80 U.S. Bankrupt Bailed Out Banks This Year, Hitting Depression Era Level

Stock-Markets / Financial Markets 2009 Aug 22, 2009 - 07:25 PM GMT Georgia and Alabama banks with combined assets of $927 million were seized by regulators, pushing the tally of failed U.S. lenders this year to 80 amid the worst economic crisis since the Great Depression.

Georgia and Alabama banks with combined assets of $927 million were seized by regulators, pushing the tally of failed U.S. lenders this year to 80 amid the worst economic crisis since the Great Depression.

State regulators shut CapitalSouth Bank of Birmingham, Alabama, and First Coweta Bank of Newnan, Georgia, and the U.S. Office of Thrift Supervision closed ebank, an Atlanta-based Internet lender. The three banks had $841 million in deposits, and the failures will cost the Federal Deposit Insurance Corp. $262 million, the agency said today in news releases. A total of 18 Georgia banks collapsed this year, 23 percent of the total.

Long-term budget deficit $2 trillion higher than stated.

A White House budget review set for release Aug. 25 will show cumulative deficits over the next decade amounting to $9 trillion, up from $7.1 trillion that the administration predicted in May, the official said on condition of anonymity because the figures haven’t been made public.

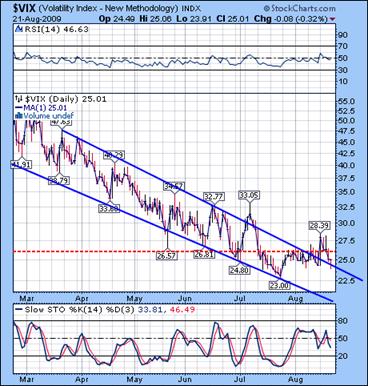

The VIX may be optioned.

--Investors should buy options expiring in the next few months to protect against a potential spike in prices (in the VIX) amid concern “significant economic headwinds” may damp a recovery, according to Morgan Stanley. “Financial conditions, eventual cooling production and cautious consumers” signal that recent improvement in some economic indicators is “unlikely to spill over into a stronger overall recovery,” Morgan Stanley analysts, including New York- based Sivan Mahadevan, wrote in a report to clients.

--Investors should buy options expiring in the next few months to protect against a potential spike in prices (in the VIX) amid concern “significant economic headwinds” may damp a recovery, according to Morgan Stanley. “Financial conditions, eventual cooling production and cautious consumers” signal that recent improvement in some economic indicators is “unlikely to spill over into a stronger overall recovery,” Morgan Stanley analysts, including New York- based Sivan Mahadevan, wrote in a report to clients.

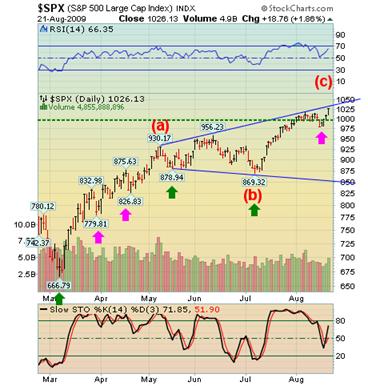

The SPX reaches for the trendline…

--The SPX rallied to a new high, exceeding the recovery rally from the Crash of 1929 in size and time.

The indexes may have put in a 1/2 Trading Cycle bottom. This extends the 23 week cycle low at least two more weeks, along with the Primary Cycle bottom, which is now in its window for a low during the same time period. Options expiration was rescued from another debacle, but may be making the decline worse by squeezing it into a tighter period. Critical Support is at 999. Trend resistance is at 1021-1025. We may see a reversal pattern once below resistance. You can see the Broadening Top trendline is at 850, which implies a drop below that level.

The NDX near a turning point.

--The NDX may have reached a critical resistance point today. Trendlines on a weekly chart are seldom accurate down to the point, but one may safely say that the NDX is very near a strong turning point. Trend resistance is at 1640 and the rally has been hugging its trendline all day. Critical Support at 1598 is the level below which things become more bearish in the NDX. The next target is below 1395, which is the July low.

--The NDX may have reached a critical resistance point today. Trendlines on a weekly chart are seldom accurate down to the point, but one may safely say that the NDX is very near a strong turning point. Trend resistance is at 1640 and the rally has been hugging its trendline all day. Critical Support at 1598 is the level below which things become more bearish in the NDX. The next target is below 1395, which is the July low.

