The Potential for Future Economic GDP Growth

Economics / Economic Stimulus Aug 18, 2009 - 03:15 AM GMTBy: John_Mauldin

This week I offer you two short pieces for your Outside the Box Reading Pleasure. The first is from my friends at GaveKal and is part of their daily letter. They address the real difference between those who think we will have a consumer led recovery (Keynesian) and those who think we will have a corporate profit led recovery (classical economics or Schumpeterian). This is actually a very important debate and distinction. I find that GaveKal pushes me to think almost more than any other group, as they constantly challenge my assumptions. (www.gavekal.com)

This week I offer you two short pieces for your Outside the Box Reading Pleasure. The first is from my friends at GaveKal and is part of their daily letter. They address the real difference between those who think we will have a consumer led recovery (Keynesian) and those who think we will have a corporate profit led recovery (classical economics or Schumpeterian). This is actually a very important debate and distinction. I find that GaveKal pushes me to think almost more than any other group, as they constantly challenge my assumptions. (www.gavekal.com)

The second piece comes from Dr. John Hussman of Hussman Funds (www.hussmanfunds.com). He offers us some very insightful analysis on the potential for growth going forward, which goes along with what I have been writing: We are in for a longer period of below trend growth, which does not bode well for corporate profits in the long run. I think you will get a lot out of these two items.

John Mauldin, Editor

Outside the Box

Growth in Potential GDP

Daily Observations from GaveKal

We are hearing concerns, from some clients and friends, that the brutal corporate cost-cutting seen in the wake of the subprime crisis will delay the recovery, because this trend is killing the US consumer. In other words, how can one spend if he has lost his job or fears as much, or has seen his work hours drastically reduced, taken a pay cut, or expects his company pension system is about to implode? For us, this all boils down to a crucial question: do we need consumption to pick up in order to achieve a rebound in growth? The answer to this question very much depends on whether one accepts a Keynesian view of the economic process, or a Schumpeterian (or classical) view. We hope our readers forgive us, but we are now going to have to get a tad theoretical....

* In a Keynesian view, consumption is the motor of growth. If companies slash their payrolls, consumption contracts and we enter into a vicious cycle in which the subsequent decline in demand leads to a second wave of cuts, which then leads to a further decline in consumption, and so on and so forth. The Keynesian cycle may have been useful from 1945 to 1990, but in the past 20 years, globalization and just-in-time technologies have changed the nature of corporate management, which is why we believe a classical, capital-spending led view of the economic cycle will reassert itself.

* In a classical view, as exemplified by "Say's law" and reinforced by Schumpeter, corporate profitability is the cause, not the consequence, of economic growth. Thus, Schumpeter would see the current cycle as the destruction phase in the creative-destruction processes that propel the economic cycle. Capital and labor are currently moving from the sectors in decline (e.g., McMansions) to the sectors in expansion (e.g., tech, alternative-energy infrastructure, etc.). Once momentum in the growth sectors overwhelm the decaying ones, then macro growth resumes. Under this framework, consumption kicks in at the end of the cycle (for more on this, see the very first paper published by GaveKal, Theoretical Framework for the Analysis of a Deflationary Book).

Within our firm, Charles is the major proponent of the Schumpeterian view, and this thinking was apparent in his and Steve's recent ad hoc, A V-Shaped Recovery in Profits. Due to the quick reflexes that new technologies allow, corporates are managing their cash flow better than ever. Rarely ever, for instance, have companies (ex-financials) remained in such strong positions during a recession, which is yet another reason why we believe that capital spending, rather than consumption, will spark the recovery.

Indeed, the scale at which corporates have been able to cut costs and return to profitability, has laid the groundwork for a deflationary boom of epic proportions (which would be a major surprise for those who fear an easy-money inflationary nightmare). Of course, there is a major threat to this deflationary-boom scenario-and that is the increased government intervention we are seeing in most corners of the world. If government intervention manages to kill off return on investment capital, as it did in the 1930s, then the current opportunity will go up in smoke. Regular readers know we tend to err on the side of optimism; at this point we still hold out hope that a major lurch to a big-government era can be resisted-as exemplified, for example, by the unexpectedly strong fight we are seeing against the health-care bill, or the ability of so many US financials to pay back their debt to the US Treasury, thus lowering the extent of government influence on their business decisions. Thus, in our view, a period of deflationary boom is the likeliest scenario, and investors should focus on sectors and countries that will see the largest resurgence in capital spending.

Growth in "Potential GDP" Shows Limited Potential

By John P. Hussman, Ph.D.

Historically, two factors have made important contributions to stock market returns in the years following U.S. recessions. One of these that we review frequently is valuation. Very simply, depressed valuations have historically been predictably followed by above-average total returns over the following 7-10 year period (though not necessarily over very short periods of time), while elevated valuations have been predictably followed by below-average total returns.

