Profitably Playing the Next MegaMove in Gold and Silver

Commodities / Gold & Silver 2009 Jul 31, 2009 - 12:25 PM GMTBy: DeepCaster_LLC

“Is it not a huge conflict of interest that JP Morgan (JPM), a bank that perpetually ranks among the largest short positions against silver on the COMEX, is the custodian for the iShares Silver Trust (SLV)? According to silver analyst Ted Butler, JP Morgan is consistently among the one or two U.S. banks that hold more than 80% to 90% of the entire commercial net short position in COMEX silver futures. If you have positioned yourself to make huge profits from drops in the price of silver, is it reasonable for you to simultaneously desire investors to buy more physical silver (if indeed the SLV holds the amount of physical silver it claims)?

“Is it not a huge conflict of interest that JP Morgan (JPM), a bank that perpetually ranks among the largest short positions against silver on the COMEX, is the custodian for the iShares Silver Trust (SLV)? According to silver analyst Ted Butler, JP Morgan is consistently among the one or two U.S. banks that hold more than 80% to 90% of the entire commercial net short position in COMEX silver futures. If you have positioned yourself to make huge profits from drops in the price of silver, is it reasonable for you to simultaneously desire investors to buy more physical silver (if indeed the SLV holds the amount of physical silver it claims)?

Is it also not a conflict of interest that HSBC (HBC) bank, a bank that allegedly holds some of the largest short positions against gold on the COMEX, is the custodian for the SPDR Gold Trust (GLD)? If these banks profit when gold and silver drop, and they manage the largest ETFs in the US regarding these respective metals, is it unreasonable to state that these two banks should be barred from acting as custodians of the GLD and SLV? In fact, how is this situation any different than Goldman Sachs’s (GS) actions in the past when they originated CDOs and then made a fortune by shorting them…

Is it also not a conflict of interest that HSBC (HBC) bank, a bank that allegedly holds some of the largest short positions against gold on the COMEX, is the custodian for the SPDR Gold Trust (GLD)? If these banks profit when gold and silver drop, and they manage the largest ETFs in the US regarding these respective metals, is it unreasonable to state that these two banks should be barred from acting as custodians of the GLD and SLV? In fact, how is this situation any different than Goldman Sachs’s (GS) actions in the past when they originated CDOs and then made a fortune by shorting them…

I have maintained for a long time now, ever since I carefully read the GLD and SLV prospectuses, that any investor that buys the GLD and the SLV and believes that these two investment vehicles are as risk-free and as sound as purchasing physical gold and physical silver is highly delusional. I call the prospectuses of the GLD and the SLV ‘Alice in Wonderland prospectuses’…”

Are GLD and SLV Legitimate Investment Vehicles?

J.S. Kim, Seeking Alpha, July 16, 2009

Typical Investors are understandably concerned that they not suffer a repeat of the Fall, 2008 when their portfolios were devastated by 30% or 40% or even 50% in the Market Crash.

Here we lay out key Strategic Guidelines which not only allow one to estimate the likely timing and direction of The Next MegaMove, but also are aimed at profiting from it.

Understanding the issue of Gold and Silver price performance, and especially the price performances of the Gold and Silver ETFs, is crucial to appreciating these Strategic Guidelines. Deepcaster recently forecast impending MegaMoves in three key Sectors (see August letter in the ‘Latest Letter’ cache at www.deepcaster.com.) and employed the following guidelines in doing so.

- Buy and Hold Rarely Works Anymore. Thus, “long-term investors” must be willing, indeed, eager, to trade in and out of positions, taking profits when they have them.

The Long-term Economic and Financial prospects are unprecedentedly uncertain at best, or more likely, downright negative. Thus it is unreasonable to assume consistent long-term profits for any industry. Rather, for the next few years one should expect Market Takedowns, followed by Rallies and more Takedowns. Thus the ability and willingness to trade in and out will be crucial.

Even consistent profits prospects in two key “Basic Needs” Sectors – “Health Care and Energy” are uncertain.

Health Care is uncertain because of spiraling costs and the specter of Government Control, and Conventional Energy because whenever Peak Oil is/was, it is indisputable that Crude Oil is a depleting Asset; Nonetheless, its Price was taken down from $147 bbl in July, 2008 to $35 bbl just a few months later. Perma-Bulls on Crude Oil got slaughtered in late 2008, even though the very long term prospects for Crude price appreciation are excellent.

