How to Profit as Consumers Tighten Their Purse Strings

Stock-Markets / Recession 2008 - 2010 Aug 18, 2009 - 09:38 AM GMTBy: MoneyWeek

If you're expecting a brief round of belt-tightening before things return to normal, you'll be disappointed. It's time to get defensive, says David Stevenson.

If you're expecting a brief round of belt-tightening before things return to normal, you'll be disappointed. It's time to get defensive, says David Stevenson.

A seismic shift is starting, both in Britain and America, in the way that people spend – or save – their cash. And it could flag the biggest change in consumer behaviour for 50 years.

"I've often written that the four most dangerous words in the investment world are 'This Time It's Different'. It almost never is," says John Mauldin of Millennium Wave Advisors. "And yet – I'm going to make the case that it really is different this time." Mauldin is one of the sharper fund managers around. So it's worth taking notice when he says: "We're on a track that looks far more like the Great Depression than the recessions of our lifetimes. We're hitting a massive reset button taking us to a new and lower level of consumer spending and leverage, etc. No one knows what the new level will be."

"I've often written that the four most dangerous words in the investment world are 'This Time It's Different'. It almost never is," says John Mauldin of Millennium Wave Advisors. "And yet – I'm going to make the case that it really is different this time." Mauldin is one of the sharper fund managers around. So it's worth taking notice when he says: "We're on a track that looks far more like the Great Depression than the recessions of our lifetimes. We're hitting a massive reset button taking us to a new and lower level of consumer spending and leverage, etc. No one knows what the new level will be."

At first glance, that may look a bit over the top. Yes, consumers are cutting back as house prices fall and job losses mount. But isn't this just a temporary round of belt-tightening before things 'return to normal' any day now?

We don't think so. Consumer confidence – despite rebounding a little from its lows – remains very fragile on both sides of the Atlantic, even compared to previous recessions. And small wonder. Not only have dole queues grown fast in both Britain and the US, but they're also set to get a lot longer. At 7.6%, British unemployment is already at its worst for 12.5 years and is likely to move towards 10% next year, says the Confederation of British Industry. In May, the US jobless rate hit 9.5%, its highest point in no less than 26 years. Again, it's likely to head even higher in 2010.

It's not just rising job losses that will force consumers to cut back. House-hold wealth has taken a pasting, meaning less money will be available to spend. For example, the collapse in property and share prices has sheared $11trn off the value of US families' net assets – about 18% of the total (more on this in a moment).

Surging borrowing was a crucial factor in fuelling the consumer boom. But the 'inverse wealth effect' has slashed the collateral consumers can borrow against. In other words, falling house prices mean there's no more equity for consumers to 'withdraw' from their homes. And that's at a time when consumers are in no position to borrow more. Personal debt as a share of disposable income in the US now stands at 130%, more than twice the 1980s peak. In Britain the figure is over 170%.

That's all scary enough. But there are two other key issues that will force 'Anglo-Saxon' consumers to save rather than spend. Firstly, they could soon have even less cash in their pockets as their pay packets come under threat. American average hourly earnings were unchanged between May and June, cutting the annualised rate of earnings growth to the lows last seen in late-2003.

It's only a matter of time before Americans see an actual drop in hourly earnings. Average earnings growth has already turned negative in the UK, says Capital Economics, and looks set to weaken further. Outright pay cuts, temporary periods of unpaid work or sabbaticals are becoming more common.

Secondly, there's the demographic factor. During the 'baby boom' years between 1946 and 1964, 76 million Americans were born. As of late-2008, they held the US purse strings, controlling 50% of the nation's entire discretionary income, purchasing 43% of all new cars, accounting for 79% of all leisure travel spending, and eating out four to five times per week. That all stacked up to the baby boomers outspending younger generations by a ratio of 2:1. In short, from 1980 to 2007, boomers were the money behind almost every economic development in the country.

But they're also the ones picking up the bill for the household wealth implosion. In just one year, they lost nearly 20% of the money they had planned to retire on, and the pain keeps coming as the US housing market meltdown continues. Now "boomers are in trouble", says Graham Summers on Seeking Alpha. "We've now entered what may be the greatest period of wealth destruction in American history. The effects on boomer spending and investing will completely change the investing and economic landscape for the US regardless of what the Fed, Obama, or any other economic/political authority attempts."

In other words, America's boomers will be cutting back and saving what they can. And Britain's boomers will have to do the same.

