The Statistical Economic Recovery and the Last Stocks Bear Standing

Economics / Recession 2008 - 2010 Jul 25, 2009 - 08:25 AM GMTBy: John_Mauldin

The Return of Muddle Through*

The Return of Muddle Through*

Can China Lead the Global Recovery?

The Statistical Recovery

The Last Bear Standing

A lot of bullish commentators are talking about a recovery being in the works, and they may very well be right. But it is not going to look like any recovery worthy of the name. This week we look at what I will call The Statistical Recovery. But first we take a look at what China is doing, as we continue our look at the rest of the world and ponder whether it is time to brace ourselves for an extended bout with the Muddle Through Economy*. (And yes, there is an asterisk.)

Quickly, and importantly, tonight we are releasing the first in a new series of quarterly Conversations entitled Geopolitical Conversations with John Mauldin and George Friedman. We believe that these new Conversations will help you better understand not only the global political landscape but also how it affects the financial umbrella that we are under. In this first Conversation, we talk about the "exogenous" risks to the markets (those from outside the markets themselves) posed by the geopolitical world.

George and I are going to make it a regular quarterly gig. We will offer this service, which will be priced separately, at some point in the near future. Now, here is the important part: all current subscribers and anyone who subscribes now will receive these Geopolitical Conversations free, as a thank you. (Current members can log in now.) If you have not yet subscribed, you can do so and receive a discount, by clicking the link and typing in the code JM49 to subscribe for $149. This is a large discount from our regular price of $199; plus, we are including the bonus Geopolitical Conversations that are worth $59.

Further, we will post a separate interview next week that I have obtained permission to use from my friends at Casey Research, and which I personally found very valuable. When we launched Conversations, we promised eight interviews a year. We are now at six, and next week I will record the seventh with housing experts John Burns of John Burns Real Estate Consulting and Rick Sharga of Realty Trac, the two leading experts on housing in the country. There is SO much uninformed, simplistic misinformation in the media about housing that I thought subscribers might like to know what the real situation is.

When you subscribe, all of the past Conversations are there for you to review. I am going to make sure subscribers get way more than their money's worth.

You don't want to wait another day to subscribe. And now, let's jump into this week's letter.

Can China Lead the Global Recovery?

China is growing by about 8% a year, which is amazing on the surface of it, as their exports are down about 20% (more in some sectors). How can that be?

I continually read about how China is going to lead the world out of its global funk. And 8% growth in GDP does seem pretty strong. But we need to look a little deeper.

If I told you that the next US stimulus package would be $4.5 trillion dollars, mostly given to banks that would be forced to loan out the money quickly, do you think that might jump spending and GDP in the short term? Would you start looking for a few bubbles to be created? What about the dollar?

That is the equivalent of what China is now doing. The volume of credit that is flowing into China is equivalent to one-third of their GDP. Banks that already have large problem-loan portfolios are now lending even more, in a very short time frame. China has severe capacity-utilization problems, as trade has sharply fallen; and the US consumer is unlikely to return to anywhere near the level of consumption that was the case in 2006.

The Chinese stock market is up 85% this year, and commodity and real estate prices are rising. And no wonder: the money supply shot up 28.5% in June alone. That money is looking for a home. My friend Vitaliy Katsenelson has written a very perceptive essay for Foreign Policy magazine, talking about the nature of the current growth in China.

"But don't confuse fast growth with sustainable growth. Much of China's growth over the past decade has come from lending to the United States. The country suffers from real overcapacity. And now growth comes from borrowing -- and hundreds of billion-dollar decisions made on the fly don't inspire a lot of confidence. For example, a nearly completed, 13-story building in Shanghai collapsed in June due to the poor quality of its construction.

"This growth will result in a huge pile of bad debt -- as forced lending is bad lending. The list of negative consequences is very long, but the bottom line is simple: There is no miracle in the Chinese miracle growth, and China will pay a price. The only question is when and how much."

I am going to quote at some length from Simon Hunt's latest note. He travels very frequently to China and is one of the world's true experts on the copper market. If you want to know something about copper, ask Simon. Copper, we are told, is the metal with a PhD in economics. If copper prices are rising, then the economy is booming. And historically, that has more or less been the case. But there may be reason to believe that PhD may be no more useful this time around than a regular Ivy League degree.

