Is America Broke Part II, The Debt God

Economics / US Debt Aug 04, 2009 - 12:21 AM GMT "Because of the fractional reserve system, banks, as a

"Because of the fractional reserve system, banks, as a

whole, can expand our money supply several times, by making

loans and investments." [1]

Abstract

The following paper is the second installment of the three part series: Is America Broke. The first article discussed the main issues of the financial crisis. It was suggested that the root cause of the systemic failure is the monetary system itself: paper fiat debt-money – Federal Reserve Notes or dollar bills.

Evidence that a dollar a bill (Federal Reserve Note) is not the dollar of the Constitution was provided. The first is a promise to pay. The second is an honest weight of silver: 371.25 grains of fine silver – the silver dollar.

This distinction lies at the heart of why the financial system is falling apart. A system of paper fiat debt-money is destined to fail. It can be no other way. Paper money is created out of thin air. Excess credit creation fuels booms that eventually go bust.

The Constitution states that only gold and silver coin is legal tender in payment of debt. Our Founding Fathers were fully aware of the destruction that paper money breeds. The Revolutionary War and the Continental paper money used to finance it had left deep wounds. Inflation rates of over 1200% had caused hardships not easily forgotten.

Runaway inflation turned into hyper-inflation that destroyed the currency. This is where the phrase: “not worth a Continental” comes from. The authors of the Constitution wanted nothing to do with paper money. Bills of credit were forbidden. Only gold and silver coin was allowed to circulate as legal tender.

Today’s bailout plans will save nothing. They are simply creating more debt to exchange for existing debt. Debt cannot pay off debt. This simply erodes the purchasing power of the dollar and quickens its inevitable demise. If excess credit continues unabated, the saying “not worth a Continental” may once again become the topic de jour.

Several questions were asked in the first article. The following paper expands on these issues, setting the stage for the final article in the series that offers a solution to the present financial crisis: a monetary system of gold and silver coin, as mandated by the Constitution.

Debt

When a banker loans money, he enters the amount of the loan on his ledger. This sum did not exist prior to the extension of the credit. Money is created by the very offer (credit) and acceptance of the loan.

However, only the principle amount of the loan is created; the interest payments needed to service the loan are not. Two questions arise: where does the money come from to pay the interest on the loan; and where did the principal amount of money come from that was loaned out as credit?

Recall that Federal Reserve Notes (non interest bearing debt) circulate as the currency. The currency is secured by United States Treasury Bonds (interest bearing debt). Federal Reserve Notes are secured by the national debt (Treasury Bonds). This means that interest bearing debt (T-bonds) are backing non-interest paying Fed Reserve Notes as currency. Debt is securing debt. Debt is used to pay off other debt, which is only shadow, not substance. Debt cannot be paid off with debt. It can be discharged or laid off to another as a bookie does, but payment does not obtain.

Reserves

The most egregious monetary illusion is the shadow cast by fractional reserve lending. What exactly does the term fractional reserve mean? It would seem that reserves are reduced to a fraction, but a fraction of what? The Fed has the following to say:

"Because of the 'fractional' reserve system, banks, as a whole, can expand our money supply several times, by making loans and investments." [2]

Obviously, whatever fractional reserve policy is, it is very powerful, as it can expand the money supply several times over. The Fed has more to say on the subject:

“Required reserve balances are balances that a depository institution must hold with the Federal Reserve to satisfy its reserve requirement. Reserve requirements are imposed on all depository institutions – which include commercial banks, savings banks, savings and loan associations, and credit unions – as well as U.S. branches and agencies of foreign banks and other domestic banking entities that engage in international transactions.

Since the early 1990s, reserve requirements have been applied only to transaction deposits, which include demand deposits and interest-bearing accounts that offer unlimited checking privileges. An institution’s reserve requirement is a fraction of such deposits; the fraction – the required reserve ratio – is set by the Board of Governors within limits prescribed in the Federal Reserve Act.” [3]

According to the above, the Board of Governors set required reserve balances within limits as prescribed by the Federal Reserve Act that depository institutions must hold on account.