"I think we're at a behaviour inflection point," says Professor Edward Kerschner of Global Wealth Management on CNNMoney. "Consumers aren't just being frugal – they're being thrifty." And this "isn't just a cyclical retrenchment. We're seeing a shift from 'conspicuous consumption' to 'conscious consumption'." Pimco's Mohammed El Erian calls it the "new normal."

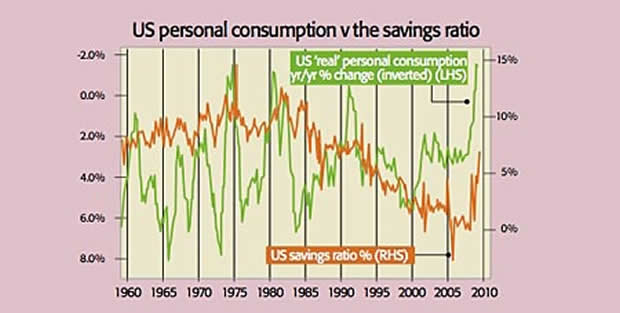

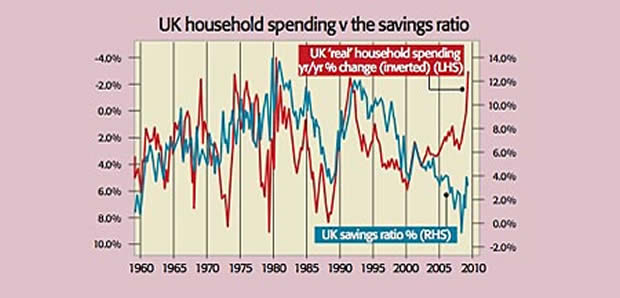

So how will this savings drive play out? The charts on the right show what's been happening to the savings ratio (the percentage of household disposable income stashed away) and consumption over the last 50 years. The dark line in each case shows the savings ratio, which in both Britain and America was on a progressive decline from the low to mid teens 30 years ago to zero by 2007. In other words, consumers weren't saving any net money out of their incomes. That hadn't been seen in Britain since 1959, and was a new experience for the US.

Meanwhile, consumer spending just kept on going. The dotted line shows the real (inflation adjusted) year-on-year change in private consumption. We've inverted it to show how consumers tended to spend more even as they saved less. Until the latest recession, that is. The savings ratio in both countries has rebounded off zero, and consumption fell off a cliff.

But the reason it's different this time is that, on previous occasions when consumers retrenched, they at least had some cash in the kitty eventually to kick start another spending spree. But now the cupboard is bare and it looks like a long-lasting shift has begun. "It would not be at all unusual for savings to go to 9% or more in a few years," says Mauldin. "That means consumer spending will drop by 9%."

Now is the time to invest in businesses that will prosper from the 'new normal' – stocks that will benefit from newly 'thrifty' consumers

A long-term rise in the savings ratio will mean homeowners staying put for longer; cars being driven for another year or two; shoppers hunting for value; and more holidays at home, or 'staycations', as Ravi Dhar of Yale's Centre for Consumer Insights tells SmartMoney. Less cash being splashed in shopping malls, high streets or online will be bad news for a wide range of retailers and their suppliers. But it won't be bad news for every company.

"The idea again is a focus on thriftiness, on long-term value and savings," says Professor Kerschner. "People aren't going to be talking about 20% returns from the hottest initial public offering or hedge fund. They're going to be considering the value of their investments." In a nutshell, this requires a new approach to selecting and buying shares. 'Cyclical' stocks, such as commodity producers and industrials, which have driven the global stockmarket rally since 9 March, depend on improving economies for their profits. With "the global crisis morphing again", says El Erian, "threatening the potency and credibility of the economic policy-making apparatus, the economy will continue to struggle". That's bad news for cyclical stocks' earnings – and their share prices, too.

So what should you buy? We've been banging the 'defensive' drum for a while now. These are firms that don't need economic growth to make their money, like pharmaceuticals, utilities and telecoms. Now could also be the right time to invest in businesses that will prosper from the 'new normal' – stocks that will benefit from newly 'thrifty' consumers. We look at seven options here: Seven stocks to cash in on the new thrift.

By David Stevenson for Money Morning , the free daily investment email from MoneyWeek magazine .

© 2009 Copyright Money Week - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Money Week Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.