"The world community has come to see that China is its savior. Growth picked up sharply in the second quarter, but it is based on fixed asset investment and renewed speculative activity in the real estate sector. It is not what the actual GDP or IP [Industrial Production] numbers will show that matters, but the quality of that growth. Money is cheap with loans and credit freely available, so much so that China risks developing new bubbles in the stock and commodity markets and real estate. Speculation is based on the simple premise that prices must rise. Foreigners as well as domestic participants are feeding this frenzy, especially in metal markets.

"The frenzied loan and credit growth is unlikely to be cut back until the fourth quarter at the earliest. It is not this year or next which worries us, but post 2010. What will China do when the world economy gets hit with its next big leg down?

"There is no better example of this speculative activity than what is being seen in the copper market. It is easy for global merchants, hedge funds etc to ship cathode into China and warehouse it outside the reporting system, so fuelling investors' sentiments that copper demand in China is soaring and at the same time draining copper from the rest of the market.

"It is not so much industry which is doing this buying in China, but individuals, financial institutions and even small companies divorced from the copper industry who are buying and holding the metal because copper is a store of value and prices will go up is the common response. We updated our numbers for the first half of this year. They are truly staggering. Over 1 million tonnes of cathode is sitting in China mostly outside the reporting system as a punt on rising prices." (Emphasis mine)

If it is happening in copper it is likely to be happening in other commodity markets as well. If you are trading the metals, you should be aware that a quick drop could happen if demand falls off due to there being a glut of supply coming back onto the market.

Why would China engage in what seems from our shores to be very risky behavior? Because from their point of view it makes sense. It is not a lot different in concept than what the US or England is doing to stimulate their economies. The scope and size are different, but China also has a much different problem. They are attempting to soften the transition from an economy dependent on the US consumer to one that is more balanced. Will they be successful? The answer depends on what they are actually trying to do. You could (and should) also ask whether Bernanke will be successful when he decides to remove reserves from the economy. Avoiding financial Armageddon may be the measure of success in both countries, with the reality that there will be some pain, no matter what.

Who Ends Up with the Old Maid?

But the important news out of China this week was the assertion that China was getting ready to use its massive $2.2 trillion reserves. From the Financial Times:

"Beijing will use its foreign exchange reserves, the largest in the world, to support and accelerate overseas expansion and acquisitions by Chinese companies, Wen Jiabao, the country's premier, said in comments published on Tuesday. 'We should hasten the implementation of our "going out" strategy and combine the utilization of foreign exchange reserves with the "going out" of our enterprises,' he told Chinese diplomats late on Monday. Mr. Wen said Beijing also wanted Chinese companies to increase its share of global exports. The 'going out' strategy is a slogan for encouraging investment and acquisitions abroad, particularly by big state-owned industrial groups such as PetroChina, Chinalco, China Telecom and Bank of China."

This is a very big deal, and from the Chinese point of view, quite smart. Right now they are stuck with $2 trillion in US Treasuries, agency paper, etc. They can't sell their dollars without really hurting the dollar, thereby forcing the renminbi to rise and hurting their own exports. But they, and much of the world, feel that the US is pursuing policies that are going to be harmful to the value of the dollar and therefore to China's largest reserve exposure.

What to do? Take those dollars and buy physical assets. Companies, natural resources, maybe a few small countries. (To my Chinese readers: that's a joke, although some in the West worry about that.)

In the card game called Old Maid we played as kids, the loser was the one who ended up with the "Old Maid" at the end of the game. For the past decade, the Chinese sent us "stuff" and we sent them dollars in the form of electrons. They in turn invested those dollars in our debt so we could buy more stuff. It was a form of vendor financing.

And now the Chinese have apparently decided to pass the Old Maid of the dollar on to other parties, who will sell them their assets for dollars. Seriously, did anyone not think they would do this? Massively selling the dollar, which so many conspiracy-theory types keep saying they will, was never really a rational option. But using those dollars to acquire productive assets? Very smart, very rational. If you figure out what they want to buy and get there first, there are profits to be had. Attention should be paid.

$2.2 trillion in reserves and growing can cover a lot of economic sins and bad bank loans. It can buy time for the companies with too much production capacity in China to find new customers. Will it be a smooth ride? Of course not. There will be a lot of bankrupt companies and a lot of angst among the entrepreneurial class. That is part of the process. But in five or ten years, China will be larger and stronger than it is today. Count on it.

