conclusion you should not concentrate on the US Dollar when looking for a crash, but rather focus on the British Pound, which is currently looking very vulnerable technically. If and when prices for GBP/USD and GBP/JPY dive below the red sell line on the daily charts, you should watch out for downside momentum to pick up. This might lead to the second big wave of GBP-selling after 2007/2008, and the lows of the British Pounds that it made against other currencies during at the beginning of the year will at least be tested then.

As prices tend to give early warning signs with regard to negative news, it is very likely that a possible debt downgrade of the UK will be "announced" by some 2-4 per cent losses against other currencies before it is actually published by S&P or any other rating agency.

If you have any questions, please do not hesitate to contact us by writing an email to

By Frederic Simons

http://www.crossroadsfx.hostoi.com

© 2009 Copyright Frederic Simons - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.