Thus, when we look at the dividend yield of the S&P 500 at the end of U.S. recessions since 1940, we find that the average yield has been about 4.25% (the yield at the market's low was invariably even higher). Presently, the dividend yield on the S&P 500 is about half that, at 2.14%, placing the S&P 500 price/dividend ratio at about double the level that is normally seen at the end of U.S. recessions (even presuming the recession is in fact ending, of which I remain doubtful). At the March low, the yield on the S&P 500 didn't even crack 3.65%. Similarly, the price-to-revenue ratio on the S&P 500 at the end of recessions has been about 40% lower than it is today, and has been lower still at the actual bear market trough. The same is true of valuations in relation to normalized earnings, even though the market looked reasonably cheap in March based on the ratio of the S&P 500 to 2007 peak earnings (which were driven by profit margins about 50% above the historical norm).

Stocks are currently overvalued, which - if the recession is indeed over - makes the present situation an outlier. Unfortunately, since valuations and subsequent returns go hand in hand, the likelihood is that the probable returns over the coming years will also be a disappointingly low outlier. In short, we should not assume, even if the recession is ending, that above average multi-year returns will follow.

That conclusion is also supported by another driver of market returns in the years following U.S. recessions: prospective GDP growth. Every quarter, the U.S. Department of Commerce releases an estimate of what is known as "potential GDP," as well as estimates of future potential GDP for the decade ahead. These estimates are based on the U.S. capital stock, projected labor force growth, population trends, productivity, and other variables. As the Commerce Department notes, potential GDP isn't a ceiling on output, but is instead a measure of maximum sustainable output.

The comparison between actual and potential GDP is frequently referred to as the "output gap." Generally, U.S. recessions have created a significant output gap, as the recent one has done. Combined with demographic factors like strong expected labor force growth, this output gap has resulted in above-average real GDP growth in the years following the recession.

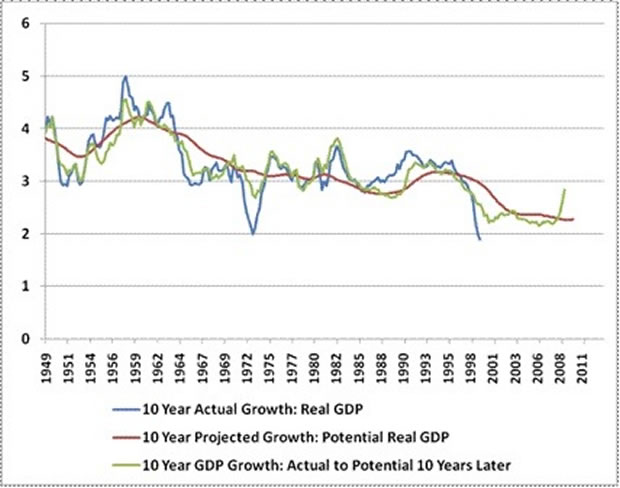

The chart below shows the 10-year growth rates in actual and potential GDP since 1949 (the first year that data are available).

The blue line presents actual growth in real U.S. GDP in the decade following each point in time. This line ends a decade ago for obvious reasons. The red line presents the 10-year projected growth of "potential" real GDP. This line is much smoother, because the measure of potential GDP is not concerned with fluctuations in economic growth, only the amount of output that the economy is capable of producing at relatively full utilization of resources.

One of the things to notice immediately is that because of demographics and other factors, projected 10-year growth in potential GDP has never been lower. This is not based on credit conditions or other prevailing concerns related to the recent economic downturn. Rather, it is a structural feature of the U.S. economy here, and has important implications for the sort of economic growth we should expect in the decade ahead.

The green line is something of a hybrid of the two data series. Here, I've calculated the 10-year GDP growth that would result if the current level of GDP at any given time was to grow to the level of potential GDP projected for the following decade. This line takes the "output gap" into effect, since a depressed current level of GDP requires greater subsequent growth to achieve future potential GDP. Notice here that even given the decline we saw in GDP last year, the likely growth in GDP over the coming decade is well under 3% annually - a level that we have typically seen in periods of tight capacity (that were predictably followed by sub-par subsequent economic growth), not at the beginning stages of a recovery.

The situation is clearly better than it was at the 2007 economic peak, where probable 10-year economic growth dropped to the lowest level in the recorded data, but again, the likely growth rate is still below 3% annually over the next decade even given the economic slack we observe.

Aside from a gradual recovery of the "output gap" created by the current downturn, there is no structural reason to expect economic growth to be a major driver of investment returns in the years ahead. With valuations now elevated above historical norms, there is no reason to expect strong total returns on an investment basis either.

The primary element that is favorable at present is speculation - excitement over the prospect that the recession is over. Investors are presently anticipating the good things that have historically accompanied the end of recessions (strong investment returns and sustained economic growth), without having in hand the factors that have made those things possible (excellent valuations and a large output gap coupled with strong structural growth in potential GDP).

By John Mauldin

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2008 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.