Bernanke Upside Down and Backwards: Is Central Banking at Death’s Door?

Politics / Central Banks Jul 27, 2009 - 05:28 PM GMTBy: Rob_Kirby

In a rare lucid moment, British Prime Minister Gordon Brown recently quipped,

In a rare lucid moment, British Prime Minister Gordon Brown recently quipped,

“Technology means that foreign policy will never be the same again”

Elaborating before a group of leading thinkers at the TED global conference in Oxford, England, Brown further explained,

The power of technology - such as blogs - meant that the world could no longer be run by "elites"

While Mr. Brown didn’t exactly enunciate it, he might as well have said, “the advances in technology [read: the internet] also mean that our system of fractional irredeemable fiat currency [read: backed by NOTHING] practiced by Central Banks like the Federal Reserve may also soon be passé too.” This is largely due to the masses becoming informed about the world’s biggest ponzi scheme, namely, irredeemable fiat currency – forget about the warm-up acts like Madeoff and sub-prime.

Earlier this week, Federal Reserve Chairman, Benedict Benjamin ǝʞuɐuɹǝq appeared before lawmakers to give sworn testimony about the state of the nation’s monetary policy. In one of his most telling pieces of testimony, Sir Benedict attempted to explain to Congressman Alan Grayson [D- Fla.] the significance of ½ TRILLION in currency swaps which recently appeared on the Fed’s balance sheet:

In his concluding remarks, Grayson asks Mr. ǝʞuɐuɹǝq if he felt the creation of these “currency swaps” had anything to do with the $U.S. Dollar’s strengthening immediately after or whether this temporary strengthening in the Dollar was coincidental?

ǝʞuɐuɹǝq responded that it was his opinion that the Dollar strengthening [at the time] was just a coincidence.

The questioning concludes with Congressman Grayson laughing in s,ǝʞuɐuɹǝq face.

Under oath, you can listen to Benedict Benjamin ǝʞuɐuɹǝq make the claim that these currency swaps were made for the benefit of ‘customers’ of foreign Central Banks.

Last Thursday, Yves Smith at naked capitalism published a piece where an ‘anonymous economist’ opined,

“I do not think the currency swaps in question -- half a trillion dollars to foreign central banks -- was what caused the US nominal dollar exchange rate to "appreciate". In the past year, dollar appreciations have been perfectly correlated with declines in the Dow, the seizing up of financial markets, and a diminishing in investor appetite for risk. The Fed's actions were almost certainly in response to this. What happened was, banks all over the world suddenly want to hold either T-bills or dollars, taking as little risk as possible, and not wanting to hold riskier assets such as the Pound or Euro. Everyone wants this at the same time, so to alleviate the demand, the Fed gives other countries half a trill [sic] in dollars in return for half a trillion their currencies... This, if anything, should slow the appreciation of the dollar, which is a good thing.

I cannot fathom why ǝʞuɐuɹǝq could not just elucidate this, except to say that perhaps ǝʞuɐuɹǝq is taking his marching orders from someone else and doesn't himself quite understand the rationale.....”

Well, let’s take a look at this.

To begin with, Dollar appreciations being perfectly correlated with the DOW is counterintuitive. In Canada, for instance, whenever the Toronto Stock Exchange gets hammered [admittedly resource centric] – the Canadian Dollar gets creamed. Secondly, the suggestion that foreigners are “flocking into Dollar [Treasury] vehicles [flight-to-quality] to avoid risk requires some deeper examination:

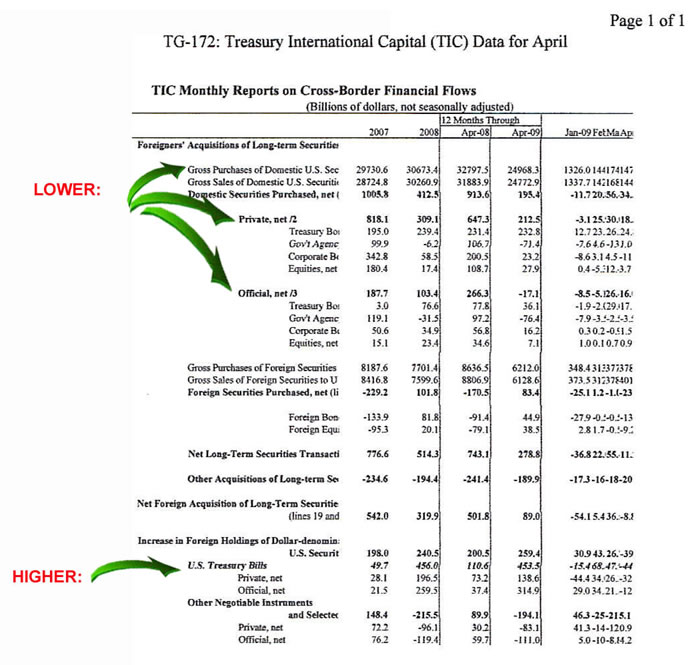

From the most recent U.S. Treasury TIC report, it is clear that, for the 12 months ended April 09, Gross Foreign Purchases of Domestic U.S. Securities declined from 32797 to 24968 Billion. Furthermore, apart from Treasury Bonds, Private net purchases of Gov’t Agency, Corporate Bonds and U.S. equities all crashed. Additionally, Official net purchases for the same categories also declined heavily across the board.

