Big Bounce in Commodities Gold, Silver, Oil and Nat Gas

Commodities / Commodities Trading Aug 03, 2009 - 01:03 AM GMTBy: Chris_Vermeulen

Last week we saw commodities sell down then put in solid bounce, which allowed us to generate new pivot lows for drawing support trend lines. This is the exact type of price action I have been waiting for. Natural Gas did nothing special but crude oil put in a very strong bounce and is now trading at a double resistance level which is explained later in the report.

Last week we saw commodities sell down then put in solid bounce, which allowed us to generate new pivot lows for drawing support trend lines. This is the exact type of price action I have been waiting for. Natural Gas did nothing special but crude oil put in a very strong bounce and is now trading at a double resistance level which is explained later in the report.

The Precious Metals Sector

Gold stocks sold down the first half of the week but then put in a solid bounce Thursday and Friday along with bullion prices. As you can see from this chart it has three reverse head & shoulders patterns and this type of pattern is bullish. You can see the patterns in March, then April, and we are currently at the final stages of the third H&S. If the charts do what they are telling us then we should see prices surge higher over the next 1-2 weeks.

This chart shows my simple signature setup. I focus on several chart patterns, tools and techniques like trend lines, MACD momentum, Elliot Wave, candle patterns and strict money/risk management rules.

Gold Bullion Prices – GLD ETF Trading

We took advantage of last weeks intraday and daily price action. Lets watch the market unfold…

Silver Bullion Prices – Silver ETF Trading

Silver is in the same boat. Looking bullish and ready to rocket higher.

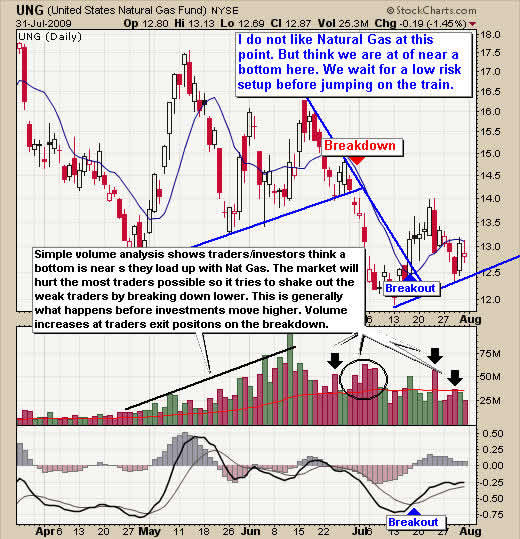

Natural Gas Prices – Natural Gas ETF Trading

Nat gas has taken almost everyone’s money that I have talked to, which means it should be bottoming soon.

Have you ever bought a stock, watched it tick higher and all of a sudden see prices drop taking out your stop order or selling down to a point here you cannot take the pain making you exit for a loss. Only to see prices reverse and move in the direction of the trade you just exited but this time without you!

If this happens then not only is your trading strategy/model needing some tweaking but you also do not understand how the markets REALY work. The floor traders (market makers) are taking your money and it’s as easy as taking money from a baby. There are tricks the market makers do on a daily basis with stocks, commodities etc… in order to make as much money as possible off the little uneducated trader. I will be sending out a special report about this in the next few weeks.

Crude Oil Prices – Crude Oil ETF Trading

Crude oil is currently trading at resistance. We could see a sharp move lower again or a sharp breakout to the up side. We continue to wait for a breakout and low risk setup in oil.

The Commodity Bounce Conclusion:

Last week was exciting with precious metals providing trading opportunities for us. We saw one of our Golden Rocket setups surge 55%. Gold stocks are becoming the flavor for investors as they anticipate gold bullion prices to spike in the coming months. Crude oil and natural gas are not providing any setups at this time. We are currently watching and waiting for some low risk setups.

Hello, I'm Chris Vermeulen founder of TheGoldAndOilGuy and NOW is YOUR Opportunity to start trading GOLD, SILVER & OIL for BIG PROFITS. Let me help you get started.

If you would like more information on my trading model or to receive my Free Weekly Trading Reports - Click Here

If you have any questions please feel free to send me an email. My passion is to help others and for us all to make money together with little down side risk.

To Your Financial Success,

By Chris Vermeulen

Chris@TheGoldAndOilGuy.com

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 6 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.