Mortgage Fixed Rates Disappearing Again…

Housing-Market / Mortgages Jun 17, 2007 - 12:57 AM GMTBy: MoneyFacts

Lisa Taylor, of Moneyfacts.co.uk – the money search engine, comments:“With base rate remaining on hold, at least for the next month, we may have expected the mortgage market to have settled. However this is far from the case, especially for fixed rate deals that have been either disappearing off the shelves or increasing rapidly.

Lisa Taylor, of Moneyfacts.co.uk – the money search engine, comments:“With base rate remaining on hold, at least for the next month, we may have expected the mortgage market to have settled. However this is far from the case, especially for fixed rate deals that have been either disappearing off the shelves or increasing rapidly.

“Since the shock base rise in January, the general trend has been of rising fixed rates. With swap rates now topping 6% and short term rates in excess of 6.25%, its no wonder that lenders need to reprice their deals.

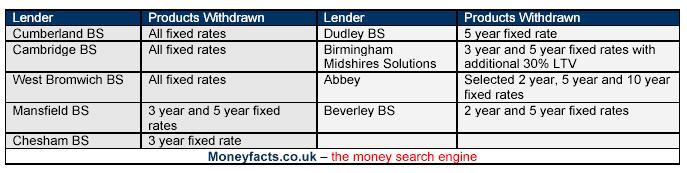

“Since the start of June at least nine mortgage lenders have withdrawn either selected fixed rate deals, or their entire range, without relaunching replacement products.

“A further 30 lenders have increased the rate on their fixed rates deals by as much as half a percent. This includes some of the larger mortgage lenders, including Abbey (by up to +0.30%), NatWest Mortgage Services (by up to +0.50%), Bank of Scotland Mortgages (by up to +0.30%) and Royal Bank of Scotland (+0.20%).

“Fixed rate deals under 6% are still readily found, but if swap rates continue to rise at their current pace it won’t be long before we see the demise of sub six percent mortgages, unless you are prepared to pay a massive upfront fee.

“Anyone coming to the end of a fixed rate deal, especially those who were on five year deals, will be in for a nasty shock when they see the increase in their monthly repayments. With a further rate rise still potentially on the cards for 2007, those consumers on a tight budget will need to act quickly before more of the current best buy fixed rate deals vanish.

“With some discounted mortgage deals to be found closer to the 5% mark, there is still some room for rates to increase before you are faced the similar rates to fixed deals. If rates do fall in the medium term, as many expect, you will of course benefit from lower repayments.

“With around 70% of mortgage applications for fixed rate deals, the additional demand, competition and expectations of a further rise are simply pushing up prices. As lenders take a conscious approach to retain rates at the lowest possible level, it is even more important for us to move away from a rate focused comparison and to take into account the full costs of the mortgage deal.”

www.moneyfacts.co.uk - The Money Search Engine

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.