What the data does show is that Foreigners “PILED IN” to the short end of the interest rate curve [less than 1 year in duration] buying U.S. Government Treasury Bills in an unprecedented fashion. Shortening of maturity is typically what creditors do to borrowers before they pull the plug on them completely.

While such a move could be described as risk aversion it is ANYTHING BUT AN ENDORSEMENT of the Dollar. So the notion that foreigners “want” to hold Dollars is misplaced and false.

So what really did happen?

The Numbers Don’t Lie

A forensic examination of the available evidence would tend to suggest another unstated reason for this financial sleight-of-hand, besides mere coincidence that Benedictus would have us believe.

Take note of when the Currency Swaps began with foreign C.B.s:

These foreign currency swaps supplied the U.S. Federal Reserve with as much as ½ Trillion worth of foreign reserve liquidity. The Fed cannot print Euros, Yen, Cad., Francs, Pounds etc. - TO SELL – to defend the DOLLAR. Prior to doing currency swaps with foreign CBs the Fed could only RAISE interest rates, or, SELL gold to defend the Dollar.

Raising interest rates was clearly OUT OF THE QUESTION.

As for selling gold, let’s just say that you would be required to possess physical gold to do so. Perhaps this is why the U.S. Treasury / Fed has stonewalled GATA’s freedom of information requests regarding the true state of sovereign American gold reserves which have not been verifiably audited since the Eisenhower Administration in the 1950s.

It seems that the true state of “declared” sovereign gold stocks is a highly questionable matter. There is compelling new insight [or questions, perhaps?] on the state of sovereign Swiss gold stocks in the subscriber portion of this article.

We note how the U.S. Dollar finally displayed ‘temporary strength’ on the back of these currency swaps completed by the Axis of Central Banks:

The charts are suggestive that the “real unstated” reason for the foreign currency swaps was to provide the Federal Reserve with “dry powder” [foreign reserves] to defend against a MASSIVE run-on-the-BUCK.

We’re seeing anecdotal evidence, with the renewed breakdown in the Dollar, that much vaunted “green-shoots” of early spring have wilted and turned brown with the summer heat. The Fed has all but exhausted their initial salvo of currency swaps [fantasy finance] and the U.S. Dollar has endured two negative MACD crossovers - in both April and July 09 at “lower lows”:

Central Bankers on the Other Hand….

Of course, Sir Benedict of ǝʞuɐuɹǝq will never admit that this was the true reason for the foreign currency swaps, nor should we be surprised. Remember folks, it was none other than former Vice Chair of the Federal Reserve, uɐןɐ ɹǝpuıןq, years ago, who told the world on the PBS Nightly Business Report,

"The last duty of a central banker is to tell the public the truth."

Ladies and gentlemen, it would appear that the esteemed Chairman of the Fed has the art of obscuring the truth down to a finely tuned, ‘nuanced’ art form. Do you think that Ken Lewis over at Bank of America would agree? How about ʞuɐɥ uosןnɐd?

Ladies and gentlemen, it would appear that the esteemed Chairman of the Fed has the art of obscuring the truth down to a finely tuned, ‘nuanced’ art form. Do you think that Ken Lewis over at Bank of America would agree? How about ʞuɐɥ uosןnɐd?

Watch for the next round of Central Bank currency swaps as the Federal Reserve chews through their initial installment of foreign currency swaps / reserves before the snow flies.

The fact that ALL Western Central Banks have hitched their wagons to the sinking fortunes of the profligate, money printing, deceitful Federal Reserve doesn’t bode well for their near term prospects either.

Western Central Banks have stood united and together they will fall. Unfortunately, we are going to have to live with the consequences resulting from the upside-down and backward policies and lies they’ve inflicted on us all.

Got physical Gold and Silver yet?

More for subscribers.

By Rob Kirby

http://www.kirbyanalytics.com/

Rob Kirby is proprietor of Kirbyanalytics.com and sales agent for Bullion Custodial Services. Subscribers to the Kirbyanalytics newsletter can look forward to a weekend publication analyzing many recent global geo-political events and more. Subscribe to Kirbyanalytics news letter here. Buy physical gold, silver or platinum bullion here.

Copyright © 2009 Rob Kirby - All rights reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Rob Kirby Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.