Trend Following in the Forex Markets

InvestorEducation / Learn to Trade Jul 26, 2009 - 08:44 AM GMTBy: Andrew_Abraham

I want to speak this morning with the idea of trend following in the forex markets and how to use forex signals. There is no magic to trend following in the forex markets. It is not easy however. The magic is using one of the time tested simple forex systems such as Donchian breakout. The Donchian breakout has been around since the 1940s.

I want to speak this morning with the idea of trend following in the forex markets and how to use forex signals. There is no magic to trend following in the forex markets. It is not easy however. The magic is using one of the time tested simple forex systems such as Donchian breakout. The Donchian breakout has been around since the 1940s.

There is no magic in order to trade the forex markets. The forex signals used are 22 day ( period) breakouts…and breakdowns with various risk parameters & exit parameters. That is it.. simple. What is complicated is the discipline and patience to let the system work. More so I would suggest not just trading the forex markets but a wide base of commodity markets ( depending on your account size) as at times they can become very quiet.

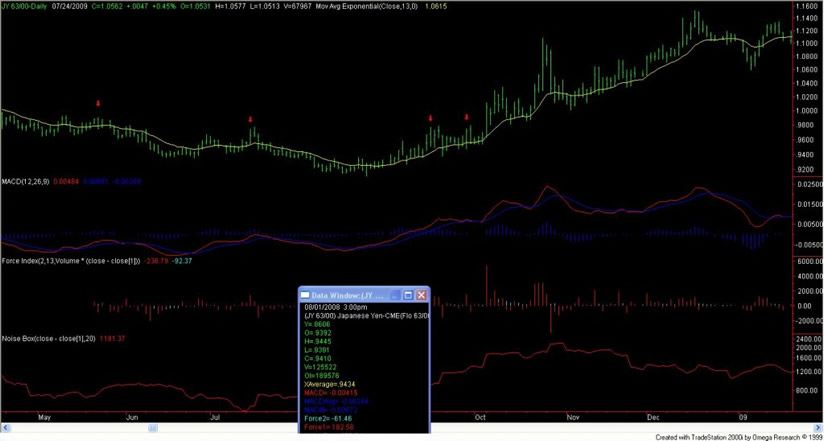

In order to enter a trade ( forex signal) is a 22 Period breakout.. or break down with the condition that a long term MACD is confirming the direction. I risk less than 1% of my account on any trade based on the risk to the initial stop. The exit is based on an initial stop based on Average true range…as well as following stop based on price. If the trade moves… I am trailing the move..

In all honesty it does not get any easier than that…

Look at these following trades… you can trade any of the forex markets or crosses..

Japenese Yen CME contracts…

5.21.08 Entry Fill .9889 loss -$3884.00 on 5.28.08 .9696 3 contracts .5% of the account

7.15.08 Entry Fill .9641 loss -$5,500 exit on 7.23.08 .9433 4 contracts .8% of the account

9.16.08 Entry Fill .9735 loss -$6,000 exit on 9.19.08 .9427 3 contracts .9% of the account

At this point most inexperienced forex traders or commodity traders would have given up. The key point is you never know what trades will work. You must be consistent without any emotions. This is were the discipline comes in.

9.29.08 Entry Fill .9748 profit of $13,638 exit on 1.05.209 2 contracts ..There were forex trades there after…You never know what trades will work.

What I have personally seen is the lack of discipline when one goes through a typical draw down. I have two suggestions. One is to have a brokerage trade your forex signals (automated forex) or allocate to a commodity trading advisor who has developed the full strategy from entries..risk… money management…and mostly discipline.

More so if you want to try to compound your way to wealth don’t think you can be an expert overnight if you try trading yourself. Too many inexperienced traders try to trade forex without a plan or methodology…they are basically gambling. However this is maybe what they might want. Ed Seykota has said we all get out of the markets what we seek. I do not seek entertainment or gambling. I know it is a hard game and I am trying to compound my way to long term wealth with strict money management and risk parameters.

Andrew Abraham

www.myinvestorsplace.com

Andrew Abraham has been in the financial arena since 1990. He is a commodity trading ddvisor and co manager of a Commodity Pool. Since 1993 Andrew has been a proponent of quantitative mechanical trading programs. Andrew's major concern is not only total return on investment but rather the amount of risk that one would have to tolerate in order to achieve returns He focuses on developing quant models that encompass strict risk adherence and correlation. He has been a speaker at conferences as well as an author of numerous articles. Andrew has spent years researching ideas that have the potential to outperform indices as well as maintain fewer draw downs.

Visit Angus Jackson Partners (http://www.angusjacksonpartners.com) Contact: A.Abraham@AngusJackson.com (mailto:A.Abraham@AngusJackson.com)

© 2009 Copyright Andrew Abraham - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.