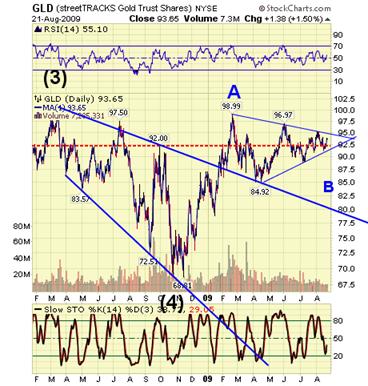

GLD wrapping up a symmetrical triangle.

-- GLD rallied just above Critical Support Friday at 92.45. The defining pattern, however, is the symmetrical triangle. A rally above 95 would let us know that a very strong rally is about to begin in GLD. However, a drop below 91.00 may signal some short-term pain for the gold bugs. The reason why is that there is often a false breakout in these triangles in the opposite direction before the rally begins. So, a sell-off in stocks may also trigger the false break in GLD. This is a time to be careful.

-- GLD rallied just above Critical Support Friday at 92.45. The defining pattern, however, is the symmetrical triangle. A rally above 95 would let us know that a very strong rally is about to begin in GLD. However, a drop below 91.00 may signal some short-term pain for the gold bugs. The reason why is that there is often a false breakout in these triangles in the opposite direction before the rally begins. So, a sell-off in stocks may also trigger the false break in GLD. This is a time to be careful.

Is the Oil Bubble still inflating?

--USO has been in a rally mode this week. The pattern appears to be an expanding triangle formation. The final wave may fail at any time it exceeds its prior high, so extreme caution is advised. It has stayed above critical support at 37.18 this week, but I am not long. If the market rally on Monday, USO may participate. I have noted intra-day that there may be a reversal pattern given this afternoon in USO.

--USO has been in a rally mode this week. The pattern appears to be an expanding triangle formation. The final wave may fail at any time it exceeds its prior high, so extreme caution is advised. It has stayed above critical support at 37.18 this week, but I am not long. If the market rally on Monday, USO may participate. I have noted intra-day that there may be a reversal pattern given this afternoon in USO.

TLT is taking a pause.

-- Treasuries fell, with 2-year notes sliding the most in two weeks, as existing home sales surged in July and Federal Chairman Ben S. Bernanke said the global economy is “beginning to emerge” from recession.

-- Treasuries fell, with 2-year notes sliding the most in two weeks, as existing home sales surged in July and Federal Chairman Ben S. Bernanke said the global economy is “beginning to emerge” from recession.

Critical Support is at 94.70. TLT missed it breakout by a buck, but may have another go at it very soon. It closed at a potential support today and trend support is close by at 93.00.

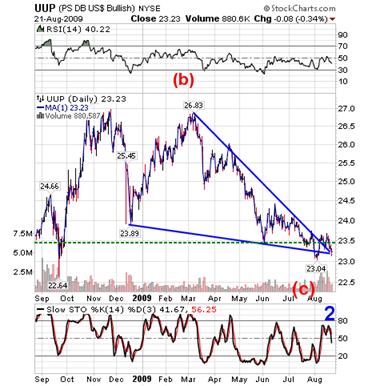

UUP retesting its bullish wedge

--UUP has spent the last several days retesting the bullish wedge formation and its own Critical Support at 23.41.

--UUP has spent the last several days retesting the bullish wedge formation and its own Critical Support at 23.41.

I am still bullish against 23.04. Bullish wedges tend to be fully retraced, so I expect a strong rally to develop in UUP.

In summary, wedges triangles and broadening tops are all coiling actions that are building up to strengthen the next move. It is obvious that their reversals may be delayed, but that just tightens the spring for a greater push back when it breaks out. I hope you all have a relaxing weekend!

Tyler Durden outed!

A 30-year-old New Yorker who was barred from the securities industry last year may be behind an increasingly popular financial blog known as Zerohedge.com, which is catching flack for its obsession with anonymity.

Daniel Ivandjiiski, whose most recently listed address is on the Upper East Side, was barred last September by the financial industry's self regulatory authority, FINRA, for insider trading.

Ivandjiiski is also suspected of being one of the founders of controversial financial blog Zerohedge.com, sources tell The Post.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.