Investor Risk Appetite Retuns As The Stocks Bears Run Scared

Stock-Markets / Financial Markets 2009 Jul 31, 2009 - 03:58 AM GMTBy: PaddyPowerTrader

The bear slaughter continues apace. Stocks surged Thursday, hitting their highest levels in nearly 9 months, as investors eyed the latest batch of “better-than-expected” (yawn) profits and guidance, a weaker Dollar, a decent 7 year US Treasury bond auction, a report that suggested the labor market is starting to stabilize and soothing words from China that they would refill the punch bowl.

The bear slaughter continues apace. Stocks surged Thursday, hitting their highest levels in nearly 9 months, as investors eyed the latest batch of “better-than-expected” (yawn) profits and guidance, a weaker Dollar, a decent 7 year US Treasury bond auction, a report that suggested the labor market is starting to stabilize and soothing words from China that they would refill the punch bowl.

There was this which got a lot of airplay Dow Sends Buy Signal That’s Worked Since 1921: Chart of the Day and enticed some hot money off the sidelines.Putting it all together thhe Dow rose 83 points, or 0.9%, ending at its best level since Nov. 4. It was also the highest close for the blue-chip index in 2009. The S&P 500 added 11 points, or 1.2%, ending at its highest point since Nov. 4. The Nasdaq composite gained 16 points, or 0.8%, to reach its highest close since Oct. 1. For oldies like me, this is the longest bull run since July 1939 !

So almost the entire coveraged universe of S&P 500 companies crushed earnings estimates due to doing what American firms excel at in hard times i.e. excellent cost containment as a function of production capacity rationalization, broad-based restructuring programs, capital expenditure reduction and headcount reductions. A recurring theme was weaker volumes and top line revenues were offset by cost reductions. Earnings and EBITDA for the quarter were generally about 15-20% better than WRONG first call estimates (guesses). Why, well one reason maybe that most analysts had low-balled estimates after the blows-ups in 2008 ! So to compensate for getting it completely wrong on the topside in 2008 they have gotten it completely wrong on the downside in 2009.

By the way we are running a survey on our content and would appreciate your feedback on our content.

Today’s Market Moving Stories

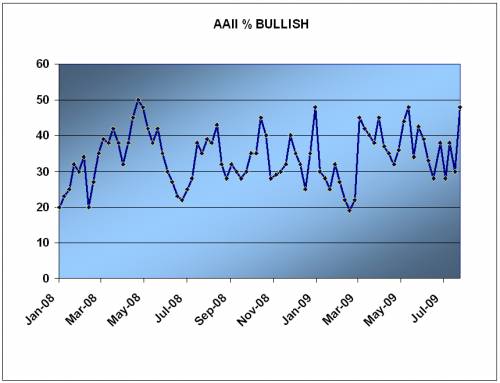

It seems that were all bullish now as the latest readings from the State Street Investor Confidence survey also show extreme signs of optimism at 48.1. You don’t need me to tell you looking at the graph below that such reads have in the past lead to sharp selloffs as the contrarian trade pays off most handsomely when everyone has the same view

It seems that were all bullish now as the latest readings from the State Street Investor Confidence survey also show extreme signs of optimism at 48.1. You don’t need me to tell you looking at the graph below that such reads have in the past lead to sharp selloffs as the contrarian trade pays off most handsomely when everyone has the same view

- All eyes were again cast eastwards on China yesterday. And with Chinese bourses managing to stage a partial rebound, helped by some dovish comments by PBoC Vice Governor Su Ning (reaffirming the Bank’s commitment to appropriately loose monetary policy), the risk rally has resumed. Key European bourses such as the DAX and FTSE rose almost 2% to post new cyclical highs. With the corporate reporting season continued to deliver better-than-expected earnings, US stocks have made new highs too, albeit with gains pared somewhat late in the session (around the time that Moody’s commented that California ’s amended state budget would still “…leave the state poorly positioned for budgetary balance in future years”.)

- Toyota Motor Corp’s loss for this business year will likely be several tens of billions of yen less than originally forecast by the automaker thanks to strong sales of hybrid cars, public broadcaster NHK reported. Toyota has forecast an operating loss of 850 billion yen ($8.9 billion) for the year to March 2010. NHK said strong sales of its new Prius and other hybrid vehicles, boosted in part by government tax incentives in Japan to promote fuel-efficient cars, would help narrow its annual loss by several tens of billions of yen. Analysts have already estimated that Toyota’s loss forecast would prove to be far too pessimistic.

Turning Japanese

Lots of economic news from Japan overnight with fresh news on deflation and unemployment made for grim reading mixed with emotions of deju vu as the country logged a record level of deflation as demand slides.

Japanese core consumer prices fell a record 1.7 percent in the year to June, with weakening consumer demand for goods playing an increasing part in pushing the country deeper into its second spell of deflation this decade. It was the fourth straight month of decline, matching a median market forecast and accelerating from a 1.1 percent drop in May in another sign the world’s second-largest economy is stuck in the doldrums with rising job losses and falling wages hurting household spending.