But what in the world does acknowledging that ‘Buy and Hold Rarely Works Anymore’ have to do with Profitably Playing the Next MegaMove? It is primarily a matter of psychology. If one believes strongly that holding for the long term will be profitable, one is likely to suffer greatly again when the next Crash arrives. As well, one will not be positioned to profit from the Crash.

Conclusion: One must take profits when one has them and One must be prepared to go ‘short’ as willingly as one goes ‘long’.

- One must stay closely attuned to Sector Trends and Invest/Trade with the Trend.

Experienced Investors know that even the highest quality stocks of strong companies often fall if their whole Industry Sector is Falling.

Similarly, Stocks of weak Companies often rise if their Sector is rising.

Conclusion: Go long the Strong in Newly Strengthening Sectors. Go Short the Weak in Newly Weakening Sectors.

- Be wary of heightened Single Stock Risks.

The last couple of decades have seen a flood of new “investment” products, “creative” accounting techniques, “investment” vehicles which greatly increase leverage, and loopholes and breakdowns in regulatory enforcement and unprecedented Market Intervention and Data Manipulation (see below).

These have all led to greatly increased risk, especially for investors in individual companies.

Among the greatest risks of investing in individual companies is the increase in “dark” counterparty risk and “off-balance-sheet” transactions. Regarding Counterparty Risk consider that nearly $600 Trillion (see below) in dark OTC Derivatives are still extant.

How is an investor, when evaluating an individual company, to know whether, or to what degree these counterparty risks exist. To do an adequate evaluation one must not only evaluate the company on which one is focusing, but also each company which is a transaction counterparty – a difficult if not impossible task. Consider the counterparty risks which doomed AIG. And who would have thought that a “Safe Haven” Big pharmaceutical company, Bristol-Myers Squibb, would have had to take a $250 Million write-down due to OTC dark derivatives exposure?

So investor/traders must increasingly seriously consider an approach which minimizes risks while preserving profit potential. And it is to

- Seriously consider buying or selling, Sectors via Exchange Traded Funds.

ETFs are liquid, minimize individual company risk and allow one to profit from Sector Moves, whether the Moves are Up or Down.

Indeed, double or triple leverage ETFs allow one to magnify profits, but also magnify the risk of loses. There are now hundreds of these ETFs which allow one to take either bullish or bearish positions on nearly every Major Sector.

In addition, however, to position oneself to profit from the next MegaMove one must consider the Real Numbers.

- Consider the Real Numbers.

The Fact is that Key Statistics continue to be gimmicked by Official Sources much to the detriment of American Citizens and Investors Worldwide.

Indeed, the True State of the Economy is much worse than the Official Figures suggest.

As the Real Numbers mentioned below demonstrate, our ongoing economic and financial crisis is not merely a “normal” business cycle Recession, but a System-Threatening Crisis. Indeed, we have entered into a Depression. (see below)

It is thus another Naïve and False Assumption that the Official Figures accurately reflect the state of the Economy and Markets - - for example, that the current Recession is merely a normal “business cycle” phenomenon.

Making matters worse, Investors and citizens-at-large are misled by Official Statistics which have been gimmicked, as shadowstats.com demonstrates. All of the following Genuine Numbers are calculated by shadowstats.com, which calculates them according to traditional methods used in the 1980s, and early 1990s, before The Political Adjustments currently being utilized began.

Consider the following Real Numbers from shadowstats:

U.S. Consumer Price Inflation (CPI) actually averaged about 11% annualized for much of 2008, rather than the 5% to 6% figures, which have been reported as Official Statistics. Thus, the consumer must cope with diminished purchasing power and the threat or reality of job loss.

Though Official Figures show CPI dropping to 0% in early 2009, the Real mid-2009 numbers reveal that CPI was still about 6% annualized.

U.S. Unemployment has (according to Official Numbers) been ranging 4% to 6% from 1995 to 2007, spiking “only” to about just under 7% in late 2008 and 8% in early 2009. In fact, Real U.S. Unemployment in 2009 now about 20.5% and is still increasing. (shadowstats.com) Thus the consumer (70% of U.S. GDP, we reiterate) is increasingly unemployed, under-employed, and indebted.

