Stock Market Bullish Stampede Continues

Stock-Markets / Stock Index Trading Aug 23, 2009 - 06:27 PM GMTBy: Joseph_Russo

Buy the DIPS or just HOLD

Buy the DIPS or just HOLD

For those adopting such strategy, we suggest using one hand to hold your nose, and keep your free hand at the ready in pulling the sell-trigger when appropriate.

We have not changed our view from a few weeks ago, which opined that our trusted shepherds of illusion would like nothing more than to ignite another long-term cycle of buy & hold fever as the only means by which participants can hope to survive amid the artificially created buying frenzy. As the desired bullish stampede persists, the results of their handiwork must now have them nearing multiple interventionist orgasms. Are you about ready for a cigarette Ben, cigar, or perhaps reappointment to another term as worshiped god and savior of all humankind?

The market’s upside persistence continues to astonish and perplex

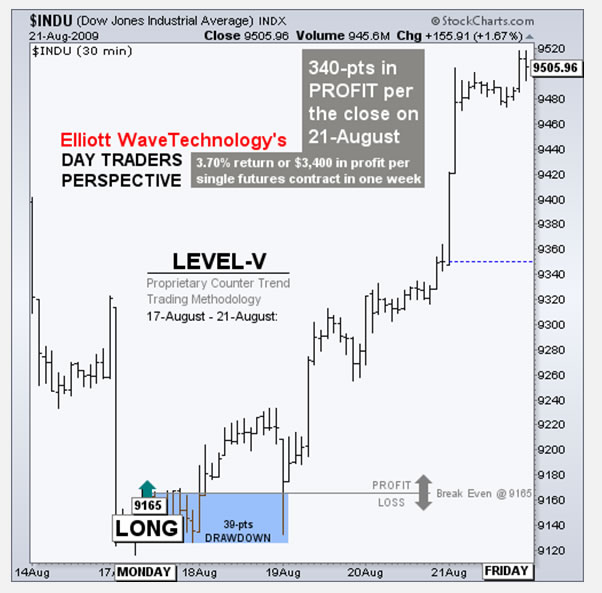

As far as we are concerned, until price action dictates otherwise, we remain long-term bearish, intermediate-term bullish, near-term bearish, and following a phenomenally bullish week of profits at Level-V, we are now beginning to turn short-term bearish.

Level-V trading operation roars back to fresh all-time highs

After moving long upon a counter-trend buy-signal amid Monday’s sharply lower open (when all were convinced a correction had finally begun), our Level-V short-term trading methodology, which typically signals much quicker exits, kept us long throughout the entire weeks bull rush. All told, by week’s end Level-V had amassed over 300-Dow points in profits.

Of interest relative to this specific level of engagement is the major 116% one-month drawdown in open profit from 495% to 360% that occurred amid the one-way stampede ramp-up rally from the July low. Once the markets began to finally register adequate levels of oversold from which to launch counter trend buy probes, we started clawing back at reclaiming ground on the steep July drawdowns. Had one began trading this method with us in July, they would have been totally wiped out within a month. In contrast, those with plenty of skin in the game sucked up the big drawdown as a cost of doing business. As the open equity graph below shows, our most recent long trade established last Monday has launched the single contract futures performance to fresh all time highs.

Probably not quite as impressive in comparison to the proprietary trading desks at Goldman, nonetheless, we’ll take what we are able to, and maintain adherence to our disciplines win, lose, or draw. Active traders must remember that losing and drawdowns are an essential part of the trading process no matter ones timeframe, strategy, or objectives. Those who lack discipline, lose patience, and run for the hills after the first rough patch of price action or series of drawdowns, are destined to remain consistent losers throughout the entirety of their trading careers.

Green shoots in full bloom for Goldman

We would not be surprised if this elite bellwether of the financial sphere continues its miraculous V-shape bailout recovery from the abyss until its 2007 highs are retested or surpassed. We can also envision an abrupt end to what may be an irrational false dawn in the audacious coup to maintain the financial spheres “WE FIRST” monopoly over the real economy.

Elliott Wave Technology vs. the DOW

The bar chart below reflects Elliott Wave Technology’s premium advisory performance results vs. the Dow. There is no doubt that recent conditions have perplexed the vast majority of seasoned participants, including us. We expect such periodic challenges, and intuitively adjust our perspectives accordingly.

Touché

The mainstream take is that institutional money managers are leading the fed-induced bullish stampede to the upside. All we can say is “Let it Rip” people, but STAY NIMBLE or risk slaughter with another imprudent long-only buy and hold strategy.

For those who wish to obtain a visually graphic, easy to understand actionable guide to the various disciplines and real-time actions needed to achieve a broad array of objectives at every level of market engagement, look no further than Elliott Wave Technology’s PLATINUM publication. Those with a more narrow focus may select from the below list of PLATINUM’S three subsidiary sister publications.

Three More Options:

GET ONE TODAY

1. The express focus of Elliott Wave Technology’s Near Term Outlook is to provide equity index traders with actionable guidance over the near and medium term.

2. Our Position Traders Perspective provides actionable guidance for longer-term time horizons.

3. EWT’s Day Traders Perspective assists short-term traders in executing proprietary methodology for capturing price moves of shorter duration.

Elliott Wave Technology’s PLATINUM 500 CHALLENGE:

In our effort to serve and empower as many individuals to trade profitably amid the sharks on the street, we will soon be announcing the availability of $500 PLATINUM service coupons. We shall award these incredibly generous service coupons to select individuals who apply and qualify for entry. We will let those interested know when entry applications for the challenge become available, and shall announce further details of the PLATINUM 500 CHALLENGE as they develop, so stay tuned. If you are interested in pre-qualifying, send us an email containing “PLATINUM 500 CHALLENGE” somewhere in the subject line or body of the email. We will place your email address on our secure list of PLATINUM-500 applicants, and keep you apprised of further developments and qualification criteria.

Until then,

Trade Better / Invest Smarter...

By Joseph Russo

Chief Editor and Technical Analyst

Elliott Wave Technology

Email Author

Copyright © 2009 Elliott Wave Technology. All Rights Reserved.

Joseph Russo, presently the Publisher and Chief Market analyst for Elliott Wave Technology, has been studying Elliott Wave Theory, and the Technical Analysis of Financial Markets since 1991 and currently maintains active member status in the "Market Technicians Association." Joe continues to expand his body of knowledge through the MTA's accredited CMT program.

Joseph Russo Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.