The Bank of Japan is forecasting two years of deflation, so price falls alone are unlikely to push it back into full-blown quantitative easing, which in Japan involved flooding the banking system with cash to meet a specific monetary target. And Japan’s jobless rate rose in June to 5.4 percent, matching a high hit in June 2003, and job availability sank to a new record low, reinforcing views that it will take time for job markets to recover despite recent improvements in corporate activity. But there was some good news Japanese manufacturing activity expanded for the first time since February last year, a survey showed on Friday, as a recovery in global trade prompts companies to slowly resume production.

The Nomura/JMMA Japan Manufacturing Purchasing Managers Index (PMI) rose to a seasonally adjusted 50.4 in July, the highest since 50.8 in February last year, from 48.2 in June, rising above the 50 threshold that separates contraction from expansion for the first time in 17 months

British Consumer Movement

British consumer confidence held steady in July as a small deterioration in Britons’ expectations for their own finances was offset by a more upbeat view of the economy as a whole, a survey showed on Friday. The GfK/NOP consumer confidence index, which is conducted on behalf of the European Commission, was unchanged at -25 in July, 14 points higher than this time last year but below the consensus forecast of -23.

But vacancy rates for town centre shops in England and Wales jumped from 4 percent in mid-2008 to nearly 12 percent at end-June, with more retailers going out of business during the recession, a report said on Thursday. The damage is spread across the two regions and affects all levels of the retail hierarchy from the largest regional centre to the smallest high street, retail research firm Local Data Company (LDC) said in its mid-year report.

The worst-hit areas were big regional centres in the UK’s north and midlands, with Derby, Blackpool and Liverpool seeing more than 21 percent of their retail capacity vacant, while vacancies in central London are at 13 percent, it said.

Irish Hopes Rise For NAMA

The big Irish news story today if of course NAMA (www.nama.ie). After all the talk, ill informed speculation & thousands of column inches (paper never sadly refused ink), the draft legislation for NAMA was published yestreday evening.It outlines some crucial dates for assessing the future of the Irish banking system.

Firstly, September 16th will see the announcement of the initial estimates for capital requirements for the Irish banking sector. While the “haircut” will not be known until after assets are fully transferred by mid 2010, Sept 16th will prove pivotal in giving the market its first steer from NAMA on the potential write downs and therefore the potential impact on equity among the Irish Banks.

The release of this estimate is much earlier than the market had expected, and the fact that there will be tentative clarity around capital requirements this early is a positive for Irish banks & the view of Ireland Inc from overseas investors in stocks & bonds. The market should have an initial assessment of the funding requirements of the banks before the October asset transfers begin.

This potentially could see either AIB or Bank of Ireland being in a position to outline capital adequacy and therefore any potential capital shortfalls in September. If further capital is required it will take the form of equity. On that assumption, the timetable for a rights issue, if required, moves forward. A buoyant equity market as a backdrop would provide another crucial ingredient in the funding scenarios; the higher the equity price of the bank pre funding, the less dilution on funding.

At this stage it is not certain if NAMA will give a case by case assessment of capital requirements but at least there will be guidelines on the scale of the haircut by the critical September date.The asset transfers begin in October and will be completed by June 2010. This timeline is agian quicker than many commentators had expected and is a positive as it brings total clarity the NAMA related assets by mid 2010. Of the 10,000 loans under scrutiny 1/3 are pure land, 1/3 WIP and 1/3 commercial property. Half of the loans are cashflow generative which will provide the funding for the NAMA bond programme.

Estimates on bond size to fund NAMA (Debt Swap Note : IT DOES NOT REPRESENT NET NEW IRISH GOVERNMENT DEBT. This is a crucial point to get right, as many experienced overseas analysts have gotten the complete wrong end of the stick on this.) will be set on Sept 16th. The 50% of the loan book producing cash is “more than sufficient to service bond interest”. Assets will be transferred at “long term economic value” inline with the EU guidelines which is as expected, providing nothing new with regard to the estimates of valuation of the assets to be transferred.

NAMA will have the power to develop out the WIP portion of the assets and have funding power. It was highlighted that several private equity group’s had already approached the agency to inquire on asset purchases, which potential speeds the unwind of the NAMA property book.

The banks can challenge the price paid by NAMA for assets but effectively the rights of appeal appear limited. It is unlikely that mortgage books will be part the NAMA remit.

Maybe Sherry & Fitzgerald should try this to build business.

A government scheme that actually worked too well !’Clunkers’ Auto Rebate Plan So Popular It’s Broke - NYT

And more bank bashing. The again regarding people for failure during the “great moderation” does seem onscene. Big Banks Paid Billions in Bonuses Amid Wall St. Crisis – NYT

Ahead Today

- Euro area CPI, Jul (10:00 BST): Deflation should accelerate to -0.6% on an annual basis on the back of lower inflation in Germany, Spain and Belgium.

- US GDP, Q2 (13:30 BST): GDP should contract by 0.8% on an annualised basis, smaller than the consensus forecast and reflecting an improvement across most components of activity. Note there will be a quinquennial benchmark revision to history in this release.

- US ECI, Q2 (13:30 BST): Consistent with high unemployment, costs should rise modestly, up only 0.3% in the quarter.

- US Chicago PMI, Jul (14.45 BST): The PMI has see-sawed recently, but should improve to 43, indicating a slower rate of contraction in activity

And finally…

Disclosures = None

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.

© 2009 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.