As well, the Delusion of Economic Growth claimed by Official Statistics is just that - - a Delusion. Real U.S. GDP growth has been negative since 2004. Indeed, in mid-2009 U.S. GDP “growth” is a negative 5%. (shadowstats.com) Thus the consumer is faced with a deteriorating economy, as well as diminishing job prospects and purchasing power.

As well, the 2008 U.S, Federal Deficit, rather than being about $1 trillion as reported officially, is over $5 trillion if one includes Social Security and Medicare. And, if downstream-unfunded U.S. obligations are included, the U.S. National Debt is approaching $70 trillion and rising!

Knowing these Real Numbers facilitated Deepcaster’s recommending “Opportunities in the Impending Perfect Storm” - - the title of his early September, 2008 (pre-Crash) Article warning of the impending Crash (available in the Articles Cache at www.deepcaster.com) and his making five short (and subsequently quite profitable) recommendations to subscribers at about that time.

Consider the Current Economic Realities as reflected in the Headlines of Shadowstats.com July 31, 2009

“Flash Update:

- GDP Shows Most Severe Recession Since Great Depression

- Second-Quarter GDP Annual Contraction Was Worst Ever

- Recession Is Not Ending

- Annual Durable Goods Plunge Continued In Great Depression Territory

- Broad Money Growth Still Slowing

- Unemployment Skew Next Week?”

- Of course to profitably play the next MegaMove, it is essential to Analyze the Fundamentals and Technicals. Since we assume our readers are sophisticated enough to do their Fundamental and Technical “Homework”, we will not elaborate further.

- But The Key, to the extent there is One Key, to forecasting the Next MegaMoves Sector/s, Timing and Intensity is The Interventionals.

There is clear and convincing evidence that a Fed-led Cartel* of key Central Bankers and Favored Financial Institutions regularly overtly and covertly manipulate the Precious Metals, Equities, Strategic Commodities and other Markets.

*We encourage those who doubt the scope and power of Overt and Covert Interventions by a Fed-led Cartel of Key Central Bankers and Favored Financial Institutions to read Deepcaster’s December, 2008 Letter containing a summary overview of Intervention entitled “A Strategy for Profiting from the Cartel’s Dark Interventions & Evolving Techniques” and Deepcaster’s July, 2009 Letter entitled "A Strategy For Profiting From The Cartel’s Dark Interventions & Evolving Techniques - II" in the “Latest Letter” Cache at www.deepcaster.com. Also consider the substantial evidence collected by the Gold AntiTrust Action Committee at www.gata.org for information on precious metals price manipulation. Virtually all of the evidence for Intervention has been gleaned from publicly available records. Deepcaster’s profitable recommendations displayed at www.deepcaster.com have been facilitated by attention to these “Interventionals.”

Consider The Interventional Background

Deepcaster has written an extensive and well-documented history of Cartel Interventions -- "A Strategy For Profiting From The Cartel’s Dark Interventions & Evolving Techniques - II" which is contained in his July, 2009 Letter Available in the Latest Letter Archive at www.deepcaster.com.

The Interventional Background of a recent Episode reflecting a high degree of Cartel Intervention is the Fall, 2008 Market Crash. Consider the following very profitable (to The Cartel presumably) rendition. Just after the numbers from the Bank for International Settlements -- the Central Bankers Banks -- (for the second half of 2008) were released in May, 2009 we stated

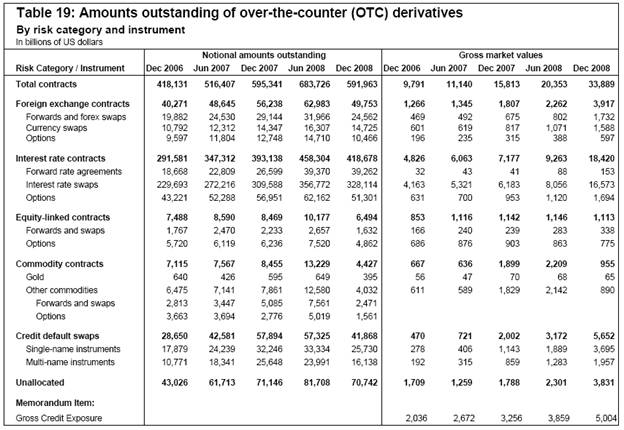

“With Key Mega-Financial Institutions around the World claiming in 2008 that they risked collapse if they were not bailed out, one must ask which ones benefited from the $13 Trillion plus Increase in Gross Market Value of their OTC Derivatives in the six months between June, 2008 and December, 2008 when the Equities Markets were crashing? A logical Conclusion: Key Central Bankers and Favored Financial Institutions of The Fed-led Cartel*, quite possibly including the shareholders of the private for-profit U.S. Federal Reserve” (see chart below)