The required reserve ratio is clearly stated to be a fraction of demand deposits and interest-bearing accounts that offer unlimited checking privileges.

Notice the words: “since the early 1990s, reserve requirements have been applied only to transaction deposits.” Such language demonstrates that previous to the early 1990’s reserve requirements were applied to a larger composite – according to the usage and meaning of the word “only.”

Reserve Requirements

The Federal Reserve has the following to say in regards to reserve requirements:

“Reserve requirements have long been a part of our nation’s banking history. Depository institutions maintain a fraction of certain liabilities in reserve in specified assets. The Federal Reserve can adjust reserve requirements by changing required reserve ratios, the liabilities to which the ratios apply, or both.” [4]

Once again, we see the use of the word “fraction” when discussing reserve requirements; however, we now have the further clarification of reserves in “specified assets.” Obviously, these “specified assets” are critically important, as they are the reserves of our monetary system.

“A depository institution satisfies its reserve requirement by its holdings of vault cash (currency in its vault) and, if vault cash is insufficient to meet the requirement, by the balance maintained directly with a Federal Reserve Bank or indirectly with a pass-through correspondent bank (which in turn hold the balances in its account at the Federal Reserve).” [5]

Depository institutions satisfy their reserve requirements by holding cash (currency) in their vaults, or if short, they get some help from the Fed or a correspondent bank. The next logical question is: how much cash are they required to have on reserve in their vaults.

Courtesy of the Federal Reserve

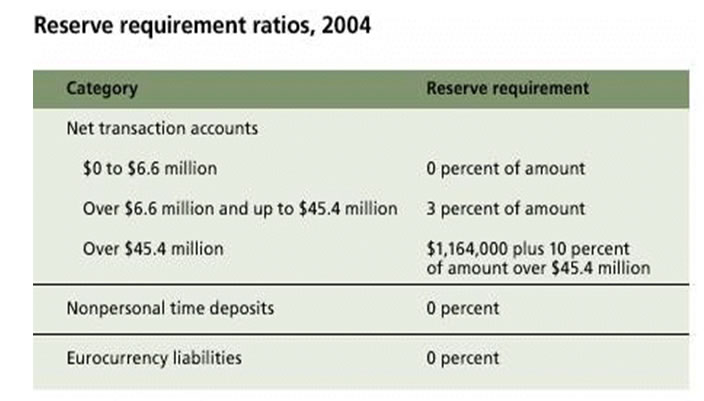

Three of the five categories listed in the chart have zero percent reserve requirements. One of the five categories has three percent reserves, and the remaining category has ten percent reserve requirements.

Now we see where the term fractional comes from and what it is referring to: the fractional amount of reserves actually held on deposit by the banks – money or cash held to meet demand withdrawals.

Autonomous Factors

“The supply of balances can vary substantially from day to day because of movements in other items on the Federal Reserve’s balance sheet. These so-called autonomous factors are generally outside the Federal Reserve’s direct day-to-day control.

The largest autonomous factor is Federal Reserve notes. When a depository institution needs currency, it places an order with a Federal Reserve Bank. When the Federal Reserve fills the order, it debits the account of the depository institution at the Federal Reserve, and total Federal Reserve balances decline.

The amount of currency demanded tends to grow over time, in part reflecting increases in nominal spending as the economy grows. Consequently, an increasing volume of balances would be extinguished, and the federal funds rate would rise, if the Federal Reserve did not offset the contraction in balances by purchasing securities. Indeed, the expansion of Federal Reserve notes is the primary reason that the Federal Reserve’s holdings of securities grow over time.” [6]

Federal Reserve notes are those little green pieces of paper we all carry around in our wallet and refer to as cash. A dollar bill is a Federal Reserve note, as are fives, tens, twenties, fifties, and one hundred dollar bills.

Where does the Fed get the Federal Reserve Notes from? Good question. Let’s try and find the answer.

