Deflation Relative to What?

Economics / Deflation Aug 16, 2009 - 05:35 PM GMTBy: Adam_Brochert

As the deflation versus inflation debate rages on, both sides present reasonable arguments that sound plausible. I am in the camp that believes stocks, commodities, corporate bonds and real estate have much further to fall. Now falling prices are not the same thing as deflation, but they are a visible symptom. To be honest, I am a pragmatist. I am not as concerned about getting my exact definitions right as I am understanding what to do with my savings.

As the deflation versus inflation debate rages on, both sides present reasonable arguments that sound plausible. I am in the camp that believes stocks, commodities, corporate bonds and real estate have much further to fall. Now falling prices are not the same thing as deflation, but they are a visible symptom. To be honest, I am a pragmatist. I am not as concerned about getting my exact definitions right as I am understanding what to do with my savings.

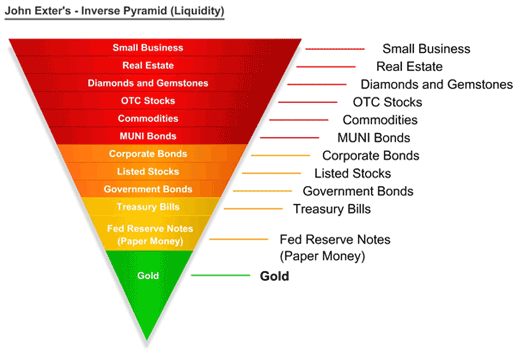

I believe all major asset classes are deflating in value relative to Gold and will continue to do so for at least a few more years. Cash in the form of US Dollars, since it is the reserve currency of the world (for now), should do fine as well for a while but presents significant risk as the deflation grinds on. This all goes back to a concept I have embraced known as Exter's liquidity pyramid. See here for some background info and below is a reproduction of a common rendering of this pyramid floating around in cyberspace:

When you think about the end stages of this deflation/liquidity pyramid, you realize how similar deflationists and hyperinflationists are in an idealized model. When a fiat credit bubble pops, assets at the top of the pyramid decline in value and "liquidity" flees these asset classes and scrambles down the pyramid towards the apex for safety. The moves are not always orderly, but as deflation intensifies, physical cash in the form of currency notes and Gold become highly valuable relative to standard investment asset classes like stocks, commodities, real estate and corporate bonds.

This fits with the classic saying "cash is king" during deflation. The problem is that you have to hold the right kind of cash. Almost no one alive today has lived under a true Gold standard where paper cash notes could readily be converted into physical Gold in the same manner that paper dollars can now be converted into quarters and dimes. I don't mean buying Gold at a coin shop, I mean exchanging paper notes for Gold at a bank or government office without incurring fees or paying a premium.

Now many scoff at this notion and think it is antiquated/quaint, restrictive or just plain bat shit crazy as a monetary system. The fact that otherwise rational and sane people laugh at the concept of Gold as money just goes to show how truly off course and ignorant America in particular has become regarding monetary issues. There are very few who don't experience at least some cognitive dissonance when the government keeps spending more and more money it doesn't have and promising more and more things we can't afford as a nation. These things happen because we have decreed as a nation that paper promises are the same as money and indeed they function this way for day to day transactions and will continue to do so for quite some time.

And during a bad deflation, paradoxically, the value of this intrinsically worthless paper becomes more valuable. In a sense, it is a cyclical bull market for cash in the midst of a perpetual secular bear market that characterizes all fiat currencies. No market moves in a straight line. It is not so much that cash is more intrinsically valuable, it simply falls in value slower than other asset classes so that cash can buy more assets.

For the saver and investor, it is thus prudent during deflation to hoard cash, as that cash can buy a greater number of assets later. In other words, if one moved to cash before the housing crash started, then one could buy a bigger house than 2 years ago. House prices are deflating relative to cash. Again, there is monetary inflation and deflation and there is asset price inflation and deflation. While they are not the same, I am not a high level economist in the academic world. I am trying to figure out where to keep my savings and investment money. If oil goes down to $20/barrel, does it really matter if the inflationists are technically right because the base money supply continues to expand through it all?

So, unlike many who harp on the subject, I am not as concerned with getting the academic concept correct as making sure my money is betting on the right asset classes over the next 5 years. So, in a sense, I actually am more interested in the symptoms rather than the underlying disease when it comes to investing. Having said that, I still think we are in a strong net deflationary environment right now. A modern fiat system is credit based and credit was functioning as a money substitute during the previous bubble. Now that credit is contracting at a scary pace, it is overwhelming the bureaucratic efforts to "reflate" the system.

Where the argument of the deflationists and hyperinflationists come together is at the very apex of the pyramid. Those who shun the notion of Gold as money are going to feel the pain when history repeats yet again. Because in the final painful layer of deflation, people flee paper fiat notes for true non-debasable and non-debt based cash. That's where only Gold comes in handy. You see, at the apex of Exter's pyramid, paper fiat cash notes deflate relative to Gold, which is paradoxically inflationary in a sense as it requires more paper cash to buy Gold if this phase comes to fruition (and I believe it will).

In a sense, this is somewhat akin to itulip's "ka-poom" theory where a deflationary crash (they call it "disinflationary," but whatever) is followed by a currency crisis that re-ignites inflation in a hurry. This is also somewhat akin to Trace Mayer at runtogold.com talking about fiat currency evaporating as the credit contraction intensifies. In the 1930s (the last deflationary/credit contractionary depression the United States went through), this event occurred via a re-pegging of the US Dollar to Gold after making private Gold ownership illegal. Overnight, by government decree, people's savings we re-valued lower by 70%!

So in the end, both the deflationists and inflationists will be proven right in a pragmatic sense, but I think we have to go through further deflationary pain before the step of a one-time rapid currency debasement occurs. Now this debasement could occur intentionally by government decree or via capital flight from the United States and either is possible. One of the reasons this is predictable in my opinion is because every wave of deflation is followed by more and more intense fiscal stimulus that is less and less able to be supported by underlying economic reality. In the end, something's gotta give.

This is not gloom and doom and I don't think the world is going to end. This is an actionable thesis that is worthy of investment consideration. Gold provides portfolio insurance that is growing more valuable by the day. Maybe this time is different. Maybe Obama and Ben Bernanke are so amazing that they can go ahead and spend another $1,000 trillion and no one will care and the rest of the world will buy our paper promises with an increasingly rabid appetite. Maybe unrealistic paper promises can be made ad infinitum and all economic realities will be suspended forever. Maybe we can re-inflate the credit bubble again and everyone can have a house, a car and a plane with no money down regardless of income and plus get a $1 million signing bonus at the time of closing. I'm guessing not, though.

Switching some of one's savings into physical (not paper) Gold now, while it can still be readily found, provides insurance against what is now an almost unavoidable future currency debasement event. Only the timing is still unclear in my mind, but you can bet that such an event won't be announced in advance and you won't be able to find physical Gold as a retail investor when it happens. Cash will ultimately deflate further relative to Gold and when it happens, the move will likely be fast and powerful. I think a dip of the Gold price to the low 900s or high 800s is dead ahead and will provide another great buying opportunity.

Visit Adam Brochert’s blog: http://goldversuspaper.blogspot.com/

Adam Brochert

abrochert@yahoo.com

http://goldversuspaper.blogspot.com

BIO: Markets and cycles are my new hobby. I've seen the writing on the wall for the U.S. and the global economy and I am seeking financial salvation for myself (and anyone else who cares to listen) while Rome burns around us.

© 2009 Copyright Adam Brochert - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be relia

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.