Deepcaster, May 29, 2009

For investors, both Opportunities and Threats reveal themselves in the recently reported stunning drop ($90 Trillion+) in Total Notional Value of OTC Derivatives Contracts Outstanding worldwide and an equally stunning rise ($13 Trillion+) in Actual Gross Market Value of OTC Derivatives Contracts Outstanding, in just the last 6 months of 2008. (See Chart Below)

The Total Notional Value of OTC Derivatives Outstanding dropped from some $683 Trillion as of June, 2008 to $592 Trillion as of December, 2008, according to the Bank for International Settlements (BIS – the Central Banker’s Bank – see www.bis.org, Path: Statistics > Derivatives > Table 19) (Ed Note: A Rough “Cocktail Party” Definition of “Notional Value” is “Unrealized Potential Maximum Value.”) Virtually all of these $595 Trillion are available to The Cartel for intervention.

This first drop in Notional Amount of OTC Derivatives Outstanding in years, mainly reflects the massive deleveraging which occurred during the Fall, 2008 Market Crash.

Perhaps even more stunning was the drop in Notional Amounts of OTC Gold Contracts outstanding from $649 Billion in June, 2008 to $395 Billion as of December, 2008. Yet the change in Gross Market Values of the OTC Gold Contracts outstanding during that period was minimal – a drop from $68 Billion to $65 Billion. We comment on what that portends for Gold below.

In order to determine and evaluate the Opportunities and Threats created by the aforementioned drop in Notional Value of OTC Derivatives outstanding coupled with a dramatic increase of $13 Trillion in Gross Market Values we must first consider a few facts.

To put the Derivatives Monster in perspective, consider that the value of all publicly (exchange-traded) Equities now existing in markets world-wide is “only” about $31 Trillion.

That $31 Trillion is only just over 5% of the still remaining (as of December, 2008) nearly $600 Trillion in Notional OTC Private (i.e. Dark) Derivatives Contracts outstanding. The implications are stunning:

- If the unwinding of a “mere” $91 Trillion in Derivatives contracts (to bring the Total down to $592 Trillion from $683 Trillion) reflected the Magnitude of the pain that the Fall, 2008 Crash caused, then imagine the Pain which awaits if and when (and probably when) any substantial Portion of the $592 Trillion remaining get unwound.

- But a substantial portion will likely have to be unwound given that various ongoing Crises have yet to be resolved, and, in many cases are worsening e.g.: Consider:

- The U.S. Treasury/Fed etc have already committed some $12.8 Trillion (by one reckoning) for Bailouts, Loans, Stimulus packages and Guarantees, much of it borrowed from, or guaranteed by, U.S. Taxpayers. Yet, clearly, the Toxic Derivatives problem has a long way to go before being solved.

- The Fed has moved over $577 billion of U.S. Treasures onto its Balance Sheet in the short time since it publicly admitted it was monetizing the Debt. (One wonders how many hundreds of Billions in Treasures were moved (and where!?) before that public admission.)

- The Chinese are switching from a U.S. Dollar basis to a Yuan basis domestically.

- The Chinese have authorized certain non-Chinese Banks to sell Yuan – based government Bonds.

- Foreign Creditors own over half the U.S. Dollar based government and Agency bonds leaving the fate of the U.S. Economy and Security in the hands of foreigners and primarily the Chinese government.

- The United Arab Emirates are spearheading plans to launch an Asset-backed (likely with Gold and Crude Oil) Currency, the Dinar.

- Germany has reportedly demanded return of all Gold held in custodial Accounts in the U.S.

- The Chinese have increased their Gold reserves from 400 Tonnes to over 1,000 Tonnes in the past five years.

- The default rate on U.S. Option ARMS recently rose to 35%. There are still some $300 Billion of these loans still outstanding.

- The interest Rates on about one Million Pick N Pay loans will reset in the next two years.