Notice in the above quote the last sentence that reads, “Indeed, the expansion of Federal Reserve notes is the primary reason that the Federal Reserve’s holdings of securities grow over time.”

With the Fed’s holding of securities entering the picture, we now have two questions to answer: Federal Reserve notes come from where; and what securities are being held by the Fed due to the expansion of Federal Reserve notes?

The Treasury

The Treasury has an important role to play in the creation of money, credit, and debt, along with the Federal Reserve. Together the two are a powerful force to be reckoned with.

The Fed has this to say regarding the Treasury:

“Another important factor is the balance in the U.S. Treasury’s account at the Federal Reserve. The Treasury draws on this account to make payments by check or direct deposit for all types of federal spending. When these payments clear, the Treasury’s account is reduced and the account of the depository institution for the person or entity that receives the funds is increased. The Treasury is not a depository institution, so a payment by the Treasury to the public (for example, a Social Security payment) raises the volume of Federal Reserve balances available to depository institutions.” [7]

From this we see that the Treasury has an account at the Federal Reserve, and that the Treasury draws on the account to make payments by check and direct deposit. Where did the Treasury’s account at the Fed come from, or more importantly – where did the money that’s in the account come from?

Also, notice the part that says, “the Treasury is not a depository institution,” which is presently true, however, at one time we had a sub-Treasury Department that did act as a depository, and the system worked quite well, until it was abolished.

The Constitution has something to say on the subject:

“No money shall be drawn from the treasury, but in consequence of appropriations made by law; and a regular statement and account of receipts and expenditures of all public money shall be published from time to time.” [8]

Open Market Operations

The United States Treasury Bond market is the predominant market the Fed uses to conduct open market operations in. The Fed adds liquidity to the system on an almost daily basis through its open market operations (it does on occasion drain reserves as well).

“Open market operations are the most powerful and often-used tool for controlling the funds rate. These operations, which are arranged nearly every business day, are designed to bring the supply of Federal Reserve balances in line with the demand for those balances at the FOMC’s target rate.” [9]

“In theory, the Federal Reserve could conduct open market operations by purchasing or selling any type of asset. In practice, however, most assets cannot be traded readily enough to accommodate open market operations. For open market operations to work effectively, the Federal Reserve must be able to buy and sell quickly, at its own convenience, in whatever volume may be needed to keep the federal funds rate at the target level. These conditions require that the instrument it buys or sells be traded in a broad, highly active market that can accommodate the transactions without distortions or disruptions to the market itself. The market for U.S. Treasury securities satisfies these conditions.” [10]

We have not yet arrived at the answers as to just exactly where the money, both in principal and the interest paid on the principal, comes from; but we are getting closer.

So far we have discovered that:

- Federal Reserve Notes circulate as the currency

- The currency is secured by Treasury Bonds

- Fractional Reserves are money required to be held by the bank

- The reserve requirements go from zero, to 3%, to 10%

- Federal Reserve notes (cash) are the main reserve deposit

- The U.S. Treasury has an account at the Fed

- The Fed holds U.S. government securities in its accounts

- The Fed conducts open market operation by buying or selling Treasury securities

Where the Money Comes From

Trillions of dollars are on deposit around the world. I remember as a kid that a million dollars was a big deal. Today, billions of dollars are tossed around without the blink of any eye. Trillions are now the topic de jour. Where does all this money come from? There are a couple of parts to the answer.

The process begins with the Treasury Department creating a bond, which is now done electronically. Treasury bonds are debt obligations of the Federal government to repay a loan, which includes both the principle amount of the loan and the interest on the loan.

The Treasury sells bonds to the public and other buyers – Japan and China being the largest players, accounting for over 40% of our debt issue. The bonds not purchased by these buyers are deposited by the Treasury with the Federal Reserve. When the Fed accepts the bonds from the Treasury, it lists the bonds on its books as an asset.

The Fed assumes the government will make good on its promise to pay back the loan. This is based on the belief that the government’s power to tax the people is sufficient collateral.

