Main Resistance Level Still Holds for S&P 500 Stocks Index

Stock-Markets / Stock Index Trading Aug 06, 2009 - 12:59 PM GMTBy: Donald_W_Dony

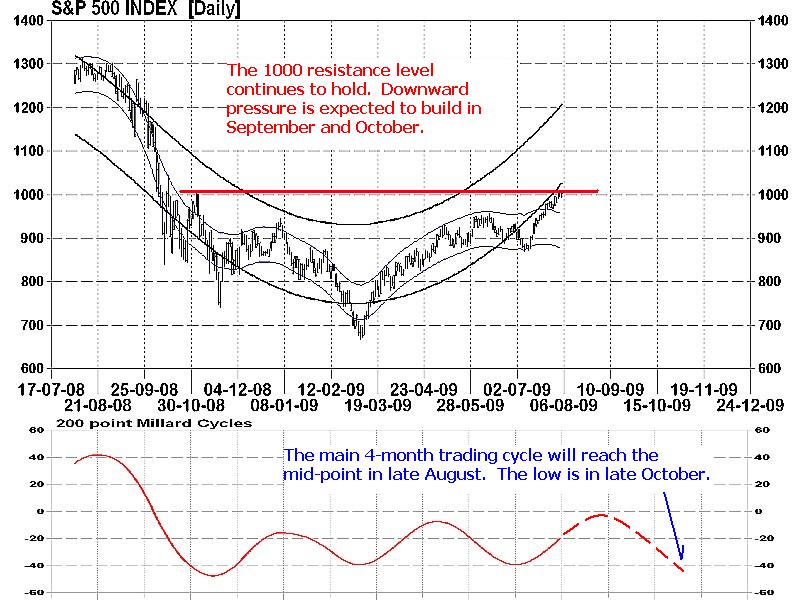

The main resistance level of about 1000 continues to hold for the S&P 500. This line is the barrier that has held the broad-based index since October 2008. As the new 4-month trading cycle began in early July, time is slowly running out for any additional advance. The mid-point of the cycle is in late August. This means that downward pressure can be expected to build in the second half of the cycle which is September and October.

Probability models (Monte Carlo) indicate that there is only a 25% chance of the S&P 500 trading in the 939-1202 range over the next 100 days. In the August newsletter (pages 8 & 9), the importance of the 1000 level is explained plus the historical pattern of bear market bottoms since 1900 is reviewed. This combined data continues to imply a high probability of lower numbers in October.

Bottom line: The S&P 500 is anticipated to have an positive bias in August. That pendulum should begin to shift in September and October. Models indicate the low of the current 4-month trading cycle is in late October.

Your comments are always welcomed.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2009 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.