Non Farm Payrolls Add to Stock Market Bullish Tone

Stock-Markets / Financial Markets 2009 Aug 10, 2009 - 04:12 AM GMTBy: PaddyPowerTrader

The positive price action on Friday was very much driven by reaction to the July Non-Farm Payrolls report as it was stronger than market expectations and more even more solid than last month (with positive revisions to previous months data), thus leaving the improving trend intact. With Jeffrey Frankel of the NBER reinforcing positive sentiment (he suggested that the recession may have ended in July), US equities responded positively to the news. The S&P 500 rallied to new cyclical highs, led by consumer cyclicals and transport stocks. An upgrade of American Express by Goldman Sachs also helped sentiment.

The positive price action on Friday was very much driven by reaction to the July Non-Farm Payrolls report as it was stronger than market expectations and more even more solid than last month (with positive revisions to previous months data), thus leaving the improving trend intact. With Jeffrey Frankel of the NBER reinforcing positive sentiment (he suggested that the recession may have ended in July), US equities responded positively to the news. The S&P 500 rallied to new cyclical highs, led by consumer cyclicals and transport stocks. An upgrade of American Express by Goldman Sachs also helped sentiment.

Perhaps the biggest surprise was in the FX market, with the Dollar actually benefiting from the better-than-expected report rather than weakening as has often been the case in recent times (perhaps helped by the disappointing German Industrial Production report earlier in the session). The employment report just made the Fed’s job a lot harder. According to the Fed Funds futures market, the probability of a tightening by next January rose this week from around 0.4 to 0.6. So when is the right time to take the punch bowl away? Too soon and you risk the party falling flat on its face or too late and everyone gets a bubble hangover (the market has no memory).

Today’s Market Moving Stories

- Japan machine orders for June showed that core orders exceeded expectations by a large margin, up almost 10%. Firms remain downbeat on the outlook, expecting a fall of 8.6% in Q3.

- In the UK, the Sunday Telegraph reported that King is set to warn at the QIR press conference on Wednesday of the ongoing risk of a long period of deflationary stagnation, and to use this as justification for the extension of Quantitative Easing.

- A faint ray of light is provided by the CBI, whose latest quarterly survey found a net 18% of respondents saying credit availability improved in the past three months; this compares with a net 20% reporting a deterioration in May. Unfortunately, the report also confirmed that the cost of new credit had risen sharply in the quarter, with 20% reporting an increase of more than 1.00%.

- As noted by Pragmatic Capitalist, Reuters has done some nifty work and showed that in this last leg of the rally, which started on July 10th, CCC-rated stocks have surged 26.4%, BB-rated stocks are up 19.3%, while AAA-rated stocks have risen 9.5%. Look, when China is up 80% year-to-date and India 60%, it’s probably safe to assume that we have a huge speculative junky market on our hands. And, we know from the 2000-2001 and 2007-2008 experiences, they don’t tend to end well.

- China has gone a step further and accused Rio Tinto of stripping $123bn from the country through a six-year program of commercial espionage, as it signalled it was broadening its spy blitz beyond the four mining employees detained in Shanghai.

- European shares have started the session on the soft side with the auto sector weighing after a Morgan Stanley downgrade of Daimler. VW and Renault are also showing some notable weakness.

- Bloxham’s have just published a 30 pager on the Irish agrifood and beverage sector. They note that since the last review in February the group have added over 30% to their stock market value with stand-out performances from C&C (+129%), Fyffes (+95%), Total Produce (+75%) and Origin Entreprises (59%). The main key drivers (1) the financial strength of the group with net debt to EBITDA levels of 1.8x and interest cover of 5.4x; (2) a 35% exposure to Sterling which declined sharply in Q4 2008 but has since rallied; (3) using a net debt to EBITDA ceiling of 3.5x we estimate the group has €1.9bn of firepower for acquisitions; (4) all eight companies are paying dividends, with yields ranging between 1% and 7% and; (5) their preferred stocks are C&C, Greencore and Total Produce.

- A cautionary tale how to lose your job on Facebook.

What Did I Take From The Payrolls Report

Well at a headline level the 247k decline in jobs reported in July, whilst still very significant, was the smallest job loss report since September 2008. The contraction in manufacturing payrolls was just 52k, down from 131k last month – a result that was in line with what had been suggested by the ISM. Job losses continued at a frenetic pace in the construction sector but seem to be moderating in the service sector. The diffusion index pointed to a welcome, albeit modest, narrowing of the overall breadth of job losses this month. The prospects for a further lessening of the rate of job loss in August, more towards the 150k decline, look pretty good given the considerable reduction in the rate of job losses in the temporary help services sector. Finally, the upturn in the factory workweek by 0.3 hours this month is consistent with a view that industrial production has turned the corner in the US.

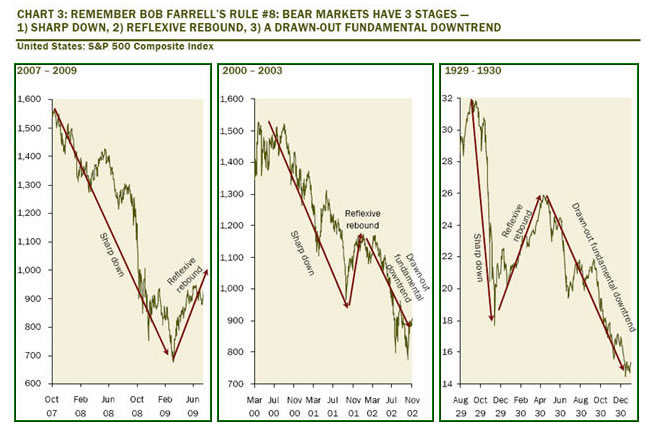

Bob Farrell’s Rule #8 In Pictures

“Bear markets have three stages – (i) sharp down, (ii) reflexive rebound, and (iii) a drawn-out fundamental downtrend”. There is little doubt as to which stage we are in today.

Data Ahead

Looking ahead to this week’s calendar, the main focus will be on the outcome of this week’s two-day FOMC meeting (which ends Wednesday). A further modest upgrade in the Fed’s description of the current economic situation seems warranted in light of the recent economic dataflow to reflect an economy that is likely no longer contracting. But crucially I doubt that the Fed will change its view that economic conditions are likely to warrant exceptionally low levels of the federal funds rate for an extended period.

As far as this week’s dataflow is concerned, the focus will be on the household sector, especially the July retail sales report out on Thursday. Given the rebound in car sales during the month the headline index should post a healthy gain but the market will be more interested in how the broader retail sector has performed. The IBD/TIPP and University of Michigan surveys (Tuesday and Friday respectively) will provide an update on consumer confidence and the countdown to the August non-farm payrolls report will begin with Thursday’s jobless claims. The July CPI and Industrial Production reports are due on Friday.

Outside of the US, in Europe we will see the first estimates of Q2 GDP for Euroland and the remaining major Euroland economies (forecast 0.4% qoq decline after Italy’s smaller than expected 0.5% qoq contraction). In the UK there is the July labour market report and the BoE Inflation Report.

The Asia-Pacific diary is quite busy. With a lot of Chinese data due this week, the key should be new loan growth. The consensus is expecting RMB500bn, but a number far below that would be cause for concern for investors as it would indicate tighter Chinese policy.

And Finally… More From The WalStreetPro Collection

Disclosures = None

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.© 2009 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.