That being said, is it likely China will pull the world out of its current slump? Not for a while. China is just 7% of global GDP. Even if they grow at 8%, that only adds 0.5% to global growth, and it is likely that we will see global GDP shrink by 2.7% in 2009. Look at the chart below from my friends at Hayman Advisors.

A few side observations on the above graph. China is roughly as big as the other three of the BRICs (Brazil, Russia, and India) combined. Russia and Brazil are in recessions. Also, note that it will be decades before China's economy is as big as that of the US, even with growth of 5-6% a year more than that of the US. Will it eventually be as big? Of course, and it should be; tt has four times more people.

Will it matter? Not a bit. Does Denmark care that the US or Germany is bigger? Not that I can tell. Does Dallas care if New York is bigger? You just deal with the reality in front of you and try and make the most of what you have. If you focus on the other person or country, you lose sight of your own goals.

Further, I rather doubt that China will be growing by 8% a year in 15 or 20 years. Like all large economies, they will start to experience slower growth. And they will have their own demographic problems in a few decades as a result of the "one child" policy. Every country has to deal with its own specific issues.

That being said, will there be opportunities in China and other emerging-market countries? You bet. I rather think that the developing world will be where the real opportunities will be as the world figures out what the New Normal will look like.

And now, let's look at a few issues the US will have to deal with.

A Statistical Recovery

"I've been down so long it looks like up to me," went the song of my youth. The recessions is not quite two years old. Every day we are hit with increasing unemployment, lower incomes, rising taxes, and more - a relentless stream of bad news. We wonder whether it will ever end. And the answer is that of course it will. And it may be ending now. But this is going to feel like a very different recovery from what we normally think of as recovery. It will be more of a statistical recovery than a real one.

The easiest way to explain that concept is to look at the following graph. At one point, housing construction was over 5% of GDP. Now it is around 2.5%. The graph shows how much a shrinking home-construction industry has reduced GDP each quarter for the last two years.

Without going into a lot of detail, housing construction may be at a bottom, or at least there is less room to fall. Instead of housing subtracting 1% (or more) from GDP each quarter, it may become a nonfactor as a bottom is reached. Does that mean recovery? No, it just means that things aren't getting worse.

We are finding that level of the New Normal.

Ditto for inventories. At some point, you have to restock the shelves. Rail shipments are down by almost 20% from last year, and UPS package volume is down 4.7%. And as Dave Rosenberg pointed out this morning, that is from last year's already depressed levels. As Alan Blinder noted today in the Wall Street Journal, at some point you finally get to bottom. Housing, inventories and business investment stop subtracting from GDP, and the GDP stops shrinking.

And as I pointed out a few weeks ago, the fact that we are buying less from outside of the US (imports) may show economic weakness, but from a statistical point of view that is positive for GDP.

All of this means that we could see – actually, we will see – a positive GDP number at some point. Those of bullish persuasion will talk of recovery. But for the 10%-plus people who will not have a job next year, it is not going to seem like a recovery. Nor for the additional 7% (at least) part-time employees looking for full-time work.

Go back to 2001. We had "the end of the recession." Bulls were out in force, trying to talk up the market. But unemployment still rose for almost a year. And the stock market noticed. The market did not really take off for well over a year, and actually continued to slide into 2002.

The Last Bear Standing

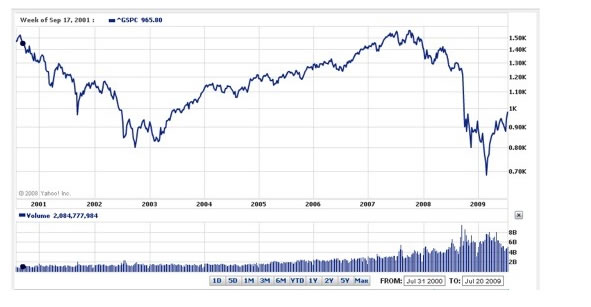

Notice in the chart below that unemployment continued to rise until the first quarter of 2003. And that is also when the stock market took off. Those who see green shoots need to think about that. Meanwhile, the market is clearly telling us that it sees nothing but blue skies in the future. I truly marvel at this rally, but I continue to think it is a bear-market rally. The weakest, high-beta names are rallying the most. This rally does not seem to be the basis for a sustained bull market. That being said, Richard Russell has removed the bear from his letter and put in a bull. I may be the last bear standing.