- Thus, it is essential to remember that a substantial portion of the aforementioned $592 Trillion in OTC Derivatives is available to The Fed-led Cartel* to continue to overtly and covertly manipulate the Precious Metals, Strategic Commodities, and Equities Markets.

The Magnitude of the foregoing derivatives positions and the prospective consequences of the foregoing developments indicate the extent to which a very wide variety of Markets are Manipulated. Thus monitoring The Interventionals is essential to forecasting and Profitably Playing the next MegaMove.

Indeed, the Central Point of “There are no Markets anymore, just Interventions” an excellent essay by the Secretary of GATA, Chris Powell, is very well taken. So what is an individual investor to do? Consider:

A Strategy for Profit and Protection

Normally, (that is to say, in a Genuine Free Market situation) the go-to “Safe Haven” Assets in times of Financial Crisis would be the Precious Monetary Metals Gold and Silver, as well as other assets such as Strategic Commodities.

We say “normally” because nearly every time yet another Financial Market Crisis has come prominently into the public eye in recent years The Cartel* has successfully taken down the price of what would normally be The Safe Haven Assets - - the Precious Monetary Metals. A prime example occurred during the much-publicized demise of Bear Stearns in March, 2008, which was accompanied by a vicious Takedown of Gold and Silver. In a non-manipulated Market, given the fact that Bear Stearns reflected great and increasing weaknesses in the Financial System, Gold and Silver should have skyrocketed. But instead they were dramatically taken down.

Yet, the late 2008 - early 2009 Crises appear to be different. Gold launched from the mid $700s/oz. to around $900/oz. during September, 2008, fell back to the low $700s and then launched again toward $900 in December, 2008 and has actually exceeded $900 several times in 2009.

So the question now, near the beginning of August, 2009, is it different this time around? Have Gold and Silver finally thrust off the shackles of Cartel Intervention? Or will The Cartel be able once again to cap and take down the prices of these Precious Monetary Metals and Strategic Commodities? Deepcaster has very recently addressed this question in a Forecast he issued for the likely fate of Gold, Silver, Crude Oil & the U.S. Dollar in the Alerts Cache at www.deepcaster.com.

One thing is certain: The Cartel will certainly attempt again to take down Gold, Silver and Crude Oil at the earliest opportunity because the Strategic Commodities and Precious Monetary Metals are Competitors as Stores and Measures of Value with the Central Bankers’ Treasury Securities and Fiat Currencies.

Yet there is a Strategy which accommodates Cartel Interventional attempts and at the same time provides excellent Profit Opportunities, whether the Cartel Interventional attempts are successful or not.

A major premise of The Strategy is that one can certainly remain a Hard Assets Partisan (as Deepcaster is) while at the same time insulating oneself somewhat from future Takedowns. The following points provide an outline of The Strategy (particularly as applied to the Gold and Silver Markets) and are designed to help avoid Portfolio unpleasantness, or even possible financial ruin, in the future, as well as to profit along the way:

- Recognize that The Cartel is still Potent, as difficult as that may be psychologically for Deepcaster and other Hard Asset Partisans to acknowledge. The Cartel is still the Biggest Player in many markets and, if the timing and market context are propitious, the Biggest Player makes Market Price. In addition, The Cartel has the advantage of de facto controlling the structure and regulation of various marketplaces and that is a tremendous advantage; just as the Hunt Brothers years ago discovered much to their dismay and misfortune, when they tried to corner the Silver Market.

- Accumulate Hard Assets near the Interim Bottoms of Cartel- engineered Takedowns.

- In order to know when one is likely near the bottom of a Cartel-generated takedown, it is essential to take account of the Interventionals as well as the Technicals and Fundamentals. Paying attention to the Interventionals facilitated Deepcaster recommending five short equities positions as of early September (just before the Fall Crash) all of which we subsequentially recommended be liquidated profitably.

- For example, regarding Gold & Silver, near such Interim Bottoms, accumulate a combination of the Physical Commodity (Deepcaster prefers “low premium to melt” bullion coins) and well-managed Juniors with large reserves. (Deepcaster provides a list of such Junior Candidates in our December 20, 2007 Alert “A Strategy for Profiting from Cartel Intervention” available in the Alerts Cache at www.deepcaster.com.) The “Physical” and “Juniors” are for holding for the long-term as a Core Position.

