Social Security Safety Nets Mask Deflationary Economic Depression

Economics / Deflation Aug 12, 2009 - 10:22 PM GMTBy: Mike_Shedlock

In a recent video Robert Prechter says the Dollar's Hit a "Major Bottom" and that a deflationary depression is coming.

In a recent video Robert Prechter says the Dollar's Hit a "Major Bottom" and that a deflationary depression is coming.

According to Prechter, the Elliott Wave pattern in the US dollar confirms we recently hit the fifth wave down. Next stop is up. He also notes that sentiment has reached an extreme:

"The Dollar Sentiment Index for the Dollar Index reports just 3% bulls among traders, an extreme level only five times in the past 20 years, usually near an important low," Prechter wrote on Aug. 5. "The last time we saw readings like this was March-July 2008, just before the dollar soared." In other words, the "short the dollar" trade is overly crowded.

I mentioned the wave pattern on July 31 in Ewave Count on the US Dollar Suggests Move Up is Coming.

Here is an updated chart.

US$ Weekly Chart

Note that bearish sentiment on the dollar is at an all time high even though the dollar index is substantially higher than it was in April and July of 2008. That's bullish for the dollar.

I still show two "?" on the chart because technically wave 5's can extend. However, fundamentally and technically I do not expect expect it to extend, at least by much.

Social Safety Nets Mask Deflationary Depression

Prechter is looking for a "major economic depression". I think it is clear we are already in one.

The only reason it is not more readily visible is people are living in foreclosed houses unable or unwilling to pay their mortgage, one in nine living in the US is on food stamps, and unemployment insurance has been extended twice. Congress is now debating extending it a third time.

If Congress does not act 500,000 Will Exhaust Unemployment Benefits by September, 1.5 Million by Year-end.

Although the official unememployment rate is a mere 9.5% alternative measures show it is over 16%. Moreover, an unprecedented 4.4 million workers have been unemployed and looking for work for 26 weeks or longer. Please see Jobs Contract 19th Straight Month and US Payrolls Less Than Meets The Eye for details about jobs.

In simple terms, more social safety nets are in place now than during the great depression.

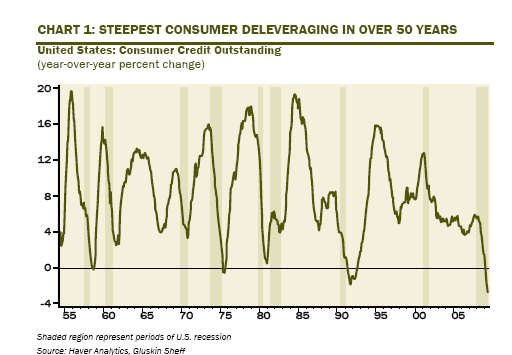

Steepest Credit Contraction in Over Five Decades

Given that deflation is a net contraction of money and credit one might ask for proof that such a phenomena is occurring. Dave Rosenberg put together a series of 5 stunning charts that I mentioned in US Consumer Credit Shows Steepest Contraction in Over 5 Decades.

Here is one of the charts.

Consumer Credit Outstanding

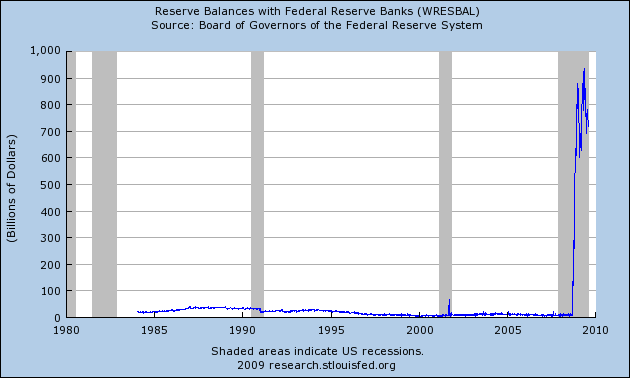

Soaring Money Supply vs. Credit Expansion

Many point to soaring money supply as "proof" of inflation. That is a misguided theory. Money sitting in banks as excess reserves because banks are scared to death to lend hardly constitutes "inflation".

Excess Reserve Balances

The above chart is proof enough of banks' unwillingness to lend and/or credit worthy individuals and businesses unwillingness to borrow.

Moreover, the destruction of credit, especially credit marked to market, continues at a huge pace. In a credit based fiat system, ultimately that is what matters.

Please see Fiat World Mathematical Model for a complete analysis.

Who's Affected By Credit Contraction?

A better question is "who's not affected by the credit contraction?" It's hard to come up with an answer to that.

Yesterday I noted Deflation Hits Porn Industry, Canadian Grocery Stores, Pension Plans, Newspapers, Firefighters, Lawyers, High Tech.

Wage freezes, benefit reductions, and mandatory furloughs are hitting a wide gamut of white collar, blue collar, and no collar industries.

Mr. Practical Is Back In The USA

Mr. Practical, a man of the world, travels freely and lives in a country in which he believes the currency will strengthen against the other world currencies. I am pleased to report he is now back in the USA.

Mr. Practical writes: "Hello Minyans! I have moved back to the USA, not because it is the best place to be, although it is a wonderful country. But because I expect the dollar now to be the strongest currency."

When asked to expound on his logic Mr. Practical cautions the Deflationary Debt Destruction Must Run Its Course. Here is the key idea:

Foreclosures, defaults, and delinquencies are being significantly under-reported even now as the government is supporting all of it and as regulatory bodies have allowed banks and other “investors” to over-value it.

As debt is destroyed the dollar will strengthen.

I think this will go on until stock prices hit new lows again and the government will abandon all sensibility. Not until then will be there be a hyper-inflationary event that most are looking for. It requires lower prices to spur lending to spur inflation. Hopefully by then my extended vacation in the US will have ended and I will be off to another place.I do not see hyperinflation coming to the USA anytime soon, if ever. Of course Mr. Practical does not expect it soon either or he would not be back in the USA. We can worry about inflation later, at the appropriate time.

The time to reconsider is after much of the consumer debt is destroyed and/or a derivatives blowup exposes fractional reserve lending for the fraud that it is.

In the meantime, too many have lost too much betting on hyperinflationary outcomes that are nearly impossible with this amount of debt overhang.

Bernanke's Deflation Preventing Scorecard

Indeed, please take a look at Bernanke's Deflation Preventing Scorecard if you have not yet done so.

Bernanke has now fired every bullet from his 2002 “helicopter drop” speech "Deflation: Making Sure "It" Doesn't Happen Here."

Robert Prechter has had a reasonably hot hand lately in regards to the stock market and the dollar. Mr. Practical has had a great run at picking countries in which to live. And sentiment-wise, with only 3% dollar bulls I am more than happy to join the small select group of individuals looking for continued deflation and a strengthening dollar.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

David

09 Jul 10, 10:15 |

social security payments

will ss payments continue if a depression is declared by the powers that be. "worried senior" |