California Public Employees’ Retirement System in Deep Trouble, Gambling on Riskier Bets

Economics / Credit Crisis 2009 Jul 26, 2009 - 09:27 AM GMTBy: Mike_Shedlock

Calpers, the California Public Employees’ Retirement System, is in deep trouble. Calpers got in trouble by not understanding risk. It still does not understand risk and thinks risk is the solution.

Calpers, the California Public Employees’ Retirement System, is in deep trouble. Calpers got in trouble by not understanding risk. It still does not understand risk and thinks risk is the solution.

Please consider the New York Times article California Pension Fund Hopes Riskier Bets Will Restore Its Health.

Calpers, lost nearly $60 billion in the financial markets last year. Though it has more than enough money to make its payments to retirees for many years, it has a serious long-term shortfall.

Those problems now rest largely on the slim shoulders of Joseph A. Dear, the fund’s new head of investments. He is not an investment seer by training, but he thinks he has the cure for what ails Calpers, or the California Public Employees’ Retirement System, the largest in the nation with $180 billion in assets.

Mr. Dear wants to embrace some potentially high-risk investments in hopes of higher returns. He aims to pour billions more into beaten-down private equity and hedge funds. Junk bonds and California real estate also ride high on his list. And then there are timber, commodities and infrastructure.

That’s right, he wants to load up on many of the very assets that have been responsible for the fund’s recent plunge. Calpers’s real estate portfolio has tumbled 35 percent, and its private equity holdings are down 31 percent. What is more, under Mr. Dear’s predecessor, Calpers had to sell stocks in a falling market last year to fulfill calls for cash from its private equity and real estate partnerships. That led to bigger losses in its stock portfolio.

Gov. Arnold Schwarzenegger, who is on the Calpers board, has called the fund “unsustainable.” He has specifically criticized a decision by Calpers last month to give California municipalities a break on their required contributions. Rather than stepping up contribution rates to 5 percent to cover investment losses, Calpers set a maximum increase of 1.1 percent — saving municipalities hundreds of millions of dollars.

Mr. Schwarzenegger called it a “pass the buck to our kids idea.” Calpers says municipalities, which pay 15 percent of their payroll — or about $11 billion a year — into the fund, needed the help.

In the end, Mr. Dear, who will get $408,000 to $612,000 in salary and can qualify for a performance bonus of up to 75 percent of that salary, will be judged by portfolio returns.Calpers Follows Roll The Dice Model

Interestingly, Mr Dear is following the Hedge Fund "Roll The Dice Model". For those unfamiliar with how hedge funds operate, many get 2% up front and 20% of the profits. Thus, there is a huge incentive for hedge fund managers to take huge risks as the payouts can be enormous.

For example, imagine managing a billion dollars and doubling it under that model. Dear's temptation is not as great, but a bonus of 75% on a starting salary of $408,000 to $612,000 is certainly not a bad incentive to take unwarranted extra risks.

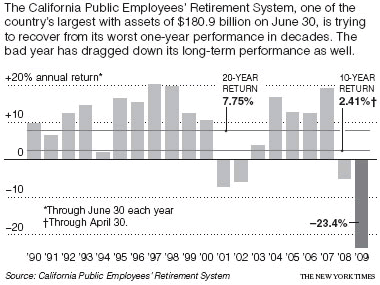

Hoping To Recover From Bad Year

Here is a chart of Calpers' rates of return from the New York Times article.

Calpers 10-Year rate of return is 2.41%. It's 20-year rate of return is a respectable 7.75%. For comparison purposes, check out a chart of 10-year treasuries for the last 20-years.

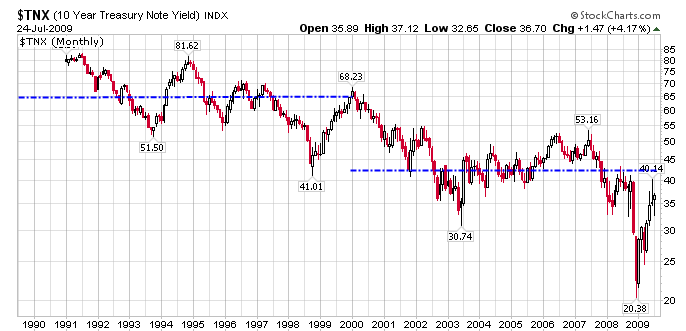

$TNX 10-Year Treasury Yield

The average yield on 10-year treasuries for the last 10 years is about 4.25% or so. The average yield on 10-year treasuries for the prior 10-year period is roughly 6.5%. Counting capital gains, one could easily have exceeded 7.75% just sitting in treasuries for the last 20 years.

