Before You Think of Going Short the Stock market index

Stock-Markets / Stock Index Trading Aug 14, 2009 - 01:10 AM GMTBy: Andrew_Abraham

How many Stock market Bears are itching to go short the stock market index? Probably too many to count. However regardless of all the fundamental reasons and thoughts to blindly go short the stock market index, this is not prudent. One could possibly listen to Paul Tudor Jones who thinks this is a bear market rally. BTW.. Paul Tudor Jones made a fortune predicting the stock market index would crash in 1987.

On the other hand you have some Bulls that are predicting this powerful rally is just the beginning of a powerful Bull market. Any prudent trend following commodity trading advisor knows they do not know the future and they rely on signals to go long and short. No one knows any more than you.

Actually we have a commodity trading advisor that we have invested with that purchased the Nasdaq back in the spring and has been following this powerful ( bear market rally) trend. More so in all truthfullness this is a trade he does not believe in or like. ..But guess what..it has been nicely profitable and why we have invested with him…is he is disciplined and he manages the risk.

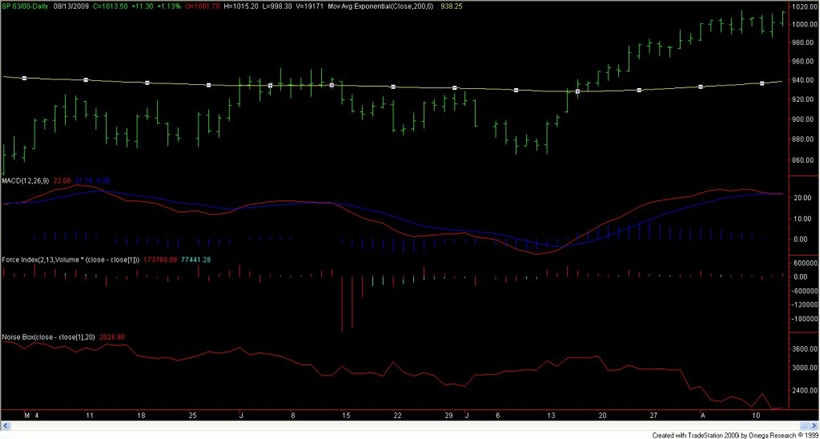

My point is in order to be successful when commodity trading or even trading the stock market index, one must put their opinions in their pocket. Commodity trading advisors rely on their thought out mechanical trading systems. For example we put on a trade selling the SP index several weeks ago. The trade did not work. We sustained a small loss. Again we are looking to sell the Nasdaq at 1520 with a risk to 1580. This is trade is based on the Donchian approach. I have no idea if it will work nor do I care. Another idea could be for one trying to short the stock market index is selling once the daily price closes two days below the 200 day exponential moving average. Using this method one would have avoided all the HUGE LOSSES in the stock market index back in Dec 2007.

Take a look at this chart… Trade with a plan if you want to succeed.

Andrew Abraham

www.myinvestorsplace.com

Andrew Abraham has been in the financial arena since 1990. He is a commodity trading ddvisor and co manager of a Commodity Pool. Since 1993 Andrew has been a proponent of quantitative mechanical trading programs. Andrew's major concern is not only total return on investment but rather the amount of risk that one would have to tolerate in order to achieve returns He focuses on developing quant models that encompass strict risk adherence and correlation. He has been a speaker at conferences as well as an author of numerous articles. Andrew has spent years researching ideas that have the potential to outperform indices as well as maintain fewer draw downs.

Visit Angus Jackson Partners (http://www.angusjacksonpartners.com) Contact: A.Abraham@AngusJackson.com (mailto:A.Abraham@AngusJackson.com)

© 2009 Copyright Andrew Abraham - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.