Because the Fed now has an assetthat it didn't have before receiving the Treasury bond, the Fed can create a liability that is offset by its new asset. The liability that the Fed creates is a Federal Reserve check. It gives the Treasury the check in payment or in exchange for the Treasury Bonds. The Fed loans the government money by purchasing Treasury Bonds.

However, where did the Fed get the money to have deposited on account to cover this check, especially if one goes back to the beginning of the Federal Reserve and the creation of the first Federal Reserve Notes?

Also, recall that Federal Reserve Notes are secured by Treasury Bonds – bonds that the Fed buys with the same Federal Reserve Notes the bonds secure. It sounds a bit circuitous to say the least.

The money was created by the very act of the Fed offering the Treasury a loan, and the Treasury accepting the loan. The Federal Reserve’s check is endorsed by the Treasury and is deposited in one of the government's accounts. The government can then use the deposits to write checks against, to pay for government expenses.

Mariner Eccles, former chairman of the Federal Reserve Board, held the following exchange with Congressman Patman before the House Banking and Currency Committee on September 30, 1941:

Congressman Patman: "Mr. Eccles, how did you get the money to buy those two billions of government securities?"

Mr. Eccles: "We created it."

Patman: "Out of what?"

Mr. Eccles: "Out of the right to issue credit money."

This is the first new money to enter the banking system. Various government contractors, vendors, etc. receive these checks as payment for services rendered, and they take the checks and deposit them in their own commercial bank accounts.

The Second Step

This is when the wizards of finance perform their greatest feats of magic. The deposits in the commercial banks take on a dual role. On the one hand, the deposits are the bank’s liabilities, as they owe the total sums to their depositors.

However, the commercial banks also list deposits as reserves on account. Because of fractional reserve lending, the bankers get to lend out nine times what they have on deposit. This is very profitable for the bankers; and very costly for all us mere mortals.

Fractional reserve lending allows the commercial banks to create nine times more money than they have on reserve. The banks lend money they do not actually have in aggregate; and they get to charge interest on it as well.

This is why the process is called fractional reserve lending, as there is only a fraction of reserves on deposit to redeem demand deposits. As the newly issued money is put to work by borrowers, they spend it.

The receiver of the new money then deposits it in their bank account, and the bank starts the reserve lending process all over again.

Money is not created without creating debt; they are one and the same in a paper money system such as ours. Wealth is not accumulated by creating money by fiat – only debt is. As the Fed has admitted:

“Commercial banks create checkbook money whenever they grant a loan, simply by adding new deposit dollars in accounts on their books in exchange for a borrower's IOU.” [11]

In a publication from the Federal Reserve Bank of Chicago, entitled Two Faces of Debt, we find: “Currency is so widely accepted as a medium of exchange that most people do not think of it as debt.”

Ninety percent of demand deposits are non-existent, nothing more than a fleeting illusion – entries on the ledger. The bank’s solvency stands on the faith that no more than ten percent of all depositors will ever want their money at the same time. Although banks may appear to be solvent, they are without question illiquid.

“Reserve requirements have long been a part of our nation’s banking history. Depository institutions maintain a fraction of certain liabilities in reserve in specified assets. The Federal Reserve can adjust reserve requirements by changing required reserve ratios, the liabilities to which the ratios apply, or both.” [12]

Congressman Patman put it into layman’s terms when he said:

“The cash, in truth, does not exist and never has existed. What we call ‘cash reserves’ are simply bookkeeping credits entered upon the ledgers of the Federal Reserve Banks. These credits are created by the Federal Reserve Banks and then passed along through the banking system.” [13]

Fractional reserve lending guarantees that it is impossible for banks to be liquid on a total or aggregate basis. If all depositors demanded their money at the same time these demands cannot and will not be fulfilled.

Banking is the only type of business allowed to function this way. If any other business used a similar modus operandi, it would be subject to censor and much worse. Banks cannot fulfill all of their contracts if demand occurs at the same time.