However, if yields stabilize here, one might get 4-5%. If yields soar, one would have capital losses buying 10-year treasuries, unless held to duration. Certainly short-term treasuries are no help given they are yielding a mere .18%!

This is enormously problematic given Calpers investment return assumptions.

Calpers Assumes Rate of Return at 7.75%

Inquiring minds are digging into the California 2009 Funding Assumption Survey. Lines 2 and 5 refer to legislative and judicial assumptions at 7.0% and 7.25% respectively. Line 37 shows the general Calpers assumption of 7.75%.

Clearly on those assumptions, Calpers cannot sit in any treasuries. So, what to do? Risk taking is what.

CalPERS and partner buy shopping centers

The Sacramento Bee is reporting CalPERS and partner buy shopping centers.

Tormented by sagging investments over the past year, CalPERS is fighting back by going bargain hunting. The big pension fund and a partner are paying more than $1 billion for a collection of shopping centers that they sold just four years ago for a much higher price.

"This is a great example of the many positive opportunities there will be in the marketplace for CalPERS coming out of the distress in the market," said Ted Eliopoulos, senior real estate investment officer for the California Public Employees' Retirement System.Question For CalPERS

If Calpers is so astute with "positive opportunities", how the hell did it manage to lose 23.4% last year?

Neighborhood centers that cater to necessities, not luxuries, are "a recession-hardy part of the real estate market," said Jim Hurley, CalPERS real estate portfolio manager.

Really? What about the recession-proof excursion into commodities based on piss-poor decoupling theories (or whatever rationale CalPERS used) to dive into commodities at the peak in 2008?

Bumpy Road For Calpers

On June 16th Fox & Hounds reported "Smoothing” Today Makes For Bumpy Road Tomorrow.

This week, the board of the California Public Employee Retirement System (CalPERS), the largest pension fund in the country, will be asked to approve a “smoothing” proposal designed to provide short- term cash flow relief to local and state governments by deferring pension contributions. If that sounds to you like a free lunch, you’re right. Such an offer is tempting to governments facing harsh budget troubles, but CalPERS should reject the proposal as at best imprudent and at worst dangerous to future generations.

Unfortunately we have been here before. In 1999, CalPERS told California governments at that time that they could not only defer contributions but also even boost pension promises retroactively by tens of billions of dollars because future investment earnings would cover the cost. As things turned out, not only did CalPERS not earn what was projected, but proposed contributions from governments today are nearly 5 times greater than what CalPERS projected would be the case. As a result, general funds in California today are facing an unanticipated $3 billion of contributions for past promises underfunded on faulty assumptions.

Worse, even those higher contributions understate the amounts required to put CalPERS on financially sound footing and to protect future general funds. This is because CalPERS continues to employ a high-yield earnings assumption ungrounded in reality (particularly for such a large fund), lulling employers into complacency about the real size of contributions needed to meet pension promises. To put this matter in perspective, to meet its earnings assumptions CalPERS needs the Dow Jones Industrial Average to grow even faster in the 21st century than it grew in the 20th century and to yield more than the legendary investor Warren Buffett assumes his defined benefit plan assets will earn.

The difference between a reasonable and unreasonable assumption means life or death for government programs. Because of the long-term nature of these liabilities, a tiny difference in earnings assumption can mean billions of dollars of shortfall and, as a result, understaffed and undercompensated police, parks, fire, education and other departments for decades to come.Calpers Gives Municipalities "A Break"

For political expediency, Calpers gave municipalities a "break" on contributions as noted above:

Rather than stepping up contribution rates to 5 percent to cover investment losses, Calpers set a maximum increase of 1.1 percent — saving municipalities hundreds of millions of dollars.

This was no "break". Calpers does not want a consumer backlash in the midst of huge recession. Unfortunately all this is going to do is make problems worse in the long run.

Interested parties should read the rest of the Fox & Hound article because the writer, David Crane, nails it with other promises unlikely to be met.

Who Is On The Hook?

New readers to this blog may be asking "who is on the hook for this nonsense?"

Longtime readers already know the score: California taxpayers are on the hook for this madness. If Calpers massive gamble pays off, taxpayers break even, assuming one calls paying ridiculous pensions to a bunch of government bureaucrats "breaking even".

However, if Calpers' dice roll comes up snake eyes, taxpayers foot the bills.

Please take one more look at that treasury chart while pondering the implications of short-term rates at .18% and Calpers' 10-year rate of return of 2.41%.

Like your chances on Calpers' rolling the dice? I don't.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

Rick

27 Jul 09, 18:35 |

Calpers

I think that I would change course if I were you Mr. Dear. In a Depression, you would definitely be seeking government securities even though the return is low. |