- Then, to the extent one wishes to speculate on the next “long” move, one should buy the major producers or long-term call options on them. These latter positions are for ultimate liquidation at the next Interim Top and are not for holding for the long-term.

- However, there will be a time when The Cartel price capping is ineffective and Gold & Silver make record moves upward. The benefit of this Strategy is that one will likely be long in one’s speculative positions when this happens.

- Near the next Interim Top, liquidate the long options and majors. Again, in order to know when we are close to the next Interim Top, it is essential to monitor the Interventionals, as well as Fundamentals and Technicals.

- Near that Top, sell short or buy puts on Majors. We re-emphasize the Majors as preferred vehicles for trading positions because such positions are more liquid and tend to be quite responsive to Cartel moves.

- Near the next Interim Bottom, cover your shorts and liquidate your puts and go long again to begin the process all over again. We emphasize that it is essential to consider the Interventionals as well as the Fundamentals and Technicals in order to determine the approximate Interim Tops and Bottoms.

- Finally, Hard Assets Partisans have the opportunity to become involved in Political Action to diminish the power of The Cartel. It is truly outrageous that the average unsuspecting citizen, and prospective retiree, can and does put his hard won assets in Tangible Assets and/or Retirement Accounts only to have those assets effectively de-valued by Cartel Takedowns and other Cartel actions. This is extremely injurious to many average citizens in many countries who are saving for the rainy day or retirement and have their retirement and/or reserves effectively taken from them. In order to help prevent this and similar outrages, we recommend taking three steps:

- Become involved in the movement to Audit and then abolish the private-for-profit U.S. Federal Reserve as Deepcaster, former Presidential candidate Rep. Ron Paul, and legendary investor Jim Rogers, all have advocated. The ‘Audit The Fed’ Bill is H.R. 1207 (and has over 180 co-sponsors); and The Abolish The Fed Bill is H.R. 2755. www.carryingcapacitynetwork.org is a nonprofit organization which actively supports these bills.

- Join the Gold AntiTrust Action Committee, which works to eliminate the manipulation of the Gold and Silver markets (www.gata.org). GATA is a nonprofit organization, which makes a great contribution by gathering evidence regarding the suppression of prices of Gold, Silver and other commodities.

- Work to defeat The Cartel ‘End Game.’ Deepcaster has laid out the evidence regarding the Ominous Cartel “End Game.” Clearly The Cartel is sacrificing the U.S. Dollar to prop up Favored International Financial Institutions and to maintain its power. But this sacrifice cannot continue forever. See Deepcaster’s July 2008 Letter in the ‘Latest Letter’ Archives at www.deepcaster.com.

If this aforementioned Strategy is employed effectively, it can result both in an increasing Core Position in Gold and Silver, and in considerable profit along the way.

Additional insights and details regarding this Strategy, which are essential to profiting from The Cartel’s Policies, are laid out in Deepcaster’s article of 3/06/09 entitled “Investor Advantage: Revisiting The Cartel’s ‘End Game’ ” in the ‘Articles by Deepcaster’ cache at www.deepcaster.com.

Protection and profit required Proactivity and attention to the Interventionals, Fundamentals and Technicals, not “Buy and Hold.” We reiterate, “Buy and Hold” rarely succeeds anymore as current market conditions attest.

Indeed, the Key Point of the Strategy for Protection and Profit is careful attention not only to the Fundamentals and Technicals but also to the Interventionals. These Overt and Covert Cartel-generated Interventions have the power to move markets as those who study the matter can attest.

Thus, the Key to Profit and Protection is a Strategy: Successful Investors must become Long-Term Position Traders, with their trading choices informed by the Interventionals, as well as the Fundamentals and Technicals. Moreover engaging in the Actions suggested above can help prevent The Cartel’s obtaining Superpower status, and aid in achieving wealth protection and profits as well.

Source: Bank for International Settlements www.bis.org, Path: Statistics > Derivatives > Table 19

Best regards,

By DEEPCASTER LLC

www.deepcaster.com

DEEPCASTER FORTRESS ASSETS LETTER

DEEPCASTER HIGH POTENTIAL SPECULATOR

Wealth Preservation Wealth Enhancement

© 2009 Copyright DeepCaster LLC - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

DEEPCASTER LLC Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.