This is why Robert Hemphill stated the following in the forward of Irving Fisher’s book, “100% Money,” when he was the Credit Manager of the Federal Reserve Bank of Atlanta, Georgia:

“This is a staggering thought. We are completely dependent on the Commercial Banks. Someone has to borrow every dollar we have in circulation, cash or credit. If the Banks create ample synthetic money we are prosperous; if not, we starve. We are absolutely without a permanent money system. When one gets a complete grasp of the picture, the tragic absurdity of our hopeless position is almost incredible, but there it is. It is the most important subject intelligent persons can investigate and reflect upon. It is so important that our present civilization may collapse unless it becomes widely understood and the defects remedied very soon.” [14]

How It Works

The following is a simple example of how fractional banking works – or doesn’t work, according to one’s perspective: one man’s riches are another man’s junk.

John Doe decides that he is going to deposit the sum of one hundred dollars in the bank. The bank gladly takes the one hundred dollars from Mr. Doe, and in return gives him a receipt (passbook) that states that the bank owes him one hundred dollars.

If you read the fine print on any deposit agreement you sign with a bank, you will notice that you have actually loanedyour money to the bank. You no longer hold title to the money – the bank holds title to the money.

In return you get a deposit slip, which states the principal owed to you, and the amount of interest to be paid to you for the loan you just made to the bank.

Also, note that the bank does not guarantee the return of the money you deposited with them. They promise to return it on demand, but they provide no surety or bailment that such promises will be kept.

Consider the fact that our money needs to be covered by insurance, which is provided by the FDIC. What is it that our money needs to be insured against? Where will the money come from to make up for any losses that are insured? How much “money” does the FDIC have on reserve to pay for such losses?

When we go to the bank to borrow money we have to put up collateral, but when the bank borrows money from us they do not put up any collateral – only promises that may or may not be honored. This is a double standard and should not be accepted – it is accepting the unacceptable.

Back to our example: the bank has a ten percent reserve requirement. This means that of the one hundred dollars that John Doe deposited with them, they have to keep ten percent (at most) on reserve – for small accounts it is 3% and in some cases there is no reserve requirement. Ten percent of one hundred dollars equals ten dollars. That leaves them ninety dollars to loan out to the next customer that wants to borrow money.

Granny Smith comes into the bank and wants to take out a loan for ninety dollars. No problem says the banker; John Doe just deposited one hundred dollars so we have plenty of money to lend you. Granny gets a loan for ninety dollars, and a loan agreement that says she owes the bank ninety dollars plus three percent interest.

What this means is that the bank owes John Doe the one hundred dollars he deposited with them, yet they only have ten dollars on reserve, as they lent the other ninety dollars to Granny Smith. How can the bank honor all of its obligations, particularly in aggregate? It can’t. This is the moral hazard of fractional reserve banking. Multiply this by billions and you will see more clearly why we are having a financial crisis. The system is broke and needs to be replaced.

Banks have on reserve between three and ten percent of all deposits. This means that if more than ten percent of all depositors go to the bank at the same time to withdraw “their” money – there isn’t any money to withdraw beyond the fraction of reserves held on account.

Perhaps this is why Josiah Stamp, President of the Bank of England in the 1920s stated:

“Banking was conceived in iniquity and was born in sin. The Bankers own the Earth. Take it away from them, but leave them the power to create deposits, and with the flick of the pen they will create enough deposits to buy it back again. However, take it away from them, and all the great fortunes like mine will disappear, and they ought to disappear, for this would be a happier and better world to live in. But if you wish to remain the slaves of bankers and pay the cost of your own slavery, let them continue to create deposits.” [15]

Interest Charges

Remember in the above example when Granny Smith borrowed ninety dollars from the bank. She agreed to pay the bank a three percent interest fee. We have not yet discovered where the money to pay the three percent interest charge comes from.

