Peak Oil has Peaked, Crude Oil About to Rollover

Commodities / Crude Oil Aug 25, 2009 - 05:58 AM GMTBy: Adam_Brochert

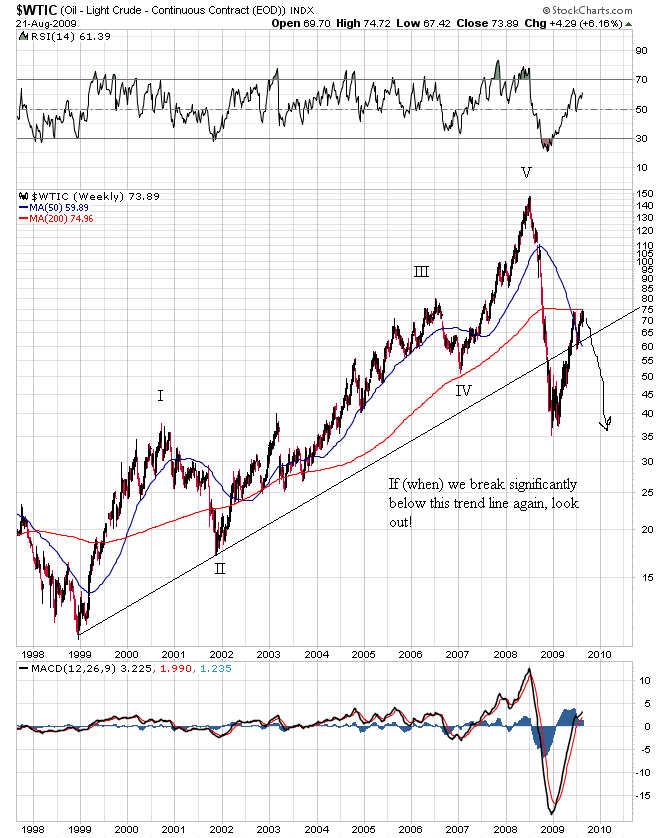

and the price of crude is about to roll over. My previous piece on oil allowed for the possibility of a double top in crude oil, and I think that is what we are getting. A "big picture" overview of the oil bull market follows using a 12 year weekly log scale chart of the price of crude ($WTIC):

and the price of crude is about to roll over. My previous piece on oil allowed for the possibility of a double top in crude oil, and I think that is what we are getting. A "big picture" overview of the oil bull market follows using a 12 year weekly log scale chart of the price of crude ($WTIC):

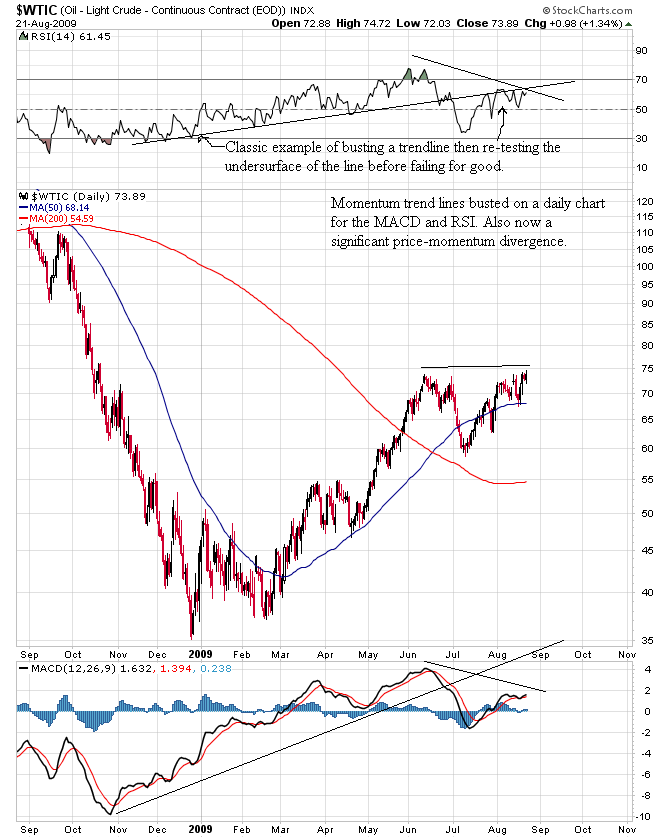

And here's a one year daily chart of the price of crude oil (as an aside, the next chart and prior chart only include action thru last Friday's close, as they were created this past weekend):

