Grab Your Shorts, the Stock Market Correction Has Begun

Stock-Markets / Stock Index Trading Aug 19, 2009 - 12:10 AM GMTBy: Graham_Summers

As I’ve noted in previous essays, this stock market rally has come much too far, much too fast. All told the S&P 500 is up over 48% since the March lows. This is unprecedented in the post-WWII era.

As I’ve noted in previous essays, this stock market rally has come much too far, much too fast. All told the S&P 500 is up over 48% since the March lows. This is unprecedented in the post-WWII era.

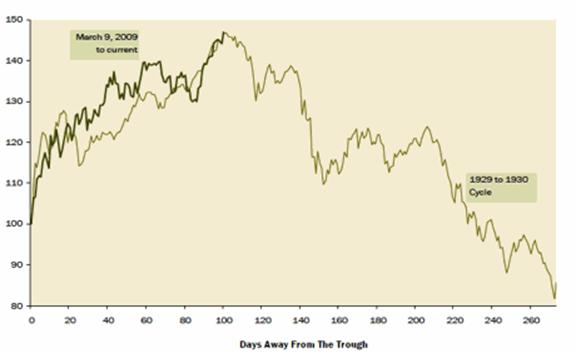

As I’ve pointed out earlier, this rally is mirroring the post-‘29 Crash rally to perfection. In fact, we just hit the “peak” in terms of both gains and days. This does not bode well for stocks.

At current levels, the S&P 500 is pricing in a 40-50% growth in earnings for 2010 AND GDP growth of 4.5% for the 3Q09. I put the likelihood of both of these items at less than 1 in 100. Earnings may have beaten Wall Street estimates, but they did so by laying off workers en masse and cutting back on inventory.

REAL earnings (including credit write-downs), in contrast, have fallen off a cliff. And they’re not coming back any time soon. The reasoning is simple: the CONSUMER IS DEAD. Despite incredible stimulus efforts, consumer spending fell at a -1.2% annualized rate in June.

In simple terms, the government is finding it harder and harder to get growth out of debt: it now takes a record $5 and change in debt to stimulate $1 in GDP growth. Failing another Stimulus Plan (I’m not in favor of this), 3Q09 earnings will be a disaster. And even WITH another Stimulus, there is NO CHANCE of earnings rebounding 50% in the next six months.

Historically, as famed economist David Rosenberg notes, by the time the stock market rallies 48%, the following have occurred:

- Real GDP had expanded on average by 4.5%

- Employment had rebounded an average of 850k jobs

- Corporate profits had recovered 12%

- Bank lending had risen an average of 5%

This time around, NONE of those has occurred. This market has risen largely based on momentum NOT fundamentals. And it’s beginning to show serious signs of weakness.

First and foremost, the financial bell-weather, Goldman Sachs (dotted line), which has been leading stocks (S&P 500= solid line) on the upside, has broken down.

As you can see, GS peaked a few weeks ago and has since posted a significant decline of more than 5%. Meanwhile the S&P 500 has only just started to come unraveled.

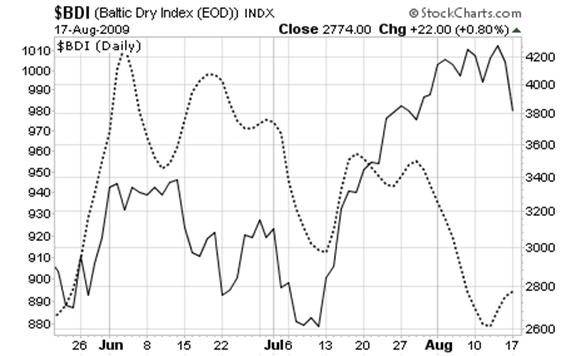

Besides this, the Baltic Dry Index has failed to confirm the July rally in stocks. If you’re unfamiliar with the Baltic, it measures shipping rates around the world. When people are moving a lot of goods and ships are in high demand, the Baltic rises. In contrast, when things slow down and ships needed less, the Baltic drops.

And as you can see, the Baltic (dotted line) has been dropping steadily against stocks (solid line) since June, which indicates that claims of economic recovery and growth are just that: claims, NOT facts.

The S&P 500 has finally begun to acknowledge these realities and is tipping over. As my friend and colleague Brian Heyliger noted in yesterday’s essay, we could well drop to 930 in the next week or so.

If you’ve not yet gone short, don’t worry. Tomorrow’s (Thursday) performance gaming due to options expiration could very well offer you a good entry point.

You see, August’s options expire on Friday. Because of this, traders who are underwater on their positions will try to push the market higher in order to close out their positions for a gain. Historically the day before expiration (Thursday) sees the largest market jumps as traders pile in pushing the market higher.

In light of this, I would not at all be surprised if the S&P 500 rallies hard tomorrow. When and if it does, you should get a good entry point to establish some shorts. Once options expiration is over after Friday’s close, the fundamentals should take hold of the market again, pushing stocks lower.

I’ve put together a FREE Special Report detailing THREE investments that will explode when stocks TRULY collapse. I call it the Financial Crisis “Round Two” Survival Kit. These investments will not only protect your portfolio from the coming carnage, they’ll also show you enormous profits: they returned 12%, 42%, and 153% last time stocks collapsed.

Swing by www.gainspainscapital.com/gold.html to pick up your FREE copy!!

Good Investing!

Graham Summers

Graham Summers: Graham is Senior Market Strategist at OmniSans Research. He is co-editor of Gain, Pains, and Capital, OmniSans Research’s FREE daily e-letter covering the equity, commodity, currency, and real estate markets.

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2009 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.