Government Bailout's Implications for Future Stock Market Trend

Stock-Markets / Stocks Bear Market Aug 11, 2009 - 12:01 PM GMTBy: Mike_Shedlock

Inquiring minds are reading Cash for Clunkers Is Just a Broken Windshield by Caroline Baum. It's the best trashing to date of the "cash for clunkers" program.

Inquiring minds are reading Cash for Clunkers Is Just a Broken Windshield by Caroline Baum. It's the best trashing to date of the "cash for clunkers" program.

Transferring money from taxpayers to car buyers is a transfer. The money taken from taxpayers can’t be used for something else.

This is the lesson of Frederic Bastiat’s essay, “That Which is Seen, and That Which is Unseen.” Bastiat, a 19th century French political economist, tells the story of a shopkeeper who has to hire a glazier to repair a broken window, providing work and income for him in the process. That’s what is seen.

What is unseen is what the shopkeeper would have done if he didn’t have to pay the glazier. He might have bought shoes for his children, providing income for the shoemaker, who in turn could buy leather to produce more shoes. The glazier’s gain is the shoemaker’s loss. There is no net gain, no job or income creation, from this transaction.

Broken Window Fallacy

The “broken window fallacy,” as it is known, can be applied to all government spending. The $787 billion fiscal stimulus enacted in February transfers money from taxpayers to the government to allocate as it sees fit. The effect of the government’s expenditures shows up as growth in gross domestic product. Auto manufacturers produce more cars to meet the juiced demand, adding to GDP. This is what’s seen.

What is unseen is what would have been produced by the private sector had the government not confiscated future revenue via taxation.

Cash for clunkers requires that trade-ins be scrapped, whether they are fully depreciated or not. How is destroying something good for the nation?

James Hamilton, professor of economics at University of California, San Diego, says cash for clunkers adopts the worst of the New Deal policies and adapts it to today’s circumstances.

The Agricultural Adjustment Act of 1933 “paid farmers to slaughter livestock and plow up good crops, as if destroying useful goods could somehow make the nation wealthier,” Hamilton writes on his blog. “And yet, here we are again, with the cash for clunkers program insisting that working vehicles must be junked to qualify for the subsidy.”

Caroline touched on several key issues. The first is is money taken from taxpayers can’t be used for something else. The second regards the destruction of productive assets. I will add a a couple more.

Government seldom if ever allocates resources efficiently. That is another problem with all these stimulus efforts. Without market feedback, it is difficult if not impossible to spend money wisely. At best, government pushes demand forward. At worst, government pays money to destroy productive assets while going deeper in debt to do so.

Moreover, interest on debt from all these stimulus program is adding up. Eventually taxes have to rise to cover those interest payments. Rising taxes will reduce both future demand and future business hiring.

For more on the Seen and Unseen, including an analysis of misguided Keynesian stimulus efforts, please consider On the Brink of Recovery.

Government Spending Crowds Out Private Sector

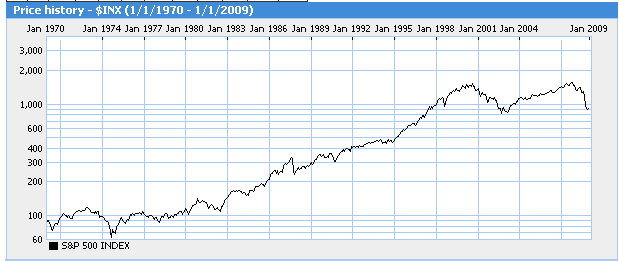

Here is a chart from a recent issue of Contrary Investor that touched on the above issues.

Commercial Bank Lending vs. Federal Debt 1970 - Present

Contrary Investor Writes:

Historically the year over year rate of change in bank lending and Federal borrowing has been negatively correlated. It has been an inverse relationship. Not too hard to understand as the government has stepped up stimulus efforts (borrowed stimulus efforts) when the private sector pulls back during economic periods of slowing.

The top clip of the chart above is clear in that bank lending (private sector borrowing) has slowed on a rate of change basis during or very near all US recessions of the last four decades at least. Simultaneously, as the bottom clip of the chart reveals, the annual rate of change in government spending (federal Government borrowing) has expanded during recessions.

The period we’ve colored in red coincides almost perfectly with what was one of the greatest and most long lived equity bull markets and economic expansions in US history. What did that decline in Federal borrowing really represent and why did it coincide with the equity bull?

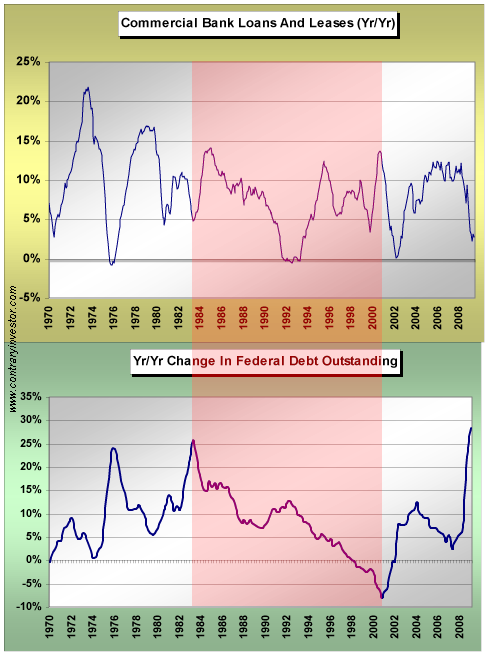

It represented a period where the Government stopped “crowding out” the private sector in the US. The less the government competed for funds with the private sector (on a rate of change basis), the better the macro US economic outcomes that were achieved and the better the stock market reward for an increasingly private sector centric economy.S&P 500 1970 - Present

Note that the biggest bull market in history came during the steepest drop in history in the year over year rate of change of federal debt.

Coincidence or Something More?

For a look at what might be coming, take another look at the Japanese stock market as presented in Effect of Household Deleveraging on Housing, Consumption and the Stock Market.

Nikkei Stock Index 1980-Present

A look at the Nikkei shows that Japan has already lost two decades since the peak in 1990. It is likely the US follows the same general pattern.

Keynesian clowns think the economy can be jump started by government spending. Japan tried that for a decade. Did it work? It has never worked once in history yet fools never stop trying.

All Japan has to show for its efforts is a massive increase in government debt.

Bailout Seen and the Unseen

Nearly everyone is cheering "cash for clunkers" and all the other stimulus programs. Bernanke even claims to have prevented another great depression.

Yes, the global equity markets stages a big rally. However, was that rally because of what Congress and the Fed did, or in spite of it? I think the latter. Either assertion cannot be proven.

One thing we do know for certain is there is an "unseen" price to be paid for the bailouts, and the Fed sponsored housing boom that preceded it.

The worst recession since the 1930's is the payback for the credit boom, while the payback for the bailouts is coming down the line. The likely payback for all these bailouts is structurally high unemployment and a stock market that goes nowhere for years to come.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.