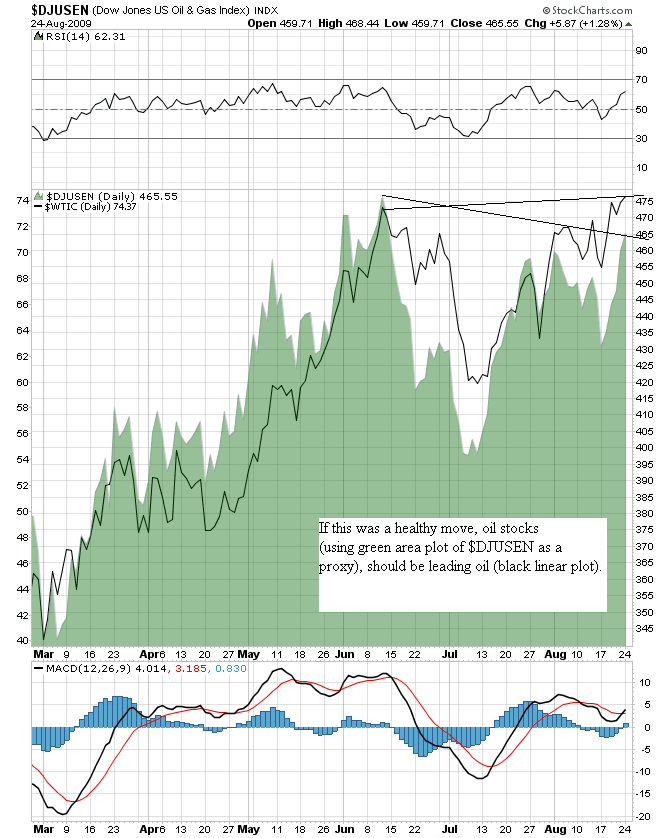

Lastly, here's a re-visit of the divergence between oil and oil stocks using a 6 month daily plot of both oil stocks (green area plot) and oil (black line plot) up thru yesterday's close:

Though it is certainly conceivable that oil and oil stocks could go a few bucks higher, they are now all but spent. The great oil bull market is over and has been since the top last summer. The bubble has burst, not to be blown again in our investing life times. Once a bubble bursts, it ain't coming back for decades. This is what I have been trying to tell anyone who will listen about real estate - just forget real estate as an overall investment class for 5-10 years (though every market may have unique individual opportunities). When inflation is finally created in the next business cycle, it will find a new market, not the one that just imploded and burned millions of "investors." Why is this? Human nature. Once bitten, twice shy.

The next plunge in crude will hopefully put an end to all the talk about "Peak Oil" for awhile. The fact that Chevy can even conceive of offering an electric hybrid-type vehicle (the Volt) in the next few years that may get 100-230 miles per gallon shows why the peak oil dilemma is bogus even in the near term. If Chevy can conceive of it, other better managed companies can actually do it and can do it much better and faster. Take that technology and put it in all cars, trucks and military vehicles. Then add further solar technology break throughs or maybe a nuclear/hydrogen advance or two. Then throw in a global economic depression to cripple demand for the next few years while these technologies are being developed, tested and implemented. Next thing you know, we don't have to worry about oil for another 20 years.

By then, who knows? Solar or nuclear-powered cars? Maybe we "stimulate" ourselves in America (and maybe in China, too) with multi-trillion dollar high-speed rail systems that link major cities throughout the country? Declare cars that get less than 100 miles per gallon illegal? Lord knows if America cut her consumption of oil significantly, that would solve the global problem for a decade by itself.

The point is that high oil prices are a tax on everyone and motivate people to change behaviors and innovate. Don't get me wrong, I read all the articles and data on peak oil and was initially concerned. I know how China and India want their cars, too. But now that I know a little about history, market cycles and bubbles (Peak Coal and Peak Food capped a few previous commodity cycles), I am much more concerned for the citizens of major oil-producing countries when oil goes back to $20/barrel. Keep in mind that a U.S. Dollar devaluation event could certainly alter the dynamics of the oil price for Americans in the future, but the global oil price, oil stocks and the price of crude in Gold terms are both headed for another leg down in their bear markets. Only the exact timing is in doubt in my mind for oil, not the outcome.

As an aside, I also think the next bubble will be in Gold and Gold miners (of course!). Keep in mind that oil went up fifteen fold over the past 10-12 years before its price collapsed, while Gold only went up four fold. I am still waiting patiently on Gold and Gold miners to correct further before considering putting new money to work in this sector via the long side.

Visit Adam Brochert’s blog: http://goldversuspaper.blogspot.com/

Adam Brochert

abrochert@yahoo.com

http://goldversuspaper.blogspot.com

BIO: Markets and cycles are my new hobby. I've seen the writing on the wall for the U.S. and the global economy and I am seeking financial salvation for myself (and anyone else who cares to listen) while Rome burns around us.

© 2009 Copyright Adam Brochert - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

Rimu

29 Aug 09, 00:16 |

haha

That is some of the most laughable technical analysis I have seen. The trend lines are tenuous at best |