The Next Phase of the Credit Contraction and Stocks Bear Market

Stock-Markets / Stocks Bear Market Aug 11, 2009 - 08:38 AM GMTBy: Adam_Brochert

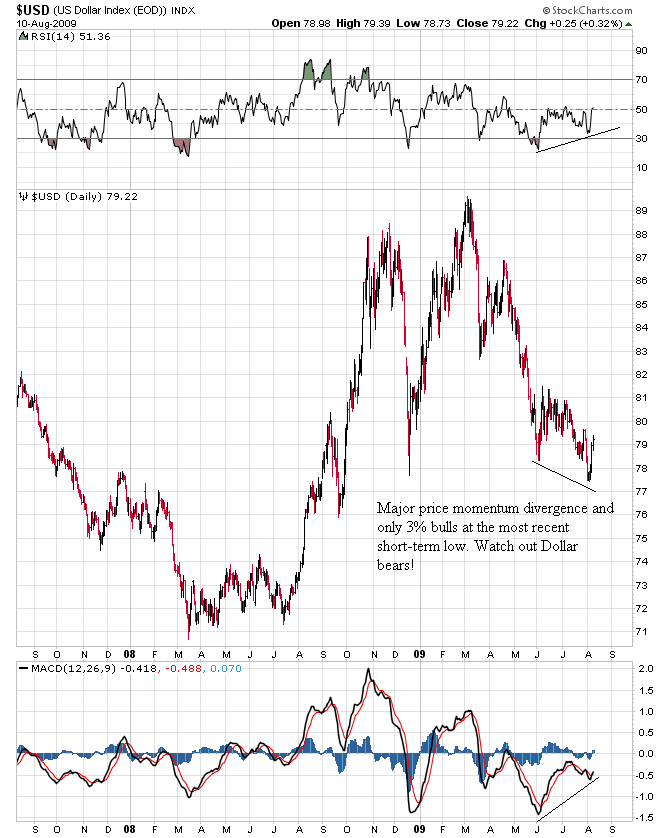

Although the waiting is the hardest part. The next phase of the credit contraction and next down leg in the bear market is set to begin. Elliott Wave just announced that on a recent day there were only 3% bulls on a daily sentiment index for the US Dollar. Now I don't care what you think about the Dollar or it's ultimate fate, a trader should be interested in taking the other side of that trade!

Although the waiting is the hardest part. The next phase of the credit contraction and next down leg in the bear market is set to begin. Elliott Wave just announced that on a recent day there were only 3% bulls on a daily sentiment index for the US Dollar. Now I don't care what you think about the Dollar or it's ultimate fate, a trader should be interested in taking the other side of that trade!

The Dollar may have already bottomed and simply need a short correction (i.e. less than 2 weeks) before a major thrust higher, which would put a stake in the equity, corporate bond and commodity rallies. I think Gold will initially get hit but will then stabilize in the $880 to $920 range.

Here's a 2 year daily US Dollar chart:

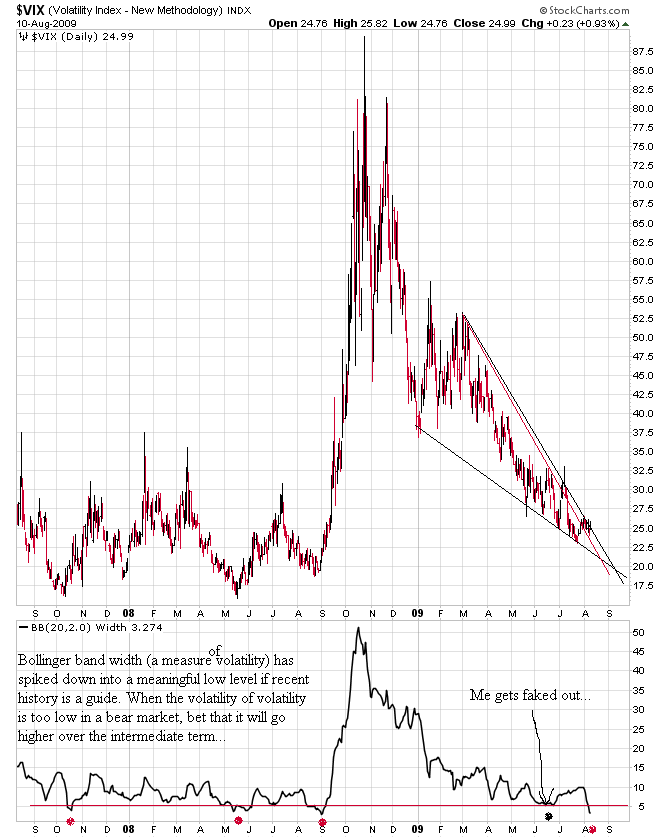

The Volatility Index ($VIX) remains within or has just barely escaped from (depends on how you draw the lines) a terminal corrective wedge and is coiled like a spring ready to begin its next sustained bull move. Here's a 2 year daily chart of the $VIX:

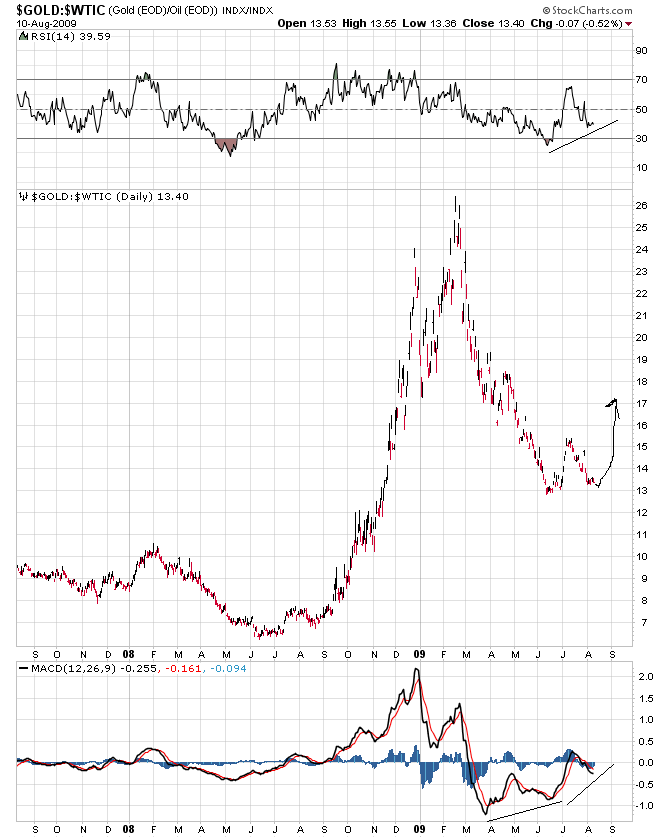

Remember that Gold stocks are countercyclical assets during a deflationary bear market and Gold stocks already made multi-year lows last fall. They will not be making new lows along with the stock market because as deflationary pressures intensify (and they will, believe me), Gold miners will become more profitable. This can be expressed using a "real" price of Gold that ignores the fiat price per ounce and compares the price of Gold to other commodities (i.e. mining costs like energy). The Gold to oil ratio chart is a thing of beauty for Gold stock bulls right now. Here's a 2 year daily chart of the Gold price divided by the oil price ($GOLD:$WTIC):

Though Gold stocks are not immune to major downturns in the stock market, they can weather them well once their uptrend is established and will rise on net balance. Because I am expecting serious nastiness in the general stock markets, I am even more cautious about buying Gold stocks at the right time. The pending buying opportunity that should occur in the next few weeks is a little bit of a mystery right now and its character will be important. A mild, wimpy bottom will likely have to be re-tested later this fall and won't get me very excited (should still be a decent multi-week trade for those so inclined, though). A strong, panicky spike bottom will present the buying opportunity of the year in my opinion.

The bittersweet irony for Gold stock investors is that a turn up in the Gold to commodities ratio or "real" price of Gold typically indicates an intensification of the credit contraction in this environment, which is bearish for all stocks. This is counterbalanced by the immediate increase in profitability that can be achieved by unhedged Gold miners when this ratio turns up. On balance, Gold mining stocks will rise, but the corrections will likely be jagged and scary due to the overall stock market environment.

A bottom in the Dollar and the $VIX and a top in commodities, stocks and corporate bonds as well as a tradeable bottom in senior Gold stocks - it's all finally starting to come together although no one knows the exact day it will occur. It's been very difficult being bearish over the past few months, to be sure, but the light at the end of the tunnel is now clearly visible. Now is not the time for bears to capitulate.

Visit Adam Brochert’s blog: http://goldversuspaper.blogspot.com/

Adam Brochert

abrochert@yahoo.com

http://goldversuspaper.blogspot.com

BIO: Markets and cycles are my new hobby. I've seen the writing on the wall for the U.S. and the global economy and I am seeking financial salvation for myself (and anyone else who cares to listen) while Rome burns around us.

© 2009 Copyright Adam Brochert - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.