The Return of Stock Market Bubble Mania?

News_Letter / Financial Markets 2009 Aug 22, 2009 - 11:27 PM GMTBy: NewsLetter

August 22nd, 2009 Issue #67 Vol. 3

August 22nd, 2009 Issue #67 Vol. 3

Dear Reader

Dear Reader

The week saw the Stock indices slump early week which triggered a near across the board, top to bottom market calls AGAIN (5th time?) that this time the 'bear' market rally IS over and to prepare for the resurgent bear market.

However the stealth bull market delivered another shock and awe rally by the end of the week with the major indices propelled to fresh highs, something that I will write about further this weekend as well as touch on the state of the U.S. Dollar.

Meanwhile our friends at Elliott Wave International have shared with our readers Robert Prechter's latest 10 page Elliott Wave Theorist Newsletter, within which he states that the financial crisis is NOT over and gives a warning he's never had to include in 30 years of analysis.

Its Free, so grab it while you can !

Your stealth bull market and real time trading analyst.

Nadeem Walayat

Editor Marketoracle.co.uk

Featured Analysis of the Week

|

|

|

|

|

|

|

|

INO TV - Watch From Your Computer for FREE Here are the newest authors: Jack Schwager, John Murphy, Jake Bernstein, and Ron Ianieri. All experts, all well recognized, and highly trafficked by our current members. http://tv.ino.com/ |

|

|

|

|

|

|

|

|

|

|

|

|

Most Popular Financial Markets Analysis of the Week :

| 1. U.S. Dollar Bull Market Trend Forecast 2009 Update |

By:Nadeem_Walayat

This analysis seeks to update the existing U.S. dollar analysis of January 2009 by evaluating whether or not the U.S. Dollar bull market remains intact and to project a trend for the USD into year end. The sideways trend of the USD for the past 6 months in the wake of the "Quantitative Easing" headlines that has repeatedly brought the Dollar collapse proponents back out of hibernation on each down leg has shown little deviation from the road map of 20th Jan 09 as illustrated by the below original price chart.

| 2. Financial Armageddon Part Two: Securitization Is Too Big To Fail So The Racketeering Must Stop! |

By: Andrew_Butter

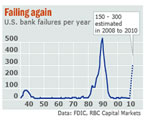

Armageddon Part One is over. The question, like a hurricane, is whether the US is now in the eye of the storm or is it plain sailing from here on? The "navigators" are mumbling something about "all clear", but then that's what they mumbled last time.

| 3. America Attacked During Obama Health Care Debate by British NHS Army |

By: Nadeem_Walayat

The onslaught of Brit's running to the defence of the NHS against US attacks during the Obama healthcare reform debate must leave american's wondering what the hells going on, perhaps the NHS is far better than they were led to believe?. However what is missing from the equation is the fact that over 1 million people in Britain ride the NHS gravy train and hence have a vested interest in the continuance of this sacred cow funding black hole that continues to exert a sizeable political force that political parties have little choice but to pander towards to ensure electoral success.

| 4. The Statistical Economic Recovery and Thoughts on the Housing Market |

By: John_Mauldin

A few weeks ago I first used the term "statistical recovery" to describe the nature of today's economic environment. Today we are going to further explore that concept, as it is important to have a real understanding of what is happening. This coming "recovery" is not going to feel like a typical one, and those expecting a "V"-shaped recovery are simply making projections from previous economic recoveries, which, based on the fundamentals, are not warranted. And of course, a few thoughts coming back from Maine are in order. There is a lot to cover, and this may take more than one letter.

INO TV - Watch From Your Computer for FREE Here are the newest authors: Jack Schwager, John Murphy, Jake Bernstein, and Ron Ianieri. All experts, all well recognized, and highly trafficked by our current members. http://tv.ino.com/ |

| 5. U.S. Debt as a Percentage of GDP Means No Growth for 50 Years |

By: Andy_Sutton

Apparently, a bazooka wasn’t enough. Last summer, that is what then Secy. of the Treasury Henry Paulson asked for when he made his case for sweeping financial powers. Instead, Congress gave him a nuke, and apparently that wasn’t enough either. Making the jump from completely absurd to the absolutely ridiculous, Timothy Geithner became the latest in a long line of Treasury Chiefs to run to Congress to ask for an increase in the nation’s debt ceiling.

| 6. Inflation and the Fall of the Roman Empire |

By: LewRockwell

This is a transcript of Prof. Joseph Peden's 50-minute lecture "Inflation and the Fall of the Roman Empire" given at the Mises Institute Seminar on Money and Government in Houston, Texas on October 27, 1984. The original audio recording is available courtesy of the Mises Institute.

| 7. Grab Your Shorts, the Stock Market Correction Has Begun |

By: Graham_Summers

As I’ve noted in previous essays, this stock market rally has come much too far, much too fast. All told the S&P 500 is up over 48% since the March lows. This is unprecedented in the post-WWII era.

| Subscription |

You're receiving this Email because you've registered with our website.

How to Subscribe

Click here to register and get our FREE Newsletter

| About: The Market Oracle Newsletter |

The Market Oracle is a FREE Financial Markets Forecasting & Analysis Newsletter and online publication.

(c) 2005-2009MarketOracle.co.uk (Market Oracle Ltd) - The Market Oracle asserts copyright on all articles authored by our editorial team. Any and all information provided within this newsletter is for general information purposes only and Market Oracle do not warrant the accuracy, timeliness or suitability of any information provided in this newsletter. nor is or shall be deemed to constitute, financial or any other advice or recommendation by us. and are also not meant to be investment advice or solicitation or recommendation to establish market positions. We recommend that independent professional advice is obtained before you make any investment or trading decisions. ( Market Oracle Ltd , Registered in England and Wales, Company no 6387055.

Registered office: 226 Darnall Road, Sheffield S9 5AN , UK )

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.