The origin of the principal amount of the loan has been explained, but not the interest fees. As stated earlier: the principal amount of the loan is created out of thin air by the very act of lending or extending credit. The interest fees, however, were not created at the same time.

Man must work and trade his labor and time on earth in exchange for money. It is the money that man earns by the sweat of his brow that provides the means to service his debts. Man must exchange part of his life to sustain his life; however, it is not a natural order of exchange at the behest of justice. It is a dishonest and manmade contrivance that transfers wealth from the many to the few.

A creditor’s property exists in the demand he has upon the debtor, yet the debtor is but a trustee to the creditor for a portion of the value of his income or private property needed to service his debts – both public and private: the first by taxes and the latter by interest. The creditor becomes richer; by the amount the nation becomes poorer, in paying the interest and taxes – in aggregate.

Congressman Patman understood this topic all too well, as he clearly explained:

“I want to show you where the people are being imposed upon by reason of the delegation of this tremendous power. I invite your attention to the fact that section 16 of the Federal Reserve Act provides that whenever the Government of the United States issues and delivers money, Federal Reserve notes, which are based on the credit of the Nation – they represent a mortgage upon your home and my home, and upon all the property of all the people of the Nation – to the Federal Reserve agent, an interest charge shall be collected for the Government.” [16]

To think that a $700 billion dollar bailout plan is going to fix a monetary system that is broke is delusional. It cannot be fixed. It needs to be replaced.

A paper fiat monetary system condemns our children to a life of perpetual debt servitude. It is a vicious circle, where few gain by the loss of many. It is wealth transference (redistribution) plain and simple – no if ands or buts.

President Jackson was aware of the vast power and influences the banking powers wielded; this is why he stated in an address to Congress, in 1829:

“The bold efforts that the present bank has made to control the government and the distress it has wantonly caused, are but premonitions of the fate which awaits the American people should they be deluded into a perpetuation of this institution or the establishment of another like it... If the people only understood the rank injustice of our money and banking system there would be a revolution before morning.” [17]

Based on the above information, it becomes clearer as to why a financial crisis is taking place, as a paper fiat system of debt-money can end in no other way. The seed of its own destruction lies within.

Although the principal amount of money (loan) is created by the extension of credit – the interest to be paid to service the debt is not created at that time.

This is why the money supply must continue to expand – to meet the ever-increasing service costs (interest rates) on the already existing loans (credit). Paper money must inflate or die – actually, it dies either way: as runaway inflation eventually turns into hyper-inflation.

Federal Budget

The 1970’s witnessed a prolific expansion of federal budget deficits. The difference between revenues collected by the state became increasingly larger than the sum of expenses spent by the state. This ever widening gap is what is referred to as deficit spending. It created the necessity for a ways and means to fund itself; or so it appears on the one hand. Viewed from another angle – it provides an excuse to create and thus continue the ever increasing supply of money, credit, and debt.

Recall that there are only two means by which the government obtains money: they collect taxes or they sell Treasury Bonds (debt).

Also, remember that the public debt represents how much public spending is financed by borrowing, as opposed to taxation.

Interest is collected by the bankers for loans – taxes do not pay interest.

At an alarmingly increasing rate since 1970, government expenditures have increased faster than government revenues, whether generated by taxes, Treasury bonded debt, or a combination thereof.

As we have seen, the currency is loaned into existence, at least the principle amount. The interest to service the loan is had by our labor and future money creation. In exchange for our life’s energy, employed as labor, we receive payment called income. We use this income to pay our bills, including the interest on any debt: be it mortgages, car payments, or college tuition. But the money must first be created before we can receive it in payment.

Every year we pay an ever-expanding amount of interest on the national debt. As this rate grows, eating up a larger percentage of the gross domestic product, the government requires more money to run the country and to service the debt. This is where the Federal budget deficit enters the picture.

To help provide a means to pay the annual interest on the debt, our government uses the federal budget deficit as a reason to issue more Treasury debt, which in turn is monetized by the Federal Reserve by creating more Federal Reserve Notes: a symbiotic relationship born in hell and nurtured by the coldest altar man has ever known.

If the federal deficit was balanced, a large portion of Treasury debt that is monetized into currency would be taken off the table. The bankers would not be pleased. Some other source would need to take its place. Since the government would have left the field, a new player would need to appear and pick up the slack. The most likely candidate is the private sector.

In order for the government to issue bonded debt, which is monetized into Federal Reserve Notes, which are then deposited into commercial banks, and subsequently lent out at a nine to one ratio; all the government is required to put up as collateral is its:

Promise to pay based on its power to tax and issue more debt.

If the private, or even the business sector, were to take the government’s place, the Fed would not accept their mere word as collateral, as they do not possess the power to tax, nor the military and police power to enforce the power to tax. The Fed would require that real collateral be put up as surety and bailment.

Soon, private assets would have to be mortgaged to provide the needed security. Foreclosures would follow not far behind, as the public cannot create money out of thin air, as the Fed and the Treasury can. Alan Greenspan, former Federal Reserve Chairman had this to say about deficit spending:

“Deficit spending is simply a scheme for the ‘hidden’ confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights”. [18]

The former chairman was right. Too bad he chose a different path to follow. On his watch more debt was created than during the reign of all those who came before. Yet, as the above quote shows, he clearly understood that excess money creation results in the confiscation of wealth; and that only gold stands in the way of the insidious process.

Why did he choose to be part of the process instead of standing in its way? Can the reckless destruction of our currency be stopped before it’s too late? What should be done?

Yes, there is a solution. If our economy is to survive, and our standard of living is to remain intact, we must return to the monetary system of gold and silver coin, as set forth in the Constitution.

The final paper in this series will offer a blueprint for such a system. All three articles are from chapters in the new book: Honest Money – available in both audio and text format.

Come visit our website: Honest Money Gold & Silver Report

New Book Now Available - Honest Money

Douglas V. Gnazzo

Honest Money Gold & Silver Report

Notes:

1. Chapter Heading – Federal Reserve Bank of New York: The Story of Banks, p.5.

2.The Federal Reserve System Purposes and Functions: The Implementation of Monetary Policy.

3. Same

4. Same

5. Same

6. Same

7. The Federal Reserve System Purposes and Functions

8. The Constitution

9. Same as two above

10. Same

11. Same

12. Same

13. Congressman Patman from the Congressional Record

14. Robert Hemphill in Irving Fisher’s book 100% Money

15. Josiah Stamp, President of the Bank of England in the 1920s

16. Congressman Patman from the Congressional Record

17. President Jackson

18. Alan Greenspan

About the author: Douglas V. Gnazzo writes for numerous websites and his work appears both here and abroad. Mr. Gnazzo is a listed scholar for the Foundation for the Advancement of Monetary Education (FAME).

Disclaimer: The contents of this article represent the opinions of Douglas V. Gnazzo. Nothing contained herein is intended as investment advice or recommendations for specific investment decisions, and you should not rely on it as such. Douglas V. Gnazzo is not a registered investment advisor. Information and analysis above are derived from sources and using methods believed to be reliable, but Douglas. V. Gnazzo cannot accept responsibility for any trading losses you may incur as a result of your reliance on this analysis and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities. Do your own due diligence regarding personal investment decisions. This article may contain information that is confidential and/or protected by law. The purpose of this article is intended to be used as an educational discussion of the issues involved. Douglas V. Gnazzo is not a lawyer or a legal scholar. Information and analysis derived from the quoted sources are believed to be reliable and are offered in good faith. Only a highly trained and certified and registered legal professional should be regarded as an authority on the issues involved; and all those seeking such an authoritative opinion should do their own due diligence and seek out the advice of a legal professional. Lastly Douglas V. Gnazzo believes that The United States of America is the greatest country on Earth, but that it can yet become greater. This article is written to help facilitate that greater becoming. God Bless America.

Douglas V. Gnazzo © 2009 All Rights Reserved

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.