The media tells us earnings are coming in above expectations. But expectations have been lowered so much that the target is much easier to hit. Even then, the "upside profit surprises" are coming from cost cutting, which is not sustainable as a profit center, at least not if you are trying to grow the business. And laying off employees, while perhaps good for the profits of one company, is not good for the overall economic business environment.

The Muddle Through Economy*

This is going to be a long, jobless recovery. Hours worked per week are at an all-time low. As noted above, part-time work is very high. Employers, when things actually start to turn around, and they will, will first give current employees more hours and then expand the hours of part-time workers. There will be few new jobs for a long time.

Because our population is growing, between 130-150,000 new jobs are required each month to keep unemployment from rising. Initial and continuing claims suggest we are currently losing at least 300,000 a month.

(As an aside, the media talks about initial unemployment claims falling. That is actually not true. Unemployment claims are in fact quite high and rising, but the seasonal adjustments make them look smaller. Normally, this would not be a big deal. But the summer seasonal adjustment assumes a normal automobile manufacturing market, with layoffs in July. The layoffs came much earlier this year, distorting seasonal adjustments.)

Higher and persistent unemployment, lower incomes and wages, higher savings rates, capacity utilization at 50-year lows and still falling, rising home foreclosures, a deleveraging financial system, etc. are not the stuff of "V-shaped" recoveries. Throw in that Moody's estimates that US banks will have to write off $400 billion in 2010, and it's a very weak recovery indeed that shapes up for next year.

It's the return of The Muddle Through Economy*, which is better than what we have had, to be sure. But that asterisk is there for a reason. Congress and the Obama administration are seemingly hell bent on a massive tax increase. If that happens, it will push a fragile recovery back into recession. It will look like the twin recessions of 1980-82.

It will be a difficult investing environment, to say the least. If buy-and-hold is not your favorite style, there are alternatives. Quick commercial: my friends at CMG have a platform of alternative managers that can be tailored to your specific needs. These are traders who have weathered the storms of this last decade. These are individually managed accounts, with daily liquidity. You really owe it to yourself to see the managers on their platform. The link to their form is http://www.cmgfunds.net/public/mauldin_questionnaire.asp.

I am encouraged by the fact that the radical health reforms look like they might not pass. The health-care system clearly needs a major overhaul. Let's hope that we get it right.

In a future letter, I am going to talk about taxes. I am concerned that we are going to raise taxes now to very high levels, and not leave any room for the tax increases we are going to desperately need in the middle of the next decade to pay for entitlement programs. That will mean a VAT tax and tax increases on the middle class. Again, not good for the economy. But enough for today. Time to hit the send button.

New York, Maine, and Tulsa

Next week I am going to take a few days off and head for a beach somewhere, along with my summer reading list. I will get back for one day, and then with my 15-year-old son head for New York for an evening dinner with Art Cashin, Ron Insana, and George and Meredith Friedman. That should make for interesting conversation.

Then off the next morning to Maine, after shooting a few spots with Aaron Task and Henry Blodgett at Yahoo! Tech Ticker. CNBC and Steve Liesman will be at the Shadow Fed fishing event, and it looks like I will do a few minutes with him, as they plan to do an hour-long special with many of the investment writers, economists, and analysts who will be there. I am really looking forward to that trip.

And then back home for a few weeks before going to Tulsa for Amanda's wedding on the 22nd. Amanda was a competitive cheerleader for a long time, and she is bringing that drive to the wedding. If there is deflation in this country, it is not in wedding costs. Two weddings in two years has me breathing hard.

And two more to go, although right now it looks like that might not be soon. And if the job market will help out, Amanda and Allen (her fiancée) and her twin sister Abbi intend to move back to the Dallas area after the first of the year, which will mean I'll have all seven kids close to me again. I really look forward to that.

We tend to get together as a family for brunch at least every other Sunday, and it's a fun day for me. Lots of love and laughing -- and now babies. And more on the way! There is a bull market in my joy in my kids, that's for sure. And now it really is time to hit the send button, as I am off to the local pub to have a drink with #2 daughter Melissa. She is going to have to have her gall bladder removed, and Dad likes to check in now and then. Have a great week, and enjoy your summer before it goes away,

Your doing better than Muddle Through analyst,

